25 Mar 2021 - {{hitsCtrl.values.hits}}

The Research Intelligence Unit (RIU) has been conducting ongoing research into the growth of illicit markets in Sri Lanka as they represent the biggest sources of revenue leakage for the government. Herein some insights shared from the most recent report.

The Research Intelligence Unit (RIU) has been conducting ongoing research into the growth of illicit markets in Sri Lanka as they represent the biggest sources of revenue leakage for the government. Herein some insights shared from the most recent report.

It would be an understatement to claim that 2020 has been an ‘outlier’ in the context of both domestic and international economic activity. Whilst the medical experts struggle to count the health cost of the COVID-19 virus, the economic fall-out from subsequent lockdowns are still being calculated. By some estimates, the global economy is expected to contract by between 5-7 percent in 2020 and Sri Lanka’s economy is likely to witness a similar contraction domestically.

Amidst the devastating economic fallout of COVID-19, 2020 will also be remembered by many commentators as the year when Sri Lanka’s sovereign debt situation hit the international headlines, with back-to-back downgrades from all international rating agencies including Fitch and S&P.

The government for its part questioned the moved as it seemed irrational considering that Sri Lanka has a perfect loan repayment record. Moreover, even after the downward revisions, the authorities duly settled all debt servicing obligations in 2020, including the matured International Sovereign Bond (ISB) of US$ 1bn, which was settled in early October 2020.

On balance, the rate revision probably reflects long-term concerns rather than immediate worries. In brief, the Government is faced a challenge to repay individual countries, international investors and multilateral agencies under bilateral agreements, whilst its ability to repay continues to face severe challenges unless Government revenue can be boosted by 2022 and beyond.

Tobacco taxation - the full picture

More than ever, it is clear that policy makers need to address the issue of illicit markets that erode the fiscal revenues of the Treasury.

Whilst it is encouraging to note that the government has accepted and acknowledged the existence of illicit markets in its 2021 budget proposal, policy makers are still far from working out the solutions to tackle this escalating issue.

Tobacco taxation is a case in point where the politicisation of the issues over many years has resulted in the emergence of a thriving illicit market and a consequent sub-optimal achievement of both the public health and fiscal targets.

Sri Lanka enjoys a higher ranking in the Human Development Index than the regional average and resembles a developed country in its health care system, life expectancy and literacy rates. The Island was one of the first to ratify the Framework Convention on Tobacco Control (FCTC) and has followed multifarious WHO guidelines including graphic health warnings on packaging, ban on sponsorships, a ban on smoking in public places, and a ban on sales to persons under 21. On the whole, Sri Lanka’s efforts to curb smoking prevalence have been met with praise by the WHO.

However, the discussion on progress often ignores the growth of cheaper alternative tobacco products such as beedi and smuggled cigarettes. Both can weaken and undermine the progress made thus far.

Our research demonstrates how the often-politicised tax policies adopted in the recent past has led to the emergence and growth of an illicit tobacco market in Sri Lanka. Consequently, we can note that both the public health and taxation objectives of the government have been compromised as the presence of these cheaper alternatives have pushed up smoking in the country even as the legal cigarette industry volumes have halved in the last 5 years.

Our analysis indicates that between 2015 and 2019 the Government’s approach to tobacco taxation in Sri Lanka is characterised by ad-hoc, knee-jerk policies that have resulted in low predictability of tax revenue, which have contributed to revenue leakages from the growing illicit market.

Using available data for 2020, we have carefully conducted our analysis with a holistic approach that considers tobacco taxation in the context of its entwined relationship with beedi and

smuggled cigarettes.

Unfortunately, most of the existing research in this area, either intentionally or unintentionally, fails to recognise the presence of beedi and illicit tobacco in the market even though both have serious health and fiscal concerns for policy makers.

Sum of all parts ≠ the total

In our research, we provide a macro level overview on the tobacco industry in Sri Lanka along with a time series analysis of the tax policy framework that has been implemented by successive governments. Our analysis demonstrates the price point at which the country turned into a smugglers’ paradise when the margins became lucrative amidst a soft enforcement and punitive system.

