12 Oct 2020 - {{hitsCtrl.values.hits}}

Investors must not react impulsively to the news of the emergence of the new COVID-19 cluster in Sri Lanka. In a special report, leading stockbroking firm Asia Securities (Pvt.) Ltd, exploring the impact of COVID-19 resurgence in several regional emerging economies as well as developed economies, notes that equity markets have remained stable through the second waves of COVID-19.

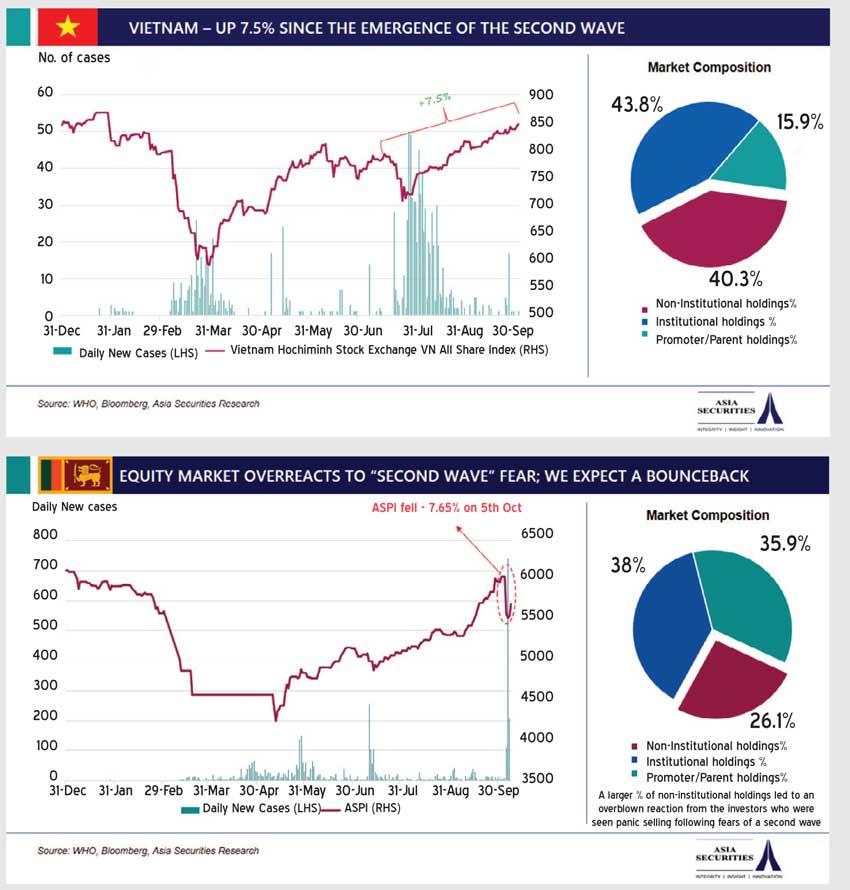

In some emerging markets, equity indices fell initially—like the Colombo Stock Exchange indices did on Monday, October 5—but have quickly rebounded. The sell down on Monday has unveiled more value on a large number of counters that are set for strong earnings this upcoming season. The current valuations in the market do not reflect this and provide an attractive entry point for investors to gain on the bounce.

In Vietnam, for example, the main index on the Ho Chi Minh Stock Exchange is up 8 percent from the point before the second wave was detected in July, the report highlights. Similarly, in Malaysia, the main stock market index has bounced back to pre-second wave levels in early September.

Similar trends have been observed in many developed markets. In Australia, where the second wave has come and gone, the stock market index is up 2 percent. Even in Italy, where the second wave is ongoing since mid-August, the index has recovered and is currently down only 4 percent during that time.

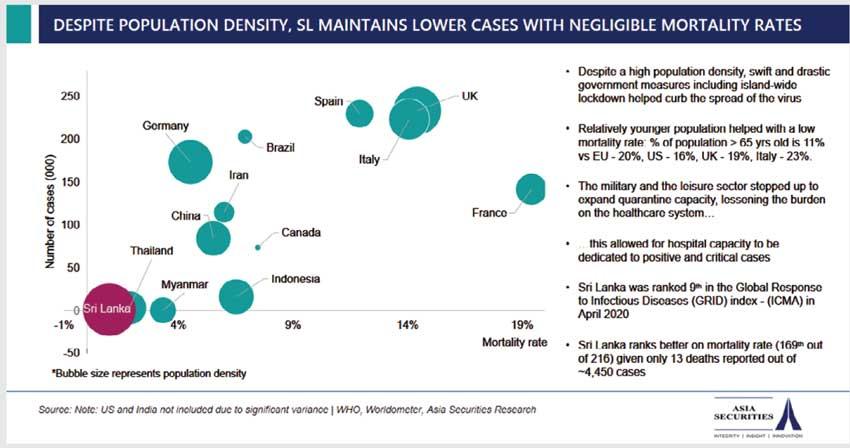

The firm’s analysis argues that Sri Lanka is better positioned to withstand any risk of an uptick in new cases this time around, due to the measures taken by the government and private sector, following the April/May lockdown.

The report further voices optimism, noting that positive economic and corporate performance is likely, thanks to the government’s coordinated management of COVID-19 preparedness and response, strong public healthcare system, as well the measures taken by corporates to ensure operational continuity.

Sri Lanka’s mortality rate, which is ranked 169 out of 216 countries, places it among the global top, in terms of pandemic preparedness. The low mortality rates are attributed to strong management of the pandemic by the government, effective containment and quarantine strategy, efficient use of hospital capacity and the relatively young population in (only 11 percent of Sri Lanka’s population are above the age of 65, compared to developed markets like the US and EU, which are 16 percent and 20 percent, respectively).

(Asia Securities is a leading investment firm in Sri Lanka, providing investment banking, research, equities and wealth management services to local and international corporate, institutional and individual clients)

24 Dec 2024 9 hours ago

24 Dec 2024 24 Dec 2024

24 Dec 2024 24 Dec 2024

24 Dec 2024 24 Dec 2024

24 Dec 2024 24 Dec 2024