18 Jul 2024 - {{hitsCtrl.values.hits}}

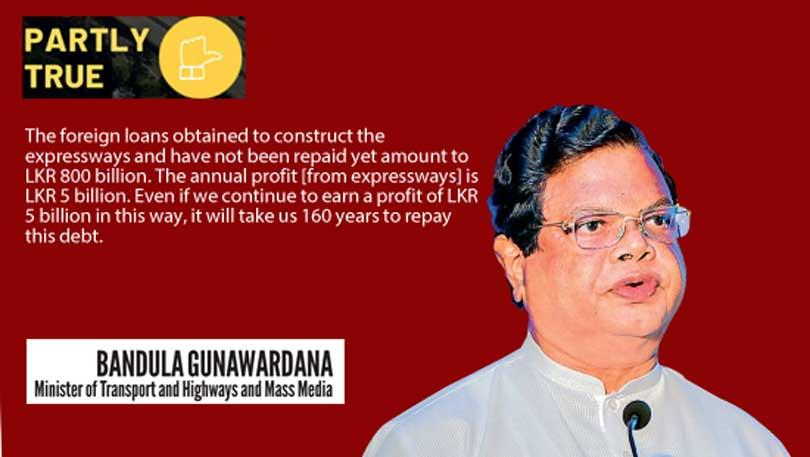

Minister Gunawardana justifies transferring expressways to a state-owned investment company to operate them as a “commercial enterprise” by arguing that: (a) Sri Lanka has borrowed LKR 800 billion in foreign loans to construct these expressways, and (b) it would take 160 years to repay the loans with the current annual profits (of LKR 5 billion).

Minister Gunawardana justifies transferring expressways to a state-owned investment company to operate them as a “commercial enterprise” by arguing that: (a) Sri Lanka has borrowed LKR 800 billion in foreign loans to construct these expressways, and (b) it would take 160 years to repay the loans with the current annual profits (of LKR 5 billion).

To check this claim, FactCheck.lk consulted the Road Development Authority (RDA) Annual Report of 2021, the Ministry of Finance (MoF) Annual Report 2023 and statistics provided by the Department of External Resources Sri Lanka (ERD).

According to the MOF, as of 31 December 2023, the outstanding balance on all foreign loans for expressway development was LKR 480.3 billion, not the LKR 800 billion cited by the minister. The minister may have referred to the initial total value of these loans—USD 2,809.48 million (LKR 843 billion at USD 1 = LKR 300)—which has since been partially repaid.

The RDA reported that expressways generated a net income of LKR 4.5 billion in 2021. This is close to the LKR 5 billion figure cited by the minister.

The minister’s argument is that if Sri Lanka were to settle the balance using its annual profits from expressways, it would take approximately 160 years to settle the debt. He arrives at this figure by dividing LKR 800 billion by LKR 5 billion.

However, the logic in the minister’s calculation of the repayment problem is flawed in two ways. First, he assumes that annual profits will remain constant, ignoring potential growth from inflation and increased usage, which could lead to nominal growth rates in the upper single digits.

Second, he ignores interest cost and currency depreciation in the loan settlement cost. Considering the debt restructuring, subsequent average interest costs, and expected currency depreciation, the growth rate of nominal interest repayments would also be in the upper single digits.

Even if the nominal interest payment cost is 7.5% (based on the above calculation), amounting to approximately LKR 36 billion annually—eight times the current income from expressways—it is not possible to cover a significant portion of the interest costs, let alone reduce the principal of the outstanding loans, with the current revenue. Therefore, the only way to repay the loan is to supplement the expressway income with funds from the treasury’s consolidated revenue.

The minister is hugely off the mark in supporting his argument. He makes three mistakes: (i) incorrectly cites the outstanding loan balance as LKR 800 billion instead of LKR 480 billion, (ii) ignores the interest payments, and (iii) disregards increased income in his repayment calculations. Nevertheless, correcting for these mistakes, the challenge of repaying the loans from expressway earnings alone is more severe than he suggests, not less. Therefore, despite his errors, the minister’s broader point remains valid: operating the expressways as a ‘commercial enterprise’ could help ease the treasury’s debt servicing burden.

Therefore, we classify the minister’s claim as PARTLY TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

04 Jan 2025 7 hours ago

04 Jan 2025 7 hours ago

04 Jan 2025 8 hours ago

04 Jan 2025 04 Jan 2025

04 Jan 2025 04 Jan 2025