19 May 2022 - {{hitsCtrl.values.hits}}

As Sri Lanka entered discussions with IMF, India offered its support by calling on the IMF to “urgently provide financial assistance”

There are macroeconomists and the rest of us. The former, having studied the nuts and bolts of economics, understand Sri Lanka’s current issues, or they do show. We, on the other hand, are in dark. Do we know the depth of the issues that burden us? Do we know what solution paths are open? Do we know where will we be in 2025? In fact, macroeconomists should explain these in plain language we all can understand, but they are wise and busy men with little time for such trivialities. So here we go.

There are macroeconomists and the rest of us. The former, having studied the nuts and bolts of economics, understand Sri Lanka’s current issues, or they do show. We, on the other hand, are in dark. Do we know the depth of the issues that burden us? Do we know what solution paths are open? Do we know where will we be in 2025? In fact, macroeconomists should explain these in plain language we all can understand, but they are wise and busy men with little time for such trivialities. So here we go.

What follows is not a piece of opinion. It is only a presentation of hard facts. It was first done as an attempt to comprehend the problem by myself. Then I thought of extending it to all non-economists down there. I hope this will assist them to correctly understand the problem.

Sri Lanka as a woman

For our convenience, let’s consider Sri Lanka as a woman. Why a woman? Well, for multiple reasons. Historically Sri Lanka has been a maternal society. The Buddha in our homes was the mother. Even if we were to ignore the fact, that Sri Lanka’s current economy is distinctly a women-oriented one.

The two biggest dollar earning means, the apparel industry and Middle-East employment are dominated by women. Women also play key roles in both tourist and digital industries. So it is unfair we call Sri Lanka a man. Sri Lanka should certainly be represented by a woman. Let’s call her Lanka.

Who is Lanka?

What do we know about Lanka? We know her age is 34 years (The median age of women in Sri Lanka). She would probably live another 46 years to reach 80 years, while her husband Amatya might probably die seven and half years before her.

The size of Lanka’s family is four members. Let’s say she and Amatya have two kids – a girl and a boy. Like in the case of most Sri Lankans, Lanka’s origin is mixed, with three of her grandparents Sinhala and Buddhist, while her paternal grandmother is from a minority.

We can also say Lanka, with her family lives in Horana, not too far or too close to the commercial and administrative capitals of Sri Lanka. She owns a smartphone and is a low Internet user through that. She is interested in watching teledramas, while she cooks for the family in the evenings. Her favorites are ‘Iskole’ and ‘Sangeethe’. Amatya owns a motorbike, the most used vehicle category in Sri Lanka with 2.5 million bikes - more than half of all vehicles. She with her family also travels by busses and train. Nobody from her family has so far traveled by air.

Lanka’s education and social status

Lanka has studied up to GCE (O/L); Amatya has not reached even that level. She got two credits and five simple passes. What she did not clear were Mathematics and English. The semi-rural secondary school she studied at did not have teachers for those two subjects continuously; otherwise, she could have scored at least simple passes. She started doing GCE (A/L) in Arts – the only stream available at her school.

She did not sit for the examination. Somewhere in between years 12 and 13 she met her now-husband and fell in love. Their love story was short. Both wanted to be together as soon as they can. They married early, on their own, in spite of the hostilities from the parents of both sides. She later started working at a nearby apparel factory. There was not much choice when it becomes to employment. Her husband is a mechanic, again not his first choice.

Well, her life was somewhat a success. Despite what we will be discussing later, you may call the living standards of Lanka’s family satisfactory. She lives in a house with permanent walls, roof, and floor. This is now common for most in her country. Her house also gets electricity though the consumption is assiduously managed to be in the low-tariff category.

The main source of drinking water is safe while the toilet facilities are exclusively for the household. The cooking fuel is both gas and firewood. They mostly bury or burn the garbage, while a portion of it is collected by authorities – not too regularly and frequently. She has no domestic electric items other than the 32” TV set, bought recently from her husband’s year-end bonus.

Lanka earns and spends this much

So, we know about Lanka’s background we can ask the question of how much she earns. The annual per capita income of Sri Lanka, tells us the recently issued Central Bank Annual Report of 2021 is US$ 3,815. (In fact, this should be lower with the sliding Sri Lankan Rupee – My guess is somewhere around US$ 3,200). Still, that is not important. This is not what Lanka earns. It is only an indication of what the country produces compared to its population. Only economists understand the logic behind the calculation of this. (For example, during the conflict years the cost of conflict, under government expenditure, increased the GDP) So let’s ignore that.

