19 Feb 2014 - {{hitsCtrl.values.hits}}

.jpg) Consider this simple question: “Does the present government have a strong commitment to high levels of capital expenditure?” Today in Sri Lanka most analysts tend to answer this question with a confident “yes”.

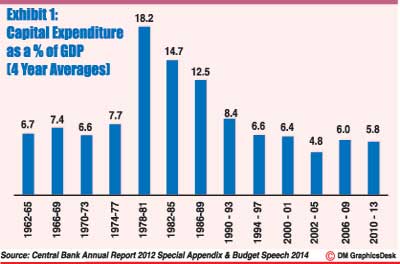

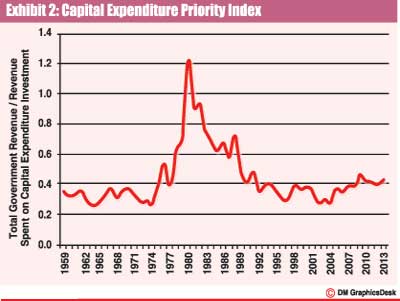

Consider this simple question: “Does the present government have a strong commitment to high levels of capital expenditure?” Today in Sri Lanka most analysts tend to answer this question with a confident “yes”.

|

|

.jpg) above 17 percent in the 1990s.

above 17 percent in the 1990s.

25 Nov 2024 6 hours ago

25 Nov 2024 7 hours ago

25 Nov 2024 7 hours ago

25 Nov 2024 9 hours ago

25 Nov 2024 25 Nov 2024