08 Jan 2020 - {{hitsCtrl.values.hits}}

Following is the full text of ‘Road Map: Monetary and Financial Sector Policies for 2020 and Beyond’ delivered by Prof. W.D. Lakshman Governor Central Bank of Sri Lanka 06 January 2020.

1. Introduction

Your Excellencies, members of the Monetary Board, Senior Deputy Governor, Deputy Governor, Assistant Governors and Officials of the Central Bank, Distinguished Invitees, Ladies and Gentlemen,

It is indeed a great honour for me to address you as the 15th Governor of the Central Bank of Sri Lanka. It is a privilege to be appointed to this esteemed and celebrated position, and I consider this as a valuable opportunity I got to contribute to Sri Lanka’s growth and development.

Being aware of the heavy responsibilities attached to this position, I pledge to perform my duties with the conscientiousness and commitment it demands. I wish to reiterate that I will do my best to sustain and add to the institutional greatness of the Central Bank and uphold the great traditions it built up over the past seven decades.

Today, the Sri Lankan economy is at a crossroads. Decades of policy making as a sovereign nation have produced improvements in many aspects of the economy. There was significant social upliftment.

Nevertheless, tough challenges remain – below potential growth, persistence of poverty pockets, underutilisation of productive resources, inadequate expansion and diversification of exports, shortfall of non-debt creating capital inflows, large credit and interest rate cycles, and high fiscal deficits and public debt levels.

These challenges, which have been the outcomes of policy as well as non-policy factors, need to be addressed decisively for the economy to take-off to a high and sustainable growth path. It is also essential that benefits of such high growth are distributed fairly across society and opportunities are created for all, leading to a more prosperous, happy and content nation, with equitable distribution of incomes and opportunities. Such an outcome needs innovative policies emanating from and backed by fresh innovative thinking.

With this background in mind, let me warmly welcome you to the presentation of the thirteenth Road Map of the Central Bank of Sri Lanka.

This Road Map will present the direction of our monetary and financial sector policies during 2020 moving into the third decade of the millennium. We believe that this would contribute to enhance transparency of our medium term policies, to generate the required public dialogue. Such discussion would enable us to fine tune our policies and to effectively implement them so that macroeconomic stability is enhanced, while contributing to economic growth, development and social wellbeing.

Let me begin by making a brief assessment of economic performance in 2019 and the policy stance of the Central Bank.

The Sri Lankan economy faced significant challenges in 2019, emanating from movements in the global economy as well as domestic developments. Within a single year, across the globe, monetary policies have reversed from tightening to easing, as economies experienced a synchronised slowdown, caused by prevailing conditions in global trade cycle, rising trade barriers, geopolitical uncertainties and numerous structural challenges.

Fiscal and monetary measures put in place in the past to stabilise balance of payments and fiscal balances, and adverse consequences of the Easter Sunday terrorist attacks, combined with the then prevailing political uncertainties have substantially weighed down on the performance of the Sri Lankan economy. The spillover effects of the Easter Sunday attacks in particular, were felt across almost all spheres of economic activity, especially in the second quarter of the year.

Consequently, below potential economic growth performance continued through 2019. The economy grew at a slow pace of 2.6 percent in real terms in the first nine months of 2019. The rate of growth for the whole year is likely to be around 2.8 percent.

Even in the years immediately preceding 2019, economic growth was sluggish, with the country failing to maintain the high growth momentum observed in the immediate aftermath of the end of the internal conflict. Policy uncertainty led to weak investor confidence and low levels of investment. Recurring natural disasters worsened conditions. The inability to address structural issues leading to a weak production economy has caused this persistent slowdown.

We hope, together with fiscal and other authorities, to formulate policies that will support a sustained revival of real economic activity through improved utilisation of domestic resources, both physical and human. This would help achieving the goal of the government to create productive employment opportunities in the economy on a large scale.

Sustained improvement of living standards of the masses would indeed depend on such employment creation, rather than through a continuation of the transfers-based poverty alleviation measures that the country has become accustomed to over the past several decades. Sri Lanka has been able to achieve commendably high human development results, thanks to past welfare policies, particularly in the spheres of education and health.

It is now time to use the extensive human resource base built up over the years and new investments backed up by conducive medium to long term policies, to enhance production growth and expansion of productive employment opportunities. Such employment enhancing growth would be the most effective mechanism to eradicate poverty as well as to achieve balanced regional development.

On the inflation front, the country has experienced single digit levels of inflation for the past eleven years. This is an achievement we in the Central Bank are rightly proud of, given its mandated role to ensure economic and price stability in the country. Sri Lanka appears to have broken off from its post-1977 history of highly volatile, often double digit levels of inflation.

Behind these inflation achievements however, lies conditions of subdued aggregate demand. This implies a negative output gap that needs to be filled urgently by utilising the available policy space. The monetary policy framework of the Central Bank, in the recent past, has been one of flexible inflation targeting. This is a subject of ongoing intellectual debate around the world. The Central Bank will continue to improve its policy framework in this area, with due emphasis on monetary stability for real sector growth. The maintenance of mid single digit levels of inflation is an essential component of macroeconomic stability; it will protect vulnerable sections of the population; equally, perhaps more, important at times of low inflation, is shared, employment-creating production growth.

The Central Bank has taken a tight monetary policy stance until 2018 in view of high rates of credit and monetary expansion and adverse balance of payments pressures at the time. It now maintains an accommodative monetary policy stance in view of subdued economic growth, muted inflationary pressures and rapidly decelerating private sector credit amidst high nominal and real market interest rates. The Central Bank reduced the Statutory Reserve Ratio (SRR) applicable to all rupee deposit liabilities of commercial banks by a total of 2.50 percentage points in November 2018 and in March 2019. The objective was to provide adequate levels of liquidity to the domestic money market. Helped also by global developments, the Central Bank reduced policy interest rates by a total of 100 basis points in two steps, first in May and then in August 2019.

