25 Feb 2021 - {{hitsCtrl.values.hits}}

Recently Central Bank  Governor Prof. W.D. Lakshman at a media briefing stated that Sri Lanka was following a market-oriented economy with state guidance, involving some controls and restrictions. He was quoted as saying that such a framework would not be successful under an IMF programme. This, in my view needs further elaboration.

Governor Prof. W.D. Lakshman at a media briefing stated that Sri Lanka was following a market-oriented economy with state guidance, involving some controls and restrictions. He was quoted as saying that such a framework would not be successful under an IMF programme. This, in my view needs further elaboration.

As we understood, the IMF programme will essentially impose some conditions such as maintaining fiscal discipline – not to exceed the government budget deficit beyond say 8-9 percent of GDP, not to defend external value of the rupee, meaning not allowing the rupee to depreciate by pumping dollars from the official reserves of the Central Bank, not to go for unnecessary commercial foreign borrowings, etc.

Managing in turbulent times

According to the IMF global economic outlook based on the October 2020 report, most countries imposed stringent lockdown measures and as a result, the economic activities contracted dramatically on a global scale. The report says that although easing lockdowns can lead to a partial recovery, economic activity is likely to remain subdued until health risks abate.

The positive feature of working with the IMF is that our credit rating could be improved and our banks and other financial institutions may be able to transact with foreign financial institutions efficiently and arrange trade finance facilities and commercial borrowings at

competitive rates.

Also, the Sri Lankan exporters may be able to receive foreign remittances without unnecessary delays and restrictions imposed by foreign correspondence banks. As for the credit rating position, Sri Lanka was downgraded four months back and at present, Sri Lanka is ranked C grade.

When a country is under an IMF standby facility, there is a greater possibility of the ratings getting improved, thus building confidence among the business partners and foreign multilateral financial institutions like the World Bank, ADB, JBIC, etc.

As articulated by the Central Bank Governor, the government has been able to contain the trade deficit through stringent import control measures in order to save the much-needed foreign exchange, as tourism and travel and some exports such as textile and garment sectors have been badly affected during the year under review. This is in the backdrop of some export targets, where the government policymakers were expecting US $ 4-5 billion per annum, in terms of tourism proceeds before the COVID-19 pandemic hit. In fact, the Sri Lankan economy could realise only US $ 0.9 billion from tourism in 2020.

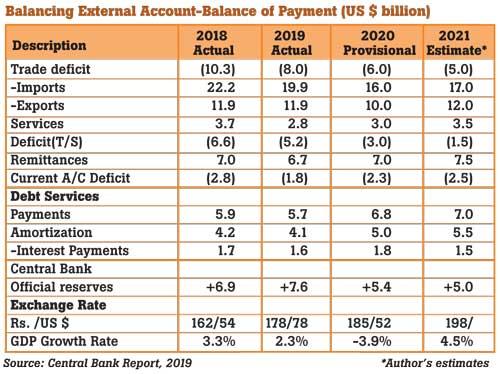

Nevertheless, the Central Bank has been able to provide guidance, support and advice to the government to manage the macro-economic fundamentals quite efficiently during these turbulent times, which is commendable. The Table shows the summary of the vital statistics of Sri Lanka’s macro- economic transactions with the rest of the world. An attempt has been made by the writer to make some provisional figures and estimates to ascertain whether the Sri Lankan economy could withstand the pressure from this global economic downturn.

Also, it is important to critically review the efficacy and effectiveness of the economic policy changes contemplated by the present government policymakers and to what extent they succeed in confronting capitalist economic system in today’s context.

As can be seen, the biggest challenge is in the management of the debt repayment capacity, especially in view of the fact that a total sum of US $ 7 billion is due during the current year, which is the highest ever debt service figure that the country has to service in order to avoid sovereign default. In addition to the above, domestic forex debt repayments such as FCBU and SLDB amounting to US $ 1.5 billion will also become due.

However, the government may be able to successfully arrange foreign SWAPs from friendly countries’ multilateral financial institutions and Central banks to meet any contingencies. It should be mentioned that the Central Bank of Sri Lanka is vested with the responsibility of the management of the public debt, in terms of Section 113 of the Monetary Law Act.

Confronting capitalism

Throughout the world, economic growth has drastically slowed. Natural resources are exploited for short-term profits. Wealth is concentrated in the hands of a few. When a large number of children living in poverty, multinational ultra-rich elites tuck their money into tax heavens. As we all know, lockdown impacted people’s ability to move across borders but it doesn’t stop money flowing into tax havens around the world, as claimed by the Forbes magazine.

Anna Zakrzewski, who leads Boston Consulting Group’s Global Wealth Management division, did a detailed study and the economic shocks of the coronavirus have meant that offshore financial centres such as Switzerland are back to their old tricks: banking people’s money away from their more-risky homelands.

‘Confronting capitalism’ by Philip Kotler published by the American Management Association explains 14 major problems undermining capitalism and offers real solutions for a troubled economic system. Although best known as a marketing guru, Kotler trained as an economist under three Nobel price-winning economists, namely Prof. Milton Friedman, who represented free market economic thinking and two other professors, Paul Samuelson and Robert Solow of MIT.

