03 Jun 2021 - {{hitsCtrl.values.hits}}

On the front page of The New York Times’ March 27 edition, a staggering chart illustrated the COVID-19-induced unemployment level in the US. The front page will certainly join the club of the most creative front pages, but it was an alarming attestation of the economic impact of the

On the front page of The New York Times’ March 27 edition, a staggering chart illustrated the COVID-19-induced unemployment level in the US. The front page will certainly join the club of the most creative front pages, but it was an alarming attestation of the economic impact of the

coronavirus pandemic.

Many countries, including Sri Lanka, started practicing mobility restrictions from March 2020. As a result, in parallel to the slowdown of global merchandise production, trade volume also contracted from the second quarter of 2020. However, the World Trade Organization (WTO) estimates that the realised trade contraction in 2020 was just 5.3 percent contrary to the April 2020 forecast of a sharp contraction by between 13 percent and 32 percent.

Many countries, including Sri Lanka, started practicing mobility restrictions from March 2020. As a result, in parallel to the slowdown of global merchandise production, trade volume also contracted from the second quarter of 2020. However, the World Trade Organization (WTO) estimates that the realised trade contraction in 2020 was just 5.3 percent contrary to the April 2020 forecast of a sharp contraction by between 13 percent and 32 percent.

Meanwhile, countries used trade policy to ensure that essential food, drugs, and medical equipment are available domestically. In addition, countries like Sri Lanka used trade policy tools to contain imports to allay pressures on the domestic currency.

This article discusses global and Sri Lankan trade during this pandemic, the impact of the pandemic and trade policy on Sri Lanka’s trade and food imports, and policy options for sustained growth in trade and domestic food security.

Global trade recovered more rapidly than expected

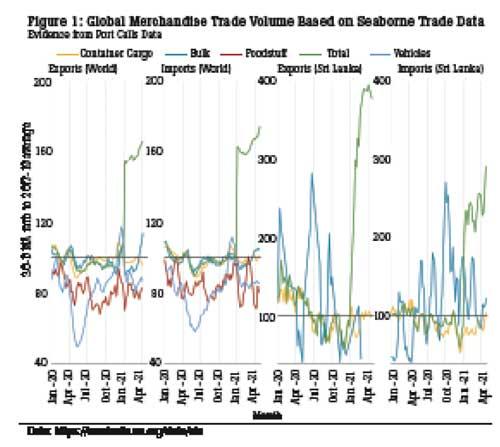

The COVID-19-induced global trade contraction renewed the dialogue on a de-globalising world order. However, new data and estimates show that global trade has rebounded to the level at the beginning of 2019. A novel seaborne trade dataset at daily frequency provides an idea of the movements of trade patterns. (Figure 1)

The trade volume returned to the 2017-2019 average levels by the beginning of 2021 after a sharp plunge in May-2020. Figure (1) also shows the recovery of bulk, container cargo, and total trade indicators for Sri Lanka. A noticeable pandemic-induced plummet in exports is visible around May-June of 2020. Reduced demand and the government’s import restrictions might have caused the contraction in imports. The monthly trade data published by the Central Bank of Sri Lanka also illustrate similar trade patterns.

