09 Aug 2021 - {{hitsCtrl.values.hits}}

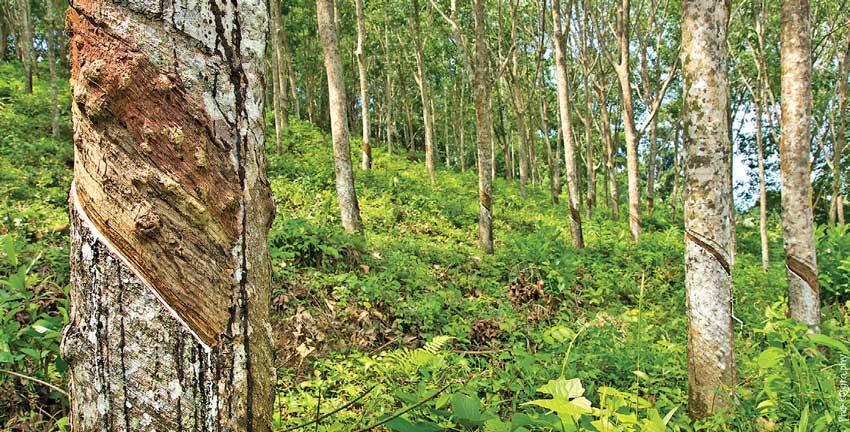

At a time Sri Lanka is in much need of increasing its foreign exchange reserves, the vast untapped potential of the country’s rubber exports industry requires due attention.

At a time Sri Lanka is in much need of increasing its foreign exchange reserves, the vast untapped potential of the country’s rubber exports industry requires due attention.

To place the rubber sector’s foreign exchange earning potential in context, the Export Development Board (EDB) had earlier set a target of US $ 4.4 billion in export earnings for the industry by 2024. This amounts to 4.4 times the value of the last international sovereign bond (of US $ 1 billion) settled by the country recently (in the last week of July 2021).

Furthermore, the rubber industry has potential to increase the country’s export earnings both in the short to medium and the long term.

In the short term, significant increase in prices of rubber offers a time-bound opportunity. During the first half of the year, the Colombo Rubber Auction saw prices doubling, increasing from Rs.300 to over Rs.600 per kilogram.

In the long term, Sri Lanka enjoys a competitive edge in its ability to manufacture grades of rubber, which are not produced by other countries. The unique properties of rubber produced by Sri Lanka (for instance, Sri Lanka is the only producer in the world of Latex Crepe and Sole Crepe grades, which is the purest form of natural rubber) further strengthens the country’s proposition. Furthermore, Sri Lanka is also the largest exporter of industrial solid tyres and the fifth largest exporter of surgical/examination latex gloves in the world, according to the EDB.

However, while the industry has enormous potential, making it a reality is not an easy task. In 2020, Sri Lanka’s export earnings from rubber and rubber products only amounted to US $ 816 million. Hence, achieving the target of earning US $ 4.4 billion through rubber exports by 2024 set by the EDB or perhaps the more feasible target of US $ 3 billion by 2025 given in the Rubber Industry Master Plan (2017 – 2026), requires cohesive action and support by policymakers.

Immediate challenges

At present, the industry is being plagued by two main challenges. These are the scarcity of fertiliser and a fast-spreading new leaf disease affecting rubber plantations.

Given the high rubber prices at present, there is renewed interest among growers to start new and expand existing cultivation, which augurs well for both the industry and the economy. However, difficulties in obtaining suitable fertiliser due to the import ban are hindering these aspirations.

Due to the fertiliser import ban, the industry expects to see a 20 percent drop in production by next year and this adverse impact will continue to increase over the years. If this were to be the case, it would be most unfortunate, since rather than expanding, the industry will contract (or shrink), thereby also reducing its contribution to the economy and to foreign exchange earnings. This would also negatively impact the lives of the large number of individuals (estimated to be around 200,000) linked with the industry in Sri Lanka.

Optimum growth and yields can only be achieved by providing the nutrients required by the rubber plant. Compounding the issue is the fact that Sri Lankan rubber plantations have gone through the cultivation of several generations, which has degraded the fertility levels of the soil. This makes application of fertiliser in correct proportions essential. The rubber growers are required to obtain a site specific fertiliser on the recommendation of the Rubber Research Institute of Sri Lanka (RRISL) based on soil and foliar analysis every three years.

Accordingly, If the RRISL guidelines are adhered, there will be no necessity to apply excess fertiliser to the plant. It is interesting to note that when compared to other crops like vegetables or paddy, the fertiliser and chemical usage in rubber per land area is very low and adverse impact on water sources are very minimal.

