22 Feb 2016 - {{hitsCtrl.values.hits}}

Capital markets have the potential to be powerful engines of economic growth in developing nations. An efficient stock market provides the public with investment opportunities and mobilizes their savings for productive corporate financing. Yet, developing a robust and efficient capital market is a difficult task for many emerging economies. It requires a fine blend of regulation, market development and marketing.

Capital markets have the potential to be powerful engines of economic growth in developing nations. An efficient stock market provides the public with investment opportunities and mobilizes their savings for productive corporate financing. Yet, developing a robust and efficient capital market is a difficult task for many emerging economies. It requires a fine blend of regulation, market development and marketing.

Further on, creating and maintaining efficient markets is identified as a joint initiative of all stakeholders. Each stakeholder has a role to play. As a front runner in the securities industry, the regulator plays an integral role in achieving the aforesaid. According to section 12 (a) of the Securities and Exchange Commission of Sri Lanka Act of 1987 (as amended), creating and maintaining a market in which securities can be issued and traded in an orderly and fair manner is a core function of the SEC.

Yet, how do we define the scope of the regulator in maintaining efficient markets? This is a topic that is debated in the local arena. The debate is centralized around regulation, market development and marketing. It is suggested that the SEC of Sri Lanka should be involved in marketing initiatives. Hence, it is timely to question the ideal disposition of a regulator and to perceive the role of the (SEC) in the local capital market.

Answers for the question underpinning the article will be based on regulation, market development and marketing.

Regulation and stock market

Regulations are an absolute necessity in the face of a growing importance of capital markets throughout the world. In a capital market, securities regulations form the framework within which the market operates. For a moment imagine a market place without regulation. Every investor would act on his own accord. It would lead to chaos. Regulations are needed to protect investors, prevent systemic crises and facilitate an efficient price discovery mechanism. Regulation is strongly correlated with policymaking and enforcement.

Ideally regulation should be based on policy. The SEC is seen as the nexus between the industry and the government. It works closely with the government and formulates suitable policies for the capital market. Regulations are usually embedded in these policies with the aim of giving coherence (in terms of regulation) and accurate direction to the market. It creates a suitable environment required for a free market economy. Effective regulation is strongly integrated with enforcement. Enforcement will be possible through appropriate surveillance, investigations, licensing/registration and investor education mechanisms.

Accordingly, it could be deduced that surveillance, investigations, licensing/registration and investor education become key functions of the SEC.

Market development vs. marketing

These two concepts give out two varied meanings, yet many use it interchangeably. Hence, it is important to clearly define these two concepts prior to analysing the stand point of the SEC.

Even though a universally accepted definition of ‘development’ cannot be brought forward it is widely accepted that it refers to the systematic use of scientific and technical knowledge to meet specific objectives or requirements.

On the contrary, marketing refers to the expansion of markets by entering new segments of the market and increasing the existing segments. In a stock market it refers to increasing the existing investor base, increasing listings, promoting lucrative stocks, etc. These initiatives will be possible by developing and promoting an appropriate marketing strategy.

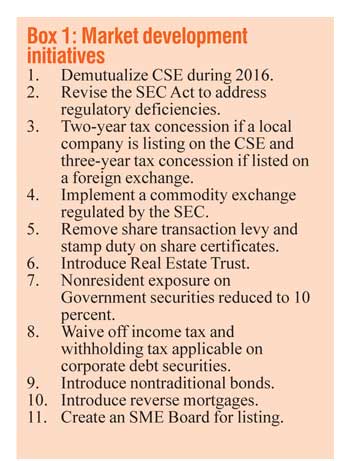

It is undoubted that both these elements are required to maintain efficient markets. As a regulator the SEC is able to engage in the role of market development. It falls within the objectives and powers vested on the SEC. Even though the development role is not expressively mentioned in the SEC Act the objectives of the SEC, mainly the commitment towards protecting the interest of the investors, compel the SEC to take up such a role. The SEC in collaboration with the government has taken many initiatives to develop the market. Some of these initiatives were reflected in the budget for 2016 (refer Box 1).

Further on, the SEC together with the Colombo Stock Exchange (CSE) embarked on an initiative to set up a Central Counter Party (CCP). This is expected to significantly minimize the risk of settlement failure and counterparty risk. Currently, the broad legal framework for the CCP is being developed by the SEC along with the CSE and a consultancy firm.

The SEC initiated a project for the ‘Development of Infrastructure – Broker Back Office and Order Management System’. This was set up with the objective of improving the settlement efficiency and maintaining uniformity in the back office systems of stockbroking firms. The project is jointly funded by the SEC and the CSE and the target date for going live is March 31, 2016.

These initiatives reflect the commitment made towards market development through economic policy, fiscal policy and investment.

