06 Apr 2021 - {{hitsCtrl.values.hits}}

Before the 1970s, agriculture exports accounted for more than 75 percent of Sri Lanka’s total exports while industrial exports were around 15 percent.

Before the 1970s, agriculture exports accounted for more than 75 percent of Sri Lanka’s total exports while industrial exports were around 15 percent.

But since the liberalisation of the economy in the late 1970s, industrial exports have grown more rapidly than agriculture exports. In 2019, export earnings from agriculture accounted for US$ 2,523 million equivalent to just 15.9 percent of total export earnings.

Sri Lanka’s agricultural exports are limited to a few products: tea accounts for 53.3 percent of total agricultural exports followed by coconut (24.3 percent) and spices (12.4 percent). Notably, the country’s tea exports are equivalent to a mere 11.3 percent of total world tea exports, and the world export share for Sri Lanka’s coconuts (2.62 percent) and spices (0.2 percent) are also low.

Many factors continue to hinder agriculture exports from reaching its full potential.

The government is giving renewed emphasis to increasing agriculture exports to manage the trade deficit and foreign debt burden. Several initiatives have been taken to transform the outmodedagricultural sector into a modern, agribusiness export-oriented industry. Most recently, a draft national agricultural policy has been prepared, with comments being sought from relevant stakeholders.

This article highlights gaps in the international market which the agriculture sector can target, identifies factors impeding export-sector growth in agriculture, and suggests solutions for unlocking the untapped potential in this vital sector.

Where is the untapped potential?

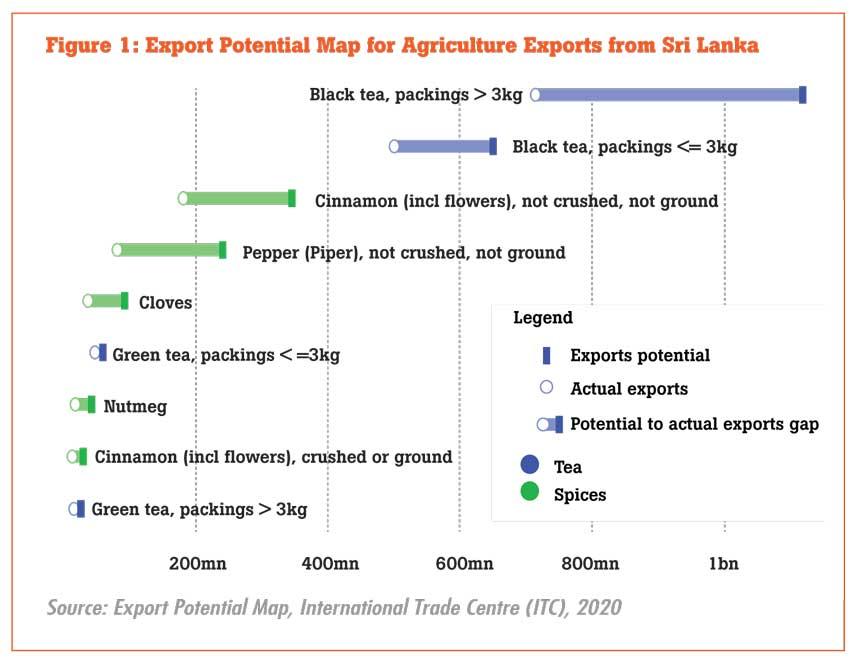

Based on the International Trade Centre’s Export Potential Map which assesses products with high export potential, agriculture products with the greatest export potential from Sri Lanka are tea and spices with a total untapped potential of US$ 1.2 billion

For black tea, the absolute difference between potential and actual exports in value terms is US$ 777.9 million while the value for spices is US$ 453 million, US$ 203 million for cinnamon, US$ 151 million for pepper and US$ 47 million for cloves.

For black tea, the absolute difference between potential and actual exports in value terms is US$ 777.9 million while the value for spices is US$ 453 million, US$ 203 million for cinnamon, US$ 151 million for pepper and US$ 47 million for cloves.

