14 Dec 2023 - {{hitsCtrl.values.hits}}

Two former Presidents Mahinda Rajapaksa (left) and Gotabaya Rajapaksa were named in a Supreme Court judegment among nine individuals as responsible for the economic crisis

Following the historical judgement delivered by the country’s apex court on November 14 (2023)-citing who is responsible for the country’s economic crisis- a few countries have sought views from the Counsel who appeared for the petitioners, how to file such cases in order to take legal action against their own politicians who have ruined their respective economies.

Following the historical judgement delivered by the country’s apex court on November 14 (2023)-citing who is responsible for the country’s economic crisis- a few countries have sought views from the Counsel who appeared for the petitioners, how to file such cases in order to take legal action against their own politicians who have ruined their respective economies.

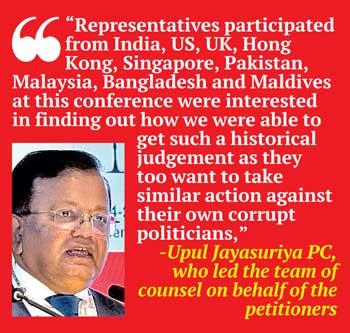

Presidents Counsel (PC) Upul Jayasuriya, who led the team of counsel on behalf of the petitioners (SCFR 1195/2022), told the Daily Mirror how participants at the Law Asia Conference held in Bangalore recently showed interest in the historical judgement delivered by a four-bench Supreme Court (SC) judges faulting three Rajapaksa brothers and few others who held top positions in the government along with the Monetary Board.

“Representatives participated from India, US, UK, Hong Kong, Singapore, Pakistan, Malaysia, Bangladesh and Maldives at this conference were interested in finding out how we were able  to get such a historical judgement as they too want to take similar action against their own corrupt politicians,” Jayasuriya said.

to get such a historical judgement as they too want to take similar action against their own corrupt politicians,” Jayasuriya said.

Two Fundamental Rights applications (SCFR 195/2022 and SCFR 212/2022) were filed against the persons who held Executive and administrative positions in the government between 2019 and 2022, for violations of fundamental rights of the citizens and for breaching the public trust reposed on them which created acute shortages in essentials like fuel, gas, food, medicine and led to prolonged power cuts and a downfall in the construction industry and a large number of small and medium Enterprises. This could have been avoided had proper administrative decisions were taken.

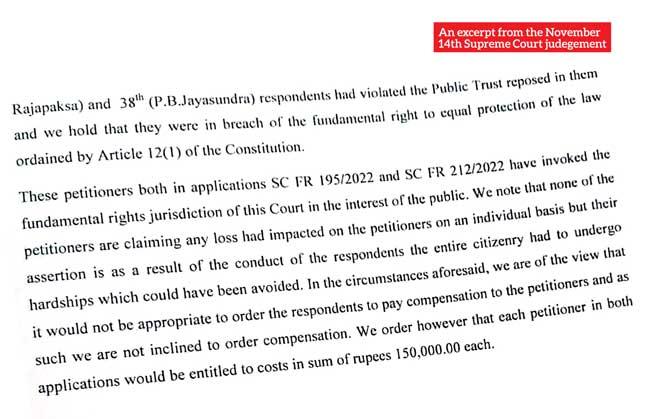

The four-bench supreme court that delivered the judgment in favour of the Petitioners comprised Chief Justice Jayantha Jayasuriya PC, Buwaneka Aluvihare PC, Vijith K. Malalgoda PC and Murdu N.B. Fernando PC. They were of the view that by the actions, omissions, decisions and conduct identified the respondents have demonstrably contributed to the economic debacle and the 2nd (Mahinda Rajapaksa), 2A (Basil Rajapakse), 28th (Monetary Board), 29th (Nivard Cabraal), 30th (W.D. Lakshman), 31st(S.R. Attygalle), 32nd (Samantha Kumarasinghe), 32A (Gotabhaya Rajapakse) and the 38th (P.B. Jayasundara) respondents had violated the public trust reposed in them and breach of the fundamental right to equal protection of the law ordained by Article 12(1) of the Constitution.

Although Mahinda Rajapaksa claimed that he will not accept the ruling as they were not given a chance to respond to the allegations made questions have been raised as to why his Counsel- Gamini Marapana PC and Navin Marapana PC- who appeared on his and Basil Rajapaksa’s behalf- could not defend them in court.