Yet, one cannot expect the regulator to be involved in marketing. For an example, the SEC can put the relevant capital and technical expertise required to introduce new products (Real Estate Fund). Yet, it cannot market the product. The predominant reason for a regulator to divest from the role of marketing is conflict of interest. Further on, another reason that could promote this standpoint would be the role of a regulator/government in an open economy.

Conflict of interest

As stated above, the regulator embarking on marketing initiatives could result in conflict of interest. This could be emphasized further by looking into an example.

Increasing listings is pivotal for efficient markets. Investors will have more companies to select from and it could increase liquidity in the market. Further on, access to capital is made less expensive for a higher number of companies. The SEC could contribute towards this cause through policy decisions, regulation and market development. The budget for 2016 provided a two-year tax concession for new listings. These initiatives take into consideration the betterment of all stakeholders (emphasis is on protecting the interest of the investors). However, if they take up the role of marketing it becomes a tedious task to execute the aforesaid impartial role.

Marketing equity to companies involves a great deal of negotiation. Many companies refrain from entering the market due to disclosure issues. Yet, these disclosures are vital to protect the interest of the investors if the regulator is to maintain a level playing field in the market and promote an efficient price discovery mechanism. SEC will be compelled to rethink about disclosure issues while disclosure is vital to protect the interest of the market. This would result in conflict of interest.

Differently stated, the exchange of securities issued by the company is regulated by the SEC from one end and on the end the SEC attempts to attract listings. Faced with such a predicament the credibility of the SEC might be questioned.

However, our readers should not misread this stand point with measures taken by the SEC to facilitate a market place in which companies can raise finances fairly. Such functions compliment the initiatives of creating efficient markets and promote an efficient price discovery mechanism.

Regulator and free markets

We live in a free market economy where market forces are expected to determine the most efficient price levels. Undue influence from the regulator or the government could hamper this process.

Intervention is required yet within limits. The degree and nature of intervention greatly depends on the prevailing political ideology. Certain ideologies might prefer to take up the role of a facilitator. This is similar to the discussion on governments boosting economic growth by increasing government expenditure. Certain groups believe that the presence of the government is required while others believe that facilitating private investment would be the most optimal.

Global outlook

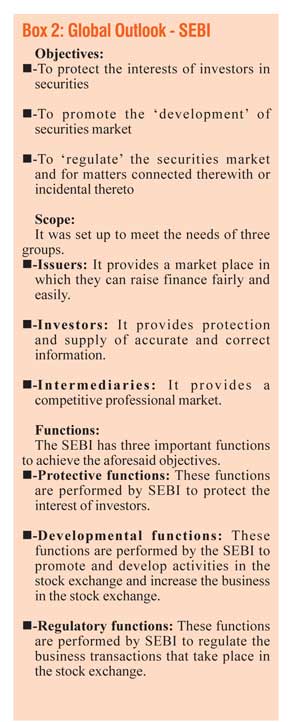

It is interesting to note that regulators from developed economies have taken a similar standpoint. In order to reiterate the aforesaid let’s observe the role and functions of the Securities and Exchange Board of India (SEBI). The regulatory and development role of SEBI is expressively stated (See Box 2).

The Securities Commission of Malaysia (SC) is another counterpart that promotes the role of regulation and development. The SC is a regulatory body mandated by parliament to develop and regulate the Malaysian capital market. According to the SCs regulatory philosophy, the institution is involved in rule-making, authorization, supervision and enforcement aspects of the capital market. It also plays a crucial role in ensuring a robust framework that continues to facilitate growth for the country’s economic prosperity. They aim to promote and maintain a fair, efficient, secure and transparent capital market, as well as facilitate the orderly development of a capital market that is innovative and competitive.

Change in attitude

Many jurisdictions refrain from ‘marketing’. Yet the question arises on why certain groups expect the SEC to get marketing on board along with the other two dimensions. Sri Lanka has been a welfare state since independence. Historical factors have compelled people to turn towards the government and its representatives to meet their needs. They expect the government to provide for their needs on a silver platter. For an example, we obtain free education from the government and thereafter expect it to provide jobs. Similar expectations are visible in the industry. It is their belief that the regulator should adopt a suitable marketing strategy to reverse the market trend. Unfortunately, as stated above the key role of the SEC does not pave the way towards adopting such strategies. Any attempt to do so might have an adverse effect on the market.

The need of the hour is a change in attitude. Stockbroker firms along with other market stakeholders should evaluate their current role and infer into possible avenues of adopting effective marketing strategies. For an example, stockbroking firms are well poised to implement such strategies. These entities could play a more active role in expanding the investor base.

The world is a stage and we are its actors. Play your role well instead of expecting others to play it for you.

24 Nov 2024 4 hours ago

24 Nov 2024 7 hours ago

24 Nov 2024 8 hours ago

24 Nov 2024 8 hours ago