21 Oct 2012 - {{hitsCtrl.values.hits}}

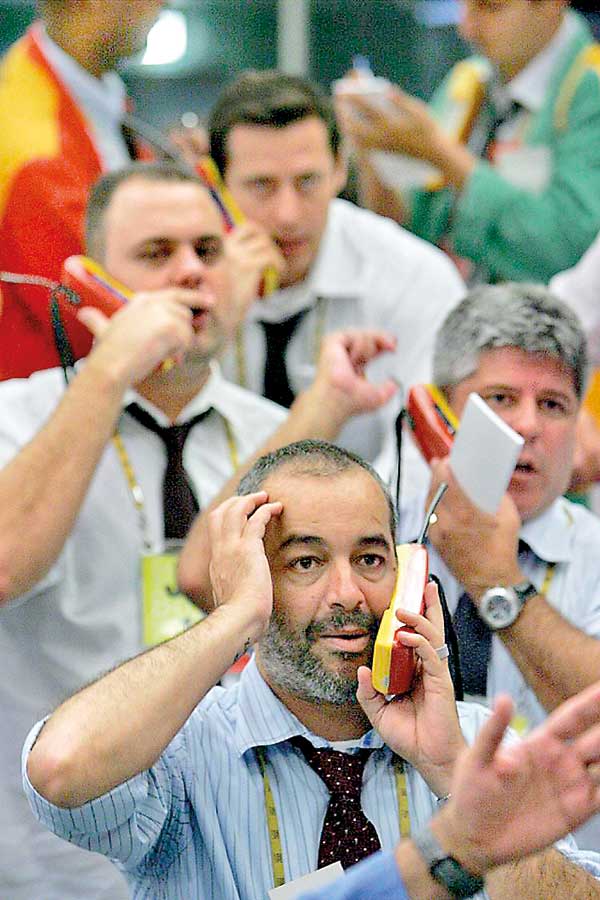

When someone trades a stock, it is for a short period of time, generally between one day and six months. The trader is not looking for the next ‘the company’; they are just looking for a stock that will move up (or down) a few percent quickly.

When someone trades a stock, it is for a short period of time, generally between one day and six months. The trader is not looking for the next ‘the company’; they are just looking for a stock that will move up (or down) a few percent quickly.

26 Nov 2024 43 minute ago

26 Nov 2024 1 hours ago

26 Nov 2024 1 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 3 hours ago