In spite of monetary policy easing, market interest rates remained high in both nominal and real terms. Private sector credit growth decelerated sharply, particularly during the first half of 2019. This prompted the Central Bank to take regulatory actions of imposing caps on deposit interest rates of financial institutions. This was done in April 2019, with a view to addressing the issue of weak transmission of monetary policy measures.

With deposit interest rates and cost of funds declining, the Central Bank removed the caps on deposit interest rates of licensed banks and imposed caps on lending rates, in September 2019. The intention was to induce a sizable reduction in lending rates, thereby increasing credit flows to support the revival of economic growth. As a result, most market interest rates declined, notably during the second half of 2019. The Central Bank expects to review the caps on lending rates, once the financial institutions meet the stipulated reduction in lending rates and credit flows normalise during the year.

In an environment of monetary and fiscal stimulus, measures are to be implemented in the near future to enhance credit flows to small and medium scale enterprises (SMEs). These measures are expected to accelerate credit growth to the private sector in 2020 and beyond, and enable a speedy revival of economic activity. A relief package for reviving SMEs is being designed, particularly targeting non performing advances.

For those who seek relief under this package, suspension of legal action and rescheduling of loans along with some interest rate concession have been proposed. The revival of businesses of such borrowers is expected to be facilitated through a grace period for capital repayments and a short term working capital loan. For borrowers in the performing category, a new facility with extended repayment periods including a grace period for capital repayments under reasonable interest rates is being considered.

In this context, I urge Sri Lanka’s banking sector to rethink its credit disbursement policies, as the traditional ‘risk averse’ mindset has deprived emerging entrepreneurs and new ventures of much needed initial capital. Credit schemes that take into consideration the specific challenges faced by startups have failed to develop. The absence of dedicated development finance institutions is felt strongly, particularly at a time when the SMEs require support from the banking sector for survival during the phase of economic downturn as well as during the period of their take-off.

The external sector recovered to some extent in 2019 from the significant pressures experienced in 2018. Trade deficit contracted as imports declined rapidly, in response to measures undertaken in mid 2018 to curb non-essential imports, including personal motor vehicles and gold.

This greatly contributed to offset the negative impact of the Easter Sunday attacks on tourism and the moderation of workers’ remittances. Consequently, the current account deficit contracted notably. As far as financial flows are concerned, Sri Lanka continued to experience low levels of foreign direct investment (FDI).

Outflows from the market for rupee denominated government securities and the stock market continued, albeit at a much slower pace than in the previous year. Given the persistent current account deficit and the inadequacy of non-debt-creating financial flows, the country was compelled to continue relying on debt related inflows to the government. Sri Lanka successfully issued International Sovereign Bonds (ISBs) amounting to US$ 4.4 billion during 2019.

The rupee has shown greater stability in foreign exchange markets, after its significant depreciation in 2018. A marginal appreciation indeed was observed in 2019 for the first time since 2010. Conducive conditions in the domestic foreign exchange markets also paved way for the Central Bank to purchase foreign exchange to build its reserves during the year.

Going forward, the production economy will be strengthened, helped by availability of required infrastructure facilities, the prevalence of conducive policy measures, attraction of export oriented FDIs, and the maintenance of appropriate fiscal and monetary conditions. The maintenance of competitive exchange rate will also help. These will lead to a sustained improvement in the country’s balance of payments position as well.

During the year 2019, Sri Lanka went through the fifth and sixth reviews of the Extended Fund Facility (EFF) of the International Monetary Fund (IMF) successfully and received the sixth and seventh tranches of disbursements. We hope to engage with the IMF and other international agencies remaining within the overall national policy framework, negotiating for changes in the IMF programme where changes are considered required.

The year 2019 also witnessed a deviation of the fiscal outcome from the envisaged targets owing to the weak performance in government revenue collection in the context of stagnant economic activity. Although lower than envisaged, a surplus is expected however in the primary balance in 2019.

Recent tax reform initiatives constitute a much needed transformation of the country’s tax system towards greater simplicity. The already announced tax relief measures are expected to stimulate the economy while actively contributing to improve business confidence. Any revenue shortfall due to the changes in taxes announced recently is expected to be largely offset by action taken to eliminate unproductive current expenditures and to prioritise capital expenditures. It is expected that the fiscal consolidation path remains intact and the level of public debt stock remains sustainable.

Several policy measures were implemented in 2019 to ensure the continued stability of the financial system and to enhance its strength and resilience to global and domestic shocks. On 01 January 2019, the banking sector successfully completed the Basel III capital phase-in arrangement, to increase the minimum Capital Adequacy Ratio on a staggered basis. Decisive action was taken to address lingering issues with some non bank financial institutions. The spillover of vulnerabilities in those institutions to other parts of the financial system has been prevented.

Across the financial sector, financial institutions were encouraged to improve their own risk management systems and relevant analytical tools. The Central Bank has also undertaken several upgrades to the analytical and monitoring methods for micro and macro prudential regulations to ensure that they are on par with global standard practices.

These include the adoption of an internal rating system and an early warning system to identify high risk financial institutions with a view to taking preemptive measures when necessary.

Much progress has been made on sustainable finance initiatives as well. In view of Sri Lanka’s increased vulnerability to climate change as well as the availability of environment conscious financial opportunities, these initiatives are gaining traction, and the formulation and launch of the ‘Roadmap for Sustainable Finance’ in April 2019 was a key milestone.

During 2019, the Central Bank continued to take measures to strengthen the payment and settlement infrastructure through modern technology. Financial institutions and the Central Bank have already invested significantly to enhance the usage of innovative systems of digital payment and settlement. It is expected that the general public will increasingly make use of these more efficient methods of payment. Technological advancement and improved people’s awareness in this sphere are the key to bridging the gaps in financial inclusion.

