18 Jul 2014 - {{hitsCtrl.values.hits}}

Very often, when discussing tourism and its performance, the focus is on occupancy and room rates. Certainly, these two indices are the most important aspects to monitor the tourism and hospitality sector, which give a good indication of how the industry is performing. However, over and above this, there are several other interesting statistics that one can explore, to give a broader perspective of the tourism industry in Sri Lanka.

Very often, when discussing tourism and its performance, the focus is on occupancy and room rates. Certainly, these two indices are the most important aspects to monitor the tourism and hospitality sector, which give a good indication of how the industry is performing. However, over and above this, there are several other interesting statistics that one can explore, to give a broader perspective of the tourism industry in Sri Lanka.

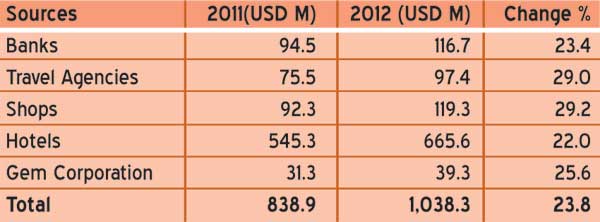

However, it is a common knowledge that the value-added component in the tourism industry is high and in the order of about 75 percent to 80 percent, while that of the apparel industry can be much lower (50 percent). Hence, if one were to discount for this factor, tourism could well then be rated as the second largest forex earning industry of the country.

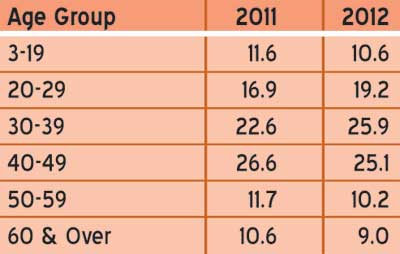

However, it is a common knowledge that the value-added component in the tourism industry is high and in the order of about 75 percent to 80 percent, while that of the apparel industry can be much lower (50 percent). Hence, if one were to discount for this factor, tourism could well then be rated as the second largest forex earning industry of the country. The largest component of about 51 percent is in the age group of 30 to 49 years. Hence, obviously, the appeal of Sri Lanka for more ‘senior citizens’ (50 years and over) is relatively less.

The largest component of about 51 percent is in the age group of 30 to 49 years. Hence, obviously, the appeal of Sri Lanka for more ‘senior citizens’ (50 years and over) is relatively less..jpg) The dramatic increase in inter-regional flights, fuelled by the Middle East carriers offering good connections to Europe has been a major factor for this drop in charter airlines operation to Sri Lanka.

The dramatic increase in inter-regional flights, fuelled by the Middle East carriers offering good connections to Europe has been a major factor for this drop in charter airlines operation to Sri Lanka.

25 Nov 2024 2 hours ago

25 Nov 2024 2 hours ago

25 Nov 2024 2 hours ago

25 Nov 2024 3 hours ago

25 Nov 2024 4 hours ago