17 Feb 2023 - {{hitsCtrl.values.hits}}

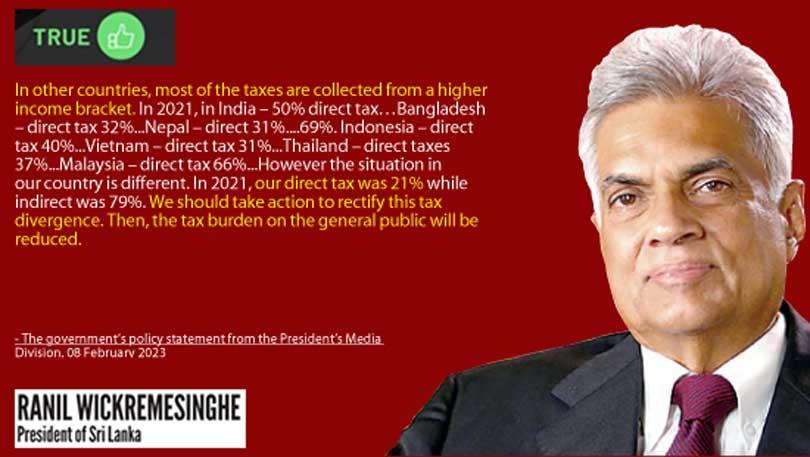

The president while delivering the government’s policy statement, claims that the share of direct taxes collected in Sri Lanka is lower compared to many Asian countries and suggests that increasing the share of direct taxes would reduce the tax burden (indirect taxes) on the “general public” (interpreted here as “wider lower-income population”).

The president while delivering the government’s policy statement, claims that the share of direct taxes collected in Sri Lanka is lower compared to many Asian countries and suggests that increasing the share of direct taxes would reduce the tax burden (indirect taxes) on the “general public” (interpreted here as “wider lower-income population”).

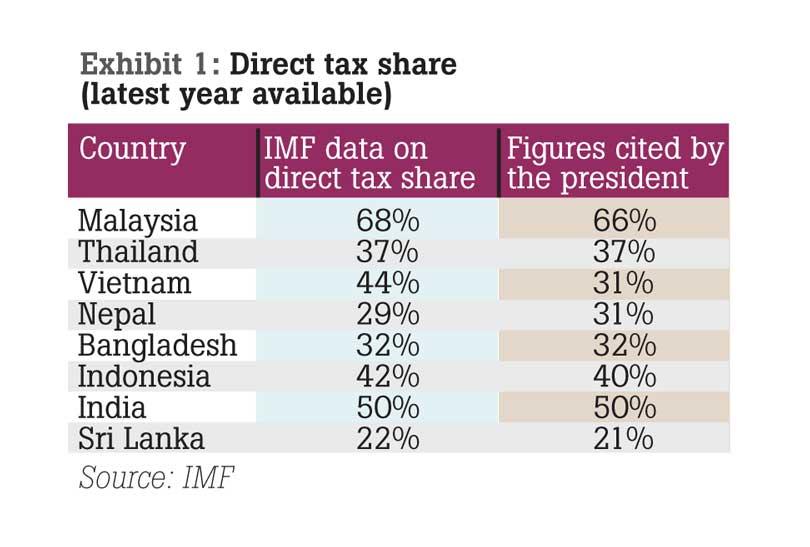

To check this claim, FactCheck.lk consulted the IMF data on revenue statistics.

Direct taxes refer to what is collected from income, profits or wealth accumulated. Indirect taxes refer to what is collected through the purchase of goods and services. All taxes can be classified as either direct or indirect.

Exhibit 1 shows that there are mostly only small deviations (under 10%) between the president’s numbers and what was reported in the IMF database. There is a large deviation in the case of Vietnam, where the direct taxes are higher after accounting for property taxes, which the president’s calculation has omitted. However, correcting for that error only strengthens the overall claim of the president: that other countries have a much larger share of direct taxes than Sri Lanka.

Subject to the additional note to this fact check (please visit our website to refer to the additional note), there is merit to the president’s suggestion that direct taxes can target the more affluent and thereby help to reduce indirect taxes that also affect wider lower-income groups. The data that he provides, and checked against IMF data, support his specific overall claim that Sri Lanka has an unusually low level of direct taxes even compared to many Asian countries.

Therefore, we classify the president’s statement as TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

22 Dec 2024 4 hours ago

22 Dec 2024 6 hours ago

22 Dec 2024 6 hours ago

22 Dec 2024 8 hours ago

22 Dec 2024 8 hours ago