Despite the growing appetite for electronic payments, the use of currency has remained, and will remain, a key feature of the economy. Accordingly, the Central Bank took measures to improve efficiency of currency management and currency operations. With the support of financial institutions and the general public, we have been successful in preserving the quality of currency notes in circulation through the clean note policy.

Public debt management was effectively carried out, ensuring that the government’s financing requirements were met at the lowest possible cost subject to a prudent degree of risk. Debt sustainability conditions were maintained. Together with the Ministry of Finance, the Central Bank took proactive measures to successfully meet the government’s debt service payment commitments in a timely manner during 2019, despite unfounded adverse speculations and criticisms.

Having identified the issues and concerns on the implementation of certain provisions of the Foreign Exchange Act No. 12 of 2017 (FEA), the Central Bank revisited the current foreign exchange Regulations, Orders and Directions issued under the provisions of the FEA to further facilitate transactions in the domestic foreign exchange market, while enhancing clarity.

Being the custodian of the Employees’ Provident Fund (EPF), the largest superannuation fund in Sri Lanka, the Central Bank continued to effectively carry out its fund management activities. During 2019, secondary market transactions in government securities and investment activities in the equity market were recommenced, adhering to investment policy statement and approved investment guidelines.

The Central Bank continued its development finance and regional development activities along with concessionary credit operations during 2019 with the aim of achieving inclusive and balanced economic growth and promoting financial inclusiveness in the country. Progress was also made in formulating the National Financial Inclusion Strategy (NFIS) with technical and financial assistance from the International Finance Corporation (IFC).

As an outcome of the collective efforts made by the Financial Intelligence Unit (FIU) of Sri Lanka and other stakeholders, in October 2019, Sri Lanka was delisted from the ‘the Grey List’ of the Financial Action Task Force (FATF). FIU continued to comply with the FATF recommendations and expanded intelligence sharing with several foreign counterparts and domestic agencies.

In a challenging global and domestic environment, the Central Bank has achieved a great deal in meeting its objectives of maintaining economic and price stability and financial system stability, with a view to encouraging and promoting the development of the productive resources of Sri Lanka. Going forward, in line with the philosophy of the new government, the Central Bank will continue to improve its contribution for the economy to progress as an upper middle income economy through equitable and inclusive growth of real economic activity of the country.

The developments in the past few years have shown that, at times, there was a tradeoff between macroeconomic stability and economic growth. While stability is important, a people-centric government cannot ignore its social and human development objectives, especially when Sri Lanka is ready for its economic takeoff. We intend to pursue our efforts to find solutions to balance these conflicting objectives of public policy, without compromising economic and price stability and financial system stability.

In this context, this Road Map expects to enunciate the broad policy framework that the Central Bank intends to pursue in the medium term, enabling all stakeholders of the economy to adjust their own future policy plans.

Accordingly, the Road Map 2020 is outlined under the following headings:

Section 2: The Central Bank’s monetary policy strategy and policies for 2020 and beyond

Section 3: The Central Bank’s policies related to the financial sector performance and stability in 2020 and beyond

Section 4: Policies related to ancillary and agency functions

2. Monetary Policy Strategy and Policies for 2020 and Beyond

Amidst varied challenges on both domestic and global fronts, the Central Bank continued to conduct monetary policy in an increasingly forward looking manner using an evidence based approach with a view to maintaining inflation at low and stable levels over the medium term and anchoring inflation expectations at such levels. These are necessary conditions for the economy to revert to a sustainable high growth path.

Several advanced economies eased monetary policy in consideration of numerous headwinds including increased geopolitical and trade tensions, widespread slowdown in the global economy as well as muted inflation and inflation outlook, led by policy rate cuts by the US Federal Reserve in 2019. A majority of the emerging market and developing economy central banks also adjusted their monetary policy stances to become more accommodative during the year.

The Central Bank of Sri Lanka too moved to an accommodative monetary policy stance in 2019, from the neutral stance that was maintained during most of the previous year. Forward guidance was provided to the market in April 2019 on the possibility of a future reduction in policy interest rates. Subsequently, key policy interest rates, namely the Standing Deposit Facility rate (SDFR) and the Standing Lending Facility Rate (SLFR), were reduced by 50 basis points in May 2019, followed by a further reduction by 50 basis points in August 2019.

Meanwhile, the Central Bank deployed the Statutory Reserve Ratio (SRR) to address large and persistent deficit levels in the domestic money market observed since mid September 2018. Accordingly, the SRR applicable on rupee deposit liabilities of commercial banks was reduced by a total of 2.50 percentage points in November 2018 and March 2019. This released a substantial amount of liquidity into the domestic money market, helping to maintain a surplus level of liquidity since mid April 2019.

In addition to the monetary policy measures taken, several regulatory measures were also introduced. The objective here was to enhance the efficiency of transmission of recent monetary policy measures to influence market lending rates. Caps on deposit rates were imposed in April 2019. As market deposit rates adjusted downwards, deposit caps on licensed banks were removed in September, and instead, caps on lending rates were introduced. There has been a notable downward adjustment in market lending rates as a result of these measures. Market lending rates are expected to decline further in 2020, and the Central Bank will review the caps on lending rates in March 2020 as announced already.

These measures helped revive credit flows to the private sector. Yet credit growth in 2019 was low compared to envisaged levels. Going forward, the Central Bank expects a boost in the growth of credit and money supply with the envisaged further reduction in lending rates and the anticipated improvement in investor sentiments.

Growth of credit to the private sector is expected to pick up to around 12-13 per cent by end 2020. This is sufficient to support a revival of economic activity. Driven by the expected growth in private sector credit, growth of broad money supply is likely to reach around 14 per cent by end 2020. This is not expected to cause any excessive build up of demand pressures with adverse impacts on inflation.

We expect to pursue our resolve to maintain inflation within a range of 4-6 per cent through a transparent, coherent, and accountable monetary policy framework going forward. Maintaining inflation at stable levels would help improve economic prosperity of Sri Lanka. In this regard, the Central Bank will continue its dialogue with fiscal authorities.

