23 Aug 2021 - {{hitsCtrl.values.hits}}

The COVID-19 pandemic brought on a stream of new regulations and policy decisions put in force to bring stability and order to an unsettled economy. This includes the import restrictions and three-month credit limit on a range of industries imposed by the Sri Lankan government in order to stabilise the foreign exchange market and provide support to local businesses in these tough times.

However, to identify and to address the challenges faced by industry, KPMG in Sri Lanka in partnership with the International Chamber of Commerce Sri Lanka (ICCSL) prepared a report to be presented to the government and private sector, to shed light on the impact the trade related restrictions have had on local businesses.

However, to identify and to address the challenges faced by industry, KPMG in Sri Lanka in partnership with the International Chamber of Commerce Sri Lanka (ICCSL) prepared a report to be presented to the government and private sector, to shed light on the impact the trade related restrictions have had on local businesses.

This report discusses the impact, analysed via a survey carried out to identify how the businesses in Sri Lanka were affected by these trade restrictions. The questionnaire was shared among the business community in Sri Lanka operating in various sectors.

Impact on business activity

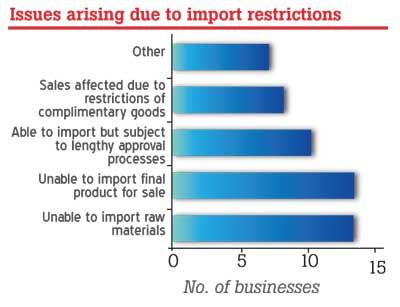

The survey found that the common problems that arose due to the import restrictions were:

Payments, clearance and penalties

Based on the survey, 90 percent of the businesses were able to clear their goods and the remaining 10 percent were unable to clear their imported goods. Of the 90 percent that were able to clear their goods, 59 percent of them were subject to import penalties and the remaining 41 percent were exempt from the penalties.

Despite paying the penalties, 45 percent of the businesses still encountered problems when clearing their goods. However, 55 percent managed to avoid any issues.

Retrospective controls

One of the key issues faced by several businesses was the inconsistent nature of the retrospective controls changes made since April 2020. According to the survey, 83 percent of the businesses were affected by the retrospective controls and the remaining 17 percent claimed to be unaffected by them.

Businesses were also asked how frequently they were subject to these changes. Fifty-five percent responded that they were affected by the controls ‘More than three times’. Since majority of businesses were affected by the controls, the survey further inquired if bulk of the losses incurred in terms of revenue and/or profit they made was as result of the retrospective changes. Seventy-six percent of the respondents agreed with the above.

Businesses were also asked how frequently they were subject to these changes. Fifty-five percent responded that they were affected by the controls ‘More than three times’. Since majority of businesses were affected by the controls, the survey further inquired if bulk of the losses incurred in terms of revenue and/or profit they made was as result of the retrospective changes. Seventy-six percent of the respondents agreed with the above.

Further, 48 percent of businesses stated that the retrospective changes had implications on their relationships with suppliers; 29 percent mentioned that the implications they faced were the unwillingness of foreign banks to accept LCs opened by local banks, unless they were confirmed by an international bank.

The remaining 24 percent faced implications due to other reasons. Based on the survey, 42 percent of businesses were informed of import restrictions via their own company research, once they were announced by the Sri Lankan government. Thirty-three percent were notified by the bank and the remaining 26 percent found out through other sources.

Stakeholder analysis

The survey further went into understanding how the import controls affected the relationship with different stakeholders and their operations.

The survey analysis reveals that 48 percent of businesses found their relationship with suppliers being hindered due to requesting a change in terms of payment. Twenty-six percent of businesses found banks refusing to pay their suppliers, due to new regulations, as the cause for negative supplier relationships. The remaining 26 percent were found to have other reasons such as lack of supplier trust due to order cancellations that harmed their relationship with suppliers.

Based on the survey, 63 percent of the impact to production processes due to import restrictions. Reasons mentioned signified that in worst case scenario, interruptions in production process had led to business failure.

The remaining 37 percent were found to have problems related to temporary production halts, due to the restrictions. However, with time, businesses have adopted alternative processes for business continuity.

The survey found that 38 percent of businesses found other reasons to have impacted their employees, due to the restrictions. The import restrictions did not impact the welfare of the employees other than the indirect effects of reduced or delayed revenue of the business, due to import restrictions. Thirty-four percent of them claimed their employees were mainly affected by salary cuts and the remaining 28 percent stated layoffs as a reason, each time a lockdown is imposed.

According to the survey, 72 percent of businesses found it difficult to supply the confirmed orders to their customers and hence it adversely impacted their relationship with customers. These businesses were mostly found to be operating in the banking and finance and other services industries.

The remaining 28 percent had other reasons that impacted their relationship with customers such as failing to make on-time deliveries.

As recognised earlier, majority (72 percent) of businesses found that their revenues, costs and thereby the profits being affected by the import restrictions. Deeper analysis identified that 41 percent of the businesses faced an increase in their costs, due to sourcing locally instead of importing.

