The energy industry globally operates with fluctuating prices that determine the final price of LPG across markets. Globally, the LPG prices have been shifting with the demand and currency discrepancies, causing costs to soar and markets to tumble, as one of the world’s most efficient and low-cost energy sources goes through turbulent times.

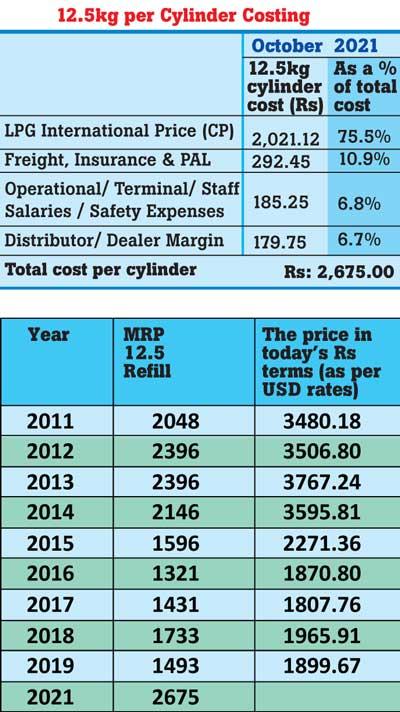

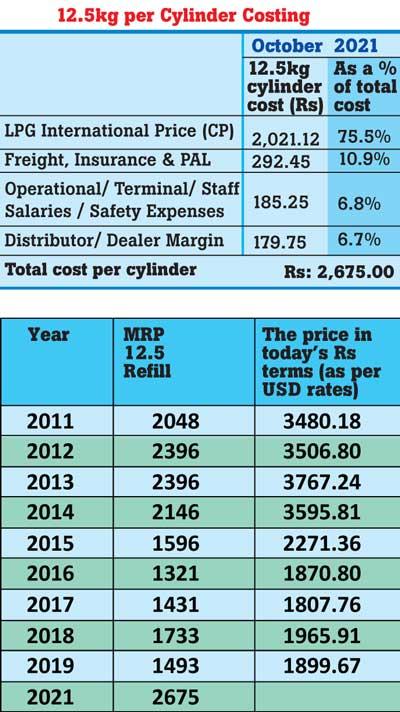

National LPG provider Litro Gas Lanka has developed a cost leadership advantage, which ensures that the price increase covers the costs (as indicated in the chart).

Additionally, with 80 percent market share, with the capability of 8000 MT and 3000 MT storage and distribution, Litro Gas Lanka sustains a unique cost leadership price advantage that has been validated by the Consumer Affairs Authority as well.

Litro Gas Lanka has been long recognised for its efficient optimisation of resources and costs, a key operational benefit that has seen the cost of operations remain low at a steady 6 percent. The price increase sustained by Litro Gas Lanka over the years affirms this.

The only state-owned entity to generate an outstanding revenue of Rs.50 billion, Litro Gas Lanka has consistently delivered exceptional economic benefit amounting to over Rs.11 billion up to now. The company has paid Rs.34.5 billion as taxes to the state and Rs.13 billion as dividends to the Treasury.

Litro Gas Lanka believes that the LPG industry in Sri Lanka has the potential for expansion and growth. Accordingly, the company has already submitted proposals towards consolidating the industry, to the government, which are as follows:

1.Litro Gas Lanka to operate the Hambantota Laugfs terminal for a management fee that will cover the operation cost and pass the income generated to banks/the Treasury.

2.Litro Gas Lanka to lease the Hambantota Laugfs facility on a long-term lease of 10 years.

3.Litro Gas Lanka to purchase 100 percent of the Hambantota Laugfs terminal via a consortium of investors.

The company believes that the proposed mechanisms will expand the industry and make the MRP more affordable to consumers.

Litro Gas Lanka further says that a floating LPG storage that can store up to 40,000 MT, without any additional cost can be utilised, if needed, to meet the supply demand.

Energy industry sources point out that the burden of servicing debt taken to finance the large facilities of Laugfs LPG terminal at Hambantota and plans to ease its 40 billion debt raised without substantiated collateral from several banks, mainly the state-owned banks, may impact the entire industry and the economy. Added to that is the fact that the Laugfs LPG storage facility at Hambantota is widely seen globally as a non-performing asset.

Further, the price of Rs.2,840 per 12.5 cylinder by Laugfs is indicative of the fact that as a privately owned company, Laugfs is sustaining losses incurred by a non-efficient process and must consolidate its efforts.

As the national LPG provider, with a strongly community-focused approach, Litro Gas Lanka plays a pivotal role as the country’s energy industry leader. Throughout the years, the company has always strived to maintain the customer value proposition, even with the price increases and market fluctuations. For an example, in 2013, when the US dollar was at Rs.160.00, the company was selling a 12.5 cylinder at Rs.2,300.00. The current price increase therefore clearly covers the costs and does not include a profit margin to the company, confirmed company sources. Litro Gas Lanka believes that as the national LPG provider, the company has a national energy mandate to fulfil to the people of Sri Lanka – a goal the company is committed to.

National LPG provider Litro Gas Lanka has developed a cost leadership advantage, which ensures that the price increase covers the costs (as indicated in the chart).

National LPG provider Litro Gas Lanka has developed a cost leadership advantage, which ensures that the price increase covers the costs (as indicated in the chart).