Adjustments to the Monetary Law Act to align it with global best practices are also envisaged. Improving Central Bank governance, enhancing its independence, transparency and accountability, as well as enhancing fiscal-monetary coordination to achieve price stability, are all extremely desirable features. At the same time, financial sector oversight and macro prudential policies are to be strengthened to ensure financial system stability.

Improvements have been made to the internal institutional arrangements with respect to monetary policy formulation, as well as to further improve the technical and institutional capacity of the Central Bank. Over the past few years, the Central Bank has become increasingly forward looking, supported by macroeconomic projections produced under a full fledged, model based Forecasting and Policy Analysis System (FPAS). Strengthening the technical and institutional capacity of the Central Bank will continue to remain a priority, while staff will be encouraged to explore alternative approaches to designing policies to suit Sri Lanka’s persistent development challenges. The scope and coverage of forward looking indicators and surveys will be further expanded. Among these initiatives is the planned extension of the coverage of the Inflation Expectations Survey (IES) beyond Colombo to the national level. This would provide better information for policy formulation.

However, short term volatility in inflation driven by food prices and global commodity price movements show that long term price stability is also a function of improved real economy as well as appropriate monetary policies. The current low inflation environment has allowed some space for fiscal as well as monetary stimulus to boost dampened economic activity. In the coming years, as the country progresses towards a higher growth trajectory, close monetary-fiscal coordination is essential to sustain price stability – the conducive platform for further growth. In this context, the Central Bank will work closely with fiscal and other government authorities to ensure a sustained improvement in the production economy and generate productive employment opportunities. Changes in demand conditions will of course be monitored with a view to undertaking proactive policy measures to ensure low and stable levels of inflation.

As in the past, the Central Bank will work with fiscal authorities to improve conditions of fiscal consolidation for sustained price as well as macroeconomic stability. We hope that the government would take further measures to rationalise expenditure and that revenue would go up as a result of the revival in economic activity. Required reforms are expected to widen the tax base, improve tax administration and compliance. Strengthening state owned business enterprises through implementing essential reforms would enhance government revenues and reduce the fiscal burden to maintain such entities, while ensuring better service delivery for the public and the business community. In this regard, we welcome the ongoing efforts to improve the operational efficiency of state owned enterprises through a streamlined process to appoint professionals to manage such entities.

In the monetary policy conduct, active open market operations (OMOs) will continue to serve as the major policy instrument to manage domestic money market liquidity. Short term market interest rates will be guided to remain at the desired level within the Central Bank’s policy interest rate corridor. Several initiatives have been taken to improve the smooth functioning of the domestic money market. Going forward, the Central Bank will continue to ensure that adequate liquidity in the domestic money market is maintained.

The need for improving the efficiency of the monetary transmission mechanism is understood. Establishing a sound benchmark interest rate for the banking sector, which reflects actual cost of funds, has become vital given the deficiencies of the existing benchmark interest rates. The Central Bank intends to set up a task force with the participation of relevant stakeholders to introduce an appropriate cost reflective benchmark interest rate for pricing loan products. We believe that this measure will improve healthy competition among banks, while supporting efficient transmission of monetary policy measures.

In line with the envisaged low inflation environment, we expect to ensure reasonably low nominal interest rates over the medium term to boost domestic economic activity. However, we understand that low nominal interest rates could affect fixed income earners, particularly senior citizens, in this fast ageing society. In this regard, we encourage banking and other financial institutions to develop new financial products to suit the needs of such affected segments of the population.

As we have reiterated in the past, the Central Bank will continue to allow greater flexibility in determining the exchange rate based on market forces and will allow the exchange rate to act as the shock absorber in the envisaged monetary policy framework. Accordingly, Central Bank’s intervention in the domestic foreign exchange market will be limited only to curtail any excessive volatility in the exchange rate. The continuation of the EFF programme with the IMF is likely to be instrumental in supporting external sector stability in the medium term. A sustained improvement in the external sector however, requires policies aimed at promoting domestic production and export of goods and services and inflows of the non-debt-creating type.

Sri Lanka’s twin deficit condition – high budget and external current account deficits - has been well known over the years. Domestic and foreign borrowing has therefore naturally resulted in rising debt levels. External borrowing contributes to widen the deficit in the external current account further. In addition, the increased foreign debt service payments drain the country’s international reserves, which serve as a buffer for external shocks. Therefore, while fiscal consolidation efforts continue, it is important to maintain the current account deficit in the balance of payments at sustainable levels by strengthening the tradable sector.

Foreign reserve management activities will continue to be based on a model based Strategic Asset Allocation (SAA) framework. Further initiatives are planned in this subject area. The Central Bank is also in the process of introducing a mid-day benchmark reference rate in line with International Organisation of Securities Commission’s (IOSCO) principles for the benefit of stakeholders, including the general public and foreign investors. In addition, to ensure a high standard of conduct in dealing with the global forex market, the implementation of global FX code is also in the agenda of policies to be adopted in the period ahead.

While acknowledging the importance of taking appropriate and timely policy measures, the Central Bank is also aware of the importance of effectively communicating such policies and their intended outcomes. Proper communication improves economic and financial literacy of masses, provides clarity, reduces uncertainty, improves transparency of policies and enhances Central Bank credibility. These would be instrumental in anchoring expectations of the stakeholders. The Central Bank has been increasingly active and open in communicating its policies. In 2020, the Central Bank envisages to further enhance its communication strategies.

