25 Jan 2017 - {{hitsCtrl.values.hits}}

For the sixth consecutive year, MTI Consulting in partnership with Daily FT, Daily Mirror and Sunday Times, has concluded the MTI CEO Business Outlook Survey, collectively outlining the Sri Lankan business community’s perception for the state of business in 2017.

Supplemented by MTI’s experience as a thought leadership-oriented organisation, the annual survey collated and analysed the perceptions of over 200 Sri Lankan business leaders with regard to their business’ past and expected performance, their predictions regarding the state of the local and global economy in 2017 and the main challenges they believe Sri Lanka and their companies will face in 2017.

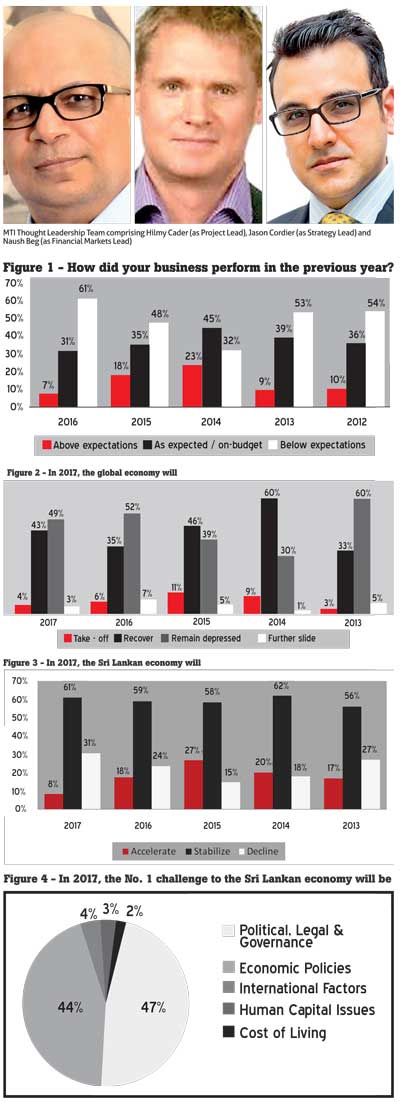

Business performance in 2016 marks a new low

The results of the survey, including its supplementary analysis, will enable organisations to streamline their strategic decision-making for 2017, effectively enabling them to gear their operations in accordance with the economic sentiments of their peers.

Sixty one percent of the CEOs reported their businesses have performed below expectations in 2016. This shows an increasing trend from 2014 onwards. As opposed to 68 percent and 53 percent respondents from 2014 and 2015, respectively, only 38 percent of respondents stated that their business performed either as expected or above expectations.

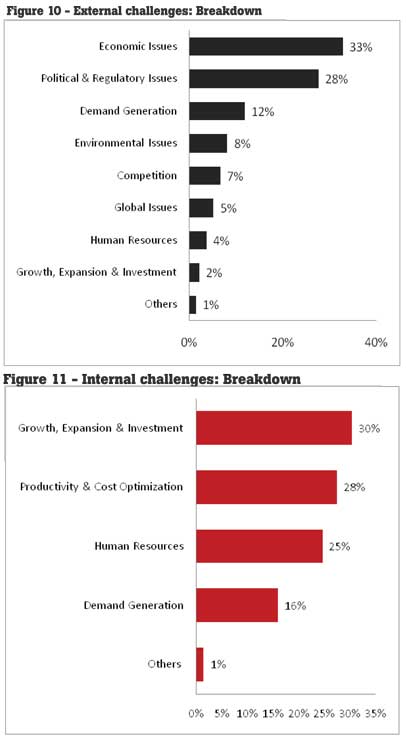

Macroeconomic performance

To supplement the CEO perceptions on 2016, MTI analysed the key macroeconomic indicators of Sri Lanka for 2016.

The growth drivers in the industry sector in the third quarter were construction and mining and quarrying. Growth in the service sector in the third quarter was a result of expansion in the categories of financial services, insurance, telecommunication, education and wholesale and retail trade.

Amidst unconducive weather conditions such as droughts and flooding, the agriculture sector witnessed a contraction of 2.5 percent. Reduction in the production of tea and rubber also contributed to the decline.

Considering many indicators, including exports and reserves, the external sector performed poorly in 2016 compared with 2015. The decline in the country’s reserves, despite the International Monetary Fund (IMF) package is a serious cause for concern – according to economists. The three-year US $ 1.5 billion loan from the International Monetary Fund (IMF) was approved in June 2016. However, despite the IMF support, the present reserves are not sufficient to meet Sri Lanka’s debt repayments for this year.

