21 Aug 2013 - {{hitsCtrl.values.hits}}

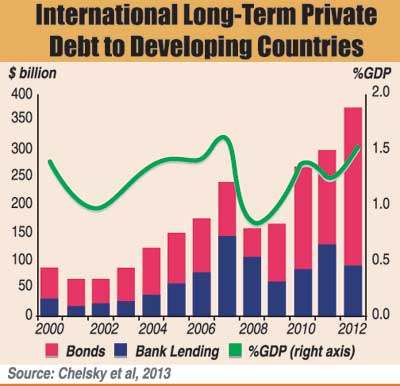

International long-term private finance to developing countries has changed dramatically in the wake of the global financial crisis. Caught in “post-crisis blues”, as my World Bank colleagues Jeff Chelsky, Claire Morel and Mabruk Kabir called it in a recent Economic Premise, some traditional sources of long-term finance are strained, and alternatives have not been able to adequately compensate. Private financing of infrastructure has been particularly hurt.

International long-term private finance to developing countries has changed dramatically in the wake of the global financial crisis. Caught in “post-crisis blues”, as my World Bank colleagues Jeff Chelsky, Claire Morel and Mabruk Kabir called it in a recent Economic Premise, some traditional sources of long-term finance are strained, and alternatives have not been able to adequately compensate. Private financing of infrastructure has been particularly hurt. “(…) institutional investors with long-term liabilities – such as pension funds, insurers, and sovereign wealth funds – may be called upon to assume a greater role in funding long-term assets. (…) local-currency bond markets – and, more generally, domestic capital markets – in emerging economies must be explored further, in order to lengthen the tenure of financial flows”

“(…) institutional investors with long-term liabilities – such as pension funds, insurers, and sovereign wealth funds – may be called upon to assume a greater role in funding long-term assets. (…) local-currency bond markets – and, more generally, domestic capital markets – in emerging economies must be explored further, in order to lengthen the tenure of financial flows”

26 Nov 2024 14 minute ago

26 Nov 2024 27 minute ago

26 Nov 2024 1 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 2 hours ago