23 Jul 2020 - {{hitsCtrl.values.hits}}

The first quarter of the Sri Lankan tea industry saw an upward momentum with an increase in elevational averages to the comparative period in 2019. Tea production saw a sharp decline in the period of review whilst exports witnessed a decrease.

The first quarter of the Sri Lankan tea industry saw an upward momentum with an increase in elevational averages to the comparative period in 2019. Tea production saw a sharp decline in the period of review whilst exports witnessed a decrease.

The coronavirus outbreak in the first quarter this year caused a stir in the global tea market with labour lockdowns stifling supplies, which triggered a spike in prices.

The pandemic forced the 137-year-old Sri Lanka outcry auction system into online trading, injecting the much-needed cash flows into the plantation sector with the pandemic’s disruption to the outcry tea auctions.

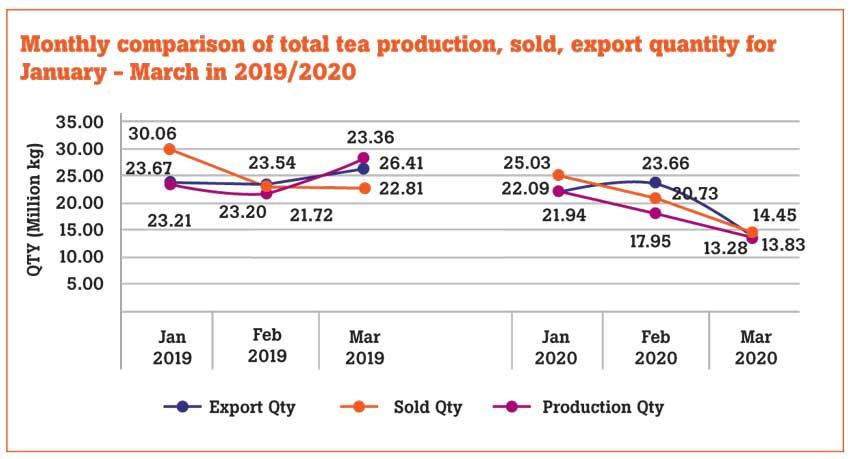

The total tea production of Sri Lankan tea for the first quarter 2020 recorded 53.27 MKgs, in comparison to 73.43 MKgs in 2019 (-20.16 MKgs). High, Medium and Low Growns show a decline in volume in comparison to the same period last year.

The CTC Medium and CTC Low Growns show a decline in volume in comparison to the period January to March 2019 whilst CTC High Growns show a marginal increase. Production has decreased by -20.16 MKgs and exports have decreased by -14.05 MKgs, compared to the same period in 2019.

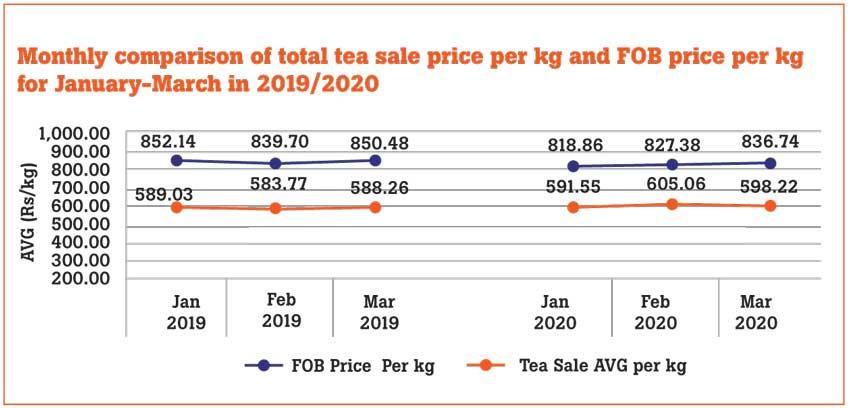

The total national average of teas sold for the period January to March 2020 was Rs.594.81 (US $ 3.26) per kilo, in comparison to Rs.585.30 (US $ 3.26) (+Rs.9.51) for the same period in 2019. Low Growns averaged Rs.628.36 (US $ 3.44); Mid Growns recorded Rs.520.82 (US $ 2.85) with High Growns at Rs.554.19 (US $ 3.03).

