31 Aug 2021 - {{hitsCtrl.values.hits}}

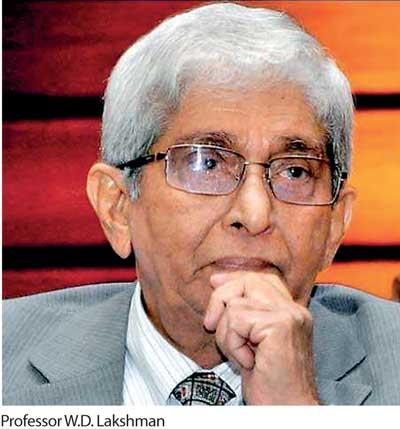

Deshamanya Professor W.D. Lakshman would have stepped into the Central Bank (CBSL) building for the first time in the early 1970s to get a foreign exchange permit to import a car after returning from Oxford.

Deshamanya Professor W.D. Lakshman would have stepped into the Central Bank (CBSL) building for the first time in the early 1970s to get a foreign exchange permit to import a car after returning from Oxford.

Subsequently, he would have made courtesy calls on his friends and students working in the CBSL. He had come to CBSL for employment as its Governor at his age 78.

Considering his learning, reading, teaching and research, Central Banking cannot be a strange subject for him. But, practicing central banking especially as its head is totally another.

Professor Lakshman is a renowned academic who held all senior positions in the University. If my recollection is correct, he is the first academic appointed to the prestigious post of Governor, CBSL.

Unlike teaching which one-way communication in Sri Lanka is, Governor CBSL has to work vertically down with his own staff working in different capacities, different Departments and more with different ideologies. Horizontally, it is with a more diverse endless set of clienteles, starting with President, Ministers, politicians, financial institutions, international organizations, trade unions, and the general public. Translation of what he read in books and taught us is not an easy task.

Number 1 target for critics

Thanks to a government that makes blunders after blunders from agriculture to zoo, actors who mishandle the entire COVID- 19 pandemic operation in an utmost uncoordinated manner, a most ineffective opposition, a section of media which attach more importance to physical details of a person than to its news value, a sleeping bureaucracy and silent intellectuals, Prof. Lakshman is spared being the number 1 target for critics. But, the criticism levelled against him during the last few months is many folds of that he got for 78 years. I cut my teeth in economics under the shade of Prof. Lakshman longer than half a decade ago.

Being a student of him, some may say that I am ungrateful, while others might say I am partial. Once I wrote an article on Public Service. I paid tribute to Paskaralingam, who was known as a ‘Super Secretary”. Much later, he told me, “Maliyadde, some of my friends say that I have paid you to write that article”.

Prof. Lakshman is being criticized for what he says; what he says not; what he does; what he doesn’t do; for things he is responsible; for things he is not responsible; for the depreciation of the Rupee; for trying to arrest the depreciation; for not advising the government to restrict extravagant expenditure; for advising the government to restrict extravagant import expenditure; for things happen during his tenure; for things happened before his tenure; for lowering the interest rate; for raising the interest rate; for honouring US$ 1 billion of International Sovereign Bonds (ISB) by balancing foreign reserves with international cash flows; for not taking IMF bailout option to honor the ISB. Those who cannot think of anything else criticize him for his age as they never grow old.

I picked the last but not least one out of a barrage of criticisms level against him for this article. It is that Prof. Lakshman is reluctant or shy to seek IMF assistance. Critics cite the experience of their own, their seniors, peers of other countries, and past Governors in similar situations.

One has commented that “The administration appears to be firm on the stand of not seeking IMF support to rescue Sri Lanka’s economy badly battered by worsening macroeconomic conditions exacerbated by the outbreak of the COVID-19 pandemic.” For most critics, IMF assistance (bailing out) is the panacea for issues faced in the external sector (foreign exchange, balance of payment deficit, and debt repayment).

These issues have not cropped up after Prof. Lakshman became the Governor. They have been building up since 4th February 1948 and aggravated to the current level after the liberal economy was introduced in 1978. British colonials left a prosperous model economy. It gradually descended to the present debt-ridden, import led, disparity widened poor lagging economy. Dr. WA Wijewardane explains this in his article on “Forex Crisis, Plea For Calmness In National Interest, And Need For Getting IMF-Driven Bailout” as “The present severely acute crisis was not totally unanticipated. It was a gradual deterioration from around 2013 and independent economic analysts had warned the governments in power about its dire consequences.”

