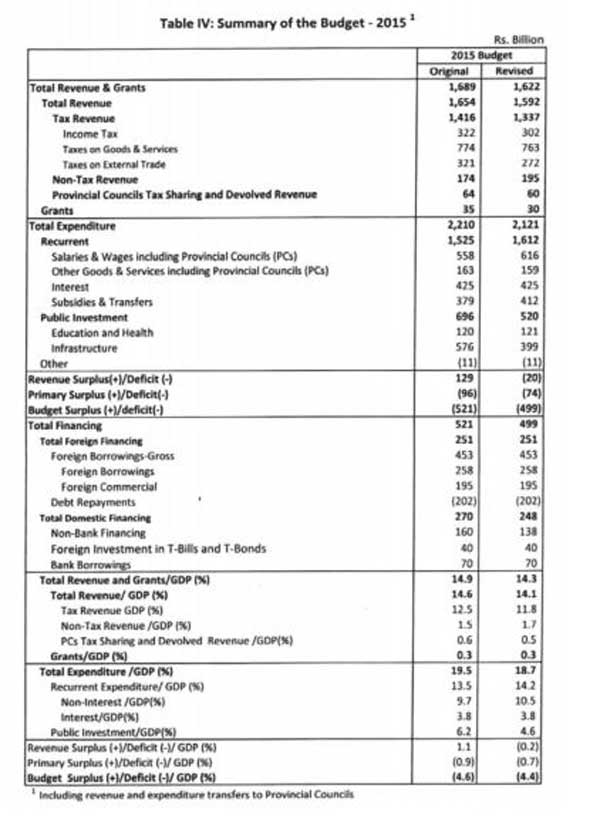

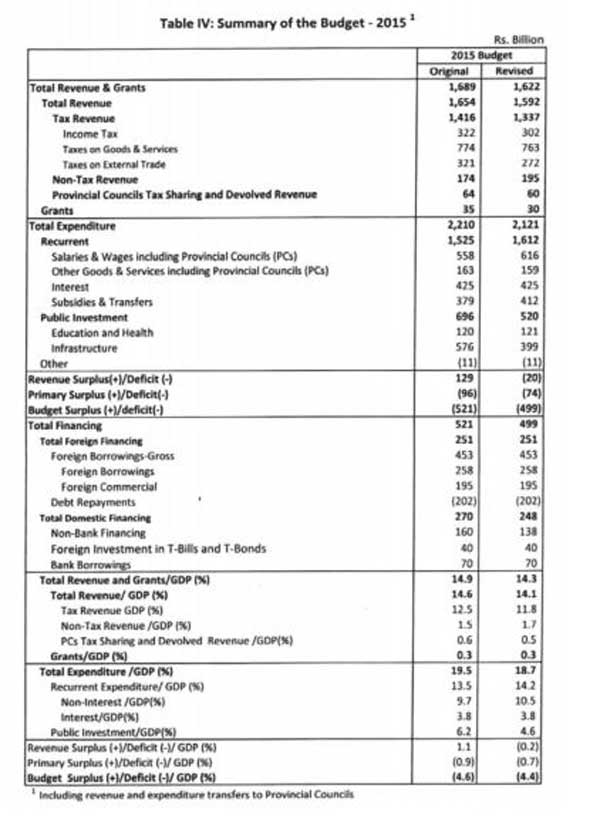

4.1 The original Budget 2015 expected a total revenue of Rs.1,594 billion, which consisted of Rs.1,400 billion of tax revenue and Rs.194 billion of nontax revenue. Total expenditure and net lending was Rs.2,990 billion of which recurrent expenditure was Rs.1,465 billion and capital expenditure and net lending was Rs.685 billion. The estimated deficit in Budget 2015 was Rs.521 billion or 4.6 percent of gross domestic product (GDP).

4.2 I should say that this deficit is related only to government revenue and expenditures. However, we have repeatedly shown to this Parliament and discussed even outside Parliament over the past several years that this deficit does not reflect the real burden of the public finances of the country today as it does not take into account many budgetary operations of the government.

4.3 This façade of duplicity has to be removed and the actual position has to be made known to the Members of Parliament and the public. We do not intend to mislead neither the Members of Parliament nor the public in our endeavour to ensure good governance.

