18 Dec 2013 - {{hitsCtrl.values.hits}}

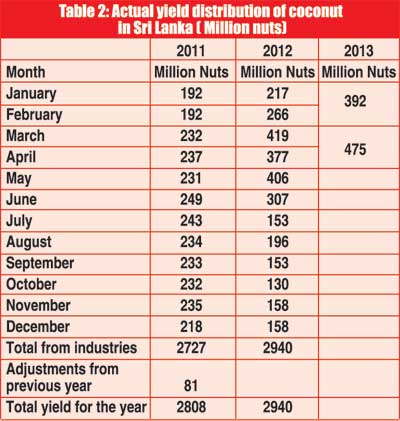

.jpg) Sri Lanka’s coconut production during the year 2010 fell down by 536 million nuts Year-on-Year to stand at 2317 million nuts, marking the lowest annual production recorded in nearly 15 years.

Sri Lanka’s coconut production during the year 2010 fell down by 536 million nuts Year-on-Year to stand at 2317 million nuts, marking the lowest annual production recorded in nearly 15 years.

It's not as simple as just planting more trees. An article from the FAO stressed that "technical and financial assistance would be needed" to plant the estimated 1.1 million acres in Indonesia alone, while producers — mostly small-scale farmers — are looking for ways to improve yield, including using hybrid varieties of seeds.

It's not as simple as just planting more trees. An article from the FAO stressed that "technical and financial assistance would be needed" to plant the estimated 1.1 million acres in Indonesia alone, while producers — mostly small-scale farmers — are looking for ways to improve yield, including using hybrid varieties of seeds. What are the causes of the secular decline in coconut production? First of all it must be realized that the bulk of coconut production (about 75 percent) are produced in home gardens. Productivity is quite high on some of these garden plots but the capacity to increase production is limited by space, lack of high yielding plants and an inadequate thrust in promoting such production. Coconut production has declined owing to the felling of coconut trees for housing and industrial uses. The land area under cultivation has declined from around 444,000 hectares to about 360,000 hectares between 2000 and 2010. Most of the coconut area lost has been in the Kurunegala, Gampaha and Puttalam districts. There has been an increase in the cultivated areas in Badulla, Moneragala and Sabaragamuwa, but the extent of new cultivation has been inadequate to offset the area lost. This shrinkage in area cultivated is undoubtedly a prime cause for the reduction in coconut output. The lower relative profitability of coconut in comparison to other land uses have been a reason for coconut lands being put to other uses.

What are the causes of the secular decline in coconut production? First of all it must be realized that the bulk of coconut production (about 75 percent) are produced in home gardens. Productivity is quite high on some of these garden plots but the capacity to increase production is limited by space, lack of high yielding plants and an inadequate thrust in promoting such production. Coconut production has declined owing to the felling of coconut trees for housing and industrial uses. The land area under cultivation has declined from around 444,000 hectares to about 360,000 hectares between 2000 and 2010. Most of the coconut area lost has been in the Kurunegala, Gampaha and Puttalam districts. There has been an increase in the cultivated areas in Badulla, Moneragala and Sabaragamuwa, but the extent of new cultivation has been inadequate to offset the area lost. This shrinkage in area cultivated is undoubtedly a prime cause for the reduction in coconut output. The lower relative profitability of coconut in comparison to other land uses have been a reason for coconut lands being put to other uses. incentive for increasing fertilizer use, improvement of soil conditions and replanting. The import of coconut is therefore not in the interests of increasing production and productivity in coconut.

incentive for increasing fertilizer use, improvement of soil conditions and replanting. The import of coconut is therefore not in the interests of increasing production and productivity in coconut.

25 Nov 2024 8 hours ago

25 Nov 2024 9 hours ago

25 Nov 2024 9 hours ago

25 Nov 2024 25 Nov 2024

25 Nov 2024 25 Nov 2024