Issuing a statement, Mahinda Rajapaksa further claimed that he will not take the responsibility for the economic crisis and maintains that it happened due to the heavy borrowings of previous governments and the mismanagement of these funds which had a direct impact to the economy. However the Judgement clearly states that the respondents ought to have known the factual situation that prevailed when they assumed public office and that they should have fashioned their acts and efforts to ensure that the situation is not further aggravated, but resolved. It further states, ‘On assumption of public office, it was their duty to ensure that the existing issues were addressed and resolved in the best interest of the country and take every possible measure to avoid an aggravation and thereby causing a detriment to the people’.

Mishandling public money

According to Jayasuriya the offence of mischief requires damage done to property which excludes its applicability when bringing action under Section 2 of the Public Property Act.

According to Jayasuriya the offence of mischief requires damage done to property which excludes its applicability when bringing action under Section 2 of the Public Property Act.

“As the judgement says, parliament’s power of control over public finance is exercised in trust for the people. Therefore mishandling public money may come under the definition of Criminal Breach of Trust. The next element is that the public money has been disposed of in violation of the law. Any conduct which is manifestly unreasonable, arbitrary or irrational would lead to further aggravation of issues which are detrimental to the public, tantamount to a breach of the trust bestowed upon them,” Jayasuriya said.

Therefore it is alleged that the conduct of the respondents is more of a breach of trust read with the Public Property Act under which the suspects are liable for a mandatory sentence of one year and a maximum sentence of 20 years with a fine of three times of the loss caused.

“If the fine cannot be paid, the accused will be liable for a default term of one month each for every one thousand rupees,” said Jayasuriya.

Appearing for Mahinda and Basil Rajapaksa, Navin Marapana PC from the outset stated that the applications should be dismissed and contended that the impugned conduct of his clients are arising from policy decisions of the Government.

It further states, ‘The case of the petitioners is based on the premise that the decisions of the respondents are not the best decisions and in hindsight, different decisions could have averted the economic crisis. He further argued that the petitioners have failed to establish as to which fundamental right that was infringed due to the conduct of his two clients. He further said that if the Court grants relief in these applications, the Court will be recognising a right to have infallible decisions from the Executive or administrative authorities. Marapana further states that no such right is recognised by the Constitution and that at no stage the petitioners claim that the respondents could not have taken the impugned decisions nor do they allege that the decisions they took are tainted with mala fide’.

Marapana further stated that the Court should desist from hearing these applications as a Parliamentary Select Committee is examining the same issues that the court is invited to examine in these proceedings. In his submissions these decisions fall in the realm of public finance and it is the parliament which has the sole jurisdiction to consider such matters.

The petitioners have claimed that the tax revision was the root cause for the economic collapse. But, Marapana has stated that the claims made by the petitioners are misconceived.

Purpose behind introducing tax revision according to Marapana

In his submissions he has stated this tax revision was introduced with the expectation to revive the economic growth, that was badly affected due to the Easter attack in 2019. He has further stated that all the cabinet papers submitted by the respondents were in line with the expert opinion of the Monetary Board (MB) as provided by its statutory reports in compliance with section 68 of the Monetary Law and in none of these reports the MB identifies seeking IMF assistance as the only available path to economic recovery. The MB commended various steps taken by the government including the adoption of the ‘home grown solution’ as opposed to seeking assistance from the IMF.

In his submissions he has stated this tax revision was introduced with the expectation to revive the economic growth, that was badly affected due to the Easter attack in 2019. He has further stated that all the cabinet papers submitted by the respondents were in line with the expert opinion of the Monetary Board (MB) as provided by its statutory reports in compliance with section 68 of the Monetary Law and in none of these reports the MB identifies seeking IMF assistance as the only available path to economic recovery. The MB commended various steps taken by the government including the adoption of the ‘home grown solution’ as opposed to seeking assistance from the IMF.

Although Marapana passed the fault to the members of the MB, Romesh de Silva PC, who represented the MB, said that no responsibility can be attributed to the MB, and responsibility must be directed to the government. He has further stated that MB in its statutory reports had informed the Minister of Finance about the dire situation in the economy and the need to seek assistance from the IMF due to the situation that prevailed during the relevant period.

He has further stated, ‘These reports reflect that the government was averse to seeking assistance from the IMF despite the critical condition the economy was in. Therefore as an agency of the government, the MB had to continue with the discharge of its duties while respecting the policy decisions of the government and made all attempts to convey the importance of seeking an IMF programme to avert the crisis and overcome the difficulties’.

Meanwhile, Jayasuriya giving reasons in court as to why these respondents went to court seeking justice on behalf of the entire society said that following the astonishing revelations made by the two members of the Monetary Board Sanjeewa Jayawardena PC and Dr. Ranee Jayamaha at the Committee on Public Enterprises (COPE), the petitioners decided to file action against the respondents.

