04 May 2020 - {{hitsCtrl.values.hits}}

The COVID-19 global pandemic is likely the defining event of the decade, if not more and its implications are expected to change the way we work, socialise and behave. Rapidly evolving consumer buying behaviour and the pivot to online shopping is one such outcome of the pandemic and its associated social distancing measures.

The COVID-19 global pandemic is likely the defining event of the decade, if not more and its implications are expected to change the way we work, socialise and behave. Rapidly evolving consumer buying behaviour and the pivot to online shopping is one such outcome of the pandemic and its associated social distancing measures.

SL’s US $ 450-500mn opportunity

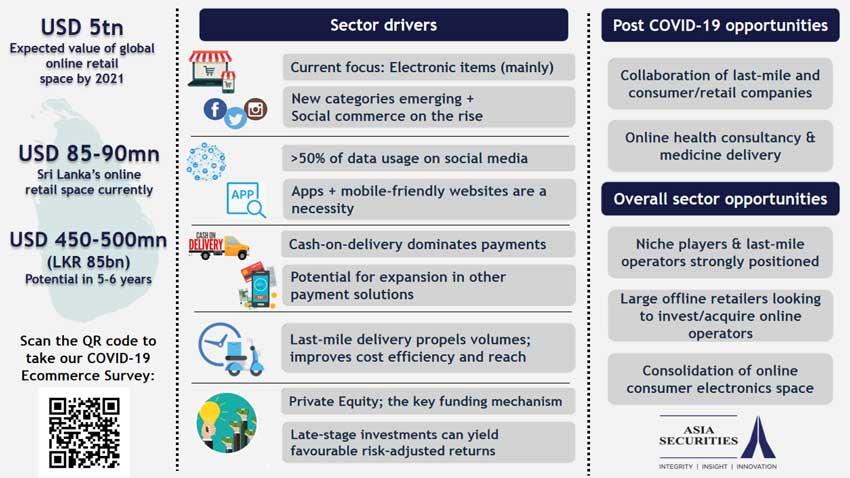

Currently, the global online retail market is valued at US $ 3.5 trillion (2019) and this is expected to reach US $ 5 trillion in 2021. Growth will be led by Asia, with the region already accounting for more than half of global sector revenues.

In Sri Lanka, online retailing penetration is still less than one percent and there is plenty of room for disruption. Asia Securities estimates the Sri Lankan online retail market to be a US $ 450-500 million opportunity over the next five to six years.

Sector still largely focused on electronics

While the local online retail sector has, thus far, focused largely on consumer electronics, new categories like fashion, healthcare and groceries are emerging. Social platforms are also fast proving to be a powerful distribution channel for small businesses, which are leapfrogging the web and going digital with ‘social-first’ models.

Sri Lanka’s 6.2 million active social media user base and the rising number of Internet users and mobile broadband connections mean that businesses are increasingly dependent on social media for

customer acquisition.

Asia Securities’ 2019 Online Retail survey indicates that ~73 percent of respondents were influenced by social media to make an online purchase. Local brands must, therefore, up their digital game and provide their consumers with mobile-optimised platforms and sites to fully tap into the opportunity that social commerce offers.

Closing e-commerce gap

Payments and last-mile logistics are the greatest challenges to e-commerce growth.

Cash on delivery (COD) makes up nearly 80 percent of online order payments in Sri Lanka, while bank transfers are the go-to option for social commerce. Consumer scepticism, slow adoption of cashless payments and debit/credit card issues (not all cards are automatically activated for online payments) fuel this reliance on COD. The prevalence of COD is also attributed to newly established merchants, who are unable to opt for expensive payment gateways set-ups.

While local aggregators are offering plug-and-play platform solutions with secure payment gateway systems, adoption is slow and start-ups in this space are constrained by lack of investments. Although fintech remains ripe for growth, the traction for mobile wallets has been slow locally.

Online retailers also have a role to play in combating some of this scepticism. At Asia Securities’ Online Retail industry webinar held last week, in collaboration with leading local venture capital firm BOV Capital, Daraz Managing Director and Country Head Rakhil Fernando noted that building trust and reliability with consumers is key and Alibaba Group’s acquisition of Daraz has facilitated the latter to do just this. Alibaba brought in technology and know-how required to establish discipline and controls at every level of Daraz’s business, which has resulted in a surge in orders.

Logistics remains the other significant bottleneck in Sri Lanka’s e-commerce ecosystems. However, the emergence of last-mile delivery operators has helped solve some of these bottlenecks in recent years. This has helped bring down delivery costs and birthed solutions like islandwide access and same-day/next-day delivery.

