24 Jun 2024 - {{hitsCtrl.values.hits}}

An audit has been conducted by the National Audit Office, specifically addressing policy decisions related to domestically assembled motor vehicles

State Minister of Finance Ranjith Siyambalapitiya recently stated that 44,430 vehicles had entered the market during the ban on vehicle imports to Sri Lanka. This information was disclosed following a discussion with representatives of several local vehicle assembly companies. Among these vehicles, 38,144 are motorcycles and 6,286 are motorcars.

A vehicle assembly factory was first established in the country in the 1980s with the introduction of the Upali Fiat car; the mastermind behind this venture being business magnate Upali Wijewardene. Subsequently, a vehicle assembly factory was established in Sri Lanka in 2002. In a context where the importation of used vehicles- that have been used for three-years- to Sri Lanka was prohibited, plans to import used vehicles were made after 2002. Vehicles imported during this period did not arrive in Sri Lanka as complete units; instead, they were dismantled before delivery. These imported vehicles were typically more than three years old; with some being used for 5-6 years.

In contrast to this background, a vehicle manufacturing factory has been operating in Sri Lanka since 2004. The company has prepared plans for the production of both vans and cars. When vehicle parts are assembled and new vehicles are manufactured, the vehicle identification number or chassis number is assigned according to the system used for giving chassis numbers in Sri Lanka.

Around 2006, Sri Lanka’s first locally assembled vehicle was released to the market. Taxes were also levied on the production of these vehicles under the Excise (Special Provisions) Act No. 13 of 1989. According to this act, taxes were both imposed and exempted. The act clearly outlines the procedures for collecting such charges and granting exemptions. Specifically, Section 3(i) of the Part 2 of the act explains the manner of taxation and tax concessions. The minister has the authority to levy and set taxes, and a gazette is issued for this purpose. This gazette has been amended from time to time, with the latest amendment being gazette No. 2364/36-2023, issued on December 31, 2023.

According to the Excise Act, five methods of deducting tax on vehicles or any other products have been discussed. One method is for foreign ambassadors and those at the United Nations, and the criteria which can be used to exempt their taxes is clearly stated in the act. The second method allows the President of the country to grant tax concessions on imported goods. The third method of tax exemption permits tax relief for items purchased from a customs duty-free shop. The fourth method allows the minister to grant tax concessions through a gazette notice, considering the state of the country’s economy.

Tax concessions

Section 3 c (i) of Part 2 of the Act states that if tax concessions are obtained and the terms of the concessions are breached, the tax concessions should be recovered. Generally, when importing goods from abroad, tax must be paid at the time of importation. For goods manufactured in Sri Lanka, taxes must be paid by the manufacturer in four quarters after their sale. Former industry ministers granted such tax concessions to encourage local manufacturers.

The fifth method of tax exemption operates under two parts. First, when exporting a product manufactured in Sri Lanka, the money spent must be deposited in a Sri Lankan bank. This requirement is not mentioned in the Excise Act, but is specified in Gazette 659/4 regarding tax concessions. When raw materials are imported to produce a certain product that is then exported as a finished product, the tax is exempted. Between 2004 and 2015, there was a 100 percent tax exemption, which was later reduced to a 70 percent tax exemption.

