08 Jul 2020 - {{hitsCtrl.values.hits}}

Ernst & Young (EY) was commissioned to conduct an assessment on the key bottlenecks for private sector investments in the Northern Province in agriculture and fishery sectors, amidst significant progress made by the International Labour Organisation (ILO) and its constituents, implementing the LEED project since 2011 in the Northern Province of Sri Lanka.

The LEED+ project builds on successes of the LEED project with the focus continuing to be on contributing to a more inclusive and equitable post-conflict recovery and development. The development of the private sector, local small and medium enterprises (SMEs) and cooperatives is the key strategy of the project, aimed to support economic regeneration and poverty reduction and attracting private sector investments is key to this strategy.

ILO Sri Lanka and the Maldives Chief Technical Advisor Dr. Thomas Kring commenting on the study stated, “The North of Sri Lanka has a huge economic potential. The study by EY helped identify some of the issues that need to be addressed in order to unlock that potential.”

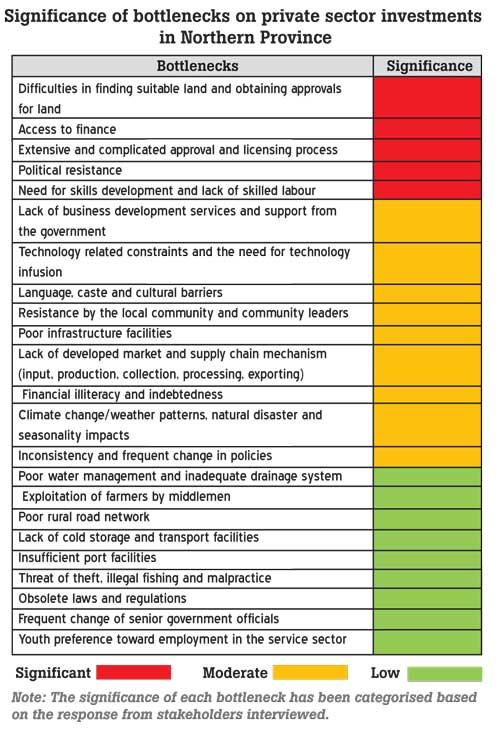

The difficulty of obtaining suitable land to commence business operations was seen as the most significant constraint for investors looking to venture into the Northern Province. Owing to the dense forestry in the Northern Province, a significant portion of the land comes under the purview and protection of the Wildlife Conservation Department and Forestry Department of Sri Lanka.

Although Jaffna has a low forest coverage compared to other districts, most land in the district is fragmented into small plots and not ideal for large-scale investment projects. As such, despite the population density being low in the north, a significant portion of the land area cannot be put to economic use for large-scale investments.

In addition, competing claims of ownership over land, secondary occupation of land and complicated approval processes in acquiring land further aggravate the issues in relation to acquiring land for commercial use. The EY study revealed that the process of obtaining a suitable land for a large-scale business operation could take up to three to five years in certain instances.

If it is a state-owned land, the entire approval process could take up to even five to 10 years. Further, if the land extent is over 100 acres, a Cabinet approval is required, which would cause further delay.

The complicated and extensive approval and licensing process required at times in order to commence business operations was also identified as a key bottleneck. The approval process could take anywhere from six months to five years. The duration is primarily dependent on the time taken to acquire suitable land.

EY Sri Lanka and the Maldives Partner and Consulting Leader Arjuna Herath commenting on the study stated, “The complexities of the overall administrative procedures and processes set forth over land deed clearances, business licensing and obtaining permits area critical bottlenecks for private sector investments in the Northern Province.”

Herath went on to further state, “During the study, it was evident that the difference in the language spoken and culture also poses a challenge when attracting new investments to the Northern Province.”

The Northern Province inherits a strong culture of its own, distinct from the rest of the country, influenced by social norms and infused by the language spoken by the native population. Owing to decades of segregation from the rest of the country due to the war, the people in the North tend to be more cautious and risk-averse by nature, in particular towards the outsiders who show signs of moving into the region.

