03 Feb 2014 - {{hitsCtrl.values.hits}}

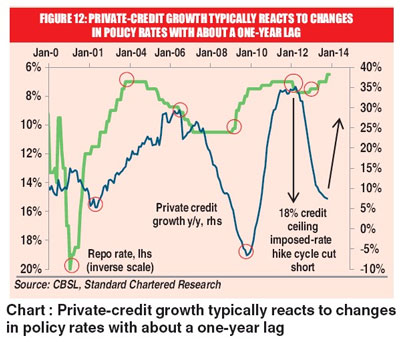

Standard Chartered Bank (StanChart) says the Central Bank is likely to further cut key policy rates if no significant improvement was recorded in private sector credit growth amid falling headline inflation.

Standard Chartered Bank (StanChart) says the Central Bank is likely to further cut key policy rates if no significant improvement was recorded in private sector credit growth amid falling headline inflation. StanChart is of the view that CB is unlikely to meet its private sector credit growth target of 16 percent set for 2014, due to recent rise in bank non-performing assets.

StanChart is of the view that CB is unlikely to meet its private sector credit growth target of 16 percent set for 2014, due to recent rise in bank non-performing assets.

26 Dec 2024 27 minute ago

26 Dec 2024 2 hours ago

26 Dec 2024 2 hours ago

26 Dec 2024 4 hours ago

26 Dec 2024 5 hours ago