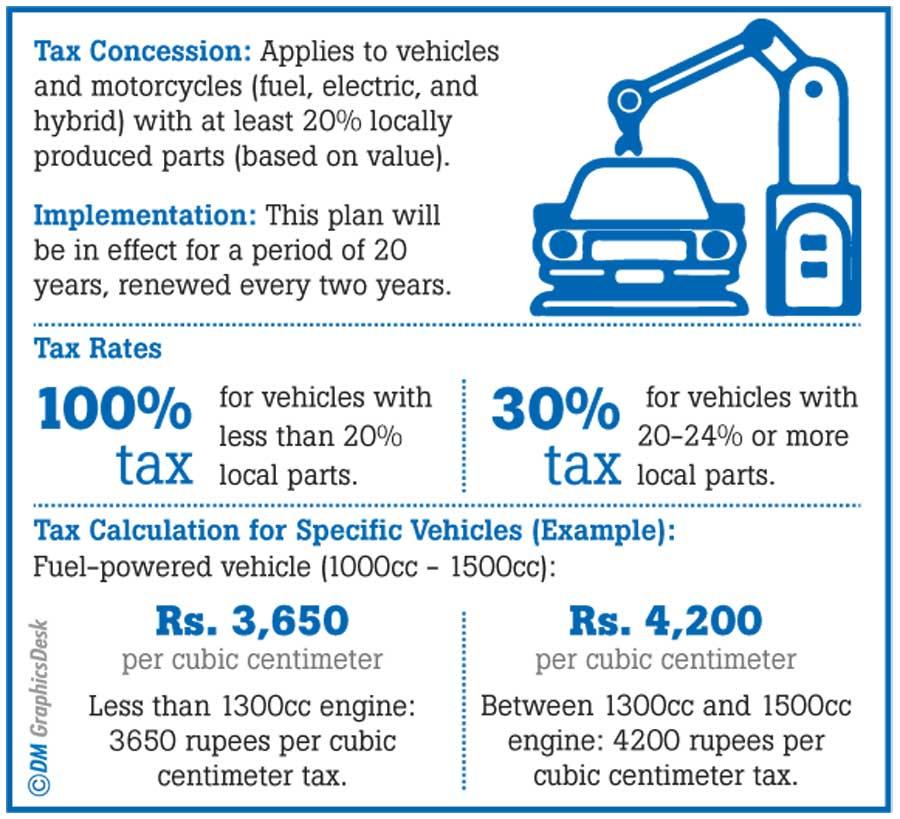

The latest gazette, issued on Sunday, December 31, 2023, under No 2364/36, provides tax exemptions for assembled vehicles manufactured in Sri Lanka using these tax exemption methods. According to the gazette, the subject minister can make recommendations for such tax concessions. These recommendations should be implemented under number 3 of page 56A of appendix II of the gazette notification. As stated in the gazette, tax concessions are granted for vehicles and motorcycles (including fuel, electric, and hybrid vehicles) that have more than 20 percent locally produced and their value calculated. This plan is set to be implemented every two years for a period of 20 years.

An auto company is required to pay 10 percent as income tax on its earnings. However, the actual income generated, as calculated above, may not have been fully disclosed. Customs data highlights the necessity for authorities to scrutinize whether these companies are paying the PAYE tax as required

An auto company is required to pay 10 percent as income tax on its earnings. However, the actual income generated, as calculated above, may not have been fully disclosed. Customs data highlights the necessity for authorities to scrutinize whether these companies are paying the PAYE tax as required

According to the calculation based on the value of domestically produced components in vehicle assembly, vehicles that do not utilise at least 20 percent locally produced parts should be subject to a 100 percent tax rate, according to the gazette. Vehicles with a local contribution in the range of 20-24 percent and above will have to pay 30 percent of the tax amount. For example, a fuel-powered vehicle with a cylinder capacity of more than 1000 cc but less than 1500 cc will be taxed at 3650 rupees per cubic centimetre if the cylinder capacity is less than 1300 cc. As specified in the gazette, if the cylinder capacity is between 1300 cc and 1500 cc, the tax will be calculated at 4200 rupees per cubic centimetre.

Generally, the cylinder capacity is not 1500, but 1498. Therefore, when taxed at 4200 rupees per cubic centimetre, the total tax amount for a vehicle with a capacity of 1498 cc would be 62,90,000 rupees. However, according to the calculation, if the locally produced component contribution is more than 20 percent, vehicles using components in the 20-24 percent range are eligible for a 30 percent tax reduction. Thus, the tax amount of 62,90,000 rupees would receive a 70 percent tax relief. Therefore, the amount calculated at a rate of 30% and payable as tax would be 18,87,000 rupees.

The remaining amount is tax exempted. Therefore, out of the total tax amount of 62,90,000 rupees what must be paid to the government by a company that assembles vehicles would be 18,87,000 rupees in tax. This results in the companies receiving a tax relief of 44,030,000 rupees. This tax calculation applies specifically to vehicles with a cylinder capacity between 1000-1500 CC. Similar tax relief is available for other vehicles when more than 20 percent of the local production is assembled here.

According to data received from Sri Lanka Customs, some vehicle assembly companies are reportedly engaging in fraudulent practices to obtain tax relief. To qualify for tax relief when assembling vehicles, it is required that more than 20 percent of the parts used in the assembly process are locally produced. These companies are only incorporating domestically produced components such as batteries, rubber bushes, seat covers, silencers and tires into their vehicles. Additionally, some individuals are attempting to import all other vehicle parts that could be produced locally in order to qualify for a 70 percent tax relief. Data from Sri Lanka Customs indicates that these individuals are obtaining tax concessions based on recommendations from the Ministry of Industries, claiming that they have utilised more than 20 percent locally produced parts in their assembly process.