“We filed audio/video and the transcription of what they said at the COPE meeting. It was shocking and revealing. They were maintaining they had written nine letters to the Governor urging that they should go to the IMF. There must be an agreement regarding the proposals, but unfortunately the Governor was in a helpless situation as the decision was taken at a higher echelon- Dr. P.B. Jayasundera. Even Nanadalal Weerasinghe has confirmed this. By that time Nivard Cabraal had resigned from the Central Bank as its Governor,” Jayasuriya PC said.

According to Jayasuriya, from the beginning, Romesh de Silva was going on the basis that it is the MB that has done what needed to be done accusing the government of not heeding to their instructions.

“Before leave was granted, the limited objection filed by Mahinda, Basil and Attygalle were making allegations that was crisscrossing each other and was involved in a blame game. They filed documents to which we didn’t have access. These documents were very useful for us to extract information from all sides. We are thankful to them for tabling these documents which enabled us to obtain more important details to strengthen our case,” Jayasuriya said.

Jayasuriya further stated that the 200 page affidavit filed by the two members of the MB, Dr. Jayamaha and Sanjeewa Jayawardena, is the longest ever affidavit filed in the history of the SC.

P.B Jayasundara and Central Bank officials

It has revealed in court how Dr. P.B. Jayasundara was critical of the Central Bank officials for having misled the MB and had accused one of the Deputy Governors, Mahinda Siriwardena, the present secretary to the treasury, in particular with insinuations that the latter is a person who tries to serve as per the needs of the IMF.

He further said how astonishing it was to find out, that the tax revision introduced in December 2019, resulted in downgrading Sri Lanka by rating agencies due to the depletion of foreign reserves, losing access to international financing institutions and single digit inflation spiraling into double digits and continuously maintaining of an artificial exchange rate and the failure to reserve tax reliefs resulted in deteriorating the economy.

Romesh de Silva PC with Uditha Egalahewa PC appeared for the Monetary Board while Shavendra Fernando PC appeared for Nivard Cabraal. Nihal Jayawardena PC appeared for S.R. Attygalle while, Anura Meddegoda PC appeared for P.B. Jayasundera. Suren Gnanaraj appeared for Prof. W.D. Lakshman.

Although questions have been raised as to why the SC could not disable civic rights of those who are at fault- Gotabaya Rajapaksa, Mahinda Rajapaksa, Basil Rajapaksa, Dr. P. B. Jayasundara, Nivard Cabraal, Prof. W.D. Lakshman, S.R. Attygalle, certain members of the Monetary Board and S.S.W. Kumarasinghe former employee of the Central Bank, Jayasuriya PC said that there are no provisions for the SC to take such action but only the Executive has the power to do so after a special Presidential commission of Inquiry.

Meanwhile a leading legal luminary in the country speaking on condition of anonymity said that, it is a Presidential Commission of Inquiry appointed by the President that must fault the accused parties and disable their civic rights.

“Unless there is a request from the President this cannot happen. Given the background how Ranil Wickremasinghe was elected as the President, we cannot expect him to do this. A new government once elected should follow this process,” sources said.

Although Gotabaya Rajapaksa was named as one of the respondents, he did not file objections nor make any legal representation in Court even though notices have been issued on him through court. Therefore it is contended that the allegations made against him remain uncontroverted.

When considering the applications, the main focus between November 2019 and April 2022 was on the economic situation of the country. The pathetic situation in the country is referred to in the Judgement as ‘Economic Debacle’.

The judgement further states, ‘The reason for this focus was that the core issue the court was invited was to consider whether the impact of the unprecedented economic crisis on the society resulted in the infringement of fundamental rights of the people and if so whether anyone or more of the respondents were responsible for such infringements due to their actions and or inaction during this period while holding office in the government. Many of the respondents argued that the root causes for this debacle spread well beyond this time period and therefore no responsibility could be attributed to these respondents in the manner alleged by the petitioners. They claimed that heavy borrowings of the previous governments and the mismanagement of such funds had a direct impact on the debt sustainability of the country.

‘Public trust reposed on them demands resolving of issues. Any conduct which is manifestly unreasonable, arbitrary or irrational would lead to further aggravation of issues which are detrimental to the public and tantamount to a breach of trust bestowed on them. This is not a recognition of public officers requiring to discharge their duties to the satisfaction of their inherent core obligations with due respect to the public trust reposed on them.

‘It is common ground that the country’s economy deteriorated not overnight, but over a period of time under consideration in the matters before us. It was evident from the material placed before us that the Gross Official Reserves (GOR) and the Reserves of the Central Bank were depleted and had reached unprecedented low levels, creating a situation of which the effects were devastating on the entire citizenry without exception. The severe hardships the people had to suffer due to scarcities in essentials brought the lives of people to a standstill and the suffering the public had to undergo was undoubtedly immeasurable.

