01 Nov 2018 - {{hitsCtrl.values.hits}}

The Central Bank of Sri Lanka this week released its half yearly publication titeld: “Recent Economic Developments: Highlights of 2018 and Prospects for 2019”.

A summary of the performance of the Sri Lankan economy in 2018 as reflected in this publication is given below:

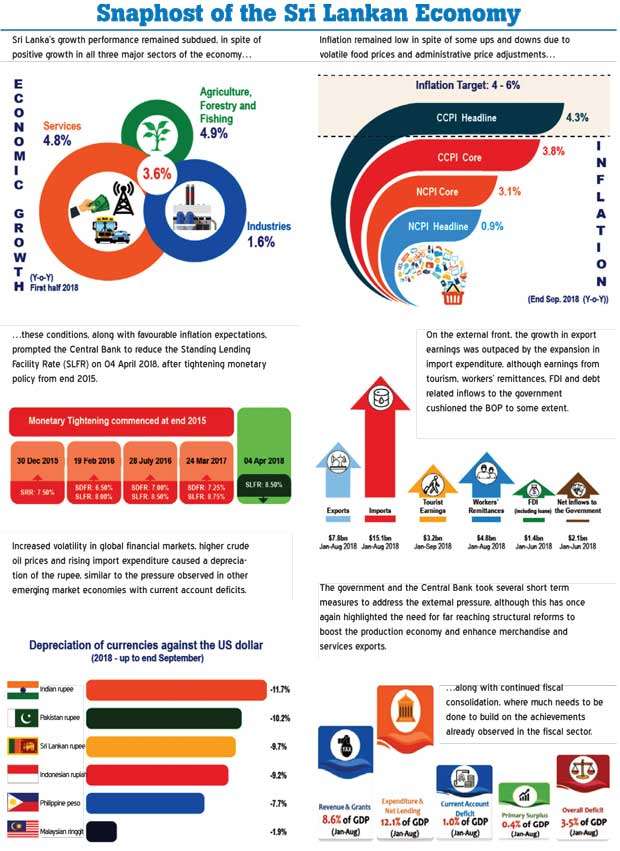

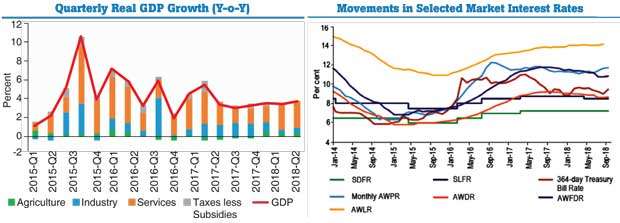

The Sri Lankan economy faced renewed challenges emanating from global market developments, which disrupted the steady stabilisation path observed up to the first quarter of the year. The economy grew at a moderate pace of 3.6 percent in the first half of 2018, following relatively low growth of 3.3 percent recorded during the year 2017.

Agricultural activities continued their rebound in the first half of 2018 supported by favourable weather conditions that prevailed during this period. The growth in industrial activities slowed, mainly due to the subdued performance in the construction and mining and quarrying subsectors. The expansion in services activities was broad-based, driven mainly by the growth of financial services, wholesale and retail trade and other personal services activities. Meanwhile, an increase in the unemployment rate was observed during the first half of 2018. Consumer price inflation has remained subdued thus far in 2018, although temporarily edging up in some months, mainly as a result of movements in volatile food prices and upward adjustments to domestic petroleum and other administered prices.