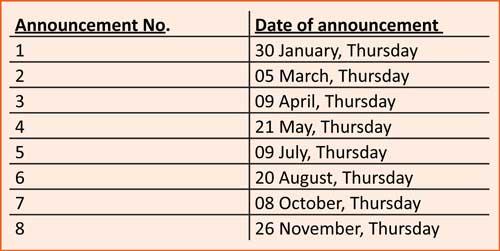

As in the past, the Central Bank will continue to announce its monetary policy stance based on an advance release calendar, and the release dates for the year 2020 are given below:

3. Financial Sector Policies for 2020 and Beyond

The Central Bank’s actions in 2019 to fulfil its mandatory role of maintaining financial system stability have been, to a great extent, described in my foregoing statements. Through these we expect to see the development of a dynamic, resilient and an efficient financial sector.

Effective supervision and regulation, introduction of comprehensive risk management practices and payment and settlement systems of improved efficiency, all have helped in this endeavour.

The banking sector expanded modestly during 2019. It exhibited resilience by maintaining capital and liquidity levels well above the regulatory requirements, despite challenging domestic and global conditions. The Central Bank continued to strengthen the regulatory framework based on international regulations and best practices during 2019 in order to improve system resilience.

Accordingly, the Central Bank has fully implemented the Basel III framework and facilitated consistent adoption of ‘Sri Lanka Financial Reporting Standard 9 on Financial Instruments’ (SLFRS 9) for the banking sector in Sri Lanka.

Further, for harmonising the adoption of SLFRS 9 and to ensure the consistency of capital and risk weighted assets computation under Basel III, the Central Bank issued Explanatory Notes to licensed banks in order to align the computation of Capital Adequacy Ratio (CAR) and Leverage Ratio under Basel III with SLFRS 9.

Also, a circular on the publication of annual and quarterly financial statements and other disclosures by licensed banks was issued specifying a new set of formats in line with the new guidelines. For maintaining integrity and quality of financial statements of licensed banks, eligibility criteria for the selection of auditors were strengthened in line with the changes in the banking sector landscape, changes in accounting and auditing professions, and introduction of Basel III requirements and SLFRS 9. Further, we introduced a framework for dealing with Domestic Systemically Important Banks (D-SIBs), which would help broad base assessment criteria applicable to D-SIBs in line with the international standards and best practices.

Considering the need for timely intervention to revive the tourism industry in the aftermath of Easter Sunday attacks, and in line with the government policy, the Central Bank took necessary action to facilitate granting of concessions by licensed banks to individuals and entities in the tourism industry.

Further, in order to strengthen the regulatory and supervisory framework of licensed banks, the Central Bank introduced new regulations. A Circular was issued highlighting the eligibility criteria for appointment of expatriate officers for licensed banks in Sri Lanka to employ suitable and competent expatriate officers with technical expertise in licensed banks.

Meanwhile, the Central Bank issued Regulations on non interest based incentive schemes for mobilising of interest bearing savings and time deposits. Also, a regulatory framework was introduced to ensure prudent market conduct and treasury operations of licensed banks in line with international best practice.

The Central Bank facilitated the acquisition and consolidation processes of small state owned banks, while strengthening communication of the Central Bank with banks, external auditors of licensed banks and with other stakeholders.

The Central Bank initiated drafting a new Banking Act and expects to complete its enactment in 2021. Key concepts of the proposed Act include provisions to introduce a single type of banking license for Licensed Commercial Banks (LCB) and Licensed Specialised Banks (LSB); adoption of proportionality in banking regulations commensurate with bank’s size, its nature of operations etc.; subsidiarisation of banks incorporated outside Sri Lanka and allowing to ring-fence subsidiaries from adverse external shocks; streamlining approval for establishment of branches and other banking outlets; strengthening consumer protection, deposit insurance, and governance; amalgamating both offshore banking unit (OBU) and domestic banking unit (DBU) operations into a single banking business; and improving resolution, enforcement and supervisory actions. Further, the new Banking Act will contain provisions to extend regulations for banks, which are to be established in the Colombo International Financial Centre.

Looking forward to a strong and dynamic banking sector, capital ratios are expected to improve with the infusion of capital to meet the enhanced minimum capital requirements for banks by end 2020.

As the regulator, we understand that crisis preparedness and resilience of banks need to be further strengthened. Accordingly, banks will be required to implement recovery plans in order to minimise the adverse impact on troubled banks and their possible spillover effects to the financial system.

Further, Accounting Standards and existing Banking Act Directions will be reviewed and amended where necessary, with a view to strengthening prudential requirements on credit, market, liquidity, operational and other risks in line with international regulatory standards and best practices.

In order to address technology risk, changes will be introduced in the regulatory and supervisory framework with respect to information technology and security of banks, in line with international standards and best practices. The proposed regulations will prompt banks to upgrade and strengthen their information systems and related technological platforms, enabling improved risk management.

Let me turn to nonbank deposit taking financial institutions. Sluggish performance of Licensed Finance Companies (LFCs) and Specialised Leasing Companies (SLCs) continued in 2019 is noted. Negative credit growth, declining profitability and an increase in non performing loans are seen as some of the sector characteristics. Subdued economic growth and commercial activities impacted by the Easter Sunday attacks and political instability ahead of the presidential election mainly contributed to this dismal performance.

On the policy front, we issued various directions to the nonbank financial institutions sector in line with government policies which were aimed at reviving economic growth. We issued Directions to Licensed Microfinance Companies (LMFC), on ‘Maximum Rate of Interest on Microfinance Loans’ with the objective of protecting customers from exorbitant interest rates and on ‘Deposits’ to restrict LMFCs from accepting deposits other than collateral deposits. A similar Direction was issued to LFCs on ‘Maximum Interest Rates on Deposits and Debt Instruments’ to enhance credit flows to the real economy. A Finance Business Regulation was issued with a view to providing guidance in prioritising Claims in winding up of a finance company. The Loan to Value (LTV) Direction was revised according to Budget 2019. Also, a Circular was issued on ‘Concessions granted to Tourism Industry’ requiring LFCs and SLCs to grant concessions to individuals and entities in the tourism industry, who wish to avail such concessions.