The liberal economy (trade) despite the high expectations of its architects, has failed to realize anticipated growth in Sri Lanka. It may be due to its inherent characteristics and deficiencies. But, to respect the sentiments of its inventors, promoters and neoliberal economists, its failure can be attributed to poor implementation, ignorance, lack of guidance and facilitation, absence of entrepreneurship, market inelasticity, inefficiency, imperfection and malpractices. We have failed to reap the benefits of an open economy through boosted investment, exports and tourism.

Difficulties faced in external front

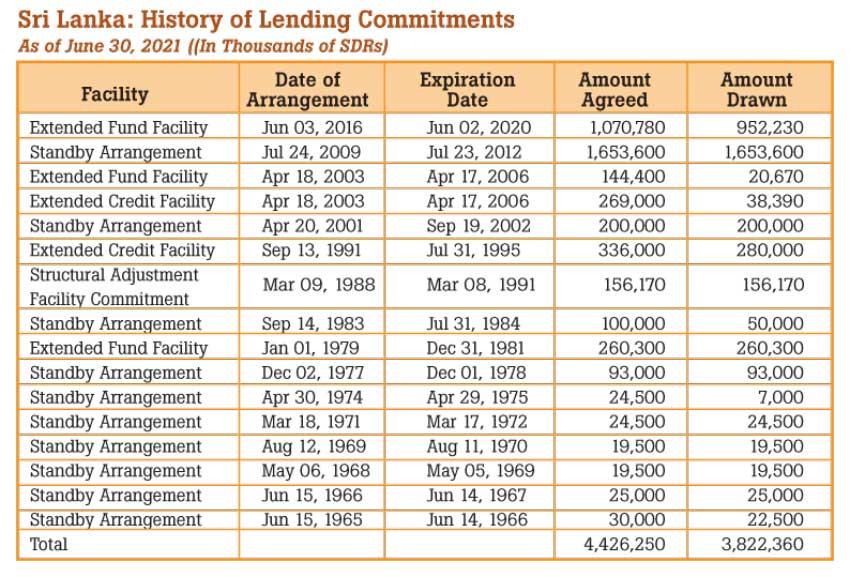

We all (including Prof. Lakshman) know that this is not the first time the country facing difficulties in the external economy. Sri Lanka has sought to bail out assistance on 16 occasions to the tune of over SDR 4.4 billion during the past 60 years. See the Table .

Seeking IMF assistance on 16 occasions reflects the failure of IMF bailout package entailed with conditionality to resolve the problems encountered in the external sector. Is it only a temporary measure of borrowing from Peter to pay Paul?

Prof. Colombage in his article on “Denying IMF support is no solution for Sri Lanka’s economic woes” states, “I wish to emphasise here that the failure of the past IMF programmes in Sri Lanka was largely due to the non-adherence to such policy packages by the successive Governments for political reasons”. This is exactly what had happened. Teams of officials led by CB Governor go for back and forth negotiations and enter into an MOU with IMF agreeing to honor the conditionality. But, fail to get the Government to honor the conditionality. We all know this.

Prof. Lakshman knows this, too. But, he does not know to lie and cheat donors as he was never in the public service. Prof. Lakshman’s reluctance or the shyness to pluck the IMF bailout package dangling before him is obvious. He being an honest man does not want to agree with IMF conditionalities that would not be adhered to by his political masters. There is a saying that those who don’t learn the lessons of history are doomed to repeat them.

I may share a bit of my experience in negotiations with donor agencies. We, public servants, go abroad for aid negotiations and spend more time on sightseeing and shopping and enter into an MOU. We forget the MOU before we land at Katunayake airport. I don’t say that CBSL Governors and officials are like us.

Views held in favour of IMF bailout package

Views held in favour of going for an IMF bailout package is that the economy would get a breathing space to establish economic stability. This would make the economy conducive to attract foreign investment and tourists and boosting exports. But, the truth is that investment, exports and tourism never fared well in this country. There are strong reasons than ‘economic stability’ impeding Investment, Exports and tourism. World Bank Ease of Doing Business Index tells most of them. Bureaucratic lethargy, Institutional inflexibility, age-old regulations, delays, excessive documentation, lengthy procedures, Frequent changes in policies, programs, Adhoc and momentarily decisions, corruption and irregularities, lack of transparency, miss-prioritization, miss-placed emphasis, absence of coordination (vertically/horizontally), the inefficiency of promotional agencies (BOI, EDB,SLTDA) are few to mention. IMF or any other F…… would not be able to change these phenomena with an MOU.