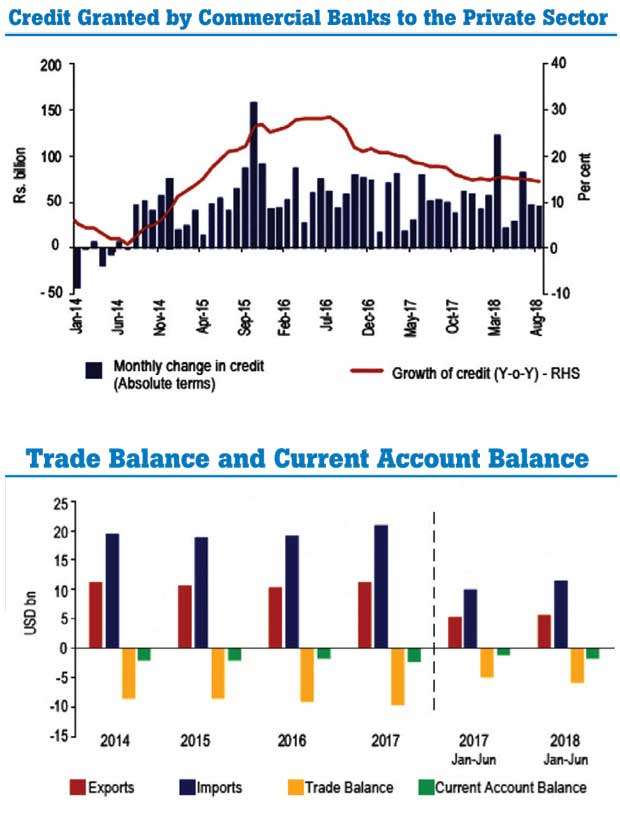

Meanwhile, monetary and credit expansion decelerated gradually, in response to the tight monetary policy stance maintained in the past. The Central Bank maintained a prudent approach in relation to monetary policy and operations, whereby the upper bound of the policy interest rates corridor was revised downwards in April 2018 and the interbank call money market rate was allowed to adjust within the corridor in line with evolving market conditions through appropriate open market operations (OMOs).

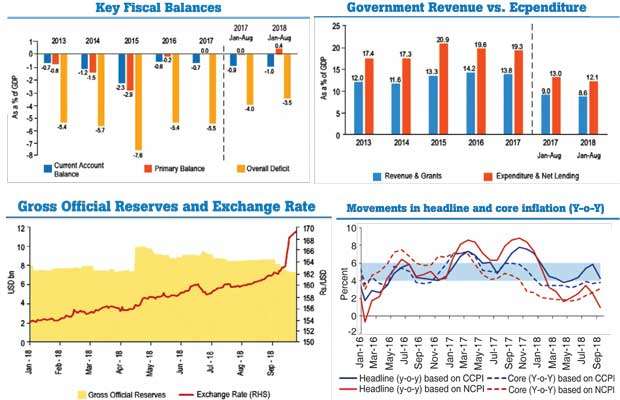

In the external sector, the trade deficit widened further as the growth in import expenditure outpaced the rise in earnings from exports, although earnings from services exports, including tourism, and workers’ remittances helped cushion the external current account deficit to some extent. Amidst the widened trade and current account deficits, which was partly due to the increased expenditure on fuel imports and imports of motor vehicles and gold, the balance of payments (BOP) also experienced pressure from the emerging market selloff caused by tightening global financial conditions and the strengthening of the US dollar. These developments resulted in a sharp depreciation of the Sri Lankan rupee, and the Central Bank intervened in the market at times to prevent disorderly adjustment of the exchange rate while allowing demand and supply conditions to determine its direction.

In the meantime, the performance was mixed on the fiscal front, with the overall budget balance and the primary balance improving during the first eight months of the year, while the current account balance deteriorated marginally. Nevertheless, the lower than expected revenue collection is likely to challenge the achievement of the targeted budget deficit for 2018, despite the slowdown observed in expenditure.

In the financial sector, the growth momentum continued during the first half of 2018 without major macroprudential concerns, while measures are being taken to address long standing issues with a few distressed financial institutions.

Meanwhile, the programme under the Extended Fund Facility (EFF) with the International Monetary Fund (IMF) continued, with the country achieving the Quantitative Performance Criteria (QPC) for June 2018 in relation to the primary fiscal balance and inflation, although missing the target on international reserves due to volatile global conditions. Several notable structural benchmarks were also achieved under this programme including the automatic price formula for fuel.

Going forward, the economy is expected to gather steam gradually responding to the measures taken to facilitate domestic production, merchandise and services exports, as well as domestic and foreign investment. At the macro level, the maintenance of low and stable inflation under the envisaged Flexible Inflation Targeting (FIT) framework, the competitive exchange rate, and the continuation of the government’s fiscal consolidation efforts are expected to ensure macroeconomic stability in the medium term.

In the backdrop of tightening policy spaces in the monetary, fiscal and external fronts amidst subdued economic performance, it is important to facilitate private sector led growth with prudent, consistent and far reaching reforms that support increased productivity in the economy. Recent experience has once again displayed the importance of strengthening the economy through structural transformation, while improving the country’s macroeconomic fundamentals. The postponement of much needed structural reforms will only lead to the Sri Lankan economy lagging behind its regional peers, amidst increased vulnerability to internal and external disturbances. Therefore, it is essential that such reforms are expeditiously implemented within a transparent framework for Sri Lanka to progress as an upper middle income economy where its human and physical resources are fully utilised in a more productive manner.

17 Nov 2024 1 hours ago

16 Nov 2024 6 hours ago

16 Nov 2024 7 hours ago

16 Nov 2024 8 hours ago

16 Nov 2024 8 hours ago