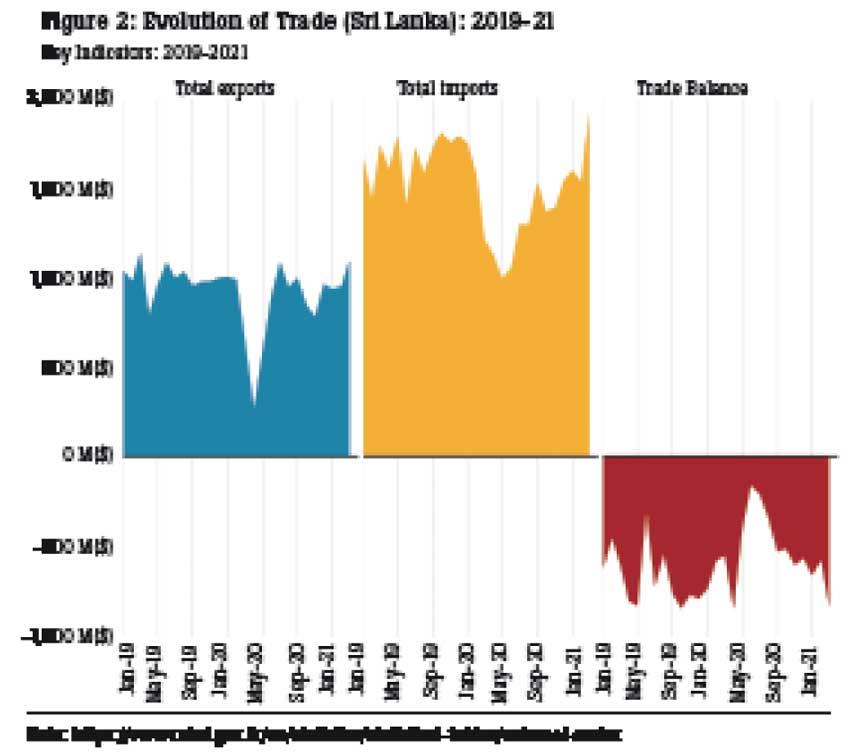

SL’s trade sector recovering but remains below pre-2019 level

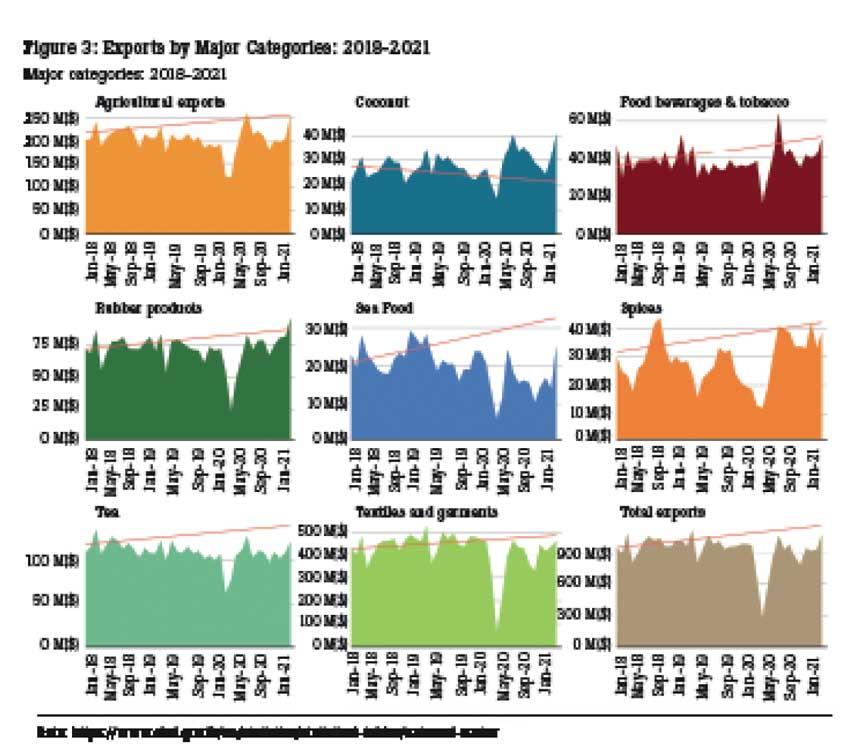

A basic analysis of the trend of exports shows that Sri Lanka is yet to achieve a full recovery to the 2016-2018 trend level (Figure 3). Crucial sectors like textiles and tea exports are still below pre-pandemic levels.

Moreover, Figure 3 shows that some sectors face subsequent plummets after the sharp drop around May 2020. The reason should be the effect of different COVID-19 waves on global demand and domestic supply of merchandise goods. However, the recovery of textiles and agricultural exports, braving the pandemic, is assuring, and credit goes to the management and the workforce. As these sectors are the driving force of Sri Lanka’s exports, it is imperative to fast-track the vaccination of the labour force to ensure sustained trade growth. With the rise of the third wave of COVID-19 in the country, the importance of a fast vaccine roll-out cannot be overemphasised.

