21 Dec 2020 - {{hitsCtrl.values.hits}}

The global economy is going through its toughest episode in its recent history. The COVID-19 pandemic has caused a sharp global economic downturn and disrupted societies in an unprecedented manner. Governments across the world have taken decisive steps to address the economic and social consequences of the pandemic, with differing degrees of success.

The global economy is going through its toughest episode in its recent history. The COVID-19 pandemic has caused a sharp global economic downturn and disrupted societies in an unprecedented manner. Governments across the world have taken decisive steps to address the economic and social consequences of the pandemic, with differing degrees of success.

In spite of the extremely adverse conditions imposed by COVID-19, the proactive policy responses of the Government of Sri Lanka have already resulted in notable achievements. These include improved trade and current account balances, a robust investment pipeline, a positive response by domestic investors, a low interest rate regime and a stable exchange rate.

Lower reliance on foreign financing and the timely repayment of the country’s debt obligations, along with the reduced cost on domestic debt, have also resulted in a favourable shift in the public debt profile as well.

In spite of these domestic improvements, the sovereign rating agencies have (seemingly in a planned manner judging by the intervals between the announcements) continued to proclaim pessimistic views on Sri Lanka’s ability to rebound from its economic and financial condition that had been weakened during the previous political regime.

In addition, certain investment houses have joined the chorus to release reports in an obviously organised manner. Prompted by those periodic downgrades of Sri Lanka’s sovereign rating by these agencies, opposition doomsayers echoed these adverse sentiments, thereby attempting to create a self-fulfilling prophecy and a spiral of despondency in keeping with their own dubious objectives.

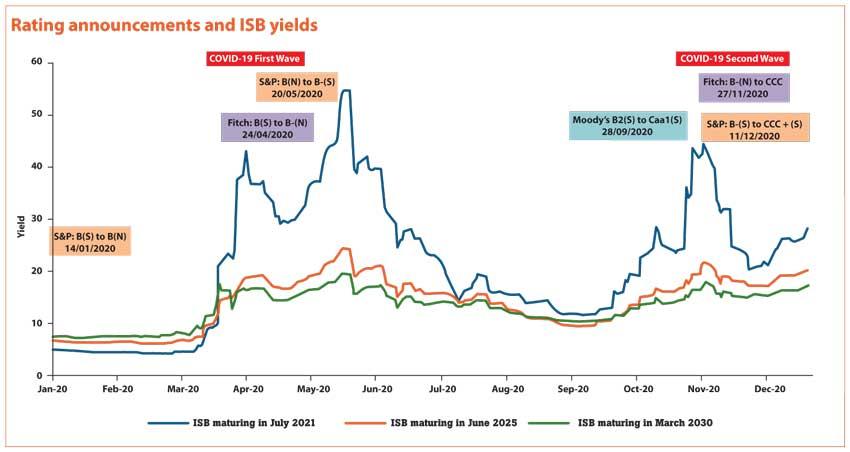

Naturally, such regular expression of views have not been helpful in meeting the economic challenges faced by the country and yields of Sri Lanka’s International Sovereign Bonds (ISB) in the secondary market over the past year have jumped whenever there has been an announcement by a sovereign rating agency. (See Chart)

Interestingly, these fluctuations have not been driven by any weakening of Sri Lanka’s macroeconomic fundamentals during the year but by the announcements of these rating agencies. Such pronouncements have of course served to cast some doubt in the minds of some foreign investors, who would have otherwise profited from Sri Lanka’s improving potential.

The commentaries by certain investment houses (which have not been able to attract any significant foreign investment inflow to Sri Lanka over the past few years) has also not been helpful. Fortunately however, after such jumps, bond yields have settled gradually each time, raising questions about the validity of such actions and commentary.

It is highly regrettable that these rating agencies and several foreign and local commentators have chosen to ignore the extreme global economic conditions caused by the COVID-19 pandemic. They have also overlooked the efforts of the Sri Lanka government to tide over the short-term difficulties while taking decisive action to boost economic growth.

In fact, it is not only Sri Lanka that has been subject to such harsh rating action by sovereign rating agencies this year. A long list of developing countries, including Angola, Bahamas, Bahrain, Belize, Bolivia, Cameroon, Cape Verde, Colombian Costa Rica, Ecuador, Gabon, Ghana, Guatemala, Hong Kong, India, Italy, Laos, Lebanon, the Maldives, Mexico, Nicaragua, Nigeria, Oman, Papua New Guinea, San Marino, Slovakia, South Africa, Suriname, Trinidad and Tobago, Tunesia, Turkey and Zambia, have been downgraded by those US-based rating agencies, thereby restricting their access to the international capital market and raising their borrowing costs.

Such an outcome is particularly disheartening, given the fact that the present time is when funding is most required by these countries to address the economic fallout of the pandemic.

Interestingly, these US-based rating agencies have also been quite generous in their treatment of the United States of America. There, economic contraction of 31.4 percent in the second quarter of 2020, unemployment levels exceeding 23 million in April 2020, increased fiscal spending, ballooning budget deficit of 16 percent of GDP and debt to GDP ratio jumping to 130 percent, appear to have had no impact on the rating decisions of these so-called independent and professional sovereign rating agencies.

This is perhaps clear evidence of the double standard followed by these organisations, which raises serious questions regarding the role and objectives of these rating agencies in the international economic arena.

In fact, the Sri Lankan public as well as foreign investors may benefit by perusing the article titled ‘Beginning of the end for the rating agencies’ dubious influence’ that appeared in the Sydney Morning Herald on December 14, 2020, written by its economics editor Ross Gittins. [https://www.smh.com.au/business/the-economy/beginning-of-the-end-for-the-ratings-agencies-dubious-influence-20201213-p56n0i.html].

It is clear from such article that rating agencies are fast losing credibility in the eyes of investors and that there is a reaction by groups with vested interests, which appear to be partisan lines rather than rationality.

(Indrajith Fernando is Founder Director Strategic Insurance Brokers (empowered by Uniba Partners) BeyondWealth, Crescent Global South Asia. He is a Past President of CA Sri Lanka, South Asian Federation of Accounts (SAFA) and Member DNC International Federation of Accountants (IFAC))

24 Dec 2024 7 minute ago

24 Dec 2024 1 hours ago

24 Dec 2024 2 hours ago

24 Dec 2024 3 hours ago

24 Dec 2024 4 hours ago