Lanka’s true earnings are found, thanks to the Department of Census and Statistics, among the outcome of the income and expenditure survey of 2020. Her household income, which is the joint income of her and her husband is close to Rs. 53,000. (I have purposely taken the median income of a Sri Lankan household, not average, as the latter gives a distorted figure and includes her in the wrong category.) With the dollar to rupee rate at the moment of keying this (US$ 1 = Rs. 375) that is only US$ 142. Out of this, she spends Rs. 47,500 (US$ 127). That leaves only Rs. 5,500 (US$ 15) as savings per month to be used in distress/loan payments. There may be others doing a bit better. For example, in the urban sector, the household income is Rs. 75,000. Lot more doing worse. Let’s not bother with all. Our focus is on Lanka.

We also know how Lanka lives. With these earnings, Lanka and her husband can spend only scanty amounts on food. The whole family eats only 9 kg of rice per month. They eat that with 650 g of dhal; 700 g of big onions; 500 g of chicken; 7 coconuts; 4 eggs and 300 g of dried fish. Please note these are monthly, not daily consumption figures, that too for a household, not an individual. We can imagine what a hard life they live. The children eat an egg once in two weeks, only. Not a choice, really.

Why do Lanka and her family have to limit their expenditure on food? That is because there is a range of other cost items. Let’s take only a few. Out of the total non-food expenditures, 11.5 percent goes for transport; 11 percent for household durable goods; 4 percent for clothing textiles and footwear. Despite enjoying free healthcare and free education privileges, Lanka’s family also spends 6.5 percent and 6 percent respectively for healthcare and education.

Miserable COIVD-19 times

Even with difficulties, Lanka was content with her life till 2019. Then came COVID-19. That dwindled their income in an unprecedented manner. Lanka still could not think how the family survived COVID-19 lockdowns. Both the breadwinners were out of their jobs for long periods. They had only one smartphone for the online classes of two children.

The signals were weak, so the children climbed to a nearby tree. Many nights passed only with water. By early 2022 she was relieved to learn Sri Lanka has successfully defeated COVID-19, with credits fully going to the medical forces that went far beyond their mandates. Then she learned a piece of worse news: She was in debt, badly.

Lanka in debt

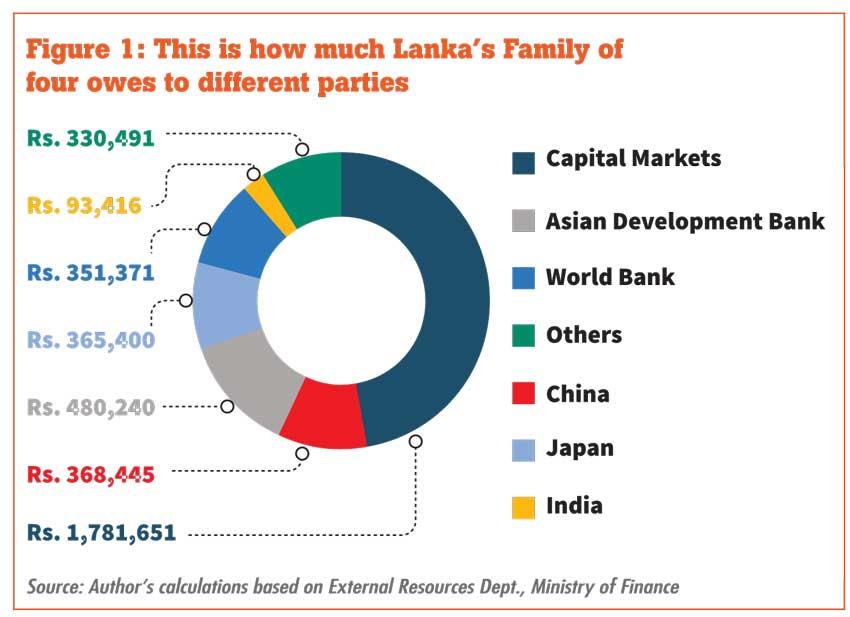

Lanka was not sure how she could be in such a mess. She looked at figures. She could not believe her eyes. Her family is in debt of US$ 10,000. Hell. That is more than 3,750,000 Rupees! Lanka was sure it was not her who took that much money. That was far above the level she, a low-income woman, has ever touched or ever seen. It could be her husband, Amatya. She was shown whom she owes. (Figure 1)

She knew part of it was to build the house. But 3,750,000 Rupees? 37 ½ lakhs? That was far too high. That was what the family earns in 6 years. Lanka was not sure what Amatya has spent so much for. Maybe Amatya spends for other women. Maybe he is gambling. She was too scared to ask. The only thing she knows is now it is her obligation to pay this amount. Whether she likes it or not. She has to spend for Amatya’s blunders.