As Colombage states in the same article “As the apex global financial body, it is the mission of the IMF to ensure the stability of the international monetary system – the system of exchange rates and international payments that enables countries and their citizens to transact with each other.” So IMF interest lies more on the stability of the international monetary system rather than the local economic stability. Do we expect Governor CBSL to seek IMF assistance to stabilize the international monetary system when his own monetary system is unstable?

In 1971, the then Minister of Finance, Dr. N.M. Perera said that the Central Bank should come up with its advice dispassionately without the colour of any political party.

I wonder which one out of the 15 Governors heeded this advice. Two Governors were packed away for their fraudulent actions. One Governor advised the Government that the economy was on a sickbed. Fortunately, he relinquished his position before taking the economy to the mortuary. Another Governor told the public that vegetable prices were low at Hunnasgiriya.

In 2008, the Governor has taken several steps to bolster the depleting foreign exchange reserves. One was to issue an International Sovereign Bond (ISB) of $ 500 million. Governor has arranged roadshows to attract investors. He led a team consisting of officials from the Central Bank, Ministry of Finance, People’s Bank and the Bank of Ceylon and visited Singapore, Hong Kong, Tokyo, Frankfurt, London, New York and Los Angeles. He had addressed nearly 50 roadshow meetings.

Then he had sent teams of Central Bank officers to the Middle East, Europe, London, USA and Oceania to request Sri Lankan Diaspora to invest in Sri Lanka government securities in foreign currencies. Since Sri Lankan Diaspora was not as patriotic as the Governor, this attempt has failed. Those who are critical of Lakshman hail these attempts not worth for a Central bank Governor as ‘initiatives’ to overcome the foreign exchange crisis.

Ernst Wolff in his book ‘Pillaging the World – The History and Politics of the IMF’ says IMF assistance pushed countries into greater dependence on global financial markets making the poor poorer and making banks and investors richer. Dedication of his book “to those people in Africa, Asia, and South America who cannot read it because the politics of the IMF denied them the right to education” tells the whole story.

Some say, “Thus, instead of dismissing the critics as purveyors of doom and gloom, it serves well for the Central Bank to sit back and listen to them.” I wonder which Governor before Lakshman came out of his cold room and consulted and listened to outside opinion.

Uwe Hessler, German Economist, in his article “IMF bailouts — roads to stability or recipes for disaster?” states that the stiff medicine doled out by the fund is still subject to huge controversy. Late 1990s Asian financial crisis hit economies of South Korea, Thailand, the Philippines, Malaysia and Indonesia. Hessler says Malaysia stood out as a country that refused IMF assistance and advice. Instead of further opening its economy, Malaysia imposed capital controls, to eliminate speculative trading in its currency. While the IMF mocked this approach when adopted, the Fund later admitted that it succeeded.

Stiglitz on IMF

Joseph Stiglitz, Nobel-prize winning economist who once served as chief economist of the World Bank, note that the IMF policy was appropriate for some Latin American countries it “doesn’t make sense to apply it blindly to other countries”.

IMF bailout package and its conditionality are based on neoliberal economic philosophy. IMF conditionality is a prescription of fiscal austerity, trade and capital account liberalization, public sector layoffs, removing price controls and state subsidies, privatising State-owned enterprises and “structural adjustment policies”.

Many questions on why doesn’t Professor Lakshman opt for IMF bailout package. Dr. WA Wijewardane in his article “Professor W.D. Lakshman: A Social Democrat to the End” provides the answer. He quotes Lakshman “The aim of social democracy is to bring justice, equity and prosperity to everyone, not for a selected crowd”.

(Chandrasena Maliyadde has served as a Secretary to three Ministries before his retirement. He is currently a Vice President of Sri Lanka Economic Association. He can be reached via [email protected])

23 Dec 2024 2 hours ago

23 Dec 2024 3 hours ago

23 Dec 2024 6 hours ago

23 Dec 2024 8 hours ago