23 Mar 2018 - {{hitsCtrl.values.hits}}

Paul Polman, Global CEO of Unilever, the world’s largest consumer goods company, told us recently about his personal mission to be a force for good instead of just making a profit and how Unilever is able to serve all their stakeholders as a result.

Paul Polman, Global CEO of Unilever, the world’s largest consumer goods company, told us recently about his personal mission to be a force for good instead of just making a profit and how Unilever is able to serve all their stakeholders as a result.

The challenge we face now is that we are today impacted by the short-term focus of financial markets and political systems. Therefore, we need serious reform in the financial system, with greater focus on serving long-term needs of society.

As Polman rightly says, “I’m a capitalist at heart and there’s no reason to give up on capitalism. It still is probably the most efficient way of doing business. But there are some fine tunings that need to happen.”

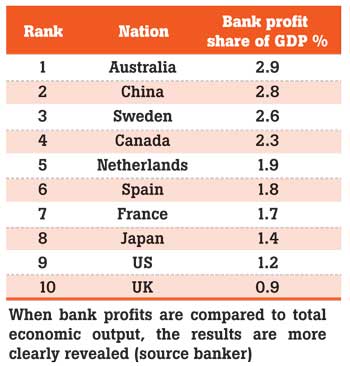

Often we hear business people complaining that banks make too much profits (see Table). Bank bashing is something of a national pastime but far from being driven solely by envy at their success, there are sometimes sound economic argument to think the big four or five in Sri Lanka make way too much money, given the state of our small and medium enterprises and the quality of our rural infrastructure.

This is nothing new in most markets. However, not all banking is bad — obviously a modern economy needs access to credit, safe savings and transactions mechanisms and other investment products and advice.

This is nothing new in most markets. However, not all banking is bad — obviously a modern economy needs access to credit, safe savings and transactions mechanisms and other investment products and advice.

A bank or non-bank financial institution (NBFI) board’s key duty is to create and deliver sustainable stakeholder value through setting strategy and overseeing its implementation. In doing so, a board needs to give due regard to the matters that will affect the future of the bank or NBFI, such as the impact the board’s decisions may have on the employees, environment, communities and relationships with suppliers.

The board also must ensure the management team achieves the right balance between promoting long-term growth and delivering short-term objectives. The members of the board are also responsible for maintaining an effective system of internal control that provides assurance of efficient operations. They too are responsible for ensuring that the top management team maintains an effective risk management and oversight process across the company, especially because the financial sector is constantly being buffeted by waves of capital issues, talent, regulatory and technological challenges.

Moreover, the increased regulatory burden and related costs impact every financial institution in both the approach to doing business and the expense of doing business.

Challenges for sector

The banking sector is in transition, with many challenges ahead. For most banks, profitability continues to be hit by the rising impairment charges and provisions, the loss recognized on loan books to account for nonperforming loans and other impaired assets. This process started few years ago on the Central Bank’s instruction to clean up the balance sheets and was a major cause of the sector’s profit reduction.

The exercise will continue for some time. As a result, there has never been a greater need for well-functioning, informed and upright boards of directors. There has also never been a more important time for the board members to keep in mind that their responsibilities go beyond the institution they serve.

To achieve long-term value for shareholders, the bank boards would need to look for ways to strengthen their institutions; to do that, they need to strengthen themselves as a board. One way of doing that is to adopt the practices of effective boards – getting competent and credible directors to their boards.

The well-performing companies on many occasions have been destroyed by bad governance. Almost always it is the board and the top management of these companies that ruin these firms and take them rapidly down. These are classic examples of boardroom and top management failure in discharging their fiduciary responsibility to shareholders and their failure to ensure the long-term health of the company.

Leadership

The most challenging and distracting governance issues a board can face are those related to its own members. These issues typically arise in connection with conflicts of interest between the board members and institutions they serve or when the board members experience financial difficulties of their own. A board can also lose its effectiveness when there are personality clashes in the boardroom or when one or more board members seek to dominate the deliberations. The best time to avoid such issues is during the selection process for new directors.

Compromise and in the selection of directors will almost always dilute the effectiveness of the board as a whole. Therefore, a group of good, solid and dependable board members could be far more effective than an all-star line-up of directors.

A board is far more effective when it acts as a group, where all members can voice their opinions and where difficult questions can be asked. Dominant shareholders and board cultures in which constructive debate never occurs have contributed to the demise of many financial institutions. Therefore, careful selection of new board members, keeping in mind the strengths and weaknesses of the other members of the board, is well worth the time and effort involved.

The board of a financial institution that runs on public deposits is accountable as a group, since their functioning is essentially collegial in nature and is expected to promote a shared point of view about what decisions the firm should make to create lasting value. The composition of a board and the interpersonal dynamics among its members are critical for the success of a financial institution.

A bank board is like any other working group can be heavily influenced by the members who dominate the conversation or by the members who actively discourage discussion or dissent. A board is not intended to merely rubber stamp the proposals of the management.

If the responsibilities are to be effectively discharged, it is important that the composition of a board and the interpersonal dynamics among its members are right. While integrity is an essential prerequisite, this alone is not sufficient and the directors must be people who are alert and have the capacity to understand the inherent risks taken on by an institution and objectively analyse the proposals submitted by the management on various aspects of a firm’s operations.

However, it is equally important that the board has competence within it which embraces other disciplines such as law, economics, marketing, human resource management and technology, so that a multidisciplinary approach is taken to managing risks and growing the bank business.

Role of independent NE directors

Most codes now insist that one third of the number of directors is independent non-executive (NE) directors. However, independence is not about ‘no-shareholding’ and it is more about how independent the director is in his thinking beyond and his ability to challenge the proposals at the board meeting.

The NE directors are the ones who really should perform the real role of independent directors, since the executive directors are often left to defend decisions and proposals in board meetings. Also, most codes now require nomination committees to recommend the appointment of new directors.

The main purpose of having a nomination committee is to ensure that there is a transparent appointment process, which is not under the control of the chairman or CEO. It is also to ensure that the right balance of skills, experience and independence is brought to the board table and the directors appointed properly understand the business they are overseeing and also have the competence to get under the skin of the institution and follow up on things that don’t seem quite right while giving due consideration to shareholder demands.

Directors are now required to educate themselves to ensure they have the competence to identify and understand the risks that need to be managed, as well as the key drivers that most influence a bank’s performance.

In the final analysis, directors are now expected to provide oversight and perspective to the executives running the institution to help the institution to make better quality decisions and to help build a sustainable banking business. If they fail to do that, they will surely face the wrath of the depositors and employees and also face legal action.

(Dinesh Weerakkody is a former bank chairman)

19 Nov 2024 1 hours ago

18 Nov 2024 9 hours ago

18 Nov 2024 18 Nov 2024

18 Nov 2024 18 Nov 2024

18 Nov 2024 18 Nov 2024