Efforts for effective communication and reconciliation are deemed to be difficult due to the difference in language spoken. This has led towards a culture that is resilient to the extent that it manifests as “resistant to change”, especially with regards to change led by outsiders.

Though the Census and Statistics Department estimated that the unemployment rate in the Northern Province was 5.6 percent in 2018, higher than the country average of 4.4 percent, many investors in the North identified the lack of skilled labour as a bottleneck. Hiring skilled labour from other provinces is costlier, as the investors would have to pay a premium for their relocation.

However, it was evident that unskilled labour is available in the north and the investors would have to provide the required training and technical skills in order to deploy them on projects. Nevertheless, cultural beliefs still continue to play a significant role in people in the North, selecting jobs due to strong beliefs arising from the caste system.

Agriculture and fisheries are amongst the most vulnerable sectors to face challenges in finding labour in the midst of the caste system. However, it was identified that the younger generation could be enticed to join the agriculture and fisheries sectors by moving away from the traditional methods currently practiced and infusing technology into the industry.

As prevalent across the country, poor access to finance and lack of financial literacy among the people in the North were also identified as key issues that deprive economic growth in the region. Owing to the high levels of poverty, the majority of the population in the north do not have money to invest and only have enough for daily sustenance.

As such, there is a need for financing for new ventures and to expand the existing commercial operations. However, most communities in the North face a challenge in terms of accessing affordable finance, as banks and lending institutions seek collateral for granting loans. Most micro, small, and medium enterprises (MSMEs) in the north find it difficult to produce such collateral and are usually underserved or even unserved.

Hence, most MSMEs, especially in the lower end of the value chain, face a risk in securing adequate financing to sustain their businesses and this has a knock-on effect on other entities that are dependent on their produce.

The absence of a ‘Single Window Service’ to disseminate information and support investors is a root cause that discourages investments to the North. Investors face difficulties in accessing information for setting up of businesses as there is no single institution endorsed to guide the ‘interested’. It was apparent that investors anticipated for a ‘One-Stop Shop’, so that all necessary information, approvals and licensing could be obtained with less constraints.

To this end, in March 2020, the Cabinet approved a proposal for the establishment of a One-Stop-Shop to provide all services related to MSMEs at a centralised location within each district in the country.

Herath stated, “The One-Stop-Shop concept, which was also a concept framed through one of EY’s assignments with the Industry and Commerce Ministry in 2019, if implemented successfully, would be a groundbreaking achievement for Sri Lanka. It will undoubtedly help eliminate most current constraints and improves the investment ecosystem across the country. At a time where the COVID-19 pandemic has caused even more stress upon our economy, action must now be taken to delineate the next and beyond to help reframe the future of private sector investments in the Northern Province.”

Apart from these main issues, inadequate infrastructure (roads, ports, storing facilities, water management and drainage systems), inconsistent policies, obsolete laws and regulations, lack of business development services and the influence of the middlemen, are some of the other issues that impose obstacles and constraints to attract private sector investments to the North.

Herath stressed, “Many initiatives implemented post conflict have not reached their desired outcomes, owing to poor coordination, flawed policies and a lack of a macroeconomic impetus. A conducive and enabling environment needs to be created by the government and facilitated through promotional efforts and incentive schemes to provide adequate yield on the investments. The private sector is generally considered as the engine of growth and facilitating investments in the North will maximise the private sector’s role in economic development.”

Dr. Kring commenting further stated, “The ILO with its labour market partners are working to facilitate investments in the north to create employment and Decent Work. The EY study has mapped out some of the obstacles, which are impeding the realisation of this goal.”

25 Dec 2024 2 hours ago

25 Dec 2024 3 hours ago

25 Dec 2024 4 hours ago

25 Dec 2024 4 hours ago

25 Dec 2024 5 hours ago