4.4 Some of the critical issues, where public debt is not adequately presented, are listed below.

a. This deficit does not reflect by any means the contingent liabilities that the country has incurred over the past few years. The government has given Rs.524 billion as Treasury Guarantees by the end of 2014, which mainly include guarantees given to commercial banks to i mplement i nfrastructure developments projects by state-owned enterprises (SOEs) (Annex I). If these liabilities are not honoured by the relevant SOEs, the government will have to pay them.

b. The outstanding debt of SOEs to the banking system of Rs.593 billion as at end-2014 also to be reflected in these numbers. This also includes the impact of US $ 60 million or Rs.7.8 billion of the Hedging Transaction of Ceylon Petroleum Corporation (CPC), which has already been paid. It has been estimated that the total loss to the government due to the Hedging Transaction could be about US $ 120 million (Rs.15.7 billion). This could be one of the most obnoxious transactions ever recorded in the history of commercial operations in Sri Lanka with the end result adversely impacting the people.

c. The government budget deficit also does not include foreign borrowings made by SOEs for i nfrastructure projects. The t otal outstanding of these borrowings as at end-2014 was US $ 2,356 million or Rs.308 billion. These have been borrowed to finance the Puttalam Coal Power Project, Hambantota Port Development Project and Mattala International Airport Project (Annex II).

4.5 If we add the Treasury Guarantees, SOEs debt to the banking system and the amount of foreign borrowings for the projects implemented by SOEs, the budget deficit could have been much higher than the published numbers.

4.6 Now you could observe the magnitude of the deficit that we have inherited from the previous regime. This is the unhealthy legacy of the previous government which we have had to inherit and from where we have to commence our journey.

4.7 A few more years of such practices would have made our country a contender t o be labelled as an economically failed nation. Once again I wish to thank all those who made this ‘change’ possible as if not, our great nation also would have ended up as a ‘banana republic’ where the economies had been ripped apart and pillaged by corrupt rulers.

4.8 According to the provisional data, the outstanding debt of the government as at end-2014 was Rs.7,373 billion. This reflects a per capita debt of Rs.357,233. However, if we i nclude t he t hree items that I indicated above, the total debt will increase to Rs.8,817 billion. Naturally, the per capita debt will also increase to about Rs.427,220. Again, you can see the magnitude of the burden that has been created by the previous government on t he people of t his country.

4.9 I should emphasize the fact that all these debts will have to be paid by the innocent people in this country, not only the present generation but generations to come. We are proud of our legacy as a country with a history of over 2500 years but how could we be proud of the legacy of debt created by the last government? The question also arises as to whether it was necessary and prudent? The previous rulers should be ashamed of the manner in which the monetary issues had been handled where generations will be called upon to pay back debt sought at the whims and fancies of a selected few.

4.10 As a percent of GDP, the total ‘government’ debt as at end- 2014 will be about 74.4 percent. This level of debt is still high in international standards. With the three items that I indicated above, total debt to GDP ratio will further increase to 88.9 percent.

4.11 The majority of the allocations in the government budget were mainly confined to a few under the previous regime. However, in the revisions that we have made to the Appropriation Bill for fiscal year 2015, we have taken measures to rectify this.

4.12 All these incidents indicate the need for strong and innovative measures in the future to avoid the repetition of such things and reduce the budget deficit and outstanding debt of the country.

4.13 Before I present our new proposals, I would like to indicate two key factors i.e. economic growth and nominal wages and the debt repayment burden.

05. Economic growth and nominal wages

5.1 We know that Sri Lanka is currently identified as an economy with relatively higher economic growth among the emerging market economies and characterized by low levels of inflation and unemployment.

5.2 This century had provided enormous opportunity for countries in the Asian region to grow, overtaking the western world as the key economic drivers of the world. Giant strides made by China and India have shown the world the ability of Asian countries to move up and we should critically analyse whether Sri Lanka should have reached a better standing based on our potential as a nation with a literacy rate of over 90 percent, the highest in the Asian region. It should not only be highways, air and sea ports and a host of buildings that constitute growth and stability that could be sustained. What is the status of agriculture, industry, services and industry-related exports?