Tea exports alone generated US$1,346.4 million of export earnings in 2019 and the major export destinations for tea in 2020 were Turkey, Russia, Iraq, Iran, China, Azerbaijan and Saudi Arabia.

Geographically, the greatest scope for export growth for black tea is in the USA, UK and Russia (Figure 2). The US shows the largest absolute difference between potential and actual exports in value terms with additional exports worth US$ 103.5 million.

Sri Lanka produces some of the world’s best-quality spices and is among the top spice exporting countries in the world. Spices are mainly exported to India, Mexico, USA, Germany, Peru, Guatemala, Bolivia, Saudi Arabia, Colombia and Ecuador. In 2019, spice exports generated US$ 312.5 million worth of export earnings.

The markets with greatest potential for spice exports are India, USA and Bangladesh (Figure 2). India shows the largest absolute difference between potential and actual exports in value terms, leaving room to realise additional exports worth US$ 178.6 million, especially for cinnamon, pepper and cloves.

What’s impeding growth?

The factors holding back the growth of agricultural exports can be found at the production level; at the supply chain level and at the export level (Figure 3). As flagged in the IPS report ‘Sri Lanka Tea Industry in Transition: 150 Years and Beyond’, production-related challenges in the tea industry primarily include low productivity, high production costs, labour shortages and climate change. Similar issues are observed in the spice sector along with substandard cultivation methods.

Another IPS report ‘Analysis of Cinnamon, Pepper and Cardamom Value Chains in Sri Lanka’, notes that poor storage and poor quality maintenance at the processing level and unstable prices are the key issues facing the spice industry.

When it comes to marketing and export level issues, archaic marketing methods, lack of traceability, lack of quality in the final output and lack of technology and digital marketing methods, are prominent in the spices industry. For tea, lack of product diversification or value addition, relying on traditional buyers and lack of digital marketing platforms are long-standing challenges.

Other than these, trade-related factorssuch as exporter’s lack of awareness or difficulty in complying with product-specific market entry requirements, inability to match consumer preferences in a specific target market and trade barriers have a considerable impact on export growth.

Way Forward

Strategic interventions are needed to unlock this untapped export potential so that Sri Lanka can bridge gaps in the world market and benefit from export-sector growth in agriculture.

The value of output must be optimised from a given acreage of land either by increasing the harvest quantities of existing crops, lowering costs or diversifying into higher value-added products. Further, using efficient and modern technologies will reduce the cost of production and labour shortage issue associated with the sector.

On the supply chain front, greater use of digital marketing platforms and blockchain technology in supply chains for the tea and spice industries will ensure product traceability and higher marketability.

At the exporter level, sound macro-economic policies are needed so that Sri Lankan exports are more competitive in international markets. Some measures that can be adopted are tariff and para-tariff rationalisation and simplification to create an enabling environment for investors, and a strengthened financial sector which will ease access to credit for exporters. Additionally, domestic barriers related to regulations, administration and information have to be lowered on a priority basis.

The draft national agriculture policy has also included areas such as crop production and productivity, input management, advanced technologies to build socially-acceptable and sustainable food systems in Sri Lanka through globally competitive agricultural production, processing and marketing mechanisms.

All these, in combination, would release the untapped potential and generate higher export revenue and employment opportunities in the agriculture sector to help meet the aims of Sri Lanka’s proposed national agriculture policy.

(Nimesha Dissanayaka is a Research Officer at the Institute of Policy Studies of Sri Lanka (IPS). She holds a BSc (Hons) in Agricultural Technology and Management specialised in Applied Economics and Business Management from the University of Peradeniya. Her research interests are food security, agriculture policies and institutions, agriculture productivity, and agribusiness value chains)

23 Dec 2024 9 hours ago

23 Dec 2024 23 Dec 2024

23 Dec 2024 23 Dec 2024

23 Dec 2024 23 Dec 2024