02 Dec 2019 - {{hitsCtrl.values.hits}}

Even in today’s glum economic climate, the average American is seven times as prosperous as the average Mexican, about 20 times as prosperous as the average person of sub-Saharan Africa and about 40 times as prosperous as the average citizen of an African country like Mali, Ethiopia or Sierra Leone.

Even in today’s glum economic climate, the average American is seven times as prosperous as the average Mexican, about 20 times as prosperous as the average person of sub-Saharan Africa and about 40 times as prosperous as the average citizen of an African country like Mali, Ethiopia or Sierra Leone.

What explains such disparities? How did some nations, like Japan, China or South Korea become wealthy and powerful, while some countries that were in the same stage of development in the 60s still remain stuck in low growth? And why do some of those powers, from ancient Rome to the modern Soviet Union prosper for periods and then collapse?

The government makes the difference, say economists Daron Acemoglu of MIT and James Robinson of Harvard University, in their book ‘Why Nations Fail’. They argue that countries that have what they call “inclusive” governments — those extending political and property rights as broadly as possible, while enforcing laws and providing some public infrastructure — experience the greatest economic growth over the long run.

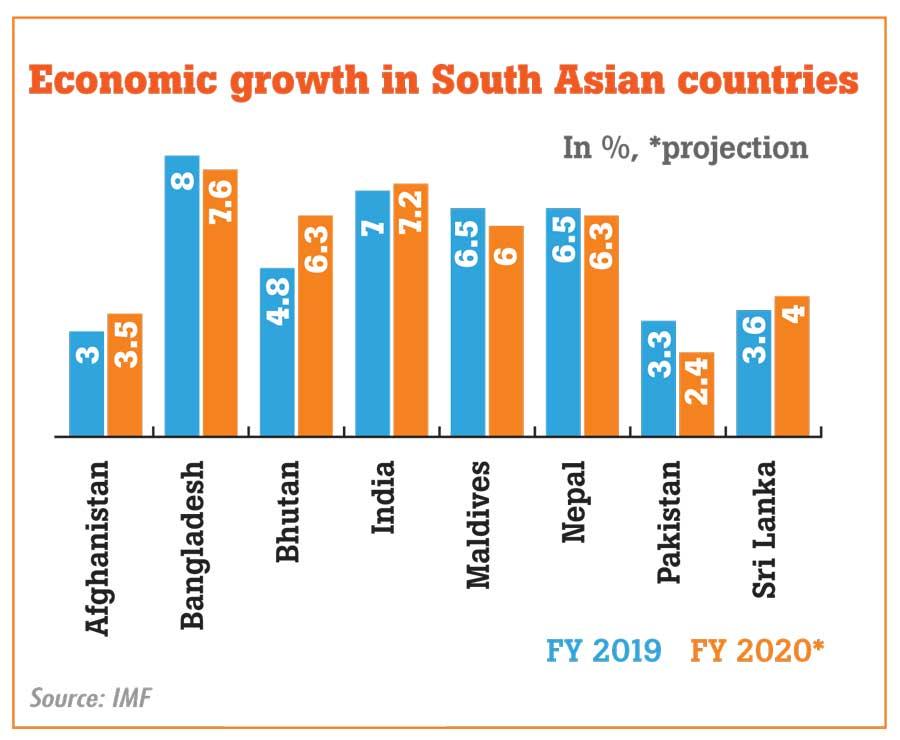

None of the problems South Asia currently has like – deficits, expensive debt, unemployment, mortgage defaults, poverty, disparity, energy insecurity and deteriorating ecosystem, will ever improve with no growth or low growth.

Policies

Many years ago, economists argued that geography matters more than the government. Later they argued that a good government was key. Some countries at that time demonstrated that natural resources could trump bad politics and the best politics require a top effort to offset bad geography.

At the same time, they argued that rich countries were in the North of the globe and most poor countries are in the South but Australia and New Zealand are part of the Southern hemisphere and both are doing fine. You couldn’t say this of Papua New Guinea, which is the Asian country closest to Australia and New Zealand.

Another argument is to blame racial differences. Black Africa is the poorest and most disordered part of the world and Haiti, with an almost entirely black population, is the poorest country of the Americas. What makes some countries rich and others prone to poverty is not related to skin colour or racial factors.

Many immigrants from poor nations do very well in the US and Canada, though one has to admit that both countries make immigration easy only for the best and the brightest of those who hail from the Third World countries.

It is also not the presence or lack of natural resources what makes a country rich or poor in the long run. Japan is a country with very limited natural resources but has been the richest country in Asia for a long time.

On the other hand, it is easy to predict that some Third World countries that currently are rich because of immense reserves of natural wealth while not being burdened with large populations will slide back when the natural resources are depleted. While a handful of countries, thanks to great leadership, managed to achieve economic prosperity that has helped them to escape the perils of poverty, while many other countries fail in this respect and continue to be trapped in poverty and low growth.

Recipe for success

The growth experiences of countries from North to South are filled with success and disasters, which have had huge implications for the living standards of ordinary people. Then in countries where power is wielded by a small elite — either fail to grow broadly or wither away after short bursts of economic expansion.

Economics has sometimes a narrow scope. It studies a nation’s prosperity through trade flows, monetary, fiscal and budget policies. The analysis of companies is a bit broader. It encompasses strategy, structure and finance but also fields such as human resources, corporate culture or consumer behaviours. Competitiveness provides a broader basis for analysis. It looks at all the elements that can explain the success of a nation.

Industries often thrive when they are forced to overcome high labour costs or lack natural resources. When their customers won’t accept inferior, outdated products, when their local competitors are “murderous” and when government offers no protection from their competition and sets tough technical and regularity standards.

For instance, the Italian shoe industry is prodded by sophisticated consumer demand that encourage entry by many new firms. Many of them, family owned, compete very jealousy. The shoemakers are compelled to spew out new models continuously and must keep improving to increase efficiency to stay competitive within Italy’s high-cost infrastructure. When the home market got saturated, Italian manufacturers went overseas and achieved international success. South Korea’s construction industry grew rapidly during the mid ‘80s simply by applying low-cost labour to projects that did not require sophisticated engineering. It lost out when other countries that had cheap labour jumped in.

Resources-based advantages too frequently suffer the same fate. Two additional variables, ‘chance’ and ‘government’ have a big impact. Chance is outside the control of industries; wars and embargoes can reshape industry structure in a country for or against it. A government can improve or retard competitive advantage. Vigorous enforcement of antitrust laws encourages competition and stimulates innovation.

For an industry to flourish, domestic rivalry is nearly always necessary. It drives companies to move beyond whatever initial advantage that led to the founding of the industry and to develop their international potential. Therefore, the success of developing countries critically depends on the quality of leadership, its ability to promote good talent to head critical institutions and its approach for policy formulation with industry.

China is a case in point. On the other hand India, even though is poor in natural resources, is super rich in human talent and in technology. Knowledge is perhaps the most critical competitiveness factor. As countries move up, it is only knowledge that will ensure their prosperity and help them to compete in world markets. How that knowledge is acquired and managed is a nation’s responsibility and finally to become economically independent.

(Dinesh Weerakkody

is a thought leader)

27 Dec 2024 8 minute ago

27 Dec 2024 23 minute ago

27 Dec 2024 35 minute ago

27 Dec 2024 39 minute ago

27 Dec 2024 43 minute ago