Audit conducted

In light of concerns regarding the cost of assembled vehicles in Sri Lanka and the tax relief provided, the Auditor General has focused attention on this matter. An audit has been conducted by the National Audit Office, specifically addressing policy decisions related to domestically assembled motor vehicles of the Department of Trade and Investment. The Audit Inquiry No. PUR/A/CUS/2023/AQ/13 was issued on February 9, 2024. According to the audit inquiry, in an effort to incentivize local automobile manufacturers, as per the Extraordinary Gazette No. 1448/1 issued by the President on June 5, vehicle manufacturers who incorporate not less than 30 percent locally produced components in their production process based on the recommendation of the subject minister are eligible for a 70 percent excise tax exemption. This policy decision aims to discourage the importation of vehicles from abroad.

According to the audit inquiry, companies that are required to pay customs duties have imported nearly all the components needed for vehicles for a long time. These companies have stored vehicle parts in warehouses without paying customs duties upon importation, and subsequently assembled the vehicles. They have obtained 70 percent excise concessions by misinterpreting those policy decisions. Companies capable of importing auto parts at high prices from overseas have utilised bonded warehousing facilities. They intended to defer paying duty until the assembled vehicles were released from the warehouse. However, they haven’t withdrawn from the facility. By obtaining letters based on Gazette Notification No. 1448/1 dated 5th June 2006, they have claimed 70 percent tax relief, as shown in the audit inquiry.

According to the audit inquiry, local companies, involved in assembling vehicles, have reportedly generated substantial profits by supplying these vehicles to the local market. This situation has deprived the government of significant excise revenue.

In 2023, a certain company sold two types of assembled vehicles to the market on February 26, 2024, aiming to achieve significant profits. The customs cost for one vehicle was 39,89,353 rupees. The excise duty paid for that vehicle amounted to 16,62,780 rupees. Social security tax was Rs 151,277, and vehicle title tax was Rs 15,000. Additionally, a luxury tax of 489,353 rupees was applied. Therefore, the total cost of this vehicle upon leaving the warehouse was 6,307,763 rupees. As of February 26, 2024, the selling price of the vehicle in the local market (excluding VAT) was Rs 11,525,423.

Accordingly, the difference between the selling price of that vehicle and its cost when it left the warehouse is 52,217,665 rupees. This means the company that assembled that vehicle made a profit of 52,217,665 rupees from that vehicle alone. For another vehicle, the cost of customs was 57,03,235 rupees. The excise for that vehicle amounted to 16,62,780 rupees. Social security tax was 1,98,409 rupees, vehicle title tax was 15,000 rupees, and luxury tax was 22,03,235 rupees. Therefore, the total cost when leaving the warehouse was 97,82,658 rupees. As of February 26, 2024, the vehicle was sold for 13,555,084 rupees; this figure excludes VAT. The difference between the selling price of the vehicle and its cost when it left the warehouse amounts to 37,72,425 rupees.

Local companies engaged in assembling auto parts and manufacturing vehicles have opted to remain within bonded warehouse facilities to defer payment of customs duties. In 2023 alone, these companies assembled and released 326 vehicles into the local market. The audit inquiry has revealed that they have benefited significantly from tax relief measures, resulting in substantial earnings.

In this scenario, it appears that only the companies that assemble vehicles have profited from the sale of these vehicles. PBSC Nonis, Director General of Sri Lanka Customs, in his letter No. CUS/ESPD/MV-2023 dated 02-5-2024 addressed to the Secretary of the Ministry of Industry, the Director General of the Department of Trade and Investment Policies, and the Director General of the Department of Fiscal Policy, underscored that these companies have not passed on the benefits of tax relief to either the vehicle buyers or the government. The letter emphasises a discussion on the local vehicle assembly policy, presenting proposals from Sri Lanka Customs. It outlines measures aimed at preventing tax evasion by vehicle assembly companies in Sri Lanka. Furthermore, the letter details the tax concessions obtained by each company up to the present.