The averages for Medium and Low Growns in rupee and dollar terms show an increase whilst the High Grown shows a decrease for the period January-March 2020, when compared to the corresponding period last year.

Low Growns with the largest market share with 57.86 percent of the production, recorded an increase of (+Rs.19.51), Medium Growns recorded an increase of (+Rs.9.86) whilst High Grown recorded a decrease of (-Rs.19.62), when compared to the first quarter 2019.

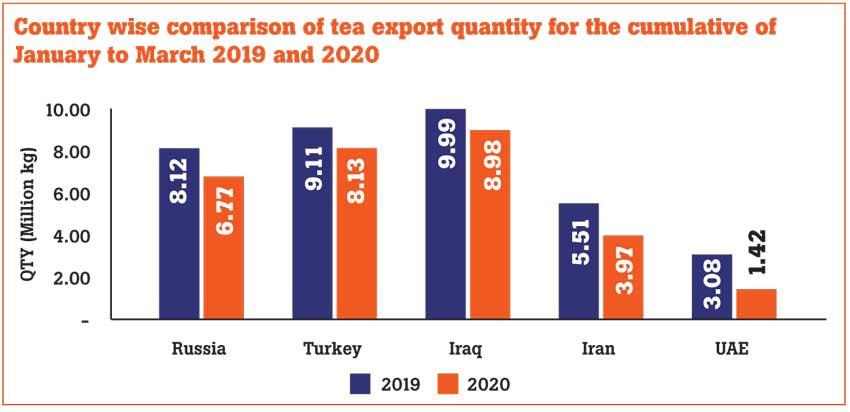

Sri Lankan tea exports for the period January-March 2020 amounted to 59.58 MKgs vis-à-vis 73.62 MKgs recorded for the same period last year (-14.05 MKgs ). The FOB average price per kilo for this period stood at Rs.826.39, in contrast to Rs.847.57 (-Rs. 21.17), when compared to the corresponding period last year. The FOB value of tea bags has dropped in comparison to the same period in 2019.

The total revenue realised from tea exports for the period January-March 2020 was Rs.49.24 billion (US $ 0.27 billion), compared with Rs.62.40 billion (US $ 0.35 billion) recorded for the period January-March 2019. It’s a decrease in rupee terms (-Rs.13.17 billion) and a decrease in dollar value (-US $ 0.08 billion), compared to the same period last year. Also, teas in packets and bulk showed a decrease in FOB value.

Country-wise analysis of exports shows that Iraq emerged as the largest importer of Sri Lankan tea for the period of January-March 2020, followed by Turkey and Russia. However, tea exports to Iraq, Turkey and Russia have dropped by (-1.01) Mn/Kg (-10 percent), (-0.97) Mn/Kg (-11 percent), (-1.35) Mn/Kg (-17 percent), respectively, compared to the previous year whilst tea exports to Chile has increased by (+0.92) Mn/Kg (+89 percent) and Saudi Arabia has increased by (+0.36) Mn/Kg (24 percent).

Global economic outlook

COVID-19 has delivered an enormous global shock, leading to steep recession in many countries. A 5.2 percent global contraction in GDP is forecasted in 2020, a deep global recession in decades. Per capita incomes in most emerging and developing countries will shrink this year. The measures taken, to slow the spread of the virus, have slowed economic activity and growth forecasted in all regions.

East Asia

Growth in the region is projected to fall to 0.5 percent in 2020, the lowest rate since 1967, due to the disruption caused by the pandemic. China is expected to slow to one percent this year. Economic activity in the rest of East Pacific is forecasted to contract by 1.2 percent in 2020.

