18 Nov 2020 - {{hitsCtrl.values.hits}}

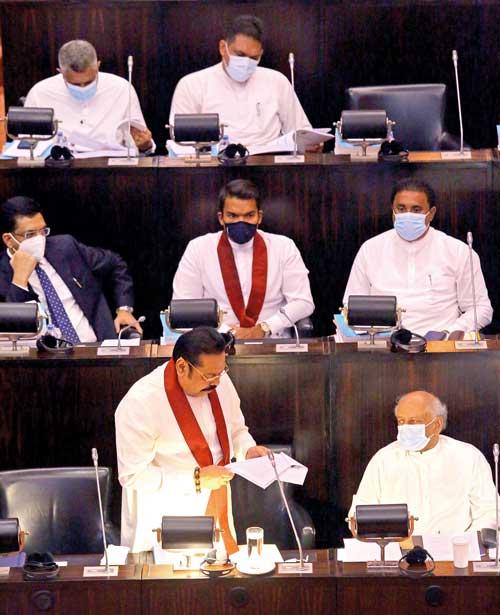

Prime Minister and Finance Minister Mahinda Rajapaksa presenting the Budget for 2021 in Parliament yesterday

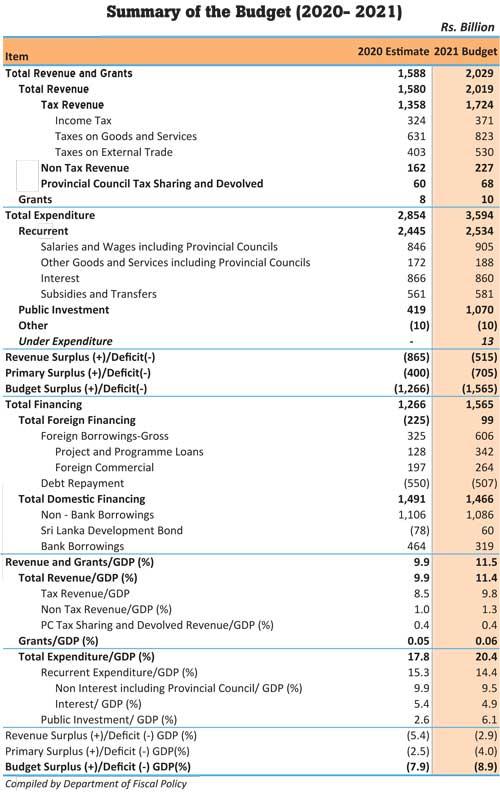

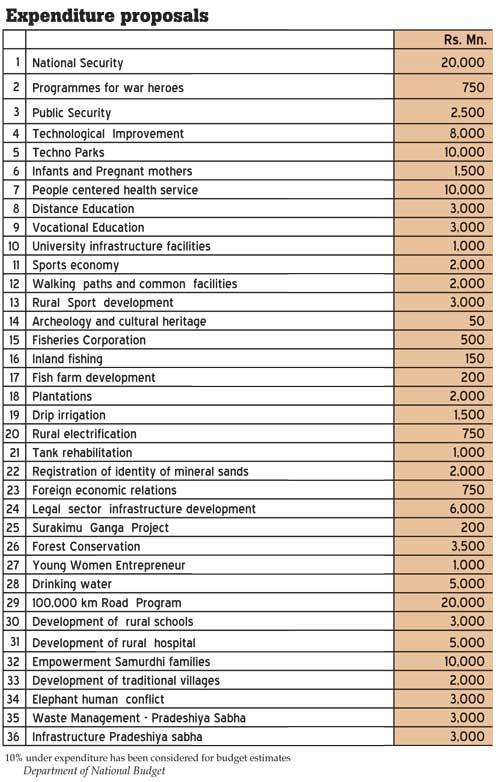

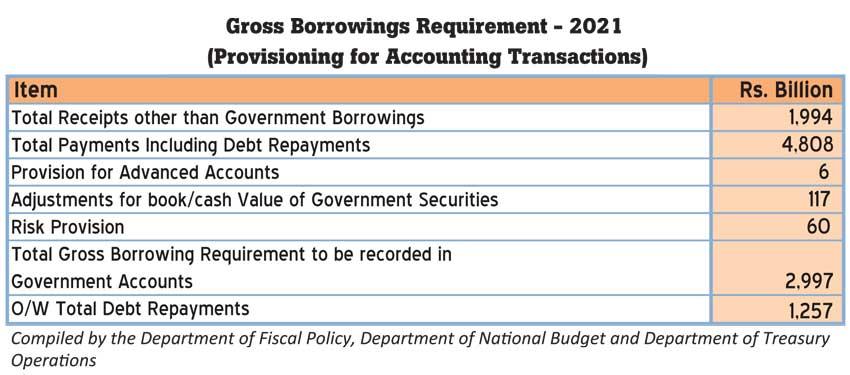

Prime Minister and Finance Minister Mahinda Rajapaksa presented the following Budget for 2021 in Parliament yesterday, considered as the 75th budget report of the country.

Honourable Speaker

It is with great pleasure that I present the budget speech 2021, which focuses on strengthening the 2021-2023 medium term programme of poverty alleviation and economic revival as envisaged within the “Vistas of Prosperity and Splendour”, the policy framework of the government of HE the President Gotabaya Rajapaksa.

Honourable Speaker

Irrespective of the economic standing of the country, irrespective of the challenges we are faced with, we must acknowledge that there is a paradigm shift in the world economy, which moved forward with industrialisation has now entered into a technology driven economy. As policy makers, we must view this as a reason to move away from our outdated strategies and in developing the Agriculture, Industry and Services sectors, technology infusion should be prioritised in accessing the integrated production and service processes. In preparing the economic development plan of our country, we must highlight that the country and the nation as one which is rich in bio diversity, committed to eco-sensitive sustainable development with a unique identity, equipped with a rich cultural history and legacy. Our production process should be modelled to harness such comparative advantages that arise in the background of the country being endowed with natural beauty, rivers, wild animals and one which owns an oceanic resource which is larger than the size of the island.

Honourable Speaker

We are at a time, when many countries have realised the geopolitical significance of our country. I believe that our neighbouring India will be a powerful economy in the world in the next decade. I also believe China together with several other Asian countries will be amongst the 5 most powerful economies in the world. The high growth neighbouring Asian Market which accounts for 60 percent of the global population and emerging economic zone.

We should formulate our national policies with a long term strategic vision, protecting our sovereignty, to exploit the development opportunities that arises as a central hub, in the new economic order of the world, to both the conventional western advanced economies and the powerful emerging eastern economies. We must develop the Hambanthota and Colombo Ports together with the Airports to be a centre in the international commercial processes, expanding the domestic economic opportunities, within a broad national vision.

Honourable Speaker

The HE the President on the two occasions when he presented his policy framework to this Parliament, emphasized the need to implement the policies in the “Vistas of Prosperity and Splendour” as they will facilitate a country owned inclusive growth development as desired by the people of this country. Minimizing the disparities in income levels between provinces and the urban rural inequalities are core factors of this vision of steering the country towards development. The primary objective of our social development programme is to expand the health services to effectively, safeguard people from pandemics such as the COVID 19 as well as from the non-communicable diseases which currently have a high incidence. A knowledge driven economy requires high quality of human resources and as such we should strive to establish an education system which allows the children to hone their skills and competencies to be productive citizens.

Our youth would be better equipped to contribute positively to the growth of the social, economic, political and cultural endeavours with foresight, where a sports friendly community will to create a healthy young generation of children and youth engaged in extracurricular activities. This demands a synchronisation of our efforts in human resource development in the sectors of education and sports. If the best and brightest of our students who successfully complete university education are left with a legacy of unemployment, then surely priority should be given to reform that education system. The Ministry of Education Reforms has already been directly in this regard.