Some of the serious shortcomings of capitalism as articulated by Kotler include: tends to focus narrowly on GDP growth, generates income and wealth inequality, proposes no solution to persisting poverty, exploits natural resources and environment in the absence of regulations, favours short-term profits over long-run investment planning, fails to pay a living wage

and others.

New economic and business model for tea plantations

This reminds me the Sri Lankan tea plantation - RPC model introduced in 1995, where some 88,000 hectares of cultivated tea estates were transferred to 20 RPCs under 53-year lease period with only one golden share retained by the government, expecting the companies to put in the much-needed investments in re/new planting, infilling of tea, optimum utilisation of arable agricultural land and other resources, including factory modernisation, tea marketing efforts and other viable diversification options and improve labour management relations through collective bargaining process etc.

As per the latest statistics at the Tea Board, the total tea production at RPC level has come down to 70.6 million own crop and bought leaf of 24.2 million kilos, totalling only 94.8 million kilos in 2020 (total national production in 2020 was 278 million kilos – 34 percent RPC share) from the 135.3 million kilos in 1995, where the total national production was as 246 million kilos – 55 percent RPC share.

in January 2019, the daily wage was revised to Rs.750 per day, under the main collective agreement entered into between the RPCs and worker trade unions in 2003. Unfortunately, the daily attendance allowance and the productivity-linked wage rates hitherto enjoyed by the workers have been taken out jointly by the parties to the collective agreement, which the undersigned, as a non-executive director attached to one of the RPCs had made written representations in January 2019 itself to the EFC and the negotiation committee, thus expressing

serious concerns.

Thereafter, the demand for wage increase came even before the presidential election held in November 2019 from worker trade unions under the collective agreement generally to be negotiated once in two years only. The RPCs have called for a new hybrid wage structure, focusing on a revenue share model based on ‘three-day’ productivity-focused rates and three daily wage rates – a total package for the entire week for the estate workers.

But this was not acceptable to the worker unions quoting ‘six-day work rule’ and practical issues. An option favoured by the trade unions is to increase the basic wage, which attracts not only the EPF/ETF, even the other terminal benefits such as gratuity, holiday pay, etc. An ‘out-grower model’, where the workers are allocated small plots of land to grow their own tea to sell to the factories was also suggested without much deliberations to study

far-reaching implications.

In view of the deadlock, the Cabinet has decided to refer the demand of Rs.1,000 daily wage to the tea and rubber industry wage board for a decision and they have incorporated a sum of Rs.900 together with a budgetary allowance of Rs.100 to make Rs.1000 as minimum daily wage payable to the workers under the wages

board ordinance.

The writer has been a proponent of the collective bargaining process under the main collective agreement entered into in 2003. My own view is, once the wage anomaly is sorted out, it is expedient that the parties to get back to the CA and honour the conditions in the said agreement in the best interest of the tea industry, thus maintaining good labour: management relations at estate level

Export earnings are getting trickled down to farmers

With annual export earnings of Rs.230 billion, at the Colombo tea auction level, the tea prices have increased from Rs.545 per kilo of made tea in 2019 to Rs.628 per kilo for the full year 2020. Despite production decreases, which is the main concern today, the foreign exchange earnings have reached this level, thanks to the fob price of tea improving from Rs.822 per kilo to Rs.867 in 2020, due to the efforts by our tea exporters – supported by improved quality of the final product by the growers and manufacturers and ‘Ceylon Tea’ promotional campaign.

Consequently, the export earnings are getting trickled down to tea smallholders and in fact, the farmers are receiving Rs.90 per kilo of their green leaf as against Rs.79 per kilo in 2019, on an average basis. The main thrust would be integrated quality and productivity. Contrary to media reports recently, the majority of RPCs have also been making profits during the year 2020, as per the Colombo Stock Exchange filing. Credit goes to all the stakeholders of the global tea value chain from our tea grower to Sri Lankan tea marketing companies.

Sri Lankan tea industry is not just a business; it is a way of life for over 2.5 million people and we need to protect and nurture nearly 500,000 smallholders and 700 tea factories and 140,000 estate workers by encouraging tea exporters to really focus on promoting and marketing Ceylon Tea B2C, in addition to B2B tea exports.

Discerning tea consumers world over are paying premium prices for Ceylon Tea, due to the promotional campaigns focused on authenticity of the product based on sustainability credentials and wellness factor of Ceylon T

ea. It is in that context only the recent wage increases should

be viewed.

Conclusion

From the above, it can be seen that the main stakeholders, namely the RPCs, worker trade unions and government have failed in working together to attain the mission set out at the time of privatisation of tea plantations in 1992. After 29 years of the first privatisation, it has now become necessary to migrate into a new economic and business model for the RPCs, thus promoting high-quality plantations and need to focus more on sustainable agricultural and manufacturing practices through infusion of increased investments and management inputs.

Nevertheless, the success depends on our ability to market and promote Ceylon Tea in global target markets as a premium quality beverage under the ‘sustainable food’ category. As Mahatma Gandhi said, the difference between what we are doing and what we are capable of doing would solve most of the world’s problems.

23 Dec 2024 8 hours ago

23 Dec 2024 9 hours ago

23 Dec 2024 23 Dec 2024

23 Dec 2024 23 Dec 2024