Further, a Consultation Paper was issued to introduce ownership limits to LFCs to strengthen corporate governance and internal controls. In addition, the first draft of the Credit Regulatory Authority Bill to regulate and supervise money lending and microfinance business was finalised jointly with the Ministry of Finance and made available to stakeholders for comments.

During 2019, the Central Bank continued to take action on distressed and high risk LFCs. These included cancellation of licenses and appointment of management panels, in order to safeguard depositors. Regulatory actions were initiated against the wrongdoers to recover losses they caused to companies and repayment of deposits of two distressed finance companies was facilitated.

Going forward, we expect to further reinforce the stabilisation of the sector with proposed changes to the Finance Business Act (FBA). We propose to issue Directions on ownership limits for LFCs, giving a reasonable time horizon for the implementation, with flexibility on ownership limits for investors who invest in distressed companies expecting to restructure such companies. Importance of strong corporate governance processes and practices in the conduct of finance business and the stability of the sector is recognised.

Revised directions setting out standards will therefore be issued to promote effective operation and management of LFCs. Meanwhile, voluntary consolidation among LFCs will be encouraged in order to meet the minimum capital requirements. Also, in future, we will disclose the names of LFCs subject to regulatory concerns.

Key priorities for the medium term in respect of non bank financial institutions sector are the following: strengthening the existing regulatory framework in line with current market developments and international best practice, establishing resilient and well performing LFCs, resolution of existing distressed and high risk companies, and initiating legal action against wrongdoers.

The Central Bank has identified the need for strengthening the resolution framework and safety net mechanism for financial institutions. We are in the process of drafting a comprehensive Resolution Framework to cover all financial institutions supervised by the Central Bank. In addition to initiatives that have been already taken to resolve distressed and high risk companies, the proposed Resolution Framework envisages several measures beyond mere cancellation of license. While continuing the compensation payments to the insured depositors of Member Institutions of the Sri Lanka Deposit Insurance and Liquidity Support Scheme (SLDILSS), we have initiated developing a comprehensive data transfer system to obtain depositor-wise data to the Deposit Insurance Unit, and improving the effectiveness of compensation payment mechanism. Also, the Central Bank will initiate necessary legal action against unauthorised deposit taking institutions and prohibited schemes, while taking measures to broaden public awareness on the consequences of engaging in unauthorised financial activities.

During the year 2019, we increasingly focused on implementing new technologies and continued to take measures to strengthen the payment and settlement infrastructure in order to develop efficient and stable payment and settlement systems capable of catering to the growing financial needs.

The Common Point-of-Sale Switch (CPS) started live operations in June 2019. The National Payments Council (NPC), finalised its Road Map for 2020-2022. A Working Committee was appointed to study Blockchain Technology. Another initiative was to issue the National Quick Response (QR) code, ‘LankaQR’. Also, we issued licenses to three financial institutions to function as service providers of payment cards, and several proposals submitted by financial institutions for new payment mechanisms were approved, aiming to enhance customer convenience and efficient settlements to merchants.

Further, the Central Bank adopted several policies to strengthen the regulatory framework, while ensuring the safety of customer funds and enhancing efficiency of the payment and settlement systems in the country. We are currently working on further promoting digital payment mechanisms to establish a less-cash society and reduce cash management costs. We will implement a FinTech Regulatory Sandbox in order to provide a safe space in a controlled environment for innovators to test their products and services, without the risk of infringing on regulatory requirements. We also expect to adopt measures to promote usage of digital payment mechanisms and instruments through enhanced awareness among general public on the digital payment options and their benefits.

Moreover, the Central Bank is planning to strengthen the supervisory framework and carry out on-site and off-site supervision of licensed service providers of payment cards and mobile payment systems, to ensure compliance with regulations and guidelines. We hope to evaluate proposals for new payment instruments considering associated risks and adopt policy measures to mitigate such risks, in order to ensure payment and settlement system stability.

Macroprudential surveillance is becoming more relevant as the Sri Lankan financial system witnesses increased interconnectivity and complexity. As such, analytical and monitoring methods for micro and macro prudential regulations are constantly upgraded to keep abreast of the dynamism and technological advancements in the financial sector in Sri Lanka.

We intend to introduce several improvements to strengthen and extend macroprudential surveillance framework. We will continue conducting the household sector survey on credit worthiness, and the coverage will be expanded gradually, to improve the analysis of risks emanating from household sector to the stability of the financial system.

Strengthening the existing macroprudential framework by identifying data gaps and coverage of banks and non banks remains a priority in 2020, and we expect to improve data accumulation and analysis of the Insurance sector from a macroprudential perspective. Another important step to be taken is to improve the financial system stability surveillance mechanism through enhancing inter regulatory coordination.

We also expect to extend the conduct of stress testing towards the corporate sector to assess the resilience of the sector against macro-financial vulnerabilities. These improvements will be facilitated by introducing necessary amendments to the legal and regulatory framework of the Central Bank.

We are committed to further strengthening inter regulatory cooperation and collaboration with the Securities and Exchange Commission of Sri Lanka and the Insurance Regulatory Commission of Sri Lanka, with the aim of improving effective consolidated risk based supervision.

The Central Bank will continue to take appropriate measures to mitigate risks to the financial sector stemming from global and domestic developments. Policy measures taken to revive private sector economic activity through the easing of monetary conditions, the recent fiscal stimulus package, and the proposed relief package for reviving SMEs are expected to strengthen the performance of the financial sector in the period ahead.

Meanwhile, an Enterprise-wide Risk Management (ERM) Framework for the Central Bank was operationalised in 2019 with improvements to existing risk management policies and committee structures. This was done with the objective of escalating key risks identified in the financial and non financial spheres to appropriate levels of management at the Central Bank in order to facilitate timely decision making.

4. Policies related to ancillary and agency functions

With a view to strengthening the broader economy, the Central Bank continued to perform several ancillary and agency functions, contributing to the smooth functioning of the economy and the financial system.

