01 Apr 2014 - {{hitsCtrl.values.hits}}

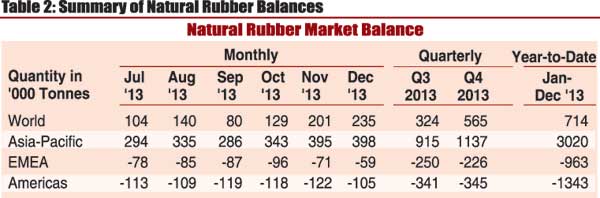

.jpg) A recent report released (March) by the International Rubber Study Group (IRSG) indicates that the stock balance of the global natural rubber industry at the end of 2013, specifically that of the Asia Pacific region, is in a position of production exceeding that of consumption by 3,020,000 tonnes, which may be a worrying factor to the producers in terms of natural rubber (NR) prices in the immediate future.

A recent report released (March) by the International Rubber Study Group (IRSG) indicates that the stock balance of the global natural rubber industry at the end of 2013, specifically that of the Asia Pacific region, is in a position of production exceeding that of consumption by 3,020,000 tonnes, which may be a worrying factor to the producers in terms of natural rubber (NR) prices in the immediate future.

25 Nov 2024 3 hours ago

25 Nov 2024 4 hours ago

25 Nov 2024 4 hours ago

25 Nov 2024 6 hours ago

25 Nov 2024 6 hours ago