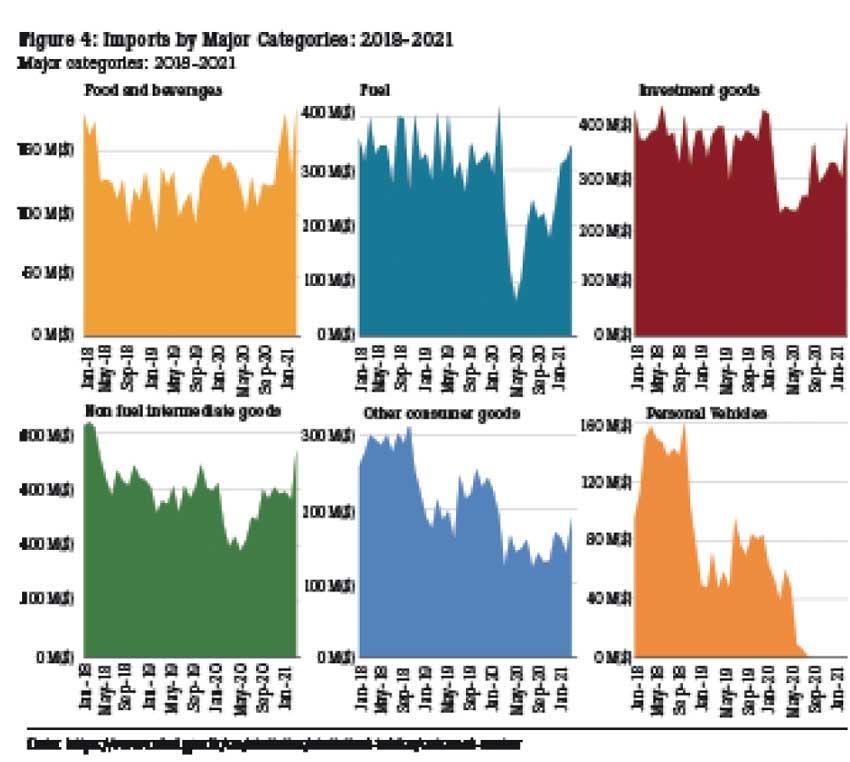

The analysis of import patterns shows that imports are contained below the pre-pandemic level. Imports of vehicles and non-food consumer goods face larger contractions, implying the effect of import control measures. Though these categories can be classified as non-essential goods, the import controls’ effect expands to crucial intermediate goods. Figure (4) shows that non-fuel intermediate goods and investment goods recovered slowly. The picking up of these imports at the beginning of 2021 is promising, but trade policy should encourage further growth.