The implementation of a robust social welfare and security programme for the vulnerable groups, elders, differently abled persons, and low income groups is a fundamental tenet of our public policy. The contribution of the health, education, sports and social protection are all inseparable components of the human development as explained in the “Vistas of Prosperity and Splendour”.

In fulfilling the needs of the people, the need for new communication technology has become a basic infrastructure requirement. Drinking water, irrigation, roads, electricity, banks and financial facilities are supplementary infrastructure facilities. It is a major responsibility of the government to empower those who lead difficult lives including farmers, fishermen, those engaged in traditional industries, the self-employed, low income groups who are trapped in home based subsistence economies and small scale businessmen who do not have access to technology, markets and credit with no fixed income yet possess latent production capacity. Given the size of this latent production capacity, they should be facilitated to become major stakeholders of the production economy in our drive to enter into a poverty free economy.

Honourable Speaker

We have understood through “Gama samaga pilisandarak” (a discussion with the village) programme that the people want an economy based on local farm products and agro industrialisation and not a trade economy based merely on imports. HE the President, in his address to this House, emphatically stated that natural resources should be utilized for development in a way that further nourishes them, while being sensitive to its environmental values and that is the vision envisaged in the “Vistas of Prosperity and Splendour”.

We have also identified the requirement of a people-centric public service with pragmatic systems that addresses the ground level requirements rather than complex administrative and regulatory methods in discharging the duties of the government.

Unlike the previous government that undermined and condemned the public service, we will ensure that the public service will be respected and will also put in place a conducive environment that allows the public service to operate with transparency, efficiently and at the least cost. We must condemn the unleashing of political vengeance on public officers who perform their duties in good faith. We must give priority to the voice of the people when reforming our organisational structures and outdated and inefficient legal systems that results in prolonged court cases. As such we must give priority to reform our legal and organisational structures, that will create an environment that encourages both the people and entrepreneurs to engage in their day to day activities.

Honourable Speaker

Macro-Economic Road Map

According to the macro-economic programme of “Vistas of Prosperity and splendour”, our target is to maintain an inclusive growth rate of 6 percent over the medium term.

Priority should be given to the maintenance of price stability facilitating an annual inflation rate of around 5 percent resulting in the control of cost of living. Stable interest and exchange rates, tax policy, banking and financial services and industry operations and regulations should be managed to encourage the supply of goods and services. In this regard the government’s main strategy is to ensure the economic freedom of the people with a production economy facilitated by a structural change within a framework of market economy.

Reducing the revenue-expenditure gap of the government annually from 9 percent to 4 percent is one of the key milestones in the management of fiscal policy. In order to reach that milestone, it is essential to reduce the public debt from 90 percent of Gross Domestic Production (GDP) to 70 percent and to minimize the risk in the debt composition caused by sourcing of foreign loans. It is required to reform the banking and financial sectors to ensure availability of credit and financing for the production process and associated transactions. We believe the Central Bank should have a new perspective on the monetary policy regarding money and liquidity management.

It is required to increase foreign earnings by diversification of exports through value addition to local resources. Trade and production processes should be aligned so as to minimizing the reliance on foreign imports in order to reduce the trade deficit. In reducing the trade deficit, and increasing our external resources, supply of goods and services must be maintained at an elevated level with income earnings from tourism, foreign employment, ports and airport services should also be enhanced. Under this macro-economic vision, we must embark on a development path which broad bases rural development targeting poverty eradication, having created more avenues for livelihood and employment with better access to health, education and social welfare.

Budget Proposals

Utilization of Foreign Loans

The number of programmes, implemented annually with foreign financing, has grown exponentially over the years. However, a significant number of projects worth more than USD 6,000 million shows slow progress. The main deficiencies identified, in monitoring of project planning, feasibility, implementation are deviation of the projects from national requirements, and frequent cost and time escalations resulting in low returns. As such, an increase in the foreign loans as well as the increase in debt services could be observed. Due to these expenditures, productive investments which could have been implemented at a lower cost are not adequately financed, adversely affecting the treasury operations.

Honourable Speaker

We have given priority to realign or reallocate those loan funds in line with the priorities identified in the “Vistas of Prosperity and Splendour” socio-economic development programme. We acknowledge and appreciate the support of the donor agencies in this respect. Within the existing loan facilities, we have given priority to prevention of COVID-19, supply of drinking water, rural road development, expansion of rural health services, and improvement of nutrition of mothers and children and facilitating students to engage in vocational education. Further, we have been able to allocate funds to support new value additions into traditional industries, provision of seed capital for the youth, to start new businesses and introduction of technology for the development of farms. We have also allocated funds for priority sectors including improving capacity of renewable energy and reforms in the finance and capital market.

Accordingly, the planned annual utilization of foreign loans as agreed with the World Bank, Asian Development Bank and Japan International Cooperation Agency alone is approximately USD 1,400 million. In addition, it is expected to obtain bilateral development loans of approximately USD 400 million. Since most of these projects have very little import content and requirement, I believe this measure will also have a positive impact on foreign currency management. Apart from requirements service foreign loans, acquisition of technological and special requirements, almost 65 percent budgetary allocations will be utilised for domestic expenditures.

To ensure better coordination and also to reduce costs, the foreign financed projects will be implemented as part of the ongoing activities of the Institutions while limiting the establishment of project offices and also the costs on foreign consultancies. Foreign financing will be sourced in line with the priorities and strategies of the development clusters. A key aspect of the public investment financing strategy is the utilisation of domestic funds as much as possible to support the implementation of the development of national infrastructure, providing access to the rural economy.

Tax Policy

As stated in “Vistas of Prosperity and Splendour”, the government simplified the tax policy with effect from January 2020 in order to better facilitate tax payers and to make the tax administration more efficient. One of the main factors, of reviving the economy and supporting the businesses to thrive, is a consistent tax policy for the next 5 years. I propose to maintain the VAT unchanged at 8 percent, for businesses with a turnover of more than Rs. 25 million per month engaged in the import and manufacture of goods or provision of services, except in the case of banking, financial and insurance sectors. I propose to improve the efficiency of tax collection through the introduction of an online – managed single Special Goods and Service Tax in place of the various goods and service taxes and levies, imposed under multiple laws and institutions on alcohol, cigarettes, Telecommunication, betting and gaming and vehicles, which accounts for 50 percent of the income from taxes and levies. It is expected through this reform to direct Institutions under special legislation such as the Excise Ordinance to have a more focused regulatory engagement in facilitating the government to secure its revenues otherwise lost through sale of illicit alcohol and cigarettes.

Given that a simplified tax system has been in place since 01 January 2020 and since the tax laws are expected to be amended to facilitate online tax administration, outstanding dues on the taxes such as the Economic Service Charge and the Nation Building Tax administered by the Inland Revenue Department are proposed to be settled through a mechanism which includes a concessionary payment plan based on the payment capacity leading to a full and final settlement resulting in the closure of the those files.

Further, tax law will be amended where it will be mandatory for all Companies to file their taxes only on an “E-Filing” system with effect from 01 April 2021, and the use of the Tax Identification Number (TIN) in all tax and tax related transactions. I also propose to issue relevant instructions under the Inland Revenue Act to ensure better and transparent management with regard to the provisions for anticipated losses of loans and doubtful loans in calculating taxes of banks and financial institutions. Further I propose to strengthen the legal provisions relating to the establishment of specific time frames for the implementation of rulings and for the settlement of appeals submitted against the tax administrative decisions made under the Inland Revenue Act. It is also proposed to establish a special tax appeals court to resolve tax appeals.

Honourable Speaker

Personal Income Tax will apply on earnings from employment, rent, interest, dividends or any other source only if it exceeds Rs.250, 000 per month. Withholding tax on rent, interest or dividends and the PAYE tax (Pay As You Earn) and taxes on interest have been abolished.

