07 Mar 2022 - {{hitsCtrl.values.hits}}

Early January of 2022 is marked by anticipation of things to come. Global economies are gearing up to put the pandemic behind them and face the uncertainties of a world whose normalcy has been altered beyond recognition.

Early January of 2022 is marked by anticipation of things to come. Global economies are gearing up to put the pandemic behind them and face the uncertainties of a world whose normalcy has been altered beyond recognition.

The accelerated adoption of digital technologies, rapid resignation of the global labour force, permanency of remote workplaces, commodity shortages, damaged supply chains and the introduction of 20 percent of US dollars in circulation are few among the many dynamics at play.

It’s truly impressive in this context that NFTs, a niche technology associated with establishing veracity for digital assets through the use of blockchain networks, is a notable highlight of discussion in the early months of 2022.

It’s truly impressive in this context that NFTs, a niche technology associated with establishing veracity for digital assets through the use of blockchain networks, is a notable highlight of discussion in the early months of 2022.

What are NFTs?

NFT is an abbreviation which represents ‘non-fungible tokens’, a form of cryptographic tokenisation, which allows digital assets such as images, video, music and animations to be coded onto a blockchain through a process known as ‘minting’.

Arguably, the most notable feature of an NFT, which distinguishes it from a standard digital asset, is the meta information, which may include ownership, available supply, details of past transfer and details of creation being encoded to a decentralised public ledger, which is practically exempt from being altered. Simply put, an NFT maintains a record of ownership and authenticity that practically cannot be edited without complete transparency and consensus of the blockchain network. Another interesting aspect of NFTs is their ability to accommodate smart contracts, which are sets of instructions programmed to execute automatically when defined parameters are fulfilled. Smart contracts are a notable feature of many popular blockchains, which NFTs inherit by virtue of their nativity to the technology.

Finally, NFTs are also synonymous with the concepts of ‘Web 3.0’ and ‘Metaverse’, which are futuristic visions of technology underpinned by the idea that life in the coming future will steadily flow into digital realms, where individuals will vicariously live through avatar representations of themselves and others. To the limited imagination, the Metaverse is a digital life, which will be lived through immersive virtual reality equipment and experiences.

To illustrate the promise of an NFT, an artist is now able to create digital works of art, which will primarily be authentic and void of unauthorised replication, will be governed by smart contractual clauses such as automatic collection of royalties and finally, may or may not have functional utility in a Metaverse.

Billion-dollar art industry of future

If the initial premise of an NFT itself is beginning to seem like something out of science fiction, the complexity is the perfect starting point to delve into the confusion that has resulted from the emergence of NFTs as an asset class.

At the time of writing, the total market capitalisation of NFTs as a class of assets is over US $ 32 billion. It is also reported that over four million Americans have bought, owned or sold an NFT. Considering the rapid growth numbers of recent weeks, the global NFT market is poised to grow to a serious class of asset holding.

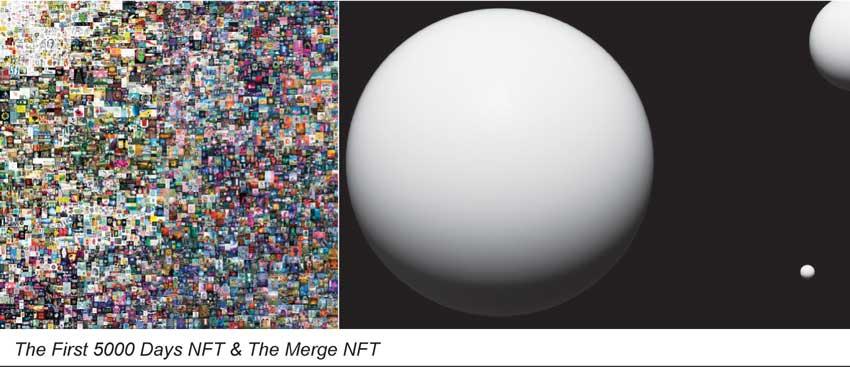

On December 2, 2021, an NFT collection titled ‘The Merge’ recorded its place as the most expensive NFT sold to date, raking in a cool US $ 91.8 million. 29,983 collectors picked up 312,686 works from the collection to make up the total.

Another artwork titled ‘The First 5000 Days’ sold for US $ 69.3 million and was purchased by a Singaporean programmer and cryptocurrency investor.

Greater Fool Theory

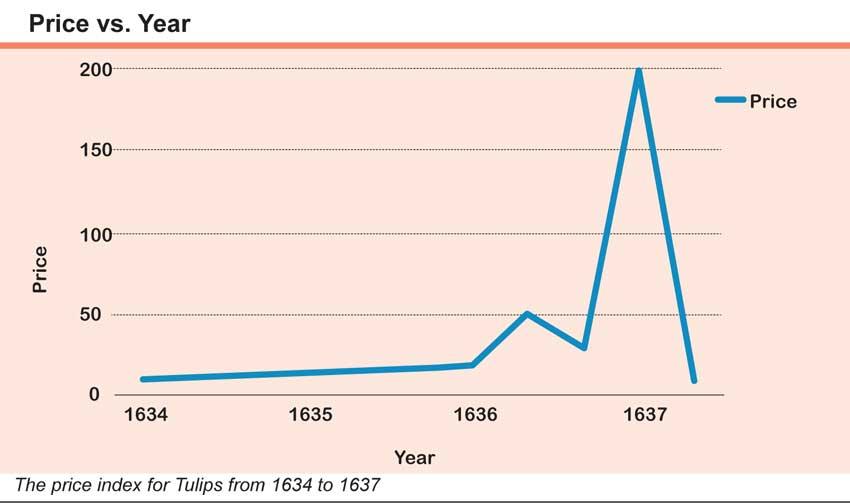

While it isn’t atypical for art to be sold at enviable price points, it is disruptive to imagine that digital art with no pedigree is fetching prices traditionally allocated to masterpieces. And with many NFT collectors employing an immediate resale strategy, questions are being raised whether NFTs are a modern-day embodiment of the Greater Fool Theory, reminiscent of Tulip Mania of the 1630s.