Europe and Central Asia

The regional economy is forecasted to contract by 4.7 percent, with recession looming in almost all countries.

Russian Federation

Economy is forecasted to contract by 6.0 percent this year. The collapse in oil prices, due to the jump in COVID cases, impacted the Russian economy heavily.

Middle East and North Africa

Economic activity in the Middle East and North Africa is to contract 4.2 percent, as a result of the pandemic and oil market developments. Iran is expected to contract 5.3 percent this year, the third year of contraction in a row. Oil export growth will be significantly constrained by the policy cuts in oil production.

South Asia

GDP in the region is projected to contract by 2.7 percent in 2020. In India, growth is expected to slow down to 4.2 percent in 2020. Pakistan and Afghanistan are both projected to experience contraction.

Crude oil

Worldwide crude oil prices will average US $ 38 a barrel for 2020. Oil prices started US $ 61/b in January 2020. Prices plummeted in the second quarter with one day in April even closing at negative US $ 37/b.

Us dollar

The US dollar is expected a tentative recovery in the third quarter of 2020. US Federal Reserve cut interest rates last in March 2020.

Sri Lanka rupee

Sri Lanka rupee reached an all-time high of 193 (buying rate) in April 2020. Sri Lanka has slapped import controls in order to keep the rupee stable.

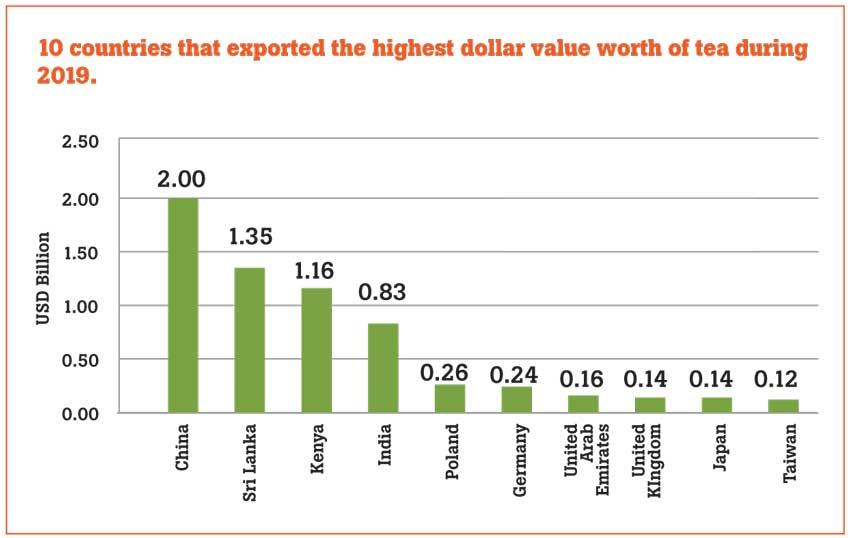

Global sales from tea exports by country totalled an estimate of US $ 6.4 billion in 2019. The value of worldwide tea exports fell by an average -12.8 percent for all exporting countries since 2015.

When shipments were valued at US $ 7.3 billion, Asian countries sold the highest dollar worth of exported tea during 2019, with shipments valued at US $ 4.5 billion exceeding two-thirds (69.9 percent) of the global total. In the second place were exporters in Europe at 16.8 percent while 9.1 percent of overall shipment originated from Africa.

Except for Kenya, major tea producing countries currently witness a decline in production levels. The COVID-19 pandemic is inflicting high and rising human costs worldwide and the necessary protection measures are severely impacting economic activity.

Whilst the Sri Lankan tea prices are currently at healthy levels, the Sri Lankan tea industry could be cautiously optimistic going into the third quarter, with the global economic uncertainty projected in the future.

24 Dec 2024 9 hours ago

24 Dec 2024 24 Dec 2024

24 Dec 2024 24 Dec 2024

24 Dec 2024 24 Dec 2024

24 Dec 2024 24 Dec 2024