14 Mar 2019 - {{hitsCtrl.values.hits}}

On 20 February 2019, the Daily News quoted Minister of Health, Nutrition and Indigenous Medicine Rajitha Senaratne as saying the following: “We have…imposed a 90% tax on tobacco in an attempt to reduce tobacco usage.”

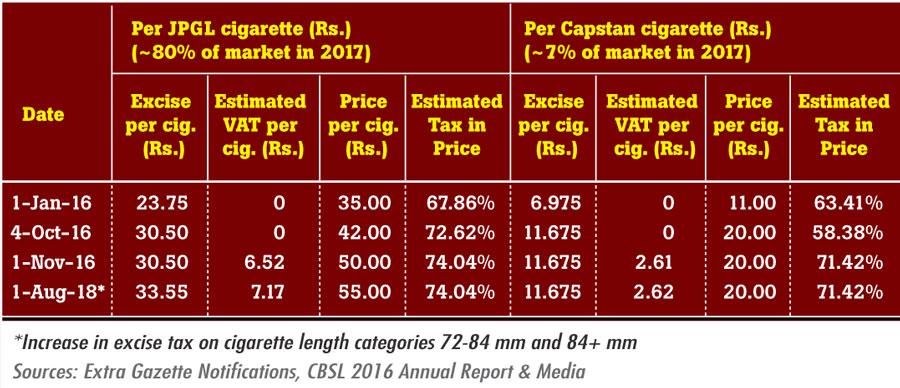

Two types of taxes are applied to cigarettes.

1. Excise tax: a fixed amount per cigarette that is levied at the point of production. Excise tax is the primary tax on cigarettes.

2. Value-added tax (VAT): a percentage of the price of the cigarette.

Cigarette companies set prices taking excise tax into account. Therefore, the cigarette companies determine the percentage of tax, and not the government.

As Exhibit 1 shows, the government increased excise tax in October 2016 and reinstated an estimated 15 per cent VAT a month later. Simultaneously, the CTC increased cigarette prices. These tax and price increases resulted in tax percentages of approximately 70–74 per cent, and not 90 per cent as the minister claimed.

Similarly, the increase in excise tax on certain cigarette categories in August 2018 combined with another CTC price increase maintained this tax percentage.

Therefore, we classify this statement as FALSE.

This is an extract from a fact check published on www.factcheck.lk on 13 March 2019. FactCheck is a platform run by Verité Research. For feedback, please write to [email protected].

23 Dec 2024 5 minute ago

23 Dec 2024 11 minute ago

23 Dec 2024 19 minute ago

23 Dec 2024 53 minute ago

23 Dec 2024 57 minute ago