12 Nov 2020 - {{hitsCtrl.values.hits}}

Sri Lanka is identified as one of the most vulnerable middle-income countries to the economic fallout from the

Sri Lanka is identified as one of the most vulnerable middle-income countries to the economic fallout from the

COVID-19 pandemic.

A key channel through which vulnerabilities are heightened relates to a country’s export earnings. While Sri Lanka is not highly exposed to global supply chain disruptions, its dependence on a limited basket of exports and export destinations is of concern. Sri Lanka’s export agriculture sector – dominated by tea, rubber and coconut – is among the impacted sectors. They account for 20 percent of total export earnings annually, with tea exports alone accounting for about 12 percent.

By the time COVID-19 hit, Sri Lanka’s tea production and export earnings had already been on a declining trend over the past few years.

The adverse weather conditions and long-term structural issues such as labour shortages and lack of technological application have affected production levels over time. With the first wave of the pandemic, the vulnerabilities of the tea sector were exposed. Now, Sri Lanka and most of the main tea buyers are experiencing a second wave which can have far reaching negative consequences than previously anticipated.

In this context, this blog discusses the impacts of COVID-19 on Sri Lanka’s tea industry and the different mitigation strategies that the government can adopt to revive the industry.

COVID-19 and Sri Lanka’s tea sector

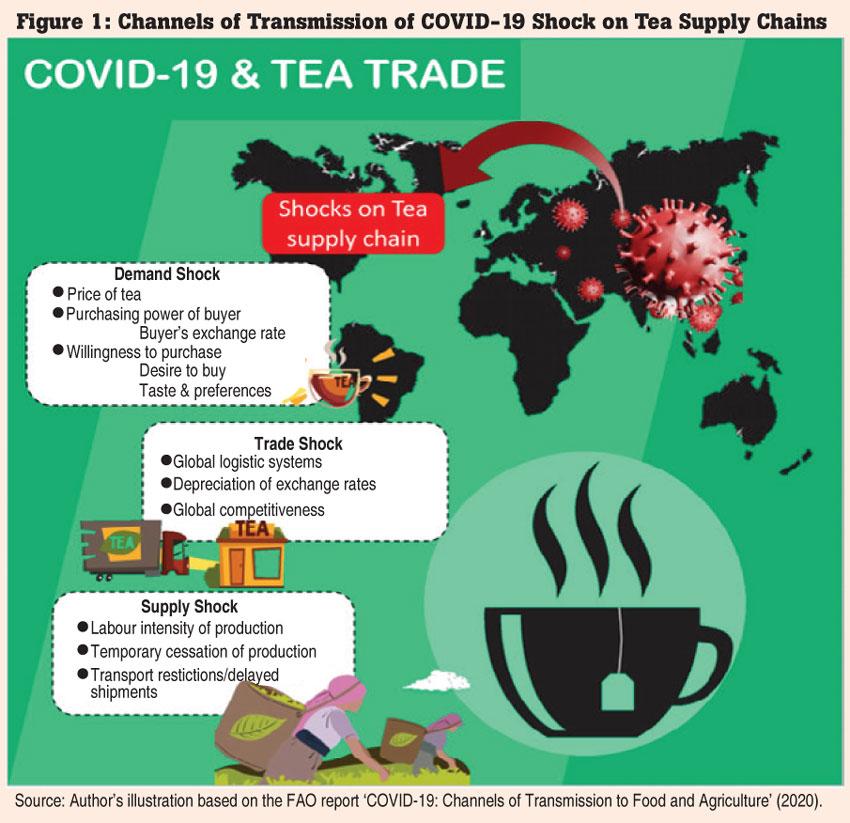

The tea supply chain comprises of diverse elements, including producers, processors, distributors, importers, national and international logistics systems and exporters who cater to both the domestic and international markets. Any disruptions to any of these elements will likely affect the tea industry either through shocks on the supply side, trade flow, the demand side or a combination of all these (Figure 1).

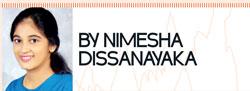

According to the Food and Agriculture Organization (FAO), the supplies of labour-intensive agricultural products in low-income countries are more prone to be badly affected due to COVID-19. Sri Lankan tea too showed a significant decrease in tea production during first and second quarters of 2020 compared to the same quarters over the past few years (Figure 2).