The Greater Fool Theory is an argument raised in the study of economics, which maintains that overvalued asset classes and asset classes with questionable intrinsic value will continue to appreciate beyond fair price by assuming value on the basis that the asset can be resold at a higher price to a “greater fool”.

In the early 1630s the Dutch economy, which at the time recorded the highest per capita income in the world, introduced futures market functions to their economy, notably characterised by the rapid ascension of value of tulip buds. Commonly known as ‘Tulip Mania’, the socio-economic phenomena of tulips gaining large increments of value and then dramatically losing much of its valuation is one of the first recorded demonstrations of a speculative asset bubble.

In more recent history, the trade of subprime mortgage loans brought the global economy to its knees with large global corporations crippling under the weight of the high-risk investments collateralised by less than ideal mortgages.

From the perspective of value investment, the idea that digital art is capitalising the market through capital raised from retail investors with limited financial understanding is convincing confirmation that we are in fact witnessing the early stages of a speculative bubble achieving inflation.

But, the traditional counter to this line of argument is that many things intrinsically don’t hold value. While stocks are underpinned by the earning potential of the companies whose ownership they democratize, precious metals such as Gold are stores of value purely on the basis of social consensus, liquidity and scarcity.

Even better examples are fine art, Swiss watches and luxury fashion. Many of these commodities hold value on brand sentiment and scarcity. In this way, an NFT too is able to meet the criteria as a store of value. NFTs are limited in supply, deflationary and may hold intangible qualities such as brand sentiment.

A great example is the recent unveiling of an NFT collection minted in collaboration with the luxury fashion house - Gucci. The Italian icon of luxury is in great company with many other popular brands finding their feet in the NFT industry and continuing to do so.

New subprime or next internet?

From an objective point of view that isn’t skewed towards speculation or value-basing, the idea of investing in NFT assets is far more complex than maximalists and minimalists will have one believe.

On one hand, NFTs and the cryptocurrency ecosystem at large are showing signs of being the next iteration of the tech boom that birthed some of the most successful corporations of our generation, including Google, Amazon and Facebook (now Meta).

On the other hand, NFTs can easily be touted as the new subprime. The hype surrounding NFTs and the unfailing speculation fits the bill easily in establishing similarities between NFTs and the subprime mortgage securities of 2008.

Being closely involved in the technology industry, my position on the future applications of NFT and blockchain technologies at large are optimistic to say the least. However, from the point of view of an investor, I see NFT art being a short-lived, speculation-driven asset class.

NFTs as a class of assets gain value from a few key attributes. Sentiment towards the founding team and associated brands is primary among these attributes. Aesthetic value and the utility of the asset itself in the Web 3.0 and Metaverse environments are other important attributes. The final critical attribute is the chain that the asset is minted on, whether it be Ethereum, Polygon, Solana or Terra. The interoperability of these chains with other chains using layer-2 scaling solutions and bridge protocols will also play a primary role in the value of NFT assets minted on these chains.

Next generation of NFTs

In my estimation, NFTs will progress beyond qualitative markers of value such as brand and aesthetics as well as evolve beyond the novelty of the underlying technology. At such a stage, the value of an NFT will fall squarely on the utility value of the use cases assigned to NFT technology.

The immutable, decentralised and transparent nature of blockchain and NFT technology will create overwhelming value in contexts where proof of authenticity is of importance. Exemplary would be the usage of NFT technology in land registries. Given its immutable nature, land deeds will be easy to authenticate with no need for centralised institutional involvement from governments. Furthermore, the pedigree of plots of land can be maintained and updated accurately to depict past ownership.

Furthermore, NFTs will provide land registries the ability to embed smart contracts, which reliably expedites the purchase and sale of plots of land. The same smart contracts can be written to include royalties for original owners in cases of subletting and also effectively avoid disputes related to leases and forgery. NFT smart contracts can plainly play the role of executing a last will.

Another instance for NFT usage will be as a proof of authenticity for luxury watches and other commodities. The applications of NFTs in the real world of the future are limitless. However, NFTs will natively play a critical role in the Metaverse of the future. From digital fashion to games, art, virtual concert tickets, crowdsourcing and philanthropy, NFTs will serve as tokens, which will unlock a future brimming with potential.

All things considered, the question of whether NFTs are the Tulips of our day or truly an opportunity to place our bets on the future is more complex than it would seem at the outset.

For investors looking out for an opportunity to enter the NFT market, the best approach is to place bets on NFT art projects with established utility statements and solid name-brand partnerships in the short term.

In the long term, the investor outlook for NFTs is clear; the technology is truly a view of things to come and utility is king. The more significant the use case, the more likely that the project will play a role in Web 3.0 and Metaverse and in turn; the future.

(Dilshan Senaratne (MBA-UK) leads talent brand marketing and corporate communication (APAC and EME) for a US $ 1 billion global technology blue chip headquartered in the US. He is also Founder and former CEO of Cyaniq Consulting, a specialised consulting and advisory service firm based in Colombo. He is an avid researcher and investor with an interest in the economy of the future)

23 Dec 2024 1 hours ago

23 Dec 2024 1 hours ago

23 Dec 2024 2 hours ago

23 Dec 2024 3 hours ago

23 Dec 2024 4 hours ago