16 Aug 2013 - {{hitsCtrl.values.hits}}

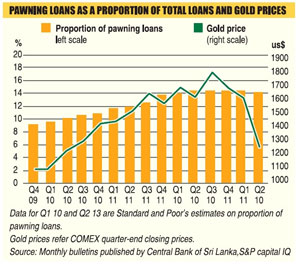

Loose regulatory guidelines with regard to gold-backed loans have been identified a key contributor to a ‘runaway growth’ in pawning loans, exposing the Sri Lankan banking industry to higher loan defaults, international credit agency Standard & Poor’s (S&P) said in a special report.

Loose regulatory guidelines with regard to gold-backed loans have been identified a key contributor to a ‘runaway growth’ in pawning loans, exposing the Sri Lankan banking industry to higher loan defaults, international credit agency Standard & Poor’s (S&P) said in a special report. “Such regulations make banks vulnerable to volatility in gold prices during the restricted period.”

“Such regulations make banks vulnerable to volatility in gold prices during the restricted period.”

27 Nov 2024 1 hours ago

26 Nov 2024 26 Nov 2024

26 Nov 2024 26 Nov 2024

26 Nov 2024 26 Nov 2024

26 Nov 2024 26 Nov 2024