29 Apr 2013 - {{hitsCtrl.values.hits}}

.jpg) Rubber industry analysts have said some time ago that, natural rubber (NR) prices are likely to take a dip after 2012 due to the acceleration in normal production on account of massive new planting undertaken across the major natural producing countries of the world during 2005-08. This effect, however, will taper off after 2020.

Rubber industry analysts have said some time ago that, natural rubber (NR) prices are likely to take a dip after 2012 due to the acceleration in normal production on account of massive new planting undertaken across the major natural producing countries of the world during 2005-08. This effect, however, will taper off after 2020. New planting

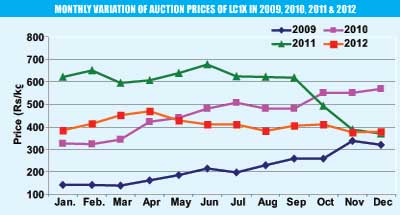

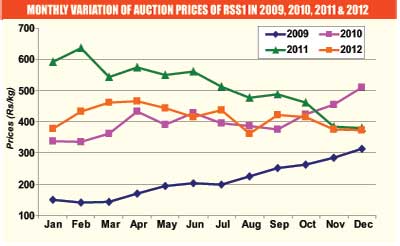

New planting Sharp fluctuations in commodity prices, which are not unique to rubber (See figures 1 & 2), are creating significant business challenges that can affect virtually everything from production costs and product pricing to earnings and credit availability.

Sharp fluctuations in commodity prices, which are not unique to rubber (See figures 1 & 2), are creating significant business challenges that can affect virtually everything from production costs and product pricing to earnings and credit availability.

26 Nov 2024 4 minute ago

26 Nov 2024 2 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 3 hours ago