Sri Lanka’s usable reserves have dropped to levels of about US $ 150 million. Acute shortages of essentials ranging from fuel to medicine have become prevalent.

Increasing public discontent amidst increasing prices and shortages has led to large protests all across the country. The country has reached a position where it is unable to import essential fuel without the help of the credit lines from bilateral partners. As the crisis reaches such depths, the government and administration have failed to come up with a credible economic plan capable of taking Sri Lanka out of a full-blown economic collapse.

At such a crucial juncture, a group of independent economists have launched an emergency plan of action, with the aim of stopping further collapse of the economy and to stabilise over the medium term. The independent group of economists highlight the macroeconomic risks will continue to worsen, if immediate action is not taken.

“Sri Lanka has run dangerously low on foreign reserves and faces the spectre of a ‘disorderly default’ on its debt obligations. Although a default may cause legal complications in debt restructuring negotiations and reputational damage for the future, much of the economic consequences of a sovereign default are already here.”

Therefore, the group of economists urge the government to take the necessary steps to achieve this outcome immediately. The key signatories of the emergency plan further argue that a staff-level “agreement with the International Monetary Fund (IMF) can establish market confidence and help unlock bridge financing.

The independent economists, who are signatories to the document, are Aneetha Warusavitarana, Anushka Wijesinha, Asanka Wijesinghe, Chayu Damsinghe, Daniel Alphonsus, Deshal de Mel, Naqiya Shiraz, Rehana Thowfeek, Shiran Fernando, Thilina Panduwawala and Umesh Moramudali.

Following is the full document.

An emergency economic stabilisation plan to address ongoing crisis

Macroeconomic risks are worsening

The economic crisis in Sri Lanka is spinning out of control.

- Sri Lanka has run dangerously low on foreign reserves and faces the spectre of a ‘disorderly default’ on its debt obligations. Although a default may cause legal complications in debt restructuring negotiations and reputational damage for the future, much of the economic consequences of a sovereign default are already here.

- The country is already locked out of international debt markets and is unable to refinance its maturing debt or its current account deficit. The result is an acute shortage of foreign exchange that has led to power outages, shortages of cooking gas, fuel, medicine and other basic necessities.

- With headline inflation based on the Colombo Consumers Price Index (CCPI) at 18.7 percent and food inflation at 30.2 percent as of March 2022, Sri Lankans are seeing the cost of goods spiralling upwards and the value of their savings diminishing rapidly.

- Spiralling costs and wage demands are making it difficult to do business in particular for small and medium-sized firms, which are struggling to survive.

- Long-run policy errors have become concentrated to a point that make daily life very difficult. Most Sri Lankans are now facing more than 10 hours of power cuts, with no end in sight.

- This discontent is fuelling protests, as the authorities have thus far failed to put forward a credible plan to tackle the economic crisis. The economy is collapsing and people’s livelihoods are being destroyed, the immediate objective should be to stem further collapse.

- This document is an attempt to provide an emergency action plan to focus the attention of parliamentarians, activists and civil society to take urgent steps to stem the economic decline.

- The immediate priority is to stop things from getting worse and implementing policy changes that provide stability in the medium term.

Stop things from getting worse and begin stabilisation

- Sri Lanka has run out of foreign reserves and its debt is no longer sustainable. All independent analysis point to an inability to meet debt repayments, even leading up to the international sovereign bond of US $ 1 billion maturing in July 2022.

- Ill-conceived decisions to use scarce foreign reserves and the overreliance on short-term credit lines such as swaps have caused extreme damage to the domestic economy. This has aggravated the current shortages and pain felt by all Sri Lankans.

- Sri Lanka also runs the risk of runaway inflation. Immediate action is necessary to stop prices spiralling out of control and to stop the value of the Sri Lankan rupee diminishing rapidly.

- The short-term objective is to stop the worsening situation by entering into negotiations with our creditors and building confidence in the currency and economy overall.