While this can be mainly attributed to extreme weather conditions and low fertiliser applications, restrictions on labour movements and transport of intermediate inputs due to COVID-19 too contributed to this decline.

There has been a reduction in the volume of shipping as a result of shrinking global trade due to the drop in demand resulting from COVID-19 and the drop in oil prices in 2020. Highly plugged into international trade via global logistics systems, Sri Lanka also encountered delays in shipments and clearance processes in ports.

However, a significant drop in production and exports from its main competitors due to COVID-19 has enabled ‘Ceylon tea’ to attract a higher price within a short period. A depreciating rupee also gave tea exports a price advantage. These are, however, short-run benefits, and will dissipate as Sri Lanka’s key competitors return to normal levels of production.

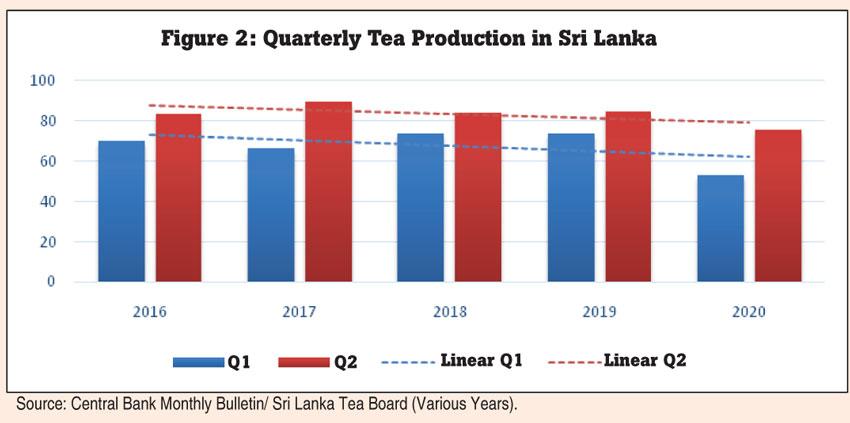

From the demand side, international price fluctuations, changes in purchasing power and consumer preferences could affect the tea sector. Although, Sri Lanka has not yet experienced import restrictions by any of its tea buyers in the world including most hit countries by the COVID-19, importing volumes of major buyers have shown decreases. All major buyers of ‘Ceylon tea’; Iraq (-18 percent), Turkey (-14 percent), Russia (-6 percent), (-22 percent) and Syria (-24 percent) showed a significant drop in their import quantities during the first quarter of 2020. However, by September 2020, the situation changed and major buyers such as Turkey, Iran and Russia are showing slight growth in their tea imports (Figure 3).

Furthermore, Sri Lanka’s tea trade is in a disadvantageous position since its exports are primarily in the black tea segment, which is likely to see a further drop. Shifts in consumer preference towards high-value products that have ‘health benefits’ – healthier green, functional, and herbal tea blends – are likely to take place post COVID-19.

Way forward

Several initiatives have been adopted by the government to minimise the negative impacts of COVID-19 on the tea supply chain including permitting work on tea estates and moving the Colombo Tea Auction to an online platform. However, the present situation of the tea industry demands that Sri Lanka reassesses its sectoral policies to increase the sector’s long-term resilience.

More attention must be paid to value addition including moving towards herbal and health-based products. This will require a comprehensive reassessment of the long-term prospects for Sri Lanka’s tea industry. Introducing modern production technologies, enhancing technical skills and fostering innovation, together with improvements in warehousing and packaging facilities and quality assurance throughout the value chain are critical areas to be addressed.

COVID-19 should be viewed as a wake-up call and an opportunity for all stakeholders to collectively drive growth in the tea industry.

*This blog is based on IPS’ ‘Sri-Lanka: State of the Economy 2020’ report on ‘Pandemics and Disruptions: Reviving Sri Lanka’s Economy COVID-19 and Beyond’.

(Nimesha Dissanayaka is a Research Assistant at IPS. She holds a BSc (Hons) in Agricultural Technology and Management, specialised in Applied Economics and Business Management from the University of Peradeniya. She could be contacted via: [email protected])

24 Dec 2024 1 hours ago

24 Dec 2024 2 hours ago

24 Dec 2024 3 hours ago

24 Dec 2024 4 hours ago

24 Dec 2024 4 hours ago