21 Sep 2021 - {{hitsCtrl.values.hits}}

The Sri Lankan economy faces a historical crisis. The root causes are the twin deficits.

The Sri Lankan economy faces a historical crisis. The root causes are the twin deficits.

First, the persistent fiscal deficit - the gap between government expenditure and income.

Second, the external current account deficit - the gap between total exports and imports. The problems have been festering for too long. Without urgent reforms, the crisis could easily morph into a full-blown debt crisis.

Sovereign debt workouts are extremely painful for citizens. A mangled debt restructuring can perpetuate the sense of crisis for years or even decades. A return to normal economic activity may be delayed, credit market access frozen, trade finance unavailable.

With the global pandemic, these are unusual and difficult times. The next five years are going to be crucial for the country.

The problems can no longer be avoided and should be faced squarely. The journey ahead is going to be painful but the longer these are delayed the worse the problem becomes and the magnitude of the damage compounds.

The state of the economy

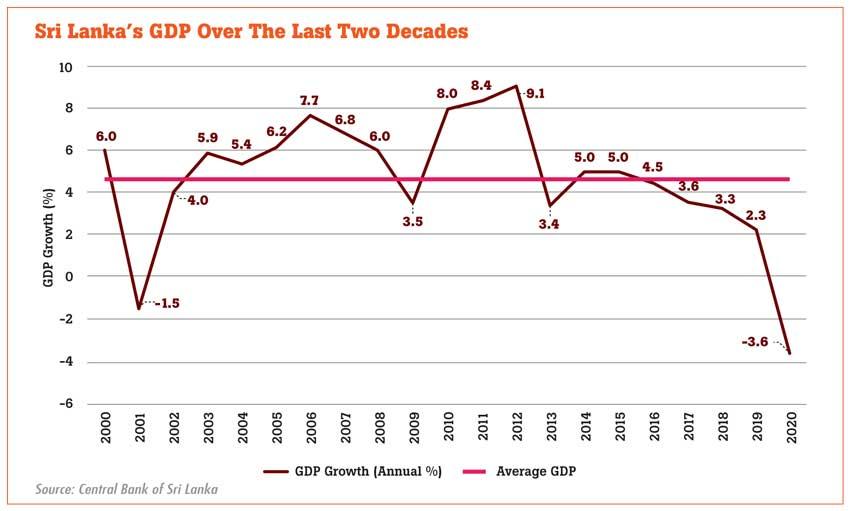

The new government inherited a fragile economy, battered by the Easter attacks of 2019, the constitutional crisis of October 2018 and the worst drought in 40 years in 2017. With the pandemic in 2020 Sri Lanka’s economy shrank by 3.6% with all sectors of the economy contracting.

Yet, the pandemic is not the sole cause - it only accelerated the decline of Sri Lanka’s economy that was weak to begin with. The country has long been plagued by structural weaknesses, with growth rates in the last few years even below the average growth rate during the war.

Mismanaged government expenditure coupled with a long term decline in revenue have characterised Sri Lanka’s fiscal policy. As of 2020 total tax as a percentage of GDP fell to just 8 percent, while recurrent expenditure increased.

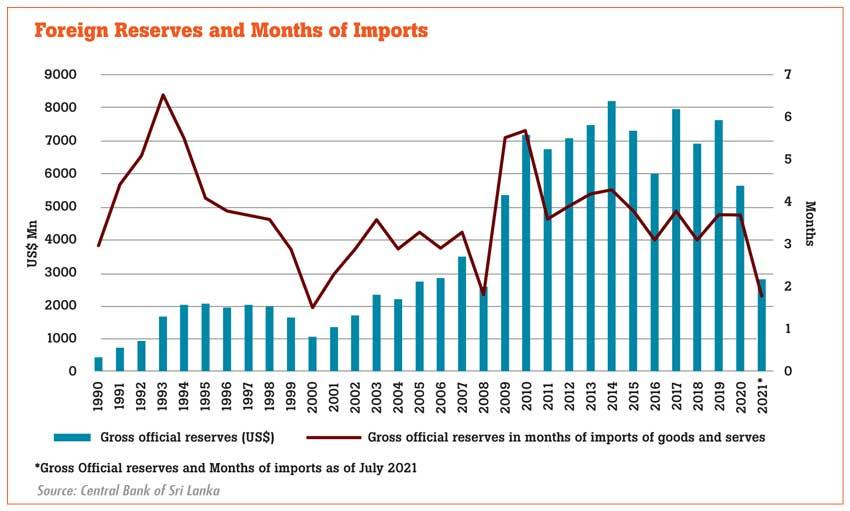

Borrowing to finance the persistent budget deficits is proving to be unsustainable. Total government debt rose to 101 percent of GDP in 2020 and has grown since. Sovereign downgrades have shut the country from international debt markets. The foreign reserves declined from US$ 7.6 billion in 2019 to US$ 5.7 billion at the end of 2020 and to US$ 2.8 billion by July 2021. This level of reserves is equivalent to less than two months of imports. With future debt obligations also in need of financing, the situation is dire.

The import restrictions placed to combat this foreign exchange crisis have failed to achieve their purpose and are doing more harm than good. Imports rose 30 billion in the first half of 2021 compared to 2020 despite stringent restrictions.