The reduction in the budget deficit and the increase in total government revenue are encouraging signs. However, these positives are perhaps more than offset by an increase in total government expenditure and more importantly, a rapid increase in government debt. The stock of government debt has risen by 13.7 percent – when comparing the end-September debt stock in 2016 against the same period of 2015.

Monetary sector performance in 2016

The upward movement could be seen in both the policy interest rates and lending rates of commercial banks (by one percent and 4 percent, respectively). After increasing the statutory reserve requirement (SRR) in December 2015, in July 2016 the Central Bank increased the standing deposit facility rate and the standing lending facility rate by 50 basis points each.

According to media reports, total private credit granted during the first nine months of 2016 has increased to Rs.516 billion from Rs.398 billion recorded during the same period the previous year. This represents an increase of nearly 30 percent. The Central Bank expects inflation to remain at mid-single digits in the period ahead.

Industry performance

Banking – The banking sector continued to expand its asset base during the first nine months of 2016 maintaining its capital and liquidity at adequate levels. Return on equity increased to 17.2 percent during the first nine months of 2016 when compared with 15.7 percent in the corresponding period of 2015.

Tourism – SL missed the arrivals target for 2016 by 149,000 tourists. Nevertheless, the arrivals growth, the momentum which started at the end of the war, continued in 2016. Arrivals grew by 14.7 percent year-on-year (YoY) and compound annual growth rate (CAGR) 17.7 percent over 2013-16. Earnings from tourism grew 14.0 percent YoY and CAGR 26.5 percent over 2013-16 to US $ 3.4 billion by end-2016. However, it was US $ 200 million below the original target of US $ 3.6 billion

Apparel – The apparel exports contracted by 1.2 percent YoY during the first 10 months of 2016.

According to media reports, the cumulative apparel exports to the USA grew at 6.6 percent YoY dropping from 14.7 percent and 14.5 percent growth rates recorded in 2014 and 2015, respectively. Exports to the European Union (EU) contracted substantially by 9.8 percent as uncertainty loomed over the EU market with the Brexit vote in the UK and elections in other European countries like Italy and Austria further aggravating an already weak market. Sri Lanka’s EU market share has witnessed a steady decline since the withdrawal of the EU GSP Plus from 50.1 percent in 2012 to 42.3 percent by 2016. Sri Lanka’s application to regain GSP Plus is currently going through an assessment and approval process and industry leaders remain hopeful about the ability to regain the GSP Plus concessions.

Tea – The cumulative tea export earnings during the first nine months of 2016 recorded a 2.1 percent marginal growth from the same period last year but this was a significant 13.1 percent drop compared to 2014 earnings. Weak export demand stemming from structurally low oil prices and macroeconomic instabilities in the Middle East and the Commonwealth of Independent States (CIS) including Russia were the main factors for this sluggish export performance according to media reports. Serious shortfall in crops and the drop in production as a result of bad weather and the inability to fertilize due to the government ban on important weedicides were critical challenges being faced by the industry.

Construction – The construction sector, which went through a rough patch in 2015 have indicated signs of recovery with some of the large infrastructure projects driven by the public sector recommencing. Large infrastructure projects driven by the public sector kick started during the first quarter continued growth in projects in the condominium and leisure sectors. In early 2016 Sri Lanka’s real estate market expanded rapidly, continuing a medium-term growth trend that has been fuelled by an increased appetite for residential property among the nation’s wealthy and middle-class population, growing demand for high-grade office and commercial space from local and foreign corporates and rising interest in the country as a tourist destination. Gross domestic product (GDP) from construction in Sri Lanka increased to Rs.158 billion with an 11 percent growth from the previous quarter.

Stock market performance in 2016

The All Share Index (ASI) declined by 9.7 percent to 6,228 points and S&P SL20 index declined by 3.6 percent to 3,496 points at end-2016 compared to 6,895 and 3,626, respectively, as at end-2015. The Colombo Stock Exchange (CSE) lost Rs.193 billion from its market capitalization by end-2016 to stand at Rs.2,745 billion as compared to Rs.2,938 billion at end-2015. The annual turnover stood at Rs.176.9 billion, which was lower by Rs.76.3 billion and Rs.164.0 billion than 2015 and 2014, respectively.

According to an analysis of the latest (September 2016) quarterly reports published by the CSE S&P 20 revealed that 20 percent of the companies experienced a YoY drop in net earnings while 10 percent experienced only a single-digit growth.

Expectations of lower global growth World in 2016

Global economic growth remained soft in 2016 for numerous reasons which vary by region.