Currency management

The Central Bank’s role in this area emanates from its being the sole authority to issue currency notes and coins in Sri Lanka. Notwithstanding the increased use of technology driven non-cash modes of payment, demand for currency notes and coins continued to increase in 2019 in line with the expansion of economic activity.

Under the clean note policy, the Central Bank strictly implemented the legal provisions in the Monetary Law Act against willful alteration, defacement or mutilation of currency notes. There was, as a result, a notable improvement in the quality of currency notes in circulation. Awareness programmes conducted with the support of Sri Lanka Police have helped to educate the public, financial institutions and Cash–in–Transit Companies (CITs) on the clean note policy and prevented willful defacement of currency notes.

Marking its 70th anniversary, the Central Bank is planning to issue a commemorative coin of Rs. 20 and a new currency note of Rs. 2,000 under the existing 11th note series in 2020. Security features will also be further upgraded in the existing 11th currency notes series.

To provide the required coins and notes for transactions, particularly in remote areas, a mechanism for coin management is being developed with the assistance of Regional Offices (ROs). To restore and preserve old coins and currency notes, we intend to establish a laboratory unit at the Economic History Museum (EHM), while improving the content and the condition of the mobile currency museum, enabling the dissemination of a wider range of information to a larger audience.

Public debt management

The Central Bank is responsible for raising, managing and servicing of government debt, maintaining the central depository for government securities and developing the government securities market. We will continue to ensure that the government’s financing requirements are met at the lowest possible cost with a prudent degree of risk, while assuring debt sustainability over the medium term. The medium term debt management strategy (MTDS) remains focused on containing the foreign currency debt as a share of total debt, improving the average time to maturity (ATM) of the foreign currency debt portfolio, and limiting the debt maturing within one year.

Public debt management encountered several challenges during 2019 for reasons noted above. Despite these challenges, the Central Bank and the Ministry of Finance proactively interacted with market participants and rating agencies to minimise speculation-driven action by such stakeholders, so that Sri Lanka’s unblemished debt service record

remains intact.

During 2019, several improvements were introduced to the Treasury bond issuance system, considering its performance, observations and feedback from market participants to further enhance the market-based acceptance arrangement in activating phase three of the issuance system. These improvements would help develop a vibrant benchmark yield curve through facilitating the issuance of benchmark maturities and enhance Primary Dealer participation in phase two of the issuance system. The advance release auction calendar was further extended to six months with the concurrence of the Ministry of Finance.

With the enactment of the Active Liability Management Act No 8 of 2018 (ALMA) in March 2018, a resolution was passed by the Parliament in July 2019 to raise additional funds for liability management purposes. This enables the government to mobilise funds for refinancing requirements ahead of time, thereby addressing rollover peaks, extending the maturity duration, and smoothing repayment structure of International Sovereign Bonds and other debt maturities.

The Central Bank has already initiated raising funds in the domestic market and building buffers within the ALMA framework by issuing Treasury bonds in the domestic market, and these operations will continue in 2020 and beyond in line with the forthcoming debt service obligations.

Opportunities to raise funds from alternative bond markets are being considered with the aim of diversifying the international capital market issuance base.

With a view to enhancing transparency in government securities transactions, the Central Bank commenced capturing price, yield and settlement value of each securities movement carried out in the LankaSecure system from 01 January 2020 onwards.

Measures are being taken to establish a distinct Electronic Trading Platform (ETP) and a Central Counter Party (CCP) arrangement for government securities along with required legal reforms to deepen and broaden the secondary market for government securities. Steps will be taken to introduce a new primary issuance system for Treasury bills and a web based auction system for Sri Lanka Development Bonds (SLDBs) to enhance their secondary market tradability.

Management of the Employees’ Provident Fund

Being the custodian of the Employees’ Provident Fund (EPF), the largest superannuation fund in Sri Lanka, the Central Bank continued to effectively carry out its fund management activities. During 2019, in view of facilitating a diversified investment strategy in the medium term, secondary market transactions in government securities and investment activities in the equity market were recommenced, adhering to investment policy statement and approved investment guidelines. Several initiatives were taken to strengthen the risk management framework and the governance structure with enhanced accountability and transparency of investment activities.

Going forward, we expect to rebalance the EPF investment portfolio in order to generate a higher risk-adjusted rate of return comparable to market conditions on a medium to long term horizon. Through a comprehensive investment diversification process, we would seek to capitalise on new market opportunities and instruments. Further, we expect to transform current paper based operations into a fully digitalised operating environment, producing a hassle free and efficient member service. A new service window is also expected to be set up at “Mehevara Piyasa” to serve the members efficiently.

Foreign Exchange Management

With regard to foreign exchange management, we are revisiting the current foreign exchange Regulations, Orders and Directions issued under the provisions of the Foreign Exchange Act, No. 12 of 2017 to further facilitate transactions in the domestic foreign exchange market while improving clarity in FEA regulations.

We continued to identify the implementation issues and concerns in combating unauthorised activities involving foreign exchange such as illegal possession, transfers, exchange and other dealings in foreign exchange within Sri Lanka. We are also in the process of introducing an International Transactions Reporting System (ITRS), a comprehensive monitoring system of cross border transactions and foreign currency transactions through the banking system.

This would facilitate effective and comprehensive data collection for compilation of external sector statistics, regulatory supervision and macroeconomic policy formulation. The proposed amendments to the provisions of the Foreign Exchange Act, which are at the finalisation stage, would be completed by early 2020.

Financial Intelligence Unit

In 2019, the priority of the Financial Intelligence Unit (FIU) was to successfully complete the time bound action plan provided by the Financial Action Task Force (FATF) to address deficiencies in the spheres of anti-money laundering and countering of financing of terrorism (AML/CFT). These actions were taken to get Sri Lanka delisted from the FATF’s “Grey List”. This aim was realised by the end of the year. We continued the supervisory role, supported by timely issuance of rules, regulations, guidelines and circulars.