‘The respondents holding high public offices bestowed with powers bear a direct impact on the lives of the people. We presume they were alive to the directive Principles of State Policy and Fundamental Duties. They were duty bound to discharge their duties in the manner spelt out in the directive principles in our Constitution.

‘They cannot shirk their responsibilities by merely claiming that the decisions that were taken were ‘policy decisions’ they were entitled to take. We note that Article 27 of the Constitution pledges a democratic socialist society the objectives of which include the realization by all citizens of an adequate standard of living for themselves and their families including adequate food, clothing and housing, the continuous improvement of living conditions and the full enjoyment of leisure and social and cultural opportunities which the public were deprived of during this unfortunate period due to mishandling of the economy when it was within the full power of the respondents to take meaningful action to prevent such a calamity. From the material placed before this Court it is as clear as can be, that the respondents had failed to act when they were not only put on notice, but were fully alive to the predicament the country would face.

‘The respondents argued that they took all possible measures within their purview to remedy the situation. They further argued that the time period under consideration overlapped with the time period where serious challenges were present that resulted due to the COVID-19 pandemic and had to be overcome. As we have discussed herein before, prolonged inaction due to arbitrary, irrational and or manifestly unreasonable decisions and inadequate measures over the period under consideration had heavily contributed to disastrous consequences.

‘The following observations and or comments as recorded in the minutes of the MB meeting held on August 4th, 2021, shed light on the situation which prevailed at the relevant time. During the period between January and June 2021- within a short period of six months reserves of the Central Bank and GOR had decreased by 35% and 28% respectively. For the first time in the history of our country the net Central Bank Foreign Reserves recorded a negative balance of US$ 78 million. As at August 3, 2021, net Central Bank assets were negative by US$ 124 million and net GOR remained at US$ 155 million. The Deputy Governor (s) had observed that, ‘The Government does not have foreign exchange and the GOR has declined to critical levels, government has no rupees either, government is depending on the CBSL for the foreign exchange as well as rupees for its domestic and foreign financing and very soon the CBSL will be required to meet the obligations of state banks and state entities such as CPC as well. Sri Lanka cannot go to the international market and borrow and foreign governments are not lending to Sri Lanka because of the credit ratings of the country and its high default risk’.

‘The DG had noted that the ‘Minister himself (Basil Rajapaksa) has stated that it is difficult to expect any sizeable funds coming into the country at this stage’.

The above quote aptly depicts the bleak picture and the disastrous state of our economy even by August 2021.

‘It is also pertinent to observe that in deciding the issues before us, this Court while considering each matter separately, had to consider all matters together in a holistic manner to decide the core issue, whether there was any infringement of fundamental rights. The reason being the matters we considered are intrinsically interwoven and a focus on issues in isolation would fail to capture reality. In this regard, we are mindful of one of the arguments of the petitioners that the purported imprudent decision brought about a domino effect and led to a series of events to which we paid attention. The cumulative effect of the conduct of the respondents in our view is what contributed to the ultimate debacle. GOR which stood at US$ 7, 645 million by end 2019, had depleted to US$ 155 million by August 2021. The scarcity of foreign exchange with the government and the CB brought about severe hardships to the people.

‘The trust reposed in the respondents was not a higher principle or epithet unique to their offices. ‘Public Trust’ is an inherent responsibility bestowed on all officers who exercise powers which emanate from the sovereignty of the people. Therefore as public officers the respondents were obliged at all times, to act in a manner which honoured the trust reposed in them’.

Following this judgement, Lawyers are looking at the implications of the judgement under the Public Property Act which imposes heavy penalties and mandatory jail terms on the nine parties that has been identified as having breached the Public Trust.

“Custodians of public property are required to safeguard them and keep the income generated from them at an optimal level.

Strict laws preventing public property being misappropriated by their custody or allowing those to be misused by their kith, kin and cronies are in force in all countries where there is a democratic system of governance. The acquisition or plunder of public property by those who have been entrusted with safe keeping or appropriating them to a third party are considered as serious offence punishable by law.

According to Jayasuriya, there was a further requirement for the state authorities to ensure that their conduct will not breach the trust placed on them and that public resources placed in their custody are protected and preserved for the benefit of the people and not to be exhausted for political or personal benefit. Economic crime is a breach of trust and will have fatal consequences like financial loss, costly investigations and follow up work, damaged reputation and ultimately a wholesale threat to existence if it strikes.

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024