Those with earnings exceeding Rs.250,000 per month, from income sources such as salaries, rent, interest and if they wish to pay taxes on a monthly basis, such individuals could advise their respective work places or banks to remit the due amounts and will introduce a simple system to reconcile the tax liabilities through a final income statement at the year end.

Individuals and companies engaged in farming, including agriculture, fisheries and livestock farming will be exempted from taxes in the next 5 years. Earnings from both domestic and foreign sources by those engaged in businesses in Information Technology and enabling services and also their earnings when made while being resident or non-resident will also be exempted from income taxes.

Out of the total tax collections made by the Inland Revenue Department 80 percent is received from high earning and large scale businesses, banks and financial institutions. The Revenue Administration and Management Information System (RAMIS) which I introduced during the period 2013/2014 will be made more effective with the introduction of technical and legal provisions into the tax laws and in further strengthening the tax administration, the various units in place, for this purpose will be brought under one Large Tax Payer Unit (LTPU) targeting those large tax payers, to operate under the direct responsibility of the Commissioner General of Inland Revenue. I propose to introduce the required changes to the Department of Inland Revenue to facilitate enhanced self-compliance and strengthen tax audits in ensuring increased tax revenue in the background of the simplified tax regime. I propose to introduce punitive legal provisions to ensure that the private tax consultants and auditors representing the tax payers and prepares and certifies fraudulent tax reports, aids and abates in such action will be faced with such consequence including being barred from practicing.

Savings and Investment

Along with our efforts to expand the avenues for livelihood improvement, we will lead in the implementation of an all-inclusive national savings programme. Although funds amounting to more than Rs.50 billion have been annually allocated for the recipients of Samurdhi and pension entitlements of farmers and fishermen, however, a savings mechanism that provides an adequate income for to the requirements that arises in their old age or for special requirements has not been in place. Therefore, I propose to open a Samurdhi Life Savings Account -SLSA for each Samurdhi beneficiary by the Samurdhi Bank and to credit the Samurdhi benefit to that account. In order to secure the savings of the Samurdhi beneficiaries, laws will be introduced to make it mandatory to invest these savings in Government Securities similar to the laws governing the National Savings bank and the Employee Provident Fund which requires them to mandatorily invest in government securities. I also propose to release all interest income of such investments from taxes. I also propose to implement a new “Samurdhi enterprise development loan scheme” utilizing 90 percent of the deposits made by Samurdhi banks in State banks to provide loans under an annual interest of 7 percent in order to enhance the home-based economies and entrepreneurial ventures of Samurdhi beneficiaries.

In order to encourage savings, I propose to release the interest income of the welfare societies and institutions from income taxes which was imposed by the previous government.

To encourage private savings, I propose to treat medical insurance, interest on housing loans, investments in Government Securities and shares of listed companies incurred up to Rs.100,000 per month as deductible expenditures in the calculation of personal income tax.

Non-residents could purchase super luxury condominiums utilising, foreign currency earnings made in Sri Lanka, earnings in foreign countries or a loan obtained from a Bank outside Sri Lanka.

In order to promote investments in the housing market through the Sri Lanka Real Estate Investment Trust (SLREIT) regulated by the Securities and Exchange Commission, I propose to exempt such investments from capital gains tax and dividends free from income tax, and to reduce the stamp duty up to 0.75 percent.

So as to promote the listing of local companies with the Colombo Stock Exchange, I propose to provide a 50 percent tax concession for the years 2021/2022 for such companies that are listed before 31 December 2021 and to maintain a corporate tax rate of 14 percent for the subsequent three years.

I propose to simplify the Taxes on Capital Gains, where such taxes will be calculated based on the sale price of a property or the assessed value of a property whichever is higher. I propose to exempt the tax on dividends of foreign companies for three years if such dividends are reinvested on expansion of their businesses or in the money or stock market or in Sri Lanka International sovereign bonds.

On instances when the commercial banks in Sri Lanka purchase Sri Lanka International sovereign bonds subject to a minimum of USD 100 million, I propose to suspend the risk weighted provisioning under Central Bank Regulations for three years and to free the profits on capital and interest income of this investments from taxes.

Investments exceeding USD 10 million with potential to change the landscape of the economy, in the areas of export industries, dairy, fabric, tourism, agricultural products, processing and information technology will be provided with concessions up to a maximum of 10 years under the Strategic Development Law.

In order to promote the Colombo and Hambanthota ports as commodity trading hubs in international trading, and to encourage investments in bonded warehouses and warehouses related to offshore business I propose to exempt such investments from all taxes.

National Security

With the aim of ensuring national security, a medium term plan to enhance the professional skills of the heroes of our tri-forces, providing them with modern technological facilities is currently being prepared. In the context of resource constraints and identified priorities in the country, further strengthening of the Sri Lanka Navy has been given priority. We must combat the drug menace and must eliminate our country from being a becoming a hub for international illicit drug trade. The government expects to ensure that the investments will facilitate to control smuggling of goods, providing the required protection for the fishery resources and fishery communities and establishing a safe environment for carrying out tasks in the Indian Ocean. Further, we have also considered the short term requirement for equipment and infrastructure of the Sri Lanka Army and Air Force in the background of the multiple tasks performed by them including in disaster management. I propose to allocate Rs. 20,000 million as an additional provision for the tri-forces to fulfill the basic requirements identified in the medium-term and long-term planning frameworks in accordance with their basic requirements.

I propose to allocate Rs.750 million for the activities implemented by the RanaViru Seva Authority, including the provision of medical aid, support for development enterprises, conducting of educational and vocational development programmes, housing loans and provision of supporting equipment for the disabled war heroes targeting, the retired and disabled war heroes of the tri forces, police and the civil defense force and the dependents of the families of those heroes have laid down their lives.

Public Security

Government has given special attention to strengthen the police forces so as to assure public security. We must consolidate the environment for all citizens to live freely without any fear. Resources will be allocated to support the control of the drug menace, to regulate vehicles and traffic rules, strengthening Tourist police, special trainings and provide the necessary facilities to prevent crimes and robberies. It is also proposed to expand the police patrols to ensure public safety by deploying special police vehicles. I propose an additional allocation of Rs.2,500 million, to address special programmes aimed at strengthening public security.

Technological Infrastructure

His Excellency the President has given special attention to enhance Digital Governance using Information Technology as a tool to simplify Government mechanisms as well as market structures and processes, ensuring efficient and people-focused service delivery and exchange of knowledge. Establishment of an international e-commerce and e-payment systems, the high speed data exchange system and the related mobile network systems are investment priorities. It is required to establish new laws and organizational structures in relation to data security, cyber security and intellectual property rights. The aim of this is to convert our economy as a technology-based entrepreneurial economy by expanding entrepreneurial development, technological infrastructure and related services to enable enhancement of the contribution of the technology sector for exports and its contribution for knowledge and professional services of the national economy. Therefore, I propose a special allocation of Rs. 8,000 million to expand the technology sector.

Connect Sri Lanka

Creating a ‘Technology based society and digitally inclusive Sri Lanka” is the governments vision. “Gamata Sanniwedanaya” (Communication for the Village) which has been initiated in Rathnapura district to ensure 100 percent 4G/fibre broadband coverage and it is expected to be expanded to the entire country by investing Rs.15,000 million from the Telecom Development Fund during the period 2021-2022.

This programme will expand the availability of mobile and fixed broadband services. It is planned to provide the required infrastructure including communication towers and fibre installations to telecom service providers to establish broadband services covering all the Grama Niladhari divisions of the island.

Priority will be given for the utilisation of local labour and products in constructing and installing the communication towers, the related appliances and the provision of technical services. The communication network will be planned with a view to minimising the impact to the environment. Under this programme, identified state lands will be vested with the Telecommunication Regulatory Commission to successfully implement communication tower installations. To ensure optimum utilization of the available resources the Telecommunication Regulatory Commission and Ceylon Electricity Board will collaborate. A five year tax concession will be made available from 01 January 2021 to domestic industrialists. I propose to allocate 50 percent of the Telecommunication Development Levy for these investments.

