16 Oct 2013 - {{hitsCtrl.values.hits}}

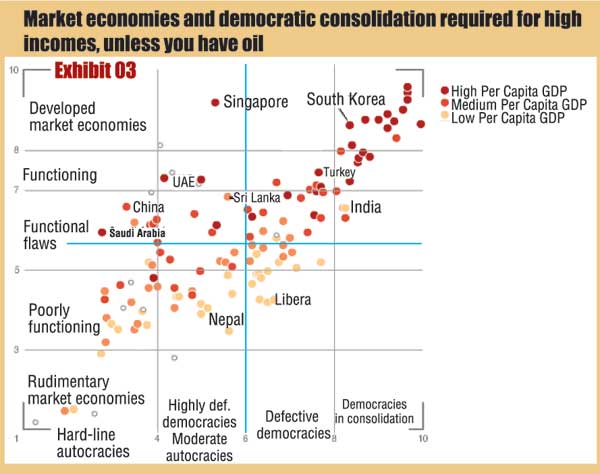

.jpg) On April 13, 2013, the Central Bank launched its Annual Report for 2012. The governor’s speech exploded in the news over the attention he drew to avoiding the ‘middle income trap’. The concern may have been a little premature – the phenomenon concerns countries that are beyond the US $ 4,000 per capita mark and on current trends, Sri Lanka will not get there till 2026 (projecting optimistically on, annually: 7.5 percent growth, 4 percent slide of the rupee against the dollar and population growth of just under 1 percent) – but there is nothing wrong with looking ahead.

On April 13, 2013, the Central Bank launched its Annual Report for 2012. The governor’s speech exploded in the news over the attention he drew to avoiding the ‘middle income trap’. The concern may have been a little premature – the phenomenon concerns countries that are beyond the US $ 4,000 per capita mark and on current trends, Sri Lanka will not get there till 2026 (projecting optimistically on, annually: 7.5 percent growth, 4 percent slide of the rupee against the dollar and population growth of just under 1 percent) – but there is nothing wrong with looking ahead.

26 Nov 2024 4 minute ago

26 Nov 2024 8 minute ago

25 Nov 2024 25 Nov 2024

25 Nov 2024 25 Nov 2024

25 Nov 2024 25 Nov 2024