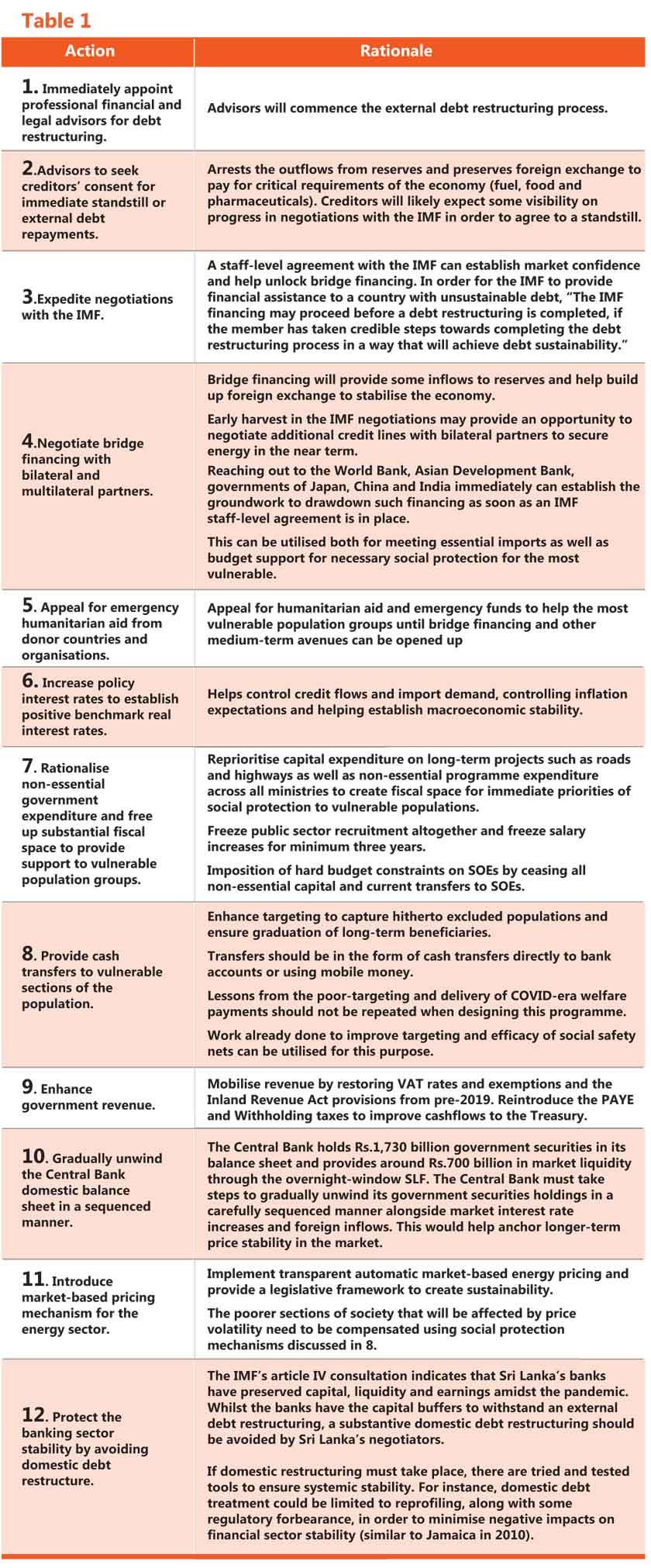

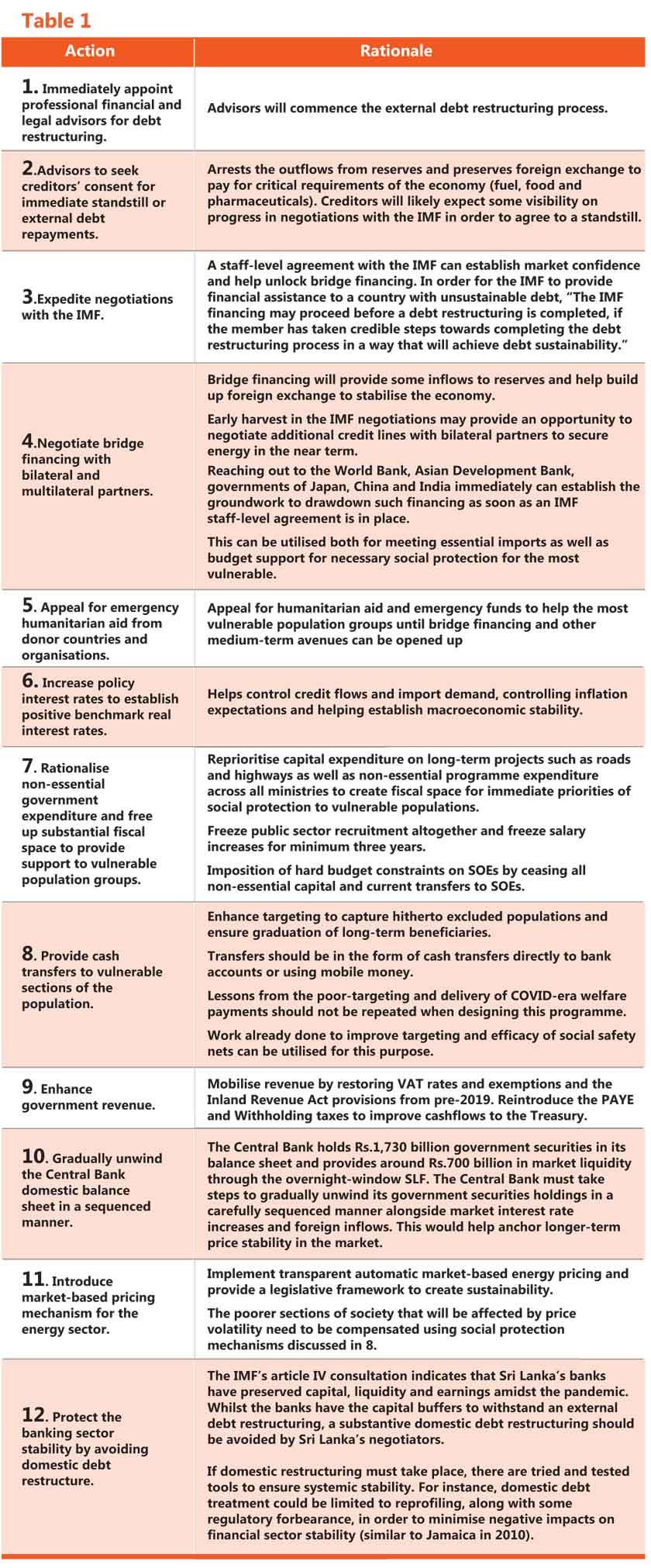

- See Table 1 for the actions that will help mitigate the situation and must be executed immediately.

Urgent legislative reforms for medium-term economic stability

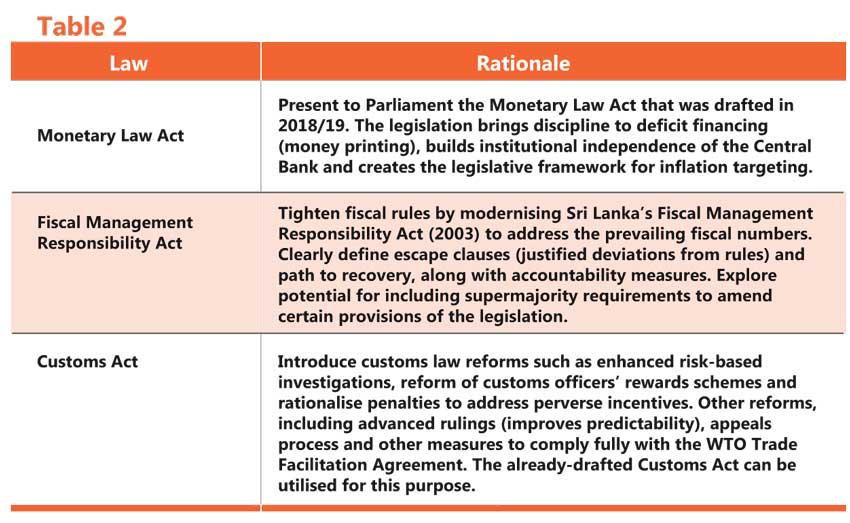

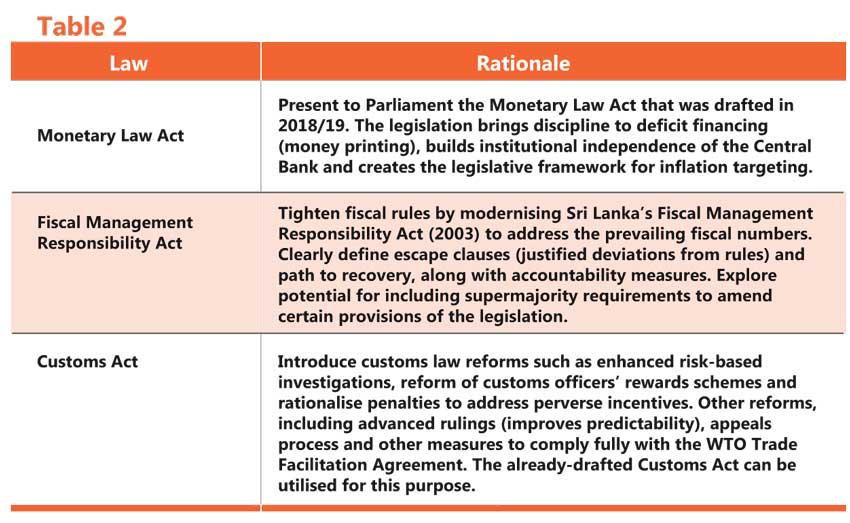

- We recommend the priority legislative reforms stated in Table 2 to build medium-term economic stability and restore credibility and confidence in the governance of public finances and monetary policy.

- However, to be effective, these changes require broader changes in the governance structure such as strengthening the independence of the judiciary, rule of law and the necessary checks and balances for each branch of government. This would inevitably mean constitutional reform that addresses these issues in order for these legal changes to serve their intended purpose.

Forging a national consensus on key economic reform areas

- The main risk facing Sri Lanka in the coming weeks and months ahead is the fallout of the current political instability on the efforts at macro stabilisation. Political and policy stability is a necessary condition for economic stabilisation measures to succeed.

- During the fiscal adjustment, budget cuts need to be prioritised in a way that doesn’t further burden vulnerable households already crippled by the current conditions. Any attempt to push through the reform programme without a clear and compelling articulation of the rationale, urgency and expected outcomes, will be unwise.

- Ensuring that an agreement with the IMF can be eked out with political consensus and as wide public acceptance as possible is crucial. Political parties must come together to agree on a common minimum programme to steer the economy out of the current crisis and towards macroeconomic stability.

- This consensus can then be extended to and reinforced by business chambers and think tanks.