19 Nov 2021 - {{hitsCtrl.values.hits}}

The Sri Lankan tea industry for the period January to September 2021 witnessed an upward momentum with production and exports whilst recorded a decline in the national average when compared to the same period in 2020.

The Sri Lankan tea industry for the period January to September 2021 witnessed an upward momentum with production and exports whilst recorded a decline in the national average when compared to the same period in 2020.

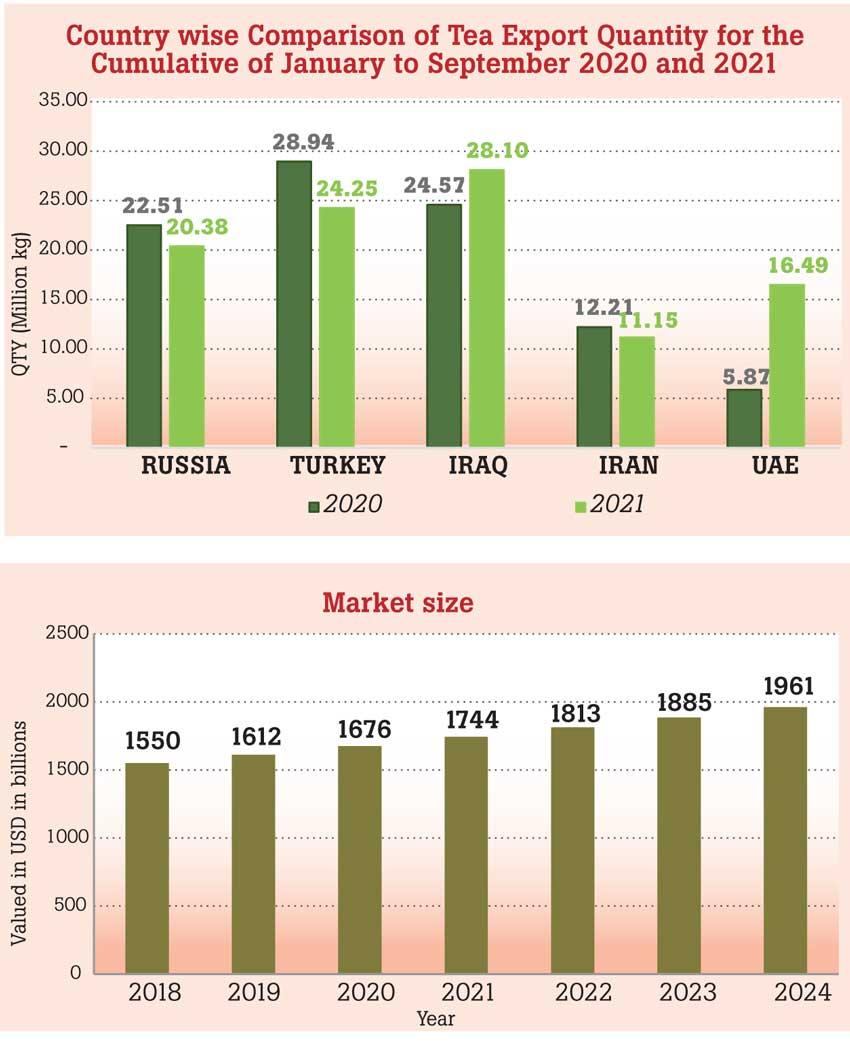

Iraq, Turkey and Russia continued with strong demand for Sri Lankan tea and were the top three importers for the period January to September 2021.