In addition to short-term yield reduction, non-application of as per RRI recommendations will retard the growth of the rubber plant and will extend the immature period, which is approximately six years from planting. This would reduce total production from the tree (within its productive lifetime of around 30 years) and hence production of the overall plantation. Besides the above, fertiliser is also required to improve the plant immunity to fight against pest and disease attacks facing Sri Lanka’s rubber plantations.

Today, ‘Pestalotiopsis’, a leaf disease, is having a serious negative impact on local rubber plantations across all rubber growing areas in Sri Lanka. This fungus causes the leaves of rubber trees to fall prematurely. Repeated attacks of this new disease could lead to a crop drop of almost up to 40 percent per annum. Unfortunately, application of certain chemicals to control the disease together with application of additional fertiliser is one of the key recommendations to address this condition. These inputs being unavailable are compounding issues further.

Long-term impact

The scarcity of fertiliser could have a long-term negative impact on the industry as well, beyond the short-term implications.

Rubber replanting is a very important and costly exercise, which is a key requirement in maintaining viability and sustainability of the rubber industry. It is heartening to see the enthusiasm building among the growers with the attractive rubber prices. But, other unfortunate negative factors would diminish it looking at the long-term repercussions forced down on it.

To produce healthy and vigorous rubber plants required for replanting, it is important to apply a special fertiliser mixture to plants every fortnight at the nursery stage. The lack of fertiliser at nurseries could compromise the quality of the plants, thereby having a long-term negative impact on production, as these plants will be used for rubber production for the next 30 years.

Even currently, Sri Lanka lags behind its competitors in terms of yield per hectare. Sri Lanka’s rubber yield per hectare is around half of that of competitors such as India, Vietnam and Thailand. This is due to factors such as the soil of being plantations being degraded by successive cycles of cultivation. Low stand per hectare, lack of income due to unstable rubber prices and high costs hindering replanting and non-use of best agronomic practices are other contributing factors. To increase the sector’s competitiveness in exports, it is important to raise these yields. However, ongoing developments could instead reduce yields further, reducing the ability of our rubber exports to compete in international markets.

Alternative solutions

The RRISL and rubber plantations of the country are already working on numerous initiatives to minimise fertiliser usage. For instance, experiments have been successfully conducted in immature rubber areas to introduce slow release fertilisers by using a porous tube buried around the rubber plant. Thus far it appears that this technique can potentially reduce fertiliser usage dramatically – essentially by half. Such techniques, which also help maximise absorption rate of fertiliser and can save plantations money both in terms of cost of fertiliser and labour and hence would be adopted by plantations if they are viable on a commercial scale.

Such alternatives would significantly lessen the impact of the use of the chemicals on the environment and hence could have a similar impact to replacement of conventional fertiliser with organic substitutes.

Although there were recommendations to use organic fertiliser to improve the physical, chemical and biological properties of soil, most rubber growing areas have shown increase incidence of pest and fungal attacks when organic matter is used. Unfortunately, there are no substitute organic fertiliser at present recommended by the RRISL for use in place of conventional fertiliser for mature areas.

‘White root disease’ (a fungal disease) and cockchafer grub can have a devastating impact on rubber plantations. Adding organic compost provides nourishment for the grub, causing it to grow rapidly. Hence, within the first three years the grub infestations will be aggravated and be destructive on rubber plants destroying the root systems. Moreover, it will affect the growth of the plants as well.

White root disease is even more dangerous and can kill the plants at any stage within a very short time. The causative fungus will show an enhanced growth with the application of organic fertiliser. Non availability of pesticides and fungicides due to current import restrictions has discouraged the estates from using organic/compost materials in the wake these problems faced by the grower.

Industry open to cooperation

While there are many challenges facing the rubber industry, it deserves greater attention, considering both its massive potential as a foreign exchange earner and in uplifting the livelihoods of a significant part of the country’s population. Superior natural properties of locally produced rubber and Sri Lanka’s ability to manufacture grades of rubber not produced by other countries have given the country a competitive advantage. However, this opportunity cannot be fully realised if the short-term and long-term industry challenges, most critically those related to fertiliser, are not addressed.

Industry stakeholders are eager to engage with the authorities and find viable solutions. We are confident that with dialogue, collaboration and cooperation, we can find a solution amenable to all parties, which will elevate the industry to its true potential.

(Manoj Udugampola has over 30 years of experience in the rubber industry. He is the current Vice President of the Rubber Traders’ Association and Chief Operating Officer Rubber of Pussellawa Plantations Ltd. An alumni of the Wayamba University, he holds an MBA and a Postgraduate Diploma in Business Management. He also possesses a Diploma in Plantation Management from the National Institute of Plantation Management)

23 Dec 2024 2 hours ago

23 Dec 2024 3 hours ago

23 Dec 2024 6 hours ago

23 Dec 2024 8 hours ago