Her immediate concerns are for the next five years. From 2021 to 2025 she has to pay roughly US$ 887 (Rs. 332,400) per year. One can argue she could pay this amount, as it is lower than her family’s annual income of Rs. 636,000. But, remember she has her own expenditures. She could maximum save only Rs. 5,500 per month or Rs. 66,000 per year. The gap is minus Rs. 266,400. This is given the best conditions. Were there another COVID19-like calamity she would not be able to save anything.

Talking about savings, we must note it was her previous saved funds that made it possible to make debt and interest payments in 2021. That has resulted in the dwindling of her savings to near-zero levels. No way she could do the same in 2022.

Lanka does not earn in dollars

I hope you have not forgotten. Lanka’s debt is in dollars. Lanka does not earn in Dollars. So, even if she has the equivalent in rupees, how could she settle the debt? This is another huge problem she faces. Well, in reality, things are not that bad. Lanka’s elder sister working in the Middle East sends her some dollars every month. Not a large amount. Only US$ 12 per year. She also sells king coconuts on the land to tourists and earns another US$ 12. Still, these are peanuts compared to what is to be paid. She has to find a way.

IMF Nilame to the rescue

Village pundits have been advising Lanka to approach IMF Nilame for a bigger loan to cover all her debt. This IMF Nilame, please note, is an influential and rich guy in the village. He has friends in high places. He is so rich that spending only a fraction of his wealth can solve Lanka’s problems. Still, why should he?

IMF Nilame is not a Vessanthara. Lanka is a poor woman; not even a distant relative of his. He may agree to resolve Lanka’s problems but more as a business transaction. No charity, please. He will offer a loan, but Lanka has to pay it in the future with interest.

Also in the priority list of payments, Lanka has to place IMF Nilame’s payment above all others. Then IMF Nilame may want to impose other harsh conditions. For example, Lanka might have to get rid of the family pet dog – to reduce costs. Even on the face of it, the deal does not look too pleasant.

Still, village pundits are adamant. They are old wise men with grey hair and decades of experience before retirement. So it is natural that they think they know all. They continuously push Lanka to approach IMF Nilame. Look at your neighbours, they say to her. Look at Mr. Pakistan, Ms. Argentina, Mr. India, and Mr. Ecuador.

Hasn’t IMF Nilame come for their help when they were in trouble? At least this part is true. IMF Nilame helped all the above when they were in bad economic situations. However, not all cases met with success. In some cases, the help in good faith actually worsened the situation.

Take the case of Mr. India. Many incorrectly think it was IMF Nilame’s assistance that took Mr. India out of his troubles in 1991. Hardly. Mr. India was in serious trouble by the end of 1990. True, Mr. India went for help, but meantime he realized he could correct the problem himself. So in the middle, he rejected further assistance.

Mr. Pakistan and Ms. Argentina are still in their own mess, despite IMF Nilame’s generous backing. The bottom line: IMF Nilame’s assistance per se will not take you anywhere. You have to clear most of the mess yourself. Otherwise, you will be surely in a bigger mess.

What are Lanka’s options?

By this time you might have realized Lanka does not have too many options. Rather, she is forced to take a few steps to avoid falling into a deeper abyss. First, about the debt. It is apparent she is not in a position to clear her debts according to the previously agreed schedule.

This, she must convey to debtors in no uncertain terms: “I have no options. I cannot just pay your debts and interests fully this year. Give me some more time. I will pay in smaller installments. There is no point arguing.” Sooner or later the debtors have to agree. Only thing Lanka must be sincere. She has to keep her promises. She cannot avoid restructured installments again. She must also genuinely work towards clearing her own mess.

Lanka to improve her income

Then certainly, Lanka must improve her income. Easier said than done. This is, in fact, the most difficult part. How can somebody make a drastic change in the vocation? It may need a change of attitudes. It may need capacity building so that individuals can improve their market values.

Knowing Lanka’s background, you know how extraordinary that effort could be. It would be something like quitting her current job and starting a new business at her place. On the other hand, Amatya could change his motorbike for a three-wheeler and take hires in his free time. Again, these options are not easy. They need investments.