Further, 45 percent had other reasons impacting their profitability such as US dollar depreciation leading to increased cost of production, increased costs due to black market rates and high shipping costs. Furthermore, restricted discounts on credit terms affected business profitability.

The remaining 14 percent were affected by unavailability of raw materials in order to sell units.

Based on the survey, 53 percent fear that there are chances that suppliers will not prefer local banks in the future as the Sri Lankan banks not honouring the payment with counterparty bank. Forty-one percent had other concerns such as buyers arranging discount facilities directly with suppliers, thus banks’ local lending has been affected in terms of interest income. The slowness of banks opening and honouring LCs in a timely manner was a major concern.

Quantification of loss

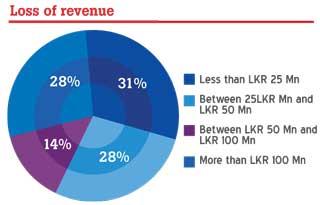

Upon analysing the loss of revenue as a percentage of the latest annual revenue, it was identified that 41 percent of businesses made a loss between 25 percent to 50 percent. Thirty-four percent of businesses appeared to have incurred a loss of 0-25 percent and were found to be predominantly from the transportation industry.

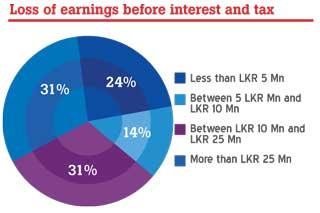

In terms of earnings before interest and tax (EBIT), 31 percent of businesses reported to have made a loss of more than Rs.25 million and were businesses primarily operating in the automobile and banking industries and another 31 percent mainly belonging to the transportation industry mentioned that they made a loss between Rs.10 million and Rs.25 million.

As a percentage of the latest annual EBIT, it can be identified that 41 percent of firms belonging to the transportation industry incurred a loss of 0-25 percent and 34 percent incurred a loss between 25 percent to 50 percent.

Based on the analysis, it can be further identified that the loss of EBIT is greater than the loss of revenue. In absolute terms, majority of businesses reported to have made a loss in revenue of less than 25 million, whereas for the loss made in EBIT most businesses claimed to have made a loss of more than Rs.25 million.

Hence, it can be concluded that the cause for the greater loss in EBIT is due to increased costs incurred by the businesses. The contributor to large costs could be as result of the import restrictions imposed.

Significance of import restrictions on businesses

Businesses were surveyed on the level of significance the import restrictions had on their businesses on a scale of 0-10 (0- no effect and 10- highly significant). The analysis revealed that 21 percent of the businesses picked 8 on the scale, which indicates that the impact has proximity to ‘highly significant’.

Most of these businesses were found to be operating in the banking and other services industries. However, the next largest majority (13 percent) picked 3 on the scale, which indicates that they were impacted less significantly and were found to be operating mostly in the transportation industry.

Recommendations

The survey respondents were asked if they would recommend the implementation of a system (Ex: Website), which would show them their restriction status with respect to any HS code searched. Seventy-nine percent of the businesses surveyed stated ‘Highly recommend’, whereas only 7 percent stated ‘Does not recommend’. This therefore shows the importance of having a system in place to provide firms with their restriction status.

Further suggestions stated that some classifications of the HS codes on industrial items imported should be reviewed in light of sustainable developments and to be feasible. In addition, some strongly recommend that HS codes specified by the shipper should be accepted rather than arbitrarily changing them.

Based on the survey, 97 percent suggest policy consistency over amendments to gazette every week/month. Policy consistency is a vital area to pay attention to as agreed by majority. This is because inconsistent policies lead high level of business uncertainty affecting planning, control and investor confidence.

The survey further reveals the importance of all parties (customs, banks, etc.) to be aware of the latest amendments in order to support business queries and clearance processes.

Ninety-seven percent stated that all parties involved must be aware. Further, according to the survey, 55 percent of businesses strongly detest having retrospective regulations going forward. No businesses want retrospective regulations in the future, while 17 percent have remained neutral about this matter.

KPMG Sri Lanka team lead by Principal Deal Advisory and Deputy Head of Markets Shiluka Gunawardena collaborated with a team led by ICCSL Chairman Dinesh Weerakkody in conducting the survey among various businesses across the island.

Furthermore, KPMG was responsible in the preparation of the questionnaire and detailed analysis based on the data gathered from this survey and in presenting the most suitable steps to be taken in addressing the problems brought on by the import restrictions in the hopes of alleviating the problems felt by these companies in the most effective way possible.

The Employers’ Federation of Ceylon, Federation of Chambers of Commerce Sri Lanka and European Chamber were also partners to the project.

23 Dec 2024 2 hours ago

23 Dec 2024 3 hours ago

23 Dec 2024 6 hours ago

23 Dec 2024 8 hours ago