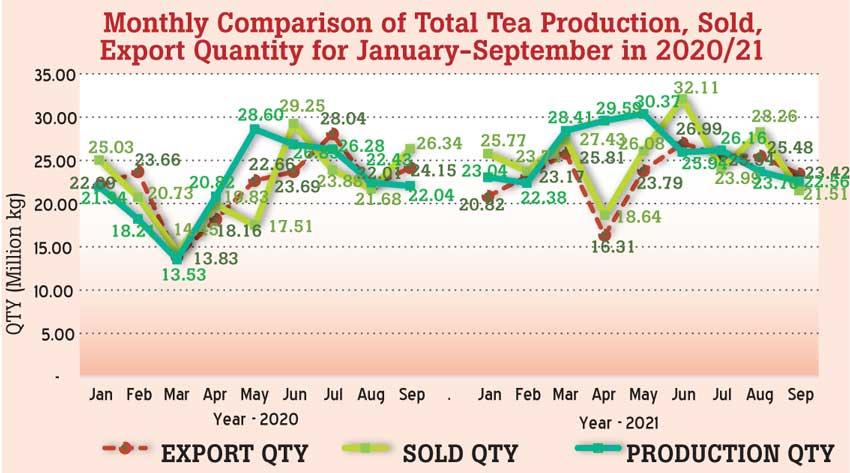

The total tea production of Sri Lankan tea for the period January to September 2021 recorded 234.43 MKgs in comparison to 201.44 MKgs in 2020 (+32.99 MKgs). High, Medium and Low Growns shows an increase in volume comparison to the same period last year. The CTC High, Medium and Low Growns recorded an increase in volume in comparison to the period January to September 2020. Production and exports increased by +32.99 MKgs and +13.34 MKgs, respectively when compared to the same period in 2020.

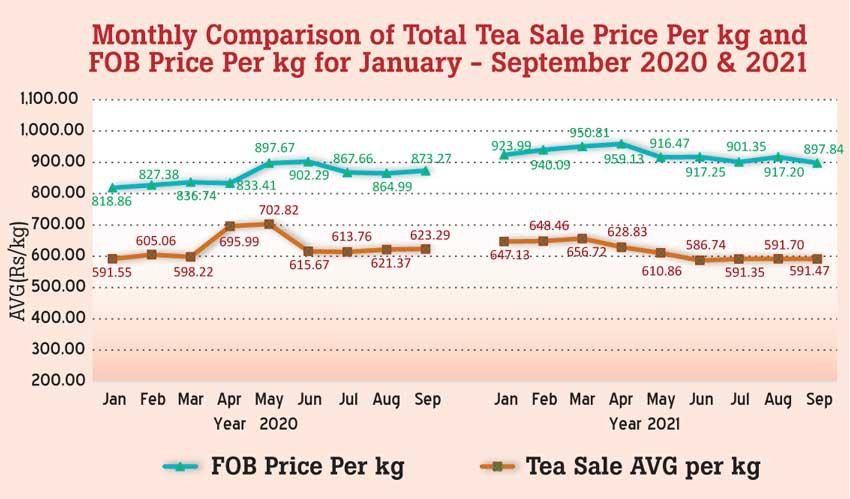

The total national average of teas sold for the period January to September 2021 was Rs.616.22 (US $ 3.11) per kilo in comparison to Rs.627.35 (US $ 3.38) for the same period in 2020, which recorded a decrease of -Rs.11.13. Low Growns averaged Rs.644.96 (US $ 3.26); Mid Growns recorded Rs.548.38 (US $ 2.77) with High Growns at Rs.590.12 (US $ 2.98).

For the period January to September 2021, the averages for High and Medium Growns in rupee term shows an increase whilst Low Grown shows a decrease when compared to the corresponding period last year. In dollar terms, all three elevations witnessed a decrease. Low Growns with the largest market share with 60.74 percent of the production recorded a decrease of -Rs.22.16 whilst High and Medium Growns recorded an increase of +Rs.11.26 and +Rs.1.56, respectively.

Sri Lanka tea exports for the period January to September 2021 amounted to 211.64 MKgs vis-à-vis 198.30 MKgs recorded for the same period last year (+13.34 MKgs). The FOB average price per kilo for this period stood at Rs.922.79 (US $ 4.66) in contrast to Rs.860.08 (US $ 4.63), which shows an increase in the rupee term (+Rs.62.71) and dollar value (+US $ 0.03) when compared to the corresponding period last year. The FOB value of tea bags has gained in comparison to the same period in 2020.

The total revenue realised for the period January to September 2021 from tea exports was Rs.195.30 billion (US $ 987.01 million), compared with Rs.170.55 billion (US $ 918.76 million) recorded for the period January to September 2020. It’s an increase in rupee term (+Rs.24.75 billion) and dollar value (+US $ 68.24 million) compared to the same period last year. Also, teas in packets and bulk showed an increase in FOB value.