Continuing import controls and food security

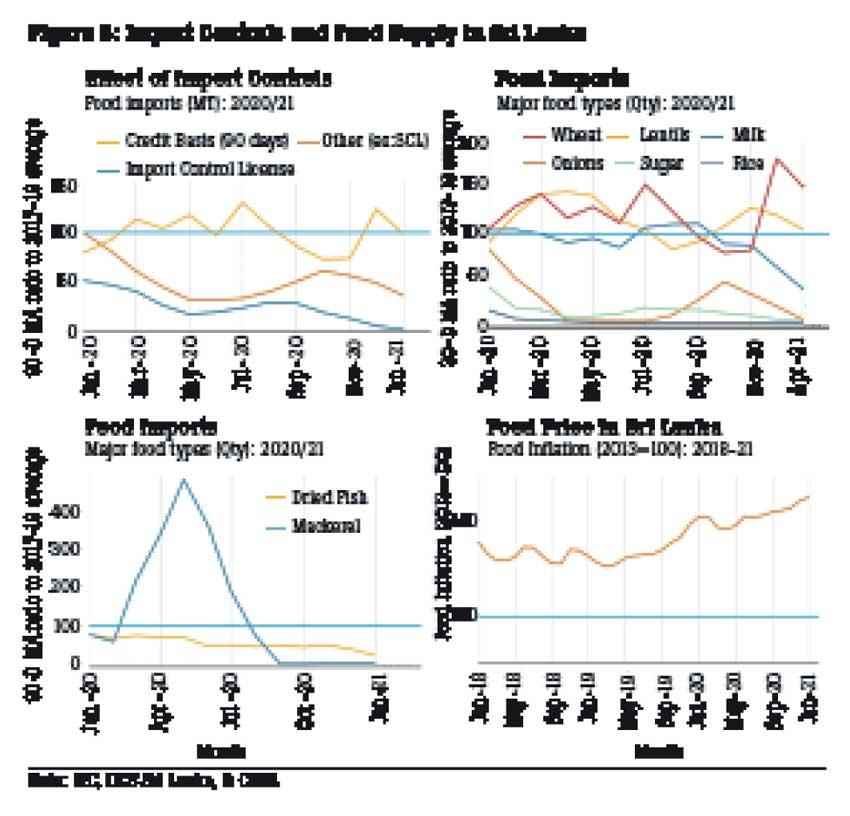

Global food prices are rising though the production prospects are encouraging. In Sri Lanka too, food inflation is on the rise. However, Sri Lanka continues to impose import restrictions on food items. Though the trade value of food and beverages shows that imports recovered to the pre-pandemic level, trade volume data of the top ten imported food commodities show a declining trend (Figure 5).

Imports of food items like onions, sugar, canned fish, and dried fish are below 2017/19 averages. Special commodity levies are being imposed on food commodities periodically. In addition, the credit base requirements are supposed to delay the outflow of foreign currency, though the trade volume data show that credit basis did not affect trade volume

much (Figure 5).

The proposed chemical fertilizer ban should be considered in the context of these restrictive trade policies. Economists predict a significant plunge in rice production if the proposed chemical fertilizer ban forces farmers to use only organic fertilizer. Therefore, a drastic food shortage can be avoided only

through imports.

Lessons learned and way forward

Contrary to the expectations of globalisation critics, global trade is recovering. Sri Lanka’s imports and exports are also picking up. However, the slow recovery of non-fuel intermediate goodsimports, investment goods, and the suppressed imports of essential food commodities require policymakers’ attention.

The rapid export recovery to the pre-pandemic level and continual growth from that point need integration to the global market. Current import controls are inimical to such integration. Though exchange rate crisis is a valid concern from the policymaker’s perspective, the short-term remedies should not be worse than the issue. Backward and forward participation in global value chains will dampen the pressure on domestic currency in

the long run.

In the context of domestic food security, the government will have to re-evaluate existing import controls for two reasons. Firstly, the third wave of COVID-19 may cause substantial income loss for informal sector workers reducing their purchasing power. Food inflation can drag them below the poverty line. Secondly, the ambitious green agriculture policies may create a domestic food shortage if imports do not compensate for production losses in the interim.

(Asanka Wijesinghe is a Research Economist at the Institute of Policy Studies of Sri Lanka (IPS) with research interests in macroeconomic policy, international trade, labour and health economics. He is also interested in the impact of adjustment costs of trade, gravity modelling in trade, econometrics and the trade origins of populist politics. He has undertaken efficiency analyses, particularly public spending efficiency, using parametric and non-parametric efficiency analysis approaches.

Asanka holds a BSc in Agricultural Technology and Management from the University of Peradeniya, an MS in Agribusiness and Applied Economics from North Dakota State University, and an MS and PhD in Agricultural, Environmental and Development Economics from The Ohio State University. His latest research focused on the effect of global trade-induced labour market changes on voting behaviour in recent US elections, including the 2016 presidential election.)

23 Dec 2024 1 hours ago

23 Dec 2024 3 hours ago

23 Dec 2024 6 hours ago

23 Dec 2024 7 hours ago