Techno Parks

I propose to create a techno- entrepreneur led economy to that will contribute to the increase of exports and foreign earnings from the technology field and broaden the knowledge and professional services to the national economy within the next 2 years. It is expected that the establishment of Technology centred investments and allied service industries, which transforms into high income employment opportunities for our young men and women. As such, I propose to establish 5 fully-fledged plug and play Techno Parks in Galle, Kurunegala, Anuradhapura, Kandy and Batticaloa districts. I propose to allocate Rs.10,000 million to develop these Techno Parks as eco-friendly new cities connected to the expressway network and other infrastructure facilities.

HE the President has already taken the initiative to establish a new University catering to Port and Aviation Technology Engineering subjects by 2023 in Deniyaya in the Matara District.

Investment in Public Health

Investment in public health has become more important than ever. The World Health Organization (WHO) as well as many countries have forecasted, the new reality would make it unavoidable to be engaged in the day to day activities of the people with the Corona pandemic.

There are more than 50 million cases of COVID-19 infections in the world with around 1 million deaths being reported. In many countries it has reached the second or third stage and there is a risk of the pandemic spreading faster than the first stage.

In this context of the new reality, I proposed to provide an additional allocation of Rs 18,000 million for the expansion of maternity and child clinics, dispensaries and adult service centers, laboratory services, hospitals and research institutes with the required human resources to maintain a people centric health service.

I also propose to create a new insurance scheme to support those who temporarily loose livelihoods due to the quarantine process related to epidemics including COVID.

I propose to get businesses and factories with more than 50 employees, to contribute 0.25 percent of the turnover to the proposed insurance fund. It is intended to use this insurance scheme for employed at retail and wholesale shops with more than 5 employees and hotels. I also propose to implement a COVID Insurance Scheme with the assistance of the Government in parallel to the Agrahara Insurance Scheme for all public services.

Manufacturing of Medicines

The importation of drugs for free health care in our country alone costs about US $ 550 million annually. I propose to provide bank and financial facilities on Treasury guarantees to increase the production capacity of the State Pharmaceutical Manufacturing Corporation to expand the production of essential pharmaceuticals. I also propose to establish a modern investment zone for local and foreign private investors under the Strategic Development Act.

Nutritional development of infants and pregnant mothers

The production of Thriposha, the supplementary food to infants and pregnant mothers in our country, has been severely curtailed due to the lack of cereals such as maize, soya and green gram are used to produce Thriposha and therefore is it distributed to only less than half of the required infants and mothers. Therefore, an additional allocation of Rs. 1,500 million will be provided to purchase from farmers these raw materials and to store the same, so as to increase Thriposha production.

With this program, which will commence with the harvesting of the grain in the Maha season, the continuous distribution of Thriposha food to infants and pregnant mothers will commence from March.

Distance Education

As the first step in educational reforms, there is a requirement to formalize the learning methodologies within schools, and the need to expand the provision of internet facilities to schools as well. There is a requirement to update the E-Thaksalawa learning portal along with the strengthening of the provincial IT education centers. To minimize the difficulties faced by students in rural and non “National Schools”, due to shortage of teachers, and ensure the provision of continuous school education in the face of the COVID-19 epidemic, the ‘Guru Gedara’ education channel should be made available to all students by providing television sets to schools in difficult areas. It is proposed to allocate Rs. 3,000 million for this purpose. All education institutes, education reforms including the expansion of the syllabi in line with the contemporary requirements, regulation of teacher education and training, and examination procedures are planned to be regulated under a national education policy.

Opportunities for Vocational Education

We have given priority to strengthening the island-wide network of these new technological and technical universities, by modernising the technical colleges to be attractive to our young men and women, under the “one TVET” concept within a formal regulatory framework, by converting these institutes into degree awarding entities in parallel to the expansion of opportunities for university education.

At the same time the main objective of this initiative will be to combine vocational education with entrepreneurship, equipping the students with knowledge and skills including in information technology, English and other languages and in the required technical skills. Action will be taken to increase the current annual intake of 100,000 students to state-run vocational education institutes up to 200,000, which requires training instructors, provision of technical equipment and to maintain and modernize buildings. I propose to provide the instructors and staff of the vocational education institutes with incentives based on their performance and to provide a monthly bursary of Rs. 4,000 for students in the vocational education system. As such, I propose to allocate Rs. 3,000 million as an additional financing for this purpose.

It is proposed to upgrade the Nursing schools to that of degree awarding institutions to expand the professional education of nursing and nursing services.

I propose to provide loans of Rs.500,000 at an interest rate of 4 percent as start-up capital to support the young men and women, who start their own businesses on the successful completion of vocational education. This loan will have a grace period of one year for both principal and interest, with a further 4 years to settle the loan.

Accordingly, these entrepreneurs will be facilitated to receive the opportunity to pay an instalment together with interest less than Rs.12,000. In order to ascertain that the said loans are invested on the approved business, an annual commitment fee of 0.25 percent will be charged for follow up and extension services. I propose to give a tax exemption of 5 years to these businesses. I propose to consider the Cost of Funds of funds provided for such start-up capital, provided by banks and finance agencies as deductible expenditure in the calculation of taxes.

In order to encourage the private sector institutions which will be standardized under one TVET concept, to enhance their student intake at least up to 50,000, I propose to give a tax holiday on their income for a period of five years if those institutions double their intake. Similarly, I propose the Foreign Employment Bureau to facilitate the youth who possesses specialized skills in sectors like Tourism, Health, Construction, Agriculture and Animal Husbandry to seek foreign employment.

Expansion of University Facilities

Provisions have been made to expand educational opportunities in national universities in disciplines, such as medicine, engineering, technology, law, commerce and business management. At the same time, I propose to set up a non-resident City University per District, targeting specific areas of high demand for employment opportunities. As a start, I propose to convert existing vocational education or other government owned buildings and infrastructure facilities in the Kalutara, Ampara, Puttalam and Nuwara Eliya districts. I propose to allocate Rs. 1,000 million for this purpose.

Sports

The Government considers sports development as a national investment, supplementing education, where sports development helps in preventing the youth from resorting to illegal activities by expanding their participation in rural as well as national level sports competitions. I propose to develop 10 sports schools with synthetic race tracts in order to attract the youth to sports and extra curricular activities through sports schools as well as youth community organizations associated with cultural centres.

I propose to allocate additional provisions amounting to Rs. 2,000 million as the initial investment out of the larger medium term investments to be made during 2021-2024 aimed at establishing a sports complex for the 2032 Olympics, expansion of female participation, in national and international sports events and establishing a sports economy of USD 1,000 million by 2025. This programme also includes establishment of synthetic tracks in Kurunegala, Jaffna, Torrington, Bogambara and Diyagama sports complexes and establishment of a modern sports city in Sooriyawewa with information and modern technology facilities.

Walking Tracks and Connected Common Amenities

It is planned to establish urban walking tracks and associated common amenities in municipal and urban council areas island wide in an eco-friendly manner co existing with the bio diversity of each these areas. Since common amenities such as relaxing and a healthy outdoor environment constitutes a fundamental requirement of urban dwellers and I propose to allocate Rs. 2,000 million to develop these facilities.

Tourism Industry

The Covid-19 has dealt a serious blow to the tourism industry before it could barely recover from the collapse experienced due to the Easter attacks. We need to formulate strategies to develop the tourism industry that has diversified fairly well, and the tourist attractions in our country under normal conditions while protecting them at this juncture. Although it will take time, there are many opportunities to develop the tourism industry as a sector worth over USD 10 billion. The tourism industry can be developed in the short run, by tapping into the domestic tourism sector which has otherwise spent almost USD 1,500 million per annum for foreign travel, to make use of the domestic tourist facilities by developing such facilities under strict health regulations. Therefore, I propose to extend the concessions and recovery of loans granted under the re-financing facilities of the Central Bank of Sri Lanka until September 30, 2021. I propose to provide the Banks with a Treasury guarantee covering 50 percent of such loans. I also propose to make necessary amendments to simplify the taxes and fees levied by the Local Government Institutions on tourism with an upper cap.