Simplex Delivery Co-founder As Inas Jenabdeen noted at the webinar event, Simplex also offer value-added services like automated payment reconciliation, which enables them to settle payments for merchants, who rely on COD, faster than their competitors.

The last-mile delivery space has also been a key beneficiary in the post-COVID-19 e-commerce surge. The sector is expected to benefit greatly from the expected broad e-commerce growth in the island. However, considering the large number of small regional players in the market, some consolidation in the last-mile space over the long-run is expected.

Investors to fuel next wave of e-commerce

The growth of the sector is somewhat constrained by the lack of funding for start-ups in the space. While the sector, which has seen the support of angel investors and venture capital funds, in the past few years, capital raising has been hampered by expectations of long investment periods, limited scalability and unproven exit strategies.

Commenting on investments in this space at the webinar, Sequoia Capital Managing Director and former Google India Managing Director Rajan Anandan noted that there are several opportunities within the value chain both horizontally (logistics/payments) and vertically (different product categories).

He also noted there is a significant opportunity in social commerce. On the flip side, he noted, the limitations of capital for e-commerce start-ups in Sri Lanka has produced very capital-efficient business models such as those of Simplex and ZigZag.

Speaking on access to investments opportunities in the sector, Asia Securities Chairman Dumith Fernando noted that there are opportunities for corporates to make strategic investments in companies, which are now well beyond the risky start-up stage and with a proven business track record.

High-net-worth investors and institutions can also invest in successful venture capital funds like the Dialog Innovation Fund, which is managed by experienced managers BOV Capital. Trends emerging from the ongoing lockdown also provide the space for strategic acquisitions by large offline players with a sound balance sheet and the right business adjacencies.

New normal?

The current pandemic experience has potentially changed customer behaviour forever. Nearly 53 percent of Asia Securities COVID-19 E-commerce Survey respondents claimed that they would still opt for online shopping in the months immediately following the lockdown; gas, non-perishable essentials and home and personal care topped the list of products that consumers hope to purchase online post-lockdown.

The pandemic has resulted in accelerated customer acquisition as market conditions favour certain segments; grocery retailing has seen the strongest expansion while the demand for medicine delivery and online medical consultancy services has surged. The lockdown has resulted in a number of collaborations within the overall e-commerce space; once the lockdown measures are lifted, industry players must look at sustaining these partnerships.

Rajan Anandan highlighted that beyond convenience, digital-first strategies can help address some long-standing pain points. In the case of healthcare, digitalisation of the whole process from diagnosis to diagnostics and drug delivery can help solve issues associated with access to good healthcare in rural areas. This will also help in maintaining social distancing post-lockdown as both patients and doctors will prefer online over in-person consultations.

Navigating new realities

The growth of e-commerce in Sri Lanka is not without challenges. Ongoing urbanisation means that large retailers are likely to continue with expansions and store-based operations will remain strong. Online retailers will have to continuously innovate to compete with offline retailers in Sri Lanka’s fairly small market space.

Payment solutions are also still underdeveloped and while mobile wallets offer an easy solution, adoption remains sluggish. Limited funding and exit opportunities mean that businesses will need to showcase high margins and quick turnarounds. However, the online retail sector stands to benefit from investments by large existing offline players.

COVID-19 has also resulted in online companies to rethink strategies. Dinindu Nawarathna, Founder and CEO, ZigZag, the country’s leading online fashion retailer, noted that as an e-commerce business that owns and controls its entire value chain, the pandemic’s impact on his business began as soon as the first COVID-19 cases were reported in Wuhan.

This disruption in the supply chain means that the brand is now prioritising a shift to near-shoring. The brand is also working on getting rid of inefficiencies in its value chain in anticipation of reduced spending on consumer discretionary goods.

It seems that the current pandemic has provided the online retailing sector and all its adjacent value chain players, the catalyst for growth that most countries around Sri Lanka have already experienced with

resounding success.

(These insights are courtesy of a webinar hosted by Asia Securities in partnership with BOV Capital. The webinar included a sector presentation by Asia Securities Consumer and Sector Analyst Mangalee Goonetilleke and a panel discussion featuring key industry experts including Sequoia Capital Managing Director Rajan Anandan, Daraz Managing Director and Country Head Rakhil Fernando, Simplex Delivery Co-founder Inas Jenabdeen and ZigZag Founder and CEO Dinindu Nawarathna. The panel was moderated by Asia Securities Chairman Dumith Fernando. Asia Securities’ COVID-19 webinar series aims to build better awareness of the dominant factors and brighter spots in the investment landscape for its clients and the public)

25 Dec 2024 25 Dec 2024

25 Dec 2024 25 Dec 2024

25 Dec 2024 25 Dec 2024