Generally, luxury tax on vehicles is applicable only to vehicles valued at more than Rs. 3.5 million when imported into Sri Lanka; necessitating a full tax payment. However, according to the audit inquiry, assembly companies have paid only Rs. 489,353 and Rs. 22,03,235 respectively. Customs sources suggest that standard basic regulation No. 2(a) for goods classification may have been disregarded. Customs data indicates substantial tax revenue losses to the government, purportedly due to some individuals exploiting a 30 percent tax relief scheme for imported auto spare parts. But the letter sent to the Ministry of Industry by Sri Lanka Customs reveals that these companies are actually only using components such as tyres, batteries, and silencers in Sri Lanka. They exploit the provision allowing for significant tax relief by falsely claiming to use more than 20 percent locally produced spare parts, thereby generating substantial profits under the guise of tax exemptions. An auto company is required to pay 10 percent as income tax on its earnings. However, the actual income generated, as calculated above, may not have been fully disclosed. Customs data highlights the necessity for authorities to scrutinize whether these companies are paying the PAYE tax as required.

The body shell for assembled vehicles isn’t manufactured in Sri Lanka but imported. According to Gazette No. 8706/10/90, a tax of 11,40,000 rupees has been stipulated for the body shell of vehicles. If so, this tax hasn’t been paid for the two types of vehicles mentioned earlier. Other parts of the vehicle incur separate types of taxes. After these taxes are paid, the necessary components are imported and the vehicle is assembled in Sri Lanka. The production cost of these vehicles includes all expenses associated with imported components.

When a vehicle is assembled and manufactured in Sri Lanka, taxes must be paid on the importation of related accessories from abroad. However, if both the chassis and the body of the vehicle are made in Sri Lanka, no taxes need to be paid regarding them. Since vehicle assembly began in 2006, following the production of vehicles in 2004, during the initial stages, only the engine and gearbox were imported. All other components of the vehicles were manufactured locally in Sri Lanka. When the Minister of Industries recommended granting tax concessions, no taxes were levied.

According to Sri Lanka Customs data, vehicle assembly companies have obtained tax concessions and evaded paying taxes by exploiting section 3 c (i) of the Excise Act, which provides tax reliefs when importing vehicles and the fact that certain goods are exempt from tax. However, the Excise Act specifies these concessions as conditions, and states that breaching these conditions necessitates tax repayment. Sri Lankan customs data reveals that these companies have evaded paying taxes amounting to 100 billion rupees. Sri Lanka Customs has faced difficulties in collecting taxes solely through enforcement of laws according to the act due to the current gazette. But if the rules and regulations specified in the act aren’t published in the gazette, then the gazette itself is considered invalid. The Gazette hasn’t been published in accordance with the Act. This has allowed frauds related to tax to persist since 2006, according to the Sri Lankan Customs spokesperson.

Local production

Previously, there was a system aimed at gradually increasing local production capabilities and providing greater tax concessions accordingly. However, there has been a shift where instead of focusing on the same vehicle model, companies now change the model every two years. Under this approach, they typically only manufacture components like batteries and tires locally in Sri Lanka. Due to the frequent change in vehicle models every two years, some companies resort to importing vehicles that have been completely disassembled. This allows them to claim 70 percent tax relief by asserting that foreign vehicle components were imported into the country.

So far, these tax payments have been evaded for 20 years. The body shells of the vehicles were imported during this period without paying any separate tax, but they were brought to Sri Lanka under a cash guarantee. Some vehicle assembly companies have reclaimed the cash guarantee by exploiting the 70 percent tax relief provision. Between 2006 and 2020, 47,000 body shells were imported to Sri Lanka in this manner, resulting in an unpaid tax amount that will increase to 18 billion rupees. Sri Lanka Customs data confirms this through an audit of accounts.

From 2006 to 2015, 100 percent tax exemptions were granted on the body shells imported in this manner, which were later reduced to 70 percent. Overall, tax concessions totaling 39 billion rupees have been provided to three vehicle assembly companies between 2006 and 2022. The 2022 National Audit Report indicates that the unpaid taxes on imported auto parts into Sri Lanka exceed 100 billion rupees.

Therefore, the authorities connected to this issue should pay attention to this issue. Additionally, this newspaper intends publishing a separate article in the future focusing on the lost tax revenue, incorporating perspectives from representatives of local assembly vehicle manufacturing companies.

22 Dec 2024 4 hours ago

22 Dec 2024 5 hours ago

22 Dec 2024 6 hours ago

22 Dec 2024 8 hours ago

22 Dec 2024 8 hours ago