Archaeological and Cultural Heritage

Presidential Task Force with the relevant institutions for the conservation of Archaeological heritage and cultural expansions have prioritized the formulation of a strong legal framework for archaeological heritage management. In addition to the budgetary allocations for the rehabilitation of archeological and cultural centers, an additional allocation of Rs. 50 million will be made to improve the basic infrastructure required for temples in remote areas.

Foreign Employment

About 1.5 million people in our country are engaged in foreign employment. The majority of them are women from rural areas with low income. From 2010 to 2014, we facilitated more skilled workers to seek overseas employments as a way to transform low-income earners in rural areas into high-income earning status. We were able to increase their earnings from USD 4 billion to USD 7 billion. From 2015 to 2019, income from foreign employment income fell to less than USD 6.5 billion in comparison to the number of skilled workers employed overseas.

Honorable Speaker

To address this situation, an integrated programme will be implemented with the participation of vocational training institutes, Foreign Employment Bureau and foreign employment agencies with the aim of directing skilled workers for foreign employment and diversifying the foreign employment market. The proposal I made in 2013 to introduce a contributory pension scheme for those whose workers engaged in foreign employment will be also implemented.

I propose to pay Rs. 2 per dollar above the normal exchange rate for the foreign exchange remittances sent by foreign workers to banks in Sri Lanka.

Measures have been taken to repatriate 45,000 employed persons from 126 countries who wanted to come to Sri Lanka in the wake of the COVID-19 epidemic. More facilities will be provided to the people who are expected to come in line with the existing health facilities in the country.

Agriculture

The 2020-2021 Maha season is now blessed with the monsoon rains. Maha season is the time when every inch of our land is cultivated. Our island has been famed for food security from the time of our forefathers. When the nature is on our side economic growth has always exceeded 5 percent. This blessing does not allow the unreasonable price escalations in rice, maize, vegetable and fruits. Apart from the farm products, electricity, irrigation, drinking water, wildlife and forest has added value to our production economy. As such it held us to keep inflation at as a subdued levels. That is why we must add value to each drop water that has been given to us by Mother Nature.

A guaranteed price will be provided to encourage our farmers to cultivate Rice, Maize, Kurrakkan, Sesame and black gram. This is a blessing also for the cultivation of vegetables, fruits and coconuts and other plantation crops. As such, a proper distribution of fertiliser should be taken care of by District Secretaries and the fertiliser secretariat should ensure. We will also guarantee the provision of fertiliser for paddy free of charge, while a 50 Kg bag of fertiliser for other crops would be given at a concessionary price of Rs.1,500. Parallel to this organic crop cultivation zones will be developed by encouraging the use of organic fertiliser with high quality mixed fertiliser.

Land that can be used for the cultivation of paddy have been left abandoned. It si a national priority to cultivate all arable lands. I request all owners of paddy land and others to engage in cultivation in the forthcoming Maha season.

I propose to amend the Agrarian Development Act no 46 of 2000 to empower the District Secretaries to direct the use of barren and abandoned paddy and other agricultural land for productive agricultural purposes.

We also promote the District Secretaries, Cooperatives and farmer organisations apart from the Paddy Marketing Board to maintain buffer stocks of paddy. It is also proposed to uphold the policy to limit the importation of all agricultural products which can be produced locally.

Budgetary provisions have been made available to provide seeds, fertiliser and the expansion of extension services in addition to the provision of a guaranteed price to encourage cultivation of B and Red Onions, Potatoes, dry and green chilies.

We will provide the concession on customs duties and will also support the extension of credit facilities to acquire cold room facilities for the preservation of fruits and vegetables.

Import of Ginger and Turmeric have been completely stopped so as to encourage the cultivation of those, while also proposing a support scheme to promote, the cultivation of ginger and turmeric as additional crops in coconut and rubber lands.

Local Dairy Industry

A key policy priority of the government is to gradually reduce the foreign exchange utilized amounting to more than USD 300 million per annum (Rs. 55 billion), on the import of milk power, and meeting the increasing demand for liquid milk through domestic dairy production. Directing the large foreign exchange outflow in importation of milk powder to local farmers and producers will result in an expansion of the agriculture sector and creation of alternative income sources for rural farmers.

The amount of milk that can be obtained from one cow per day in dairy farms operating at different scales ranges from 4.5 liters to 22.4 liters. Experts have pointed out that the imported dairy cows can produce more than 20 liters in accordance with their genetic potential. Lack of pastures and lands that can be developed as pastures, temperature and issues in water management as well as insufficient animal feed with the required nutrients, non-usage of modern methods in animal farms and infertility of cows are identified as constraints for the enhancement of milk production.

Therefore, it is planned to import dairy cattle for the development of Rideegama and Bopaththalawa farms of the National Livestock Board as cattle breeding farms and to cultivate nutritious pasture, maize, sorghum crops in the livestock farms. I also propose to increase the government contribution to develop small and medium scale dairy farms through extension services which supports the dairy cattle for breeding. I propose to implement a loan scheme to provide special loan facilities up to Rs. 500,000 at an interest rate of 7.5 percent per annum for the purchase of dairy cattle, setting up of ecofriendly cattle sheds and purchase of equipment for small and medium scale dairy farms.

I also propose to provide allow the deprecation in 2 years of the capital investments done on latest technology to collect local liquid milk in collaboration with local dairy farmers, enhancements to milk related productions and promotion of liquid milk. I also propose to provide strategic investment tax concessions for a period of 5 years for capital investments of over USD 25 million with the view of facilitating these companies to process milk powder exports instead of importing milk powder.

Fishery economy

With a view to increase rural income sources and ensure availability of nutritious food, I propose to increase freshwater fish production to 250,000 metric tons by releasing 50 million fingerlings annually to tanks and freshwater reservoirs with an allocation of Rs. 150 million.

I propose to simplify the administrative process for the exportation of most sought after fish and aquatic plants, to develop tissue culture methods, to increase the availability of fish feed and to increase airport and cargo/freight facilities for exports. I propose to allocate Rs. 200 million for the development of Fisheries Farm Zones with infrastructure facilities in line with the environmental standards in the Districts of Batticaloa, Jaffna, Puttlam and Mannar which are suitable for fish production such as prawns, lobster, carp, tilapia and modha.

A mechanism will be developed to import fish that are not available in Sri Lanka for the production of dried fish, Maldive fish and canned fish. The tax levied on the importation of such items, will be maintained at a high level to encourage domestic production. I propose to allocate Rs. 500 million to enable a complete restructuring of the Ceylon Fisheries Corporation to make it a profit-making entity for the benefit of consumers as well as the fishermen.

We will provide facilities in line with green European standards at the Kudawella, Beruwela, Devinuwara, and Galle fishery harbors and develop the Point Pedro, Oluvil, Gandara Fishery Harbors and anchorages at the Kapparathota, Dodanduwa and in Hikkaduwa. I also propose to further increase the provisions for developing facilities of fishery habours and modern fishing vessels and for increasing deep sea fishery production during 2021-2021 Medium Term Budgetary Framework.

Plantation

Special attention has been given to use new techniques in tea cultivation, mitigate the impact of adverse weather and to enhance the usage of organic fertilizer. The profitability of plantation sector can be enhanced by diversifying income streams of small rubber plantations and through natural rubber associated industries. For enhancing the productivity of coconut cultivations, water conservation methods, including trenches, drip irrigation systems as well as usage of fertilizer and use of barren paddy fields for coconut and king coconut cultivation are identified as priorities. It is planned to diversify the local Kithul and Palmyrah industries with a view to access the export.