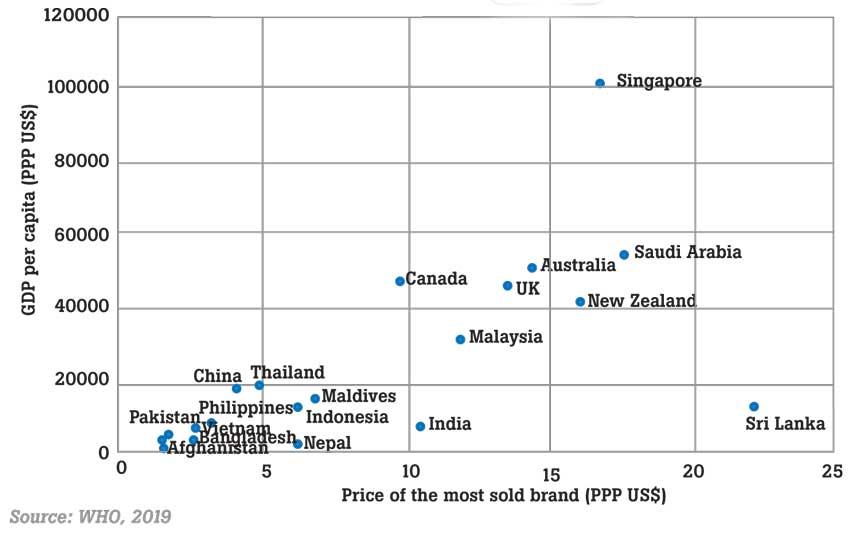

In 2012, the illicit share in Sri Lanka was ~2 percent of total cigarette sales. A massive 52 percent increase in the price of cigarettes between 2015 and 2016 and subsequent upward price revisions, resulted in Sri Lanka becoming the most expensive country by the year 2018, to purchase a legal cigarette on purchasing power parity basis (PPP).

Consequently, the share of the illicit market increased to 14 percent by 2018 and to 21 percent by 2019 according to our own research. Based on the data and our ongoing research, the share of the illicit market is expected to have grown further to 24 percent in 2020.

This massive size of the illicit market results in significant loss of revenue for the government, as well as the legal industry and for those whose livelihoods are intertwined - such as tobacco farmers and retailers. In 2020 the illicit market value is estimated at Rs. 26 billion, which, if converted to legitimate sales, could have resulted in fiscal revenue of Rs. 38.5 billion. To put things in perspective, this sum would have almost entirely covered the cost of the Central Expressway section 1, or fully funded the Lotus Tower which cost some Rs. 20 billion.

Policy navigation and better enforcement

The findings of our research points towards developing a preventive strategy in the form of tax policies. The price of legal cigarettes has increased over the years due to the persistent increase in excise and taxes on the legal industry. Increasing taxes above the threshold affordability levels of consumers has resulted in consumers shifting to smuggled tobacco products. Therefore, it is imperative that the government adopts a more comprehensive and pragmatic tobacco taxation policy to maximize revenue and curb the growth of the illicit tobacco market and meet its public health objectives.

We have also highlighted policies that the Sri Lankan government can take on board to address the growing illicit tobacco market more directly. These include the strengthening of enforcement agencies by investing in modern technology, such as high-tech scanners.

Penalties for those found guilty of being engaged in smuggling activities are also extremely soft compared to the profits to be made from smuggling operations and need to be revisited by the government.

For example, in Malaysia the minimum fine for smugglers, traffickers, suppliers and sellers of contraband cigarettes was increased in 2019 to US$ 25,000 or a minimum jail term of six months.

The Research Intelligence Unit (RIU) has always been an organisation that has addressed issues of national interest and has been advocating pursuance of prudent and pragmatic policies that avoid spurring the growth of illicit markets. In addition to tobacco, Sri Lanka is affected by illicit markets that exist in other sectors such as agriculture, alcohol and pharmaceutical products, that all result in fiscal revenue leakage for the government. Our Illicit Market in Agriculture report is due for release in May 2021.

23 Dec 2024 8 hours ago

23 Dec 2024 9 hours ago

23 Dec 2024 23 Dec 2024

23 Dec 2024 23 Dec 2024