Generally, the culprits include structural adjustments in many countries, efforts to reduce overcapacity, recurring natural disasters, geopolitical events such as Brexit and the ongoing civil war in Syria. The appointment of new President Donald Trump in the US, as well as potential policy changes in the US created many uncertainties in the global economy. Comprehensive data showed that the global economy grew 2.6 percent YoY in 3Q (at current exchange rates) and remains on track to have grown 2.5 percent overall in 2016.

World in 2017

In contrast to what the CEOs predicted, the World Bank and IMF forecasted the real value of goods and services produced globally to grow by 2.7 percent and 3.4 percent, respectively in 2016 – up by 0.4 and 0.3 percentage points, respectively from the previous year.

Goldman Sachs forecasted rising interest rates and inflation and upward pressure for the US dollar as the key challenges for the US this year. There will be further impact from the new Trump administration’s tax reforms, fiscal easing and investments in infrastructure and protectionist propagandas.

Growth is seen slowing slightly in the eurozone in 2017, after coming in at an expected 1.6 percent in 2016. A rise in inflation will reduce tailwinds to consumption and investment growth is likely to slow amid heightened uncertainty. Despite the easy monetary policy and improvements, the crowded election cycle can create political and economic uncertainties in Europe.

The key growth drivers of Asia would be high productivity, especially in China and other emerging economies. China is expected to grow due to increased infrastructure and consumer spending. The key challenges for the Asian economies would be geopolitical issues, territorial disputes, political transitions, US interest rate hike and protectionist policies. The economy of India is expected to slow down with the currency reforms.

Sri Lanka in 2017

Likewise, both the Asian Development Bank (ADB) and World Bank expect a slight increase in Sri Lanka’s real GDP growth rate. The ADB expects the economy to grow by 5.5 percent this year (up from 5 percent in the previous year) and the World Bank expects the economy to grow by 5 percent (up from 4.8 percent in the previous year). The World Bank expects Sri Lanka’s GDP growth to remain unchanged in 2016 and grow marginally over 5.0 percent in 2017 and beyond driven by public and private investment, tourism and reduced negative impact on growth from commodity imports.

The impact of past currency depreciation and the increase in the value-added tax (VAT) rate is expected to increase inflation in 2017 despite the downward pressure from low international commodity prices. ADB lowered growth forecast of Sri Lanka to 5.5 percent in 2017 because of tight monetary and fiscal policies.

Critical need for consistent policies

Forty seven percent of the CEOs perceive political, legal and governance area to contribute to more challenges. This is closely followed by economic policies with 44 percent. Less cited primary challenges were international factors or the volatilities of the global economy that are likely to impact the Sri Lankan economy, the cost of living due to increased taxes and human capital issues ranging from difficulty to find and retain skilled workers.

Political, legal and governance

They key issues under political, legal and governance were concerns on policy consistency and effective implementation of policy decisions. According to MTI Research, several experts and economists have emphasized the importance of having consistent and coherent policies. Especially as mentioned by the US and China ambassadors, having consistent investment policies is vital to attract the US and Chinese investments.

An equal amount of concern is shared between political stability of the coalition government and attracting foreign direct investments and building investor confidence. Less frequently cited concerns were, government having a clear direction and effective decision-making, fight against corruption and ensuring good governance, etc.

Economic policies

A closer look at the composition of responses citing economic policies as a challenge revealed that the depreciation of the Sri Lankan currency, increased taxes due to fiscal policy reforms, high interest rates, need to improve net trade were considered as the most significant issues among Sri Lankan business leaders. Less frequently cited issues cover ensuring economic stability and growth, managing national debt, stability of monetary policy, etc.

Exchange rate: The Sri Lankan rupee was highly volatile during the year of 2016. It started at the Rs.144 range and ended at Rs.150 per one US dollar at the end of the year, leading to 4 percent depreciation.

Interest rates: All the policy interest rates were increased by one percent (standing deposit facility rate 6 percent to 7 percent and standing lending facility rate 7.5 percent to 8.5 percent). The prime lending rates of commercial banks increased by 4 percent from 7.5 percent to 11.52 percent.

Tax revisions: With the budget proposal for 2017, the government has increased several taxes. A few revisions are mentioned below. The corporate income tax rate is proposed to be revised to create a three-tier structure of 14 percent, 28 percent and 40 percent; the income tax rate of 10 percent currently applicable on funds, dividends, treasury bills and bonds will be increased to 14 percent; the withholding tax (WHT) on interest income will be increased to 5 percent from the present level; the capital gain tax will be introduced with effect from April 1, 2017 at a rate of 10 percent, etc.