It is planned to promote sugarcane cultivation in Kantale, Badulla, Monaragala to enable sugarcane farmers with garner a higher income. Plans are also in place to increase the production capacity of the Lanka Sugar Company by 70,000 MT, to modernize sugar production factories and to modify the distilleries to enhance Ethanol and related products.

Provisions are also made to expand programmes implemented under the Ministry of Plantation Industries with the aim of establishing export, cultivation and processing zones for Ceylon True Cinnamon.

Diversification in the plantations industry is included in the government priority of revitalising the plantations economy based on tea, coconut, rubber and cinnamon .

Department of Civil Security has planned to cultivate 6,500 acres of cashew of land belonging to the Sri Lanka Cashew Corporation in conjunction with the farmers in tegh area, and to cultivate crops such as black gram, green gram and chilli during the first phase of cultivation of cashew. Sri Lanka Cashew Corporation will provide the extension services to promote cashew cultivation in Mannar and Puttalam districts amongst the small land owners.

I also propose to provide relief on custom duties and financing facilities to obtain land and modern equipment for entrepreneurs investing in value additions to local crops such as pepper, cloves, cardamom and coffee suitable for the export market. I propose to provide additional allocation of Rs. 2,000 million for these development work to be undertaken in the plantation sector.

Reform of Large Scale Plantation Companies

For almost 30 years since the privatization of plantation companies in 1992, large-scale estate management has been entrusted to the private sector. Small-scale tea plantations have increased their total tea production while the contribution of large-scale estates has fallen to about 25 percent. Diversification has not materialised in many of those estates. Only a few companies have developed high value brand of their own and with only a few companies developing into a true export industry. Non-cultivated lands can also be seen in many estates under these companies. The government also provides basic facilities such as hospitals, schools, houses, roads, electricity and water that enables the ongoing operations of these companies. Among them are companies that have not paid their taxes. Also, workers on plantation estates receive very low daily wages.

Under these circumstances, steps will have to be taken to encourage plantation companies that have become more successful and to review the privatization agreements of unsatisfactory plantation companies and to setup alternative investments that can be commercially developed. I also propose to increase the daily wage of plantation workers to Rs. 1,000 from January 2021. I intend to present to Parliament in January a legal framework that will change the management agreements of plantation companies that are unable to pay this salary and provide opportunities for companies with successful business plans.

Roads

Under the expansion of expressway network, the construction of Kerawalapitiya-Meerigama as well as Kurunegala-Dambulla and Pothuhera-Galagedara sections of the Central Expressway and the construction of Ingiriya- Kahathuduwa section being the first phase of Ruwanpura Expressway are expected to be completed by 2024. Construction of the Port Access Elevated Expressway is now underway while the procurement procedures are at the final stages with regard to the Road from Kelani Bridge to Athurigiriya. A separate state company has been formed with the vesting of expressways and related assets, to ensure the development and maintenance of the expressway network in the country. Steps have been taken to extend the marine drive up to Moratuwa. Public Investments have been allocated develop bridges and by roads to ease the traffic congestion in Colombo and its suburbs. I propose to fast track the implementation of the 3 year Road Development Programme which covers all 25 districts as mentioned in the Budget Estimates. I further propose to expand the railway network in Colombo and suburban areas and to expand the Kelani Valley Railway up to Awissawella which will complement the development in the urban highway network. It is also proposed to obtain the direct contribution of Department of Railways and local engineers in rail road development projects.

Electricity

Since no power plant has been added to the national grid during the last five years, continuous supply of electricity in 2021 and 2022 is at risk. In order to mitigate the risk, it is planned to augment the capacity of the Lakvijaya Coal Fired Power Plant by 300 MW and to establish 2 natural gas power plants with a generation capacity of 600 MW. It is also planned to convert the Kerawalapitiya power plants as natural gas power plants and to establish an additional natural gas power plants with private ownership. Since the existing diesel power plants has been in operation for over 20 years, it is proposed to amend the related agreements to reduce expenditure amounting to over Rs. 15 billion that is incurred in this regard. I also propose to amend the Public Utilities Commission Act and Ceylon Electricity Board Act to allow the rapid implementation of projects. Our target is to ensure that the electricity cost of the consumers and businesses will be reduced, establishing a competitive electricity supply in the region by 2023 through the reduction of the current level of massive expenditure spent on electricity generation.

Development of Renewable Energy

The “Vistas of Prosperity and Splendour” aims to ensure that by 2030 at least 70 percent of the total energy requirement of the country could be sourced through renewable sources. Since the foreign exchange spent on the importation of fuel for power generation is saved through the development of renewable energy, it will be one of the main import substitution industries. Up to now 300 MW of solar energy is added to the national grid and it is expected to add 1,000 MW capacity through local investments within the period 2021 – 2023.

I propose to add a capacity of 500 MW to the grid, by providing solar panels generating 5 kW to 100,000 houses of low income families, through the loan schemes from the Asian Development Bank and the Indian Line of Credit, to supplement the government’s investments in the sector. I propose to provide loans at an interest rate of 4 percent in this regard. This will facilitate the low income families to save the expenditure on electricity and also earn an extra income by supplying excess energy to the national grid. I propose to invest on installation of solar panels on roof tops of religious places, public institutions, hospitals, schools and defence establishments. I propose to facilitate private entrepreneurs at rural level, to install solar power plants connected to 10,000 transformers under the theme “Gamata Balagarayak - Gamata Vyavasakayek”.

I propose to provide capital grants of Rs.150,000 to 10,000 small and medium scale commercial agro entrepreneurs, with agricultural wells to install solar power operated water pumps in order to increase production capacities by harnessing new technology including drip irrigation. I propose to reduce the expenses on electricity by providing solar energy for lift irrigation and drinking water supply projects that use RO plants. I also propose to provide electricity either through solar energy or rural electricity generation schemes and to ensure the objective of “electricity for all” by the end of 2021. I propose to allocate Rs. 750 million in this regard.

I propose to increase renewable energy capacity to 1,000 MW by the expeditious implementation of both off shore wind and floating solar power plants exceeding 100 MW, with incentives provided by the Board of Investment. I propose to allow a tax holiday of 7 years for all renewable energy projects.

Irrigation

Allocations are made in the 2021-2023 Medium Term Budgetary Framework to rapidly complete the Uma Oya Multi-purpose Irrigation Project and hydro power plants, to enhance the irrigation facilities in Central and North Western provinces through the expansion of Moragahakanda- Kalu Ganga related irrigation system and Hurulu Oya irrigation scheme and to rapidly complete the major water supply schemes including Gin, Nilwala and Malwathu Oya.

With the completion of the harvesting in 11 Districts, small and medium sized tanks will be rehabilitated in agricultural areas to improve the water stock to support the farmers to prepare for the 2021 Yala season and to prepare for this process, I propose to an additional allocation of Rs.1,000 million.

Water for all National Programme 2021-2024

Providing safe drinking water for all is considered a priority. At present, only 54 percent of the population have access to pipe-borne safe drinking water. Therefore, under the “Water for All” national plan, it is planned to invest Rs. 1 trillion (Rs. 1,000 billion) in 2021-2024 in 1,000 community water projects, 171 major projects aimed at enhancing the production capacity, new water supply schemes and expedite on going projects with the objective of ensuring access to drinking water to the entire population. It is also planned to enhance the local value of this project by engaging local engineers and contractors at national as well at rural level.

Under this mechanism, it is expected to increase daily volume of water supply from 2.1 million cubic meters to 4.4 million cubic meters and to provide pipe-borne drinking water to an additional 3.5 million families, by laying at least 40,000 km of pipes throughout the country. Commencing this initiative Rs. 125 billion is allocated for 2021 to implement 263 community water projects, enhance the usage of current water supply through 171 projects and to commence 40 new projects. Along with this allocation, treasury guarantees will be provided to obtain bank financing.