Going forward, in order to strengthen Sri Lanka’s AML/CFT regime further, we will coordinate with stakeholders to develop individual AML/CFT policies in line with the National AML/CFT Policy. Also, the National Risk Assessment (NRA) on Money Laundering and Terrorist Financing will be conducted in 2020, in collaboration with all relevant stakeholders.

Further amendments are to be introduced to the Financial Transactions Reporting Act, Prevention of Money Laundering Act, and Convention on the Suppression of Terrorist Financing Act. Also, amendment to the Companies Act in the area of ultimate Beneficial Ownership is expected to be facilitated.

In coordination with other stakeholders, we will act to effectively implement United Nations Security Council Resolutions on proliferation financing and terrorist financing while working towards the completion of implementation of the ‘goAML’ online reporting and analysing system.

Further, we will issue sector guidelines for lawyers, notaries, accountants, trusts and company service providers in order to strengthen the AML/CFT requirements for designated non finance businesses and professions.

Regional Development

On the regional development front, we believe that there is ample space to reduce regional differences in economic development. In this regard, we expect to work closely with other relevant institutions to support the government programmes of poverty reduction through the creation of productive employment opportunities across the country.

We have limited operational involvement in regional development under the current mandate. But we have expanded our involvement in this sphere through promotion of concessionary credit operations. We have embarked on developing and implementing new policy strategies relating to development finance initiatives. A series of financial literacy and skill development programmes was also conducted during 2019, focusing on those who have never accessed the formal financial sector. These actions contributed towards the promotion of inclusive and balanced economic growth and financial inclusiveness in the country.

The Central Bank will continue these activities with increased vigour in the time to come. The first National Financial Inclusion Strategy (NFIS) is expected to be implemented in early 2020 in collaboration with other relevant authorities. Efforts will also be taken to enhance financial literacy and awareness among general public on credit schemes implemented by the Central Bank via electronic and print media and by conducting programmes on skills development, capacity building, and entrepreneurship development. We also expect to conduct the first ever Financial Literacy Survey for Sri Lanka in 2020 with technical assistance of the International Finance Corporation (IFC). Action will also be taken to promote existing and potential businesses, particularly Micro, Small and Medium Enterprises (MSMEs), promoting inclusive and balanced growth while facilitating action to increase their scale of operations.

5. Concluding remarks

Amidst several tribulations stemming from internal and external circumstances, the Sri Lankan economy has now graduated to an ‘Upper Middle Income’ status. In the ongoing process of its integration to the global economy, the Sri Lankan economy is bound to encounter vulnerability.

Resulting impediments could weigh down on both growth and overall macroeconomic and financial system stability. Continuing our legacy as a modern, dynamic and innovative institution, we will continue to be proactive in our policy crafting and implementation to create a low inflation and stable economic environment that will serve as the springboard for shared and inclusive economic growth, creating opportunities for all.

I wish to also take this opportunity to express my heartfelt gratitude and appreciation to several individuals and parties who have enabled my seamless transition into this role. First and foremost, I am extremely grateful to His Excellency the President, Honourable Prime Minister and Minister of Finance, Economic and Policy Development as well as the Secretary to His Excellency the President for placing faith in me. I look forward to working with them closely in the period ahead. I must also thank my immediate predecessor Dr. Indrajit Coomaraswamy for having skillfully guided this institution amidst several turbulences during his tenure, making his successor’s management issues less difficult to handle.

Although, it has only been a few weeks since I assumed office, the support I have received from the Secretary to the Treasury, S.R. Attygalle, the ex-officio member of the Monetary Board, and other members of the Monetary Board, Nihal Fonseka, Chrisantha Perera and Dr. Dushni Weerakoon, has been deeply encouraging and immensely helpful. Needless to say, their experience in their respective spheres of expertise and also within the Monetary Board itself helps in well rounded decision making at the Monetary Board.

I am grateful to them for the provision of varied insights and perspectives on matters placed before them.

I must also express my sincere gratitude to Senior Deputy Governor Dr. Nandalal Weerasinghe, and Deputy Governor, H A Karunaratne. Over the last few days my interactions with them have helped me in moving forward with confidence. I am lucky to have their competent advice and support in managing this esteemed and complex institution.

I would also like to express my sincere gratitude to the Assistant Governors, Senior Heads and Heads of Departments, particularly the Director of Economic Research and the Staff of the Economic Research Department for their effort in producing this policy document. It is also my pleasure to acknowledge my colleagues in the Governor’s Secretariat, the Governor’s Secretary in particular, who have greatly assisted in my process of adaptation to my new role.

I wish to express my gratitude to all the Staff of the Central Bank who serve the nation with the greatest sense of duty, professionalism and of course, technical rigour.

The Central Bank attempts to communicate its policies in respect of monetary and financial sector management to the public. This facilitates essential forward guidance to our stakeholders in making rational and well informed decisions. It also paves way for a two way engagement with stakeholders. As you have done with my predecessors, I hope you will continue to extend your support and cooperation to take this country forward.

At this juncture, Sri Lanka strives to make the next economic leap forward. There are many domestic and international challenges, much of which are of an economic and structural nature. I strongly believe that the economy possesses the potential to overcome these challenges. In the words of Sir Winston Churchill: “The pessimist sees difficulty in every opportunity. The optimist sees the opportunity in every difficulty.” Let us also begin to see opportunities in the difficulties we encounter. The Central Bank of Sri Lanka as the apex institution in money matters will continue to guide Sri Lanka to reach new heights in socio-economic achievement.

Ladies and gentlemen, thank you and I wish you all a Happy and Prosperous New year 2020.

26 Dec 2024 41 minute ago

26 Dec 2024 47 minute ago

26 Dec 2024 1 hours ago

26 Dec 2024 2 hours ago

26 Dec 2024 4 hours ago