Country wise analysis of exports shows that Iraq emerged as the largest importer of Sri Lankan tea for the period of January to September 2021, followed by Turkey and Russia. Tea exports to Iraq have increased by 3.54 Mn/Kgs. However, Turkey and Russia have dropped by -4.69 Mn/Kg, -2.13 Mn/Kg, respectively. Tea exports to Iran decreased by -1.06 Mn/Kg whilst the UAE has increased by +10.63 Mn/Kg and China increased by +1.78 Mn/Kg compared to the same period in year 2020.

World economic outlook

The global economy is projected to grow 5.9 percent in 2021 and 4.9 percent in 2022. Global economic recovery continues amid an increasing pandemic, with different vaccine rates and policy support emerging as the principal factors driving divergent recovery paths across countries and regions.

Vaccine manufacturers in high-income countries should support the expansion of regional production of COVID-19 vaccines in developing countries through financing and technology transfers.

Europe and Central Asia

The regional economy is expected to grow by 5.5 percent in 2021. This is significantly higher than projected, due to a strong recovery and domestic demand in the region’s largest economies. Growth is then expected to increase by 3.8 percent in 2022, as the effects of the pandemic gradually wane and the recovery in trade and investment gathers momentum.

The outlook remains highly uncertain, given the continuation of the pandemic, especially in the context of low vaccination. The regional recovery remains vulnerable to financial stress, which could be triggered by an unexpected tightening of external financing conditions or a sharp rise in policy uncertainty and geopolitical tensions.

Middle East and North Africa

The regional economy is projected to grow by 3.8 percent in 2021 and 2.8 percent in 2022. The recovery is ongoing but it is uneven and incomplete, with new waves of the virus emerging.

Oil exporters have started to recover with higher prices. Therefore, higher oil prices and declining OPEC + production curbs will support the economic activity of oil exporters.

US economy

The US economy is still the largest and most important in the world. GDP will expand rapidly this year as the impact of the pandemic fades and the labour market recovers. The GDP is expected to grow by 6.1 percent in 2021 and 4.1 percent in 2022.

China economy

China’s economy is projected to grow by 8.5 percent in 2021 and 5.5 percent in 2022 as low base effects dissipate and the economy returns to its pre-COVID trend growth. More transmissible COVID-19 variants could lead to a significant economic disruption.

China’s economy is facing structural headwinds, given adverse demographics, tepid productivity growth and the legacies of excessive borrowing and environmental pollution. These challenges require attention, with short-term macroeconomic policies and structural improvements targeted at strengthening to more balanced high-quality growth.

(Source: Worldbank.org)

Crude oil

Brent crude oil prices expected to average US $ 62.26 per barrel in 2021 and US $ 60.74 per barrel in 2022. Oil price forecasts depend on the interaction between supply and demand for oil in international markets. (Source: Worldbank.org)

US dollar

Interest rate in the United States is expected to be 0.25 percent by the end of this quarter. In the long-term, the United States Fed Funds rate is projected to trend around 0.75 percent in 2022.

(Source: Federal Reserve)

Sri Lankan rupee

Sri Lankan rupee depreciated by 6.2 percent for the period January to September 2021 from 6.7 percent in January to August 2021 against the US dollar. The Sri Lankan rupee is expected to trade at 201.20 by the end of this quarter. (Source: CBSL)

Market size of global beverage industry| 2020-2024

The global beverage market size is valued at US $ 1550 billion for the year 2018 and the industry is growing at a CAGR of 4 percent. Its value estimations are US $ 1676.48 billion in the year 2020 and the US $ 1885 billion in the year 2023. The beverage industry will further grow and would have been valued US $ 1961.24 billion in the year 2024.

High disposable income, rapid urbanisation and changing lifestyles are the major factors that contribute to the growth of the global beverage industry. (Source: Vijaya Sripada)

23 Dec 2024 3 hours ago

23 Dec 2024 5 hours ago

23 Dec 2024 5 hours ago

23 Dec 2024 5 hours ago

23 Dec 2024 7 hours ago