Foreign Trade and the National Economy

Honourable Speaker,

We have extensive experience of the limitations of the closed economy that existed for about 20 years before 1977, and the open economy that has been in place since then. Many countries, through multilateral, bilateral and unilateral experience, have embarked on extensive reforms to expand the domestic production. In many countries today, the roles of the private and public sectors are being aligned more carefully than ever before in the face of the private sector’s limitations in the wake of the global Corona pandemic.

We cannot be satisfied with the benefits accruing from the free trade agreements that our country has entered into in the past. As a result of these agreements, many manufacturing sectors have suffered setbacks and instead becoming manufacturing entrepreneurs they have become importers. The negative impact in trade balances, facing the country have not been resolved due to these agreements. In trade with India, China and Japan, the major economies in Asia alone, we have a trade deficit of close to USD 9,000 million. We should strive to create a market of this calibre in these in these 3 nations for our products such as Tea, apparel, rubber products, cinnamon, pepper, gems electrical appliances. We believe this to be the main responsibility and role of the Ministries of Foreign Relations and Trade.

We will allow the import of high technology and equipment of developed countries as well as unique raw materials and intermediate products that cannot be manufactured in the country which could result in development of high value addition exports. The Export Development Board and the Ministry of Foreign Affairs should take the lead in formulating bilateral trade agreements that will expand the market for exports of our country’s specific agricultural products such as tea, cinnamon, pepper, traditional ornaments and consumer goods, as well as toxic free vegetables, grains and fruits. We have taken steps to deploy our new foreign ambassadors for this purpose. We are not in a position to open the service sector that includes banking, finance and various professional sectors.

Therefore, free trade agreements should be drafted with strategies to bridge the trade gap by limiting imports through production of goods that can be manufactured within the country facilitating industrial development. Therefore, I propose the to formulate a balanced trade policy yielding long-term returns so as to increase the export earnings of our industrial products and to save foreign exchange through import substitutions that could be produced locally.

Honourable Speaker,

In ensuring that the production economy is geared to fulfil the above objectives, the following proposals will be implemented.

1. To limit importation of agricultural commodities except the items that cannot be produced domestically (negative List).

2. To impose the Special commodity levy to balance the supply and demand of domestic production for selected agricultural products

3. To impose CESS to provide the required protection on the imports and exports of domestic production

4. To remove import taxes on the raw materials not available in the country, machineries and equipment with modern technology, to boost exports, and also to encourage domestic industries to produce value added goods

5. To classify all imports other than the above, under three categories of 0, 10 and 15 percent.

6. If any commodity has been exempted from VAT at its importation point, I propose to exempt from VAT, the domestic production of that particular commodity as well.

7. In order to make import and export procedures more efficient the officials of required regulatory bodies, will be assigned to the Department of Import and Exports to provide the required services.

8. To ban the importation of batik products under national sub headings in order to develop batik and related fashions as a national industry.

9. In order to develop the local garment industry as a local and international garment manufacturing hub with high quality garment and leather products demanded by foreigners and tourists, relax the import and to implement the new tariff system.

10. To develop the Rathnapura International Gem Industry City and enhance the gem and jewellery industry.

11. In order to encourage the exports of multi-national companies which are import based for requirements of the domestic market, it is proposed to reduce the tax imposed on their dividends by 25 percent in 2021 and 50 percent in 2023 under the condition that they increase their exports by 30 percent and 50 percent in the respective years.

12. In order to maintain a similar amount as the import expenditure in foreign exchange in domestic banks, the interest income of such deposits will be exempted from taxes.

13. Development of untapped industries such as mineral sand, phosphate, fertilizer and graphite as export industries with high value. To develop the latent industries such as mineral sand, phosphate, fertilizer and graphite as high value export industries, I propose to reduce the expenditure on research and development expenses of local entrepreneurs involved with the Institute of Nanotechnology from taxes. I propose to allocate Rs. 2,000 million to initiate the registration of the Sri Lanka identity of these products.

14. Provide investment incentives for rubber and coconut related industries, building materials and office equipment and furniture as major industries. I also propose to provide incentives for investments on household needs as well as coconut related industries including brooms, ekel brooms, rugs and rubber related products including agricultural and consumer needs, building materials, office furniture, to support them as main industries.

15. I propose to provide separate docks, dockyard access facilities and long-term credit facilities to promote boat and shipbuilding activities which has high development prospects due to the rising demand in the fisheries, tourism and shipping sectors and the high production potential of local manufacturers. It is also proposed to grant a tax break of 7 years for local boat and shipbuilding.

Foreign Economic Relations

In meeting the needs and expectations of the people, specially those of our citizenry that is employed overseas and engages in commercial activities, it has been made necessary to restructure the Ministry of Foreign Relations and Diplomatic Missions abroad to go transcend its traditional diplomatic endeavours. One of the primary tasks in this regard is to bring the staff employed for tasks to be performed overseas by various institutions and Diplomatic Missions abroad under direct supervision and coordination of the head of the Missions.

Further, it is required to expand the contribution of the Diplomatic Missions for Economic Diplomacy in a way that optimises the opportunities for exports, tourism, foreign employment and investment in our country under the dynamic world economic conditions.

We consider it to be a prime responsibility of the Diplomatic Missions in their performance evaluations, to review the bilateral agreements entered into from time to time and to implement the friendly and non-aligned foreign policy of the government in a way that secures the national security and sovereignty with due consideration to contemporary trends and local economy. I propose to allocate Rs. 750 million to take necessary steps to overcome the barriers faced by our entrepreneurs in order to utilize market opportunities presented in the emerging Asia- Pacific region, Africa, the Middle-East and Western countries.

Engaging Public Enterprises in the Manufacturing Process

In spite of the large quantum of funds utilised annually for maintaining public enterprises, we cannot be satisfied about their contribution to the national production process. The recurrent expenditure spent on these institutes in 2019 by the Treasury is over Rs. 42 billion with capital expenditure exceeding Rs.20 billion. Further, there is an increasing trend of these institutions to depend on loans from state banks and treasury guarantees. Most enterprises except those that have a strategic importance such as Sri Lankan Airlines must be transformed to reduce their dependence on state banks and treasury guarantees and thereby to reduce the burden on the government. It is expected that with public investment reaching over Rs,1,000 billion, that state sector construction and service entities will also be participating in the implementation of the envisaged work, which will reduce the transfers of both recurrent and capital nature to the public enterprises.

I propose to implement various development programmes through public enterprises amounting to at least twice as the budget provisions allocated to them.

For example, public institutions in the construction sector such as Kolonnawa Government Factory, Department of Buildings, State Engineering Corporation, State Development and Construction Corporation, Central Engieneering Bureau, Railway Engineering Bureau, Sri Lanka Land Reclamation and Development Corporation can implement construction projects of the Government. Therefore, I propose to entrust the public enterprises with the task of implementing the projects in the Public Investment Programme instead of allocating recurrent and capital expenditure for 2021. Public institutions should refrain from underestimating the procurement process by carrying out the intermediate role of providing sub contracts to the private sector.

Automobile Industry

The value of vehicles imported utilizing foreign exchange during the last 5 years has amounted to around USD 5,318 million which is significant in that it is equivalent to around 21 percent of the amount of debt we borrowed during that period. Even though the domestic market is this large, industries relating to at least reconditioning of vehicles for exports or vehicle assembly have not been developed in the domestic market. The present vehicle fleet in the country consists of a large number of repairable vehicles of the public sector and ambulances. I propose to reduce the import taxes levied on vehicle spare parts required for new production sectors to incentivize entrepreneurs in automobile industries engaged in vehicle repairing and vehicle assembly. Further, it is proposed to develop railway compartment production as a domestic industry.