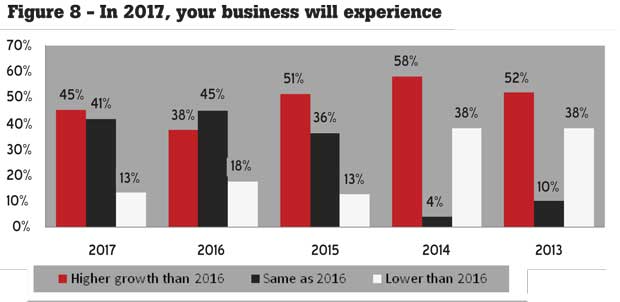

Business leaders still optimistic 2017 will see higher growth

Despite performing below expectations in 2016, 45 percent of the surveyed CEOs are optimistic on achieving better performances in 2017. This is an improvement from last year where only 38 percent were expecting higher growth. The number of CEOs who expect to grow at a same level has reduced from 45 percent in 2016 to 41 percent in 2017.

Only 13 percent CEOs are expecting a lower growth rate as oppose to 18 percent last year. Despite the economic, monetary and fiscal challenges, increasing confidence on world economic recovery and growth opportunities may have been the reason for better expectations than previous year

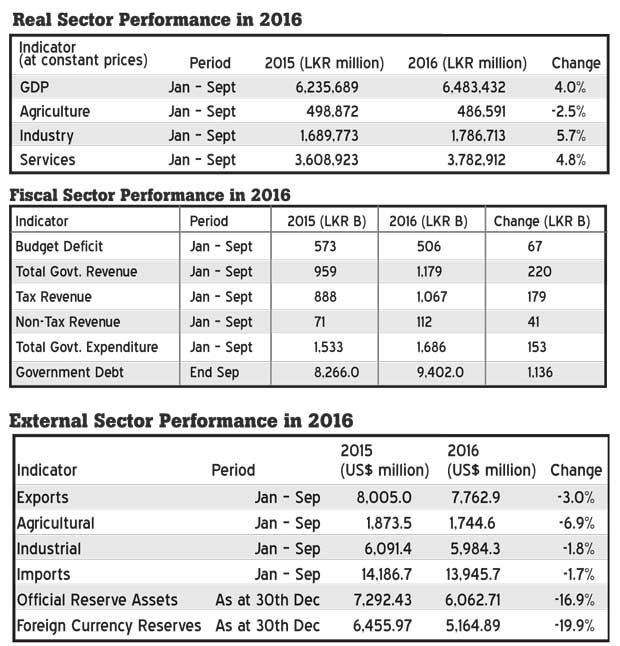

Challenges come from outside

In the same vein as the previous year’s results, two-thirds of the surveyed CEOs believe that their organisations’ success in 2017 will be primarily affected by factors external to their business.

In contrast, only 34 percent of respondents believe that the problems lie either within their organisations or within their span of control.

External challenges

The main external challenges the CEOs have identified are related to the economy – such as devaluation of the Sri Lankan rupee, rising interest rates, fiscal policy and tax reforms, etc. Hence, the key challenges for the Sri Lankan economy and businesses are more or less the same.

The second most significant issues are political and regulatory issues, which cover policy inconsistency and implementation, political stability and rules and regulations. The external demand generation challenges mainly cover the low disposable income and purchasing power of consumers.

The environmental issues have pointed out the threat of facing a severe drought in 2017, which can especially affect agriculture and plantation industries. Other less frequently cited issues cover, competition from both local and foreign companies, global protectionist schemes and crisis in tea importing countries, difficulty to find and retain talent, etc.

Internal challenges

Although less mentioned, the internal factors were majorly comprised of concerns towards being able to successfully pursue expansion strategies or attract further investments, such as expanding to new territories, lack of funding. This was followed by the need to enhance productivity, efficiency and to reduce costs of production with special mentions on improving labour productivity.

Finally, a few respondents expressed their difficulties in attracting, training and retaining good talent and the internal difficulties to increase business volumes and attract more customers.

Conclusion

2017 will be an interesting and challenging year for business leaders, considering uncertainties and volatilities both at home and abroad. Despite the majority having performed below expectations in 2016, the CEOs enter the new year with relatively positive expectations for their businesses. However, the confidence on the recovery of both global and local economies has not been fully restored.

Nation-wide political and economic challenges such as policy inconsistencies, political stability, fiscal and monetary policies are expected to directly impact the businesses making them the key concerns for business leaders. All the Sri Lankan companies and business leaders are encouraged to consider re-strategizing and gearing their organisations to overcome the mentioned challenges, to achieve the expected business objectives and results.

24 Nov 2024 1 hours ago

24 Nov 2024 4 hours ago

24 Nov 2024 4 hours ago

24 Nov 2024 5 hours ago