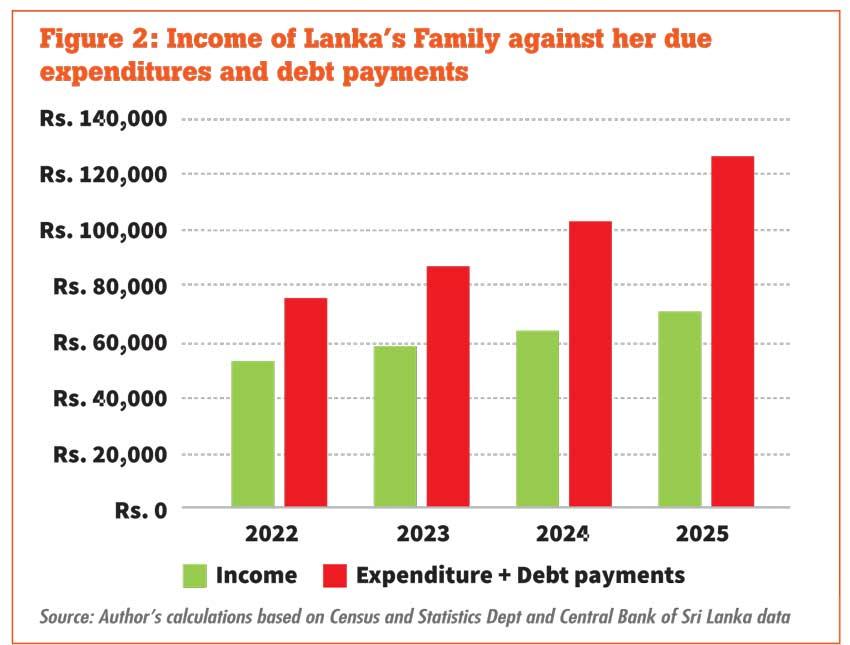

Knowing Lanka’s difficult financial position, nobody would be ready to invest in her ventures. Still, is there an alternative? Figure 2 shows the estimated income of Lanka’s monthly household income against her estimated expenditure and debt repayments. For this month, she has to make payments (normal monthly expenditure + debt repayments due) for more than Rs. 75,000 while her income is only Rs. 53,000. Poor Lanka. How could she fill the gap if not she were to find another source of income?

Lanka to sell family silver

That brings us to more unpleasantries. If Lanka could find another source of income by 2025 she has to spend more than Rs. 125,000 a month, while earning only Rs. 70,000.

This is impossible. She is no more different from a woman tangled with a micro-finance loan. One way of easing this financial burden, whether we like it or not, is selling the family silver. Lanka has a nice build house and land. Building infrastructure was perhaps the only intelligent thing Amatya has done in the last few decades. Lanka may sell part of these. Not the best thing to do, but this is an unprecedented situation.

This “selling” (Yes, I know you hate the word) can come in different ways. Maybe, “99-year lease” is a better term. That is another practical way of easing some of the burdens. A pertinent question is, how much maximum Lanka can find in this way.

Why only Lanka in trouble, not others?

Finally, why not the neighbours of Lanka in trouble? Why only her? Well, not really. One of her neighbours Mr. Pakistan too is in the same abyss as her. His savings too have fallen sharply in the past two months. He is also as cash-strapped as Lanka and can no longer afford to buy coal or natural gas. The story is not too different from that of Lanka, so there is little point to get into that.

Still, some of her other neighbours are doing relatively well. Let’s take the case of Mr. India – whose economy is going strong following the economic transformation of the 1991-2 period. Mr. India currently is the village’s sixth richest individual though some of his children still live in poverty.

Mr. India is also doing well in his factory, soon trying to be the sixth-largest manufacturer in the village. One of his sons is a leading IT services provider to the village.

His hotel and restaurants cater to local and international tourists. Not to mention his farms and paddy fields. Then Lanka’s other neighbour Ms. Bangladesh is doing a good job in the apparel industry. Actually, it was to her Lanka now runs for loans occasionally.

How could they have done better? This is a difficult question to answer. This may disturb our egos, but we have to admit that they have followed better paths, though 75 years ago their grandparents were of a much lower status than those of Lanka. There is no point crying over spilled milk. Lanka with her family must amend ways. Only doing that will ensure a bright future for her two children.

(Chanuka Wattegama is a policy researcher. The opinions expressed are personal. He could be contacted via: [email protected])

23 Dec 2024 24 minute ago

23 Dec 2024 29 minute ago

23 Dec 2024 1 hours ago

23 Dec 2024 2 hours ago

23 Dec 2024 3 hours ago