23 Jan 2018 - {{hitsCtrl.values.hits}}

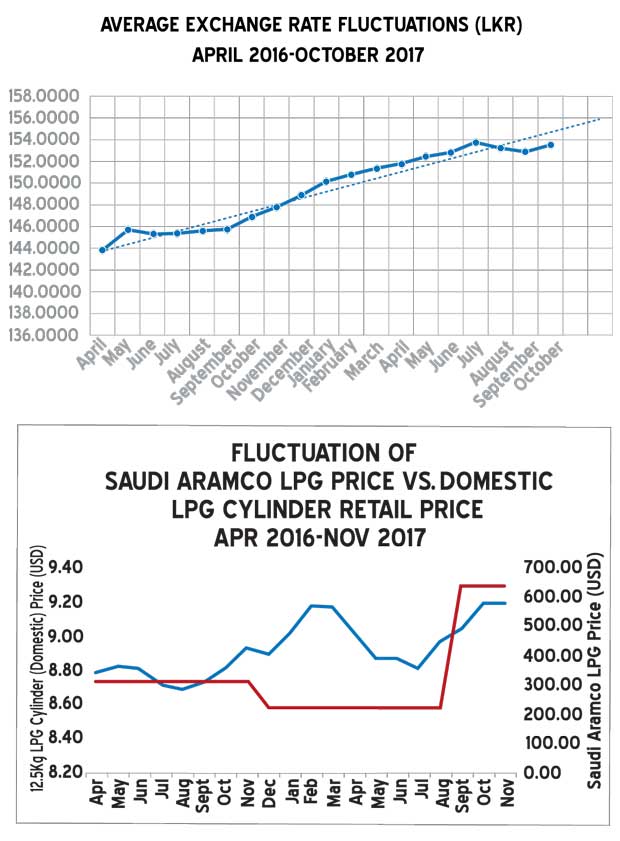

A permanent shift in the international prices of liquefied petroleum gas (LPG) has been taking place during the past few months fuelled mainly by the price fluctuations of the Saudi Aramco contract price (CP) of LPG. The Saudi Armaco CP is the key global benchmark of LPG price regulations in Arabian Gulf and Asian region and by February 2017, the CP price rose by 20 percent in comparison to the price range recorded in the previous month.

While a stable situation was observed from May to July 2017, the CP rose again in August by 25 percent, marking the beginning of another upward trend. The overall change in the global CP price within the course of a year and a half was approximately a 70 percent increase, which calls for an inexorable change. LPG retailers in Sri Lanka continue to suffer further cost increases given the rupee value depreciation contributing to increasing the cost of import of LPG.

LPG is widely considered a safer, more convenient and an efficient fuel alternative to traditional firewood, apart from reducing health issues arising from smoke inhalation with the usage of conventional firewood. In addition, eliminating the time-consuming task of gathering firewood saves time and energy to engage in more productive economic activities.

The positive impact that the usage of LPG as a fuel alternative has on the general population of Sri Lanka remains significant. However, the increasing cost of imports is causing retailers to suffer substantial losses and authorities need to address the situation in a timely manner before it reaches an inevitable crisis point and escalates into an economic calamity.

Cost of imports and impact on business continuity

The LPG retailers in Sri Lanka have continued to incur losses in the face of the strictly regulated local retail price. The recent increase of a 12.5KG of LPG cylinder by Rs.110.00 has not been able to bridge the gap between the cost of importing and retail sales.

The dire consequence of this status quo is the impact that it has on the balance of payment. When the retailers fail to recover costs, the losses have to be financed by borrowings from the banking sector, which affects the country’s balance of payment. In the event that the importers of LPG keep on making losses, the country’s economy will be forced to bear the brunt of the instability triggered by an unhealthy balance of payment.

While the two LPG retail companies in operation within Sri Lanka will have to manage the negative impact of price instability in different ways, both cases create an overall negative impact on the economy. In the case of Litro Gas Lanka, a state-owned company, the government is called upon to fund the inevitable losses, thus directly affecting the country’s capital investment capability.

The listed Laugfs Gas PLC’s losses in the LPG retail sector will negatively affect the share market by eroding shareholder value. Furthermore, the company’s ability to contribute to the country’s economy too will suffer.

Commenting on the situation, Laugfs Group Managing Director Thilak De Silva remarked, “In a backdrop where we (Laugfs) are engaged in heavy futuristic and strategic investments that will develop the country’s LPG sector, such as the Laugfs LPG Terminal at the Hambantota Port, which is set to become a regional powerhouse, sustainable and transparent industry policies are required for us to forge our way ahead with confidence.

The current situation with regards to LPG retailing will lead us to accumulate losses at a large scale, consequently inhibiting our potential for sustainable growth. However, the damaging effect of the current price issue will not be limited to the LPG industry but will extend beyond to the country’s economy.”

Impeding sustainable growth of LPG retailers in the country will also impede their potential for economic value creation and innovation, imperative to become an economically and socially progressive country in the evolving global arena.

Rupee depreciation

As the value of the rupee continues to drop against the US dollar, the cost of imports, transportation and inward customs clearance too keeps on increasing.

The inevitable result of the concurrent amalgamation of these factors is the damaging losses that the LPG retailers in Sri Lanka incur, which then translate into a contributing factor to economic instability in the country.

Economic experts relate that since the LPG prices have hereto failed to increase gently in line with contributing costs, a considerable increase will be required later to bridge the gap.

Finding a solution

A system that does not take into account varying changes (global and local), which affect the cost of imports and prices, causes difficulties for both firms and consumers. While the retailers suffer from strict price control mechanisms, which keep the prices artificially low, the consumers will find drastic yet inevitable price changes difficult to manage.

The situation calls for a formula-based pricing of LPG to stabilize this situation. All types of fuel, including diesel and petrol, require timely price adjustments in line with global trends to prevent destabilization.

“A formula-based price is the best course of action given the highly sensitive global price variations. This type of mechanism will safeguard the interest of both the consumer and retailer. While transparency will protect consumers from unfair pricing, a stable and a fair pricing policy will guarantee business sustainability of retailers,” Litro Gas Lanka Limited Director Sales and Marketing/Corporate Affairs Chaminda Ediriwickrama commented.

A more credible and a transparent pricing formula will be advantageous in ensuring that the retailers are able to raise and lower the price of LPG in line with the global and local socio-economic factors. This mechanism will ensure that the consumers benefit from lower prices during the world LPG price drops while the retailers will not have to bear the consequences of low retail prices in times of cost hikes.

The current crisis calls for immediate and pragmatic action as both consumers and retailers stand to lose if the situation continues unaddressed. Authorities should try to strike the correct balance between protecting consumers and retailers in order to pave the way for a sustainable future not only for individual companies and consumers but also the country as a whole.

20 Nov 2024 10 minute ago

20 Nov 2024 14 minute ago

20 Nov 2024 17 minute ago

20 Nov 2024 1 hours ago

20 Nov 2024 2 hours ago