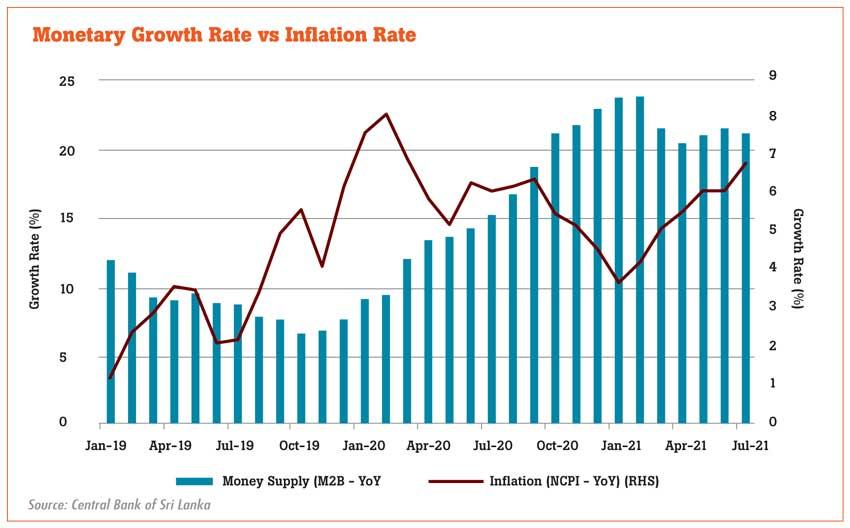

The problem lies not in the trade policy but in loose fiscal and monetary policy that has increased demand pressures within the economy, drawing in imports and leading to the balance of payments crisis and consequently the depreciation of the currency.

Measures by the Central Bank to address this by exchange rate controls and moral suasion have caused a shortage of foreign currency leading to a logjam in imports.

Fundamental and long-running macroeconomic problems were intensified by the pandemic. Import restrictions; price and exchange controls do not address the real causes.

Treating symptoms instead of the underlying causes is a recipe for disaster.

The continuation of such policies will lead to the deterioration of the economy, elevate scarcities, disadvantage the poor who are more vulnerable and in the long run lead to even higher prices and lower output due to lack of investment.

Sri Lanka’s GDP growth over the last decade has been alternating between short periods of high growth and prolonged periods of low growth. This is a result of the state-led, inward looking policies of the last decade.

A comprehensive reform agenda must be built around five fundamental pillars:

i) Fiscal consolidation - The need to manage government spending within available resources and to reduce debt are paramount. Revenue mobilization must improve but the control of expenditure cannot be ignored. Budgetary institutions must be strengthened and there must be reviews not only of the scale of spending but also the scope of government.

ii) Much of government expenditure is rigid - the bulk comprises salaries, pensions and interest so reducing these is a long term process. Reforming State enterprises, especially in the energy sector and SriLankan Airlines is less difficult and could yield substantial savings. Continued operation of inefficient and loss-making SOE’s is untenable under such tight fiscal conditions. Financing SOE’s from state bank borrowings and transfers from government reduces the funds available for vital and underfunded sectors such as healthcare and education. Excessive SOE debt also weakens the financial sector and increases the contingent liabilities of the state. Therefore SOE reforms commencing with improving governance, transparency, establishing cost reflective pricing and privatisation are necessary. This can take a significant weight off the public finances and by fostering competition contribute to improvements in overall economic productivity.

iii) Tighten monetary policy and maintain exchange rate flexibility -Immediate structural reforms include, Inflation targeting, ensuring the independence of the central bank by way of legislation and enabling the functioning of a flexible exchange rate regime.

Further significant attention has to be placed on the financial sector stability with a cohesive financial sector consolidation plan, with special emphasis on restructuring of SOE debt.

iv) Supporting trade and investment-Sri Lanka cannot achieve economic growth without international trade which means linking to global production sharing networks. Special focus has to be given to reducing Sri Lanka’s high rates of protection which creates a domestic market bias in the economy along with measures to improve trade facilitation and attract new export oriented FDI.

Attempts to build local champions supported by high levels of protection have

(a) diverted resources away from competitive businesses,

(b) created a hostile environment for foreign investment,

(c) been detrimental to consumer welfare,

(d) dragged down growth

v) Structural reforms to increase productivity and attract FDI - Productivity levels in Sri Lanka have not matched pace with the rest of the growing economies. The reforms mentioned above are extensively discussed in Advocata’s latest publication “Framework for Economic Recovery”.

Sri Lanka stumbled into the coronavirus crisis in bad shape,with weak finances; high debt and widening fiscal deficits. It no longer has the luxury to delay painful reforms. Failure to do so will not only jeopardize the economy; it could even spawn social and humanitarian crises.

(Naqiya Shiraz is the Research Analyst at the Advocata Institute and can be contacted at [email protected]. K.D.D.B. Vimanga is a Policy Analyst at the Advocata Institute. He can be contacted at [email protected]. The opinions expressed are the author’s own views. They may not necessarily reflect the views of the Advocata Institute)

23 Dec 2024 2 hours ago

23 Dec 2024 4 hours ago

23 Dec 2024 4 hours ago

23 Dec 2024 4 hours ago

23 Dec 2024 6 hours ago