Construction Industry

Upgrading the construction industry which contributes to more than ten percent of the national economy will pave the way for development of construction related industries, expansion of professional services, new employment generation, and improving livelihood initiatives. Government has taken necessary action to simplify various institutional approvals and license procedures pertaining to the construction industry in order to make the supply chain more efficient.

The special presidential task force has prepared an estimate of raw materials for implementing projects such as housing, roads, irrigation and water supply. Accordingly, RDA will prepare a special programme to obtain raw materials such as rock, sand, soil etc. from identified locations, minimizing the damage to the environment. All identified excavation centers will be assigned to the RDA and they will supply those materials to the construction industry without a middle-man. The RDA is entrusted with the development of these sites pose excavation in an eco-friendly manner. Certain raw materials such as cement, premix, iron rods, bitumen that cannot be produced domestically will be imported in bulk without import duties, to be used to for the construction of mega housing schemes, highways and also to ensure the smooth and continuous availability of such materials for small and medium construction activities at a competitive price. Vocational training institutions have planned to implement fast tracked training programmes facilitating the training of skilled workforce to match the labor requirement of the construction industry.

To ensure the availability of skilled labour required for the construction industry vocational training institutions have planned on intensive training courses. Since we cannot rely on the unskilled labor of foreign countries, multipurpose development department has planned to provide the required labour to meet the demand. As such the government has planned the supply chain in order to reduce the overall cost of the construction industry.

To ensure continuous payment pertaining to the contractors engaged in government sector projects, facilities will be proposed to be provided to obtain ninety percent of the value of the certified bills from the banks. I propose to exempt import tax on the import of machinery with modern technologies. I further propose to implement a treasury guarantee scheme for leasing companies to obtain the leasing payments for purchase of equipment required by small and medium-term entrepreneurs.

In order to encourage the recycling and re use of material from construction, I also propose a ten year tax holiday for investments in selected recycling sites.

Urban Townships

Expansion of housing complexes and associated social facilities required by the emerging workforce over the next 5-10 years through urban development activities of the expansion of the Colombo Port, urban development zone, Colombo and suburbs as well as in the island’s major cities will be a key component of our development program. This national programme is an integrated investment effort to enhance the investments relating to private sector industries, including in service delivery, forest density and waste management. The Urban Development Authority has already commenced construction of fully fledged housing complexes amounting to 50,000 houses for low and middle level income earners. I propose to implement a loan scheme with an annual interest of 6.25 percent with a payback period of 25 years to facilitate the acquisition of these houses.

Finance Sector Reforms

Honourable Speaker,

Attorney General has been directed to expedite legal action against the Edirisinghe Trust Investments Finance Limited (ETIFL) and its subsidiary companies in line with the Report of the Presidential Commission of Inquiry appointed to investigate alleged malpractices of the ETIFL.

The Presidential Commission of Inquiry has pointed out the need to prevent the malpractices that jeopardises the credibility of the entire finance company sector over a long period, indirectly impacting the financial, banking and entire economic process.

Therefore, it is recommended to completely restructure the Department of Supervision of Non-Bank Financial Institutions of the Central Bank and to formulate a robust organizational structure to regulate finance companies as per the recommendations of the Presidential Commission of Inquiry. The Commission has presented an extensive study on the legal framework used in the Great Britain and India relating to the regulation of the sector. Thus, I intend to appoint a committee of specialists for the preparation of such a legal framework and to present the relevant bill to the Parliament.

The need for merging finance companies in a way that strengthens the companies currently functioning commercially in the sector has been identified. Merging 21 finance companies as 10 finance companies under the 2014 Budget led to the stabilization of the financial system. However, non-implementation, of such processes during the last 5 years and the economic downturn in the country have caused many finance companies such as the ETI, to shut down. It is essential to take legal action against those who are responsible for this, especially considering the additional capital required to rebuild these companies and the financial pressures amounted through their mergers with other companies. The main aim of the Government is to assist the helpless depositors of these companies. Accordingly, these depositors will be facilitated under the deposit fund held with the Central Bank, supported by the People’s Bank.

Out of the 58 finance companies functioning in the country, only 20 companies account for assets over Rs. 20 billion. In order to strengthen these finance companies, I propose to merge the subsidiary finance companies that have not been cancelled by the Central Bank of Sri Lanka with the parent company. Further, it is proposed to merge the finance companies functioning under commercial banks with the banks in order to strengthen the banking sector. With the aim of incentivizing the strengthening of banks and finance companies, I propose to consider the investment expenditure in acquisitions as deductible expenditures. I further propose to amend the necessary laws to enable commercial banks to also act as investment banks with the view to enhancing the diversification of the finance sector.

I also propose to establish National Development Banking Corporation – NDBC by merging Housing and Investment Bank, Housing Development Real Estate Limited and Regional Development Bank.

Justice and Legal Reforms

It is a legal maxim that “Justice delayed is justice denied”. To put it simply, delays in legal system deny the people of legal protection. This not only leads to business related uncertainties and adverse effects to investment climate, but also causes various forms of corruption and malpractices that affect our day to day life. It also adversely affects the trust of the people in the legal system. It seems that most of the inmates have prolonged stays in prisons due to legal delays. Apart from this, the inordinately amount of time taken to reach a verdict in court cases can be a cause for numerous social challenges such as unemployment, loss of livelihood, conflicts and crimes. If we are to create a law-abiding socio-economic system, we should strive to avoid delays in the legal system and for this purpose the unstinted commitment of the entire legal sector is mandatory.

The recently passed 20th Amendment to the Constitution provided for the increase of number of justices in the Superior Courts in Sri Lanka, eliminating the most significant factor for delays in the legal system and hence, Honourable Members of this House who voted in favour of the Amendment can be proud that they voted for the benefit of the people. The number of justices in the superior courts has not been increased since 1978. Therefore, this increase comes after 42 years.

Now we have the opportunity to rapidly complete cases and appeals related to fundamental rights of the people that have been piled up in the Supreme Court. Apart from this, I propose to allocate Rs. 20,000 million for a fast-tracked intensive 3 year programme aimed at increasing the number of Justices and staff in the entire legal system including in high courts and magistrate courts and expanding the required infrastructure to rapidly solve those cases.

Unlike the previous government who implemented narrow-minded politically intended reforms such as establishing special high courts in order to seek political vengeance, this government will take necessary steps to renovate and expand the courts and to provide them with modern facilities and equipment. I propose to start the provision of the required building facilities for the Supreme Court and Court of Appeal due to the expansion of Superior Court Complex within this year itself. I expect to present bills on amendment of 60 Acts relating to existing Commercial Law, Civil Law and Criminal Law to this House within the first 3 months of 2021, with the contributions received from 10 specialist consultant teams. Further, by January next year, I am planning to present to the Parliament required amendments to the Companies Act of 2007 considering the timely needs therefor.

Public Sector Reforms

Although our country as well as almost all developing countries have moved away from the closed economic and strict control and regulatory policies they have implemented before 1977, opting for globalized and market-based policies, over the past few years, necessary reforms have been initiated to build a strong national production economy within that global economic framework.

While the private sector is ahead of the public sector in commercial activities, we do not choose the alternative of privatization of public enterprises. Our policy is to allow public enterprises to function with the private sector management freedoms and to enhance the market competition and consumer welfare with the intervention of the state sector. Therefore, I propose to introduce a regulatory framework providing the required commercial freedoms to the public enterprises in various sectors.

Under certain legal frameworks, staff of certain public institutions have to work in the same place of employment throughout their entire career. This limits their professional and technical contribution as well as their welfare. Therefore, I propose to amend the Finance Act to introduce a legal framework to allow the attachment of public sector employees of closed services to other institutions according to their service requirements within the existing conditions of respective services. This will also facilitate to create opportunities for employees who are currently trapped in closed service institutions to work as per their professional interests or pursue employment in their hometowns. This further allows to ensure job satisfaction of employees and to employ them suitably.