The norm is that within an overall development plan, there should be provisions for road networks and other infrastructure requirements. There was no such development plans and ad hoc projects had been formulated, once again at the whims and fancies of a selected few jeopardizing the country’s economy. Focus of attention to develop selected townships to glorify and promote political dynasties drained the economy almost beyond remedial options.

5.3 Sri Lanka’s annual real economic growth averages around 7 percent during the last three years, while it expanded by around 15 percent annually in nominal terms during the same period. This has resulted in a substantial growth in per capita income, which was estimated to be about US $ 3,646 or Rs.477,600 in 2014, which is comparable to middle-income economy levels according to international classifications.

5.4 However, the growth in national income in nominal terms has not reflected the improvements in standard of living of every citizen.

We have to look at an average citizen and observe whether he had reached the level of prosperity the per capita income depicts. If not there is a missing link. This government will ensure, as our Prime Minister had often stated, that we would bring about an economy where the pockets of all citizens will be filled without limiting the benefits to a dynastically privileged few. We do not believe in the prosperity of a few families and a selected few but glad tidings for all stakeholders i.e. all citizens of mother Lanka.

5.5 Some nominal wages have increased at a lower rate than the others. For instance, public sector nominal wages have increased by less than 10 percent on average during the last two years and once it is adjusted for inflation, the annual growth in real wages is about 5 percent, which may not reflect sizable improvement in the purchasing power of the households. In addition, real wage may have deteriorated for some segments in the labour market.

5.6 This situation warrants some adjustment in both wage level and price level. With the salary increase of Rs.10,000 per month within the Hundred Day Revolutionary Programme of which Rs.5,000 will be increased from February 2015 and the balance by June 2015, the nominal wage growth of government employees is estimated to increase by about 47 percent in 2015 compared to 2014.The real wage growth also will increase by 40 percent in 2015 compared to the previous year under the low inflationary situation.

5.7 With the reduction of prices of identified goods and services, the positive impact on household real incomes may be higher for all households. As such the future prospects for all Sri Lankans will be enhanced within a framework of good governance and equal opportunity.

06. Debt repayment burden

6.1 We know that the debt service payments create a huge pressure on government budgetary operations. In 2015 alone, the interest payments amount to Rs.425 billion and debt repayments amount to Rs.840 billion, making a total debt service of Rs.1,265 billion.

6.2 This will be about 77 percent of the revenue in the revised Budget for 2015. This has significantly limited the space in the budget to provide many essential services to the public. I would like to highlight followings in terms of debt repayments;

a. The debt repayment to bilateral and multilateral agencies as well as on commercial borrowings and export credit will be US $ 1,394 million in 2015. Total debt repayments related to these sources will be about US $ 8,461 million in the next five years. This includes the repayment of international sovereign bonds, which amounted to US $ 5,000 million by end-2014, in which a substantial amount will be maturing during the 2015-2020 period.

b. The foreign investments in Treasury bills and bonds will be gradually retired and there could be premature sales of outstanding foreign investment in government securities amidst rising yields in international capital markets.

c. The majority of recent loans obtained for large-scale projects may start repayment this year onwards after the initial grace period which is about three to four years on average.

d. We still have to pay defence-related loans of US $ 15 million to suppliers. In addition, there will be hedging transaction related payments, which we are still unaware of t he exact magnitudes. 6.3 These debt repayments will amount to substantial sums in aggregate terms increasing the foreign currency outflows over the coming years. As such, the burden of meeting debt repayment requirements in the short-term may fall on the level of international reserves. The interest rates of t he foreign borrowings made in the last few years are given in Annex III.

6.4 This again depicts how vulnerable we are today as a country and more critically the precarious status of the national economy. Hence, there is a strong need to increase export earnings and reduce short-term debt obligations with longer tenure debt to ease the pressure on fiscal operations as well as external sector stability.

07. Expenditure proposals

7.1 Today’s statement could be termed as one of the most important exercises of the Hundred Day Revolution. For me, I would call it the ‘Hundred Day Challenge’. The planned benefits to the people of Sri Lanka that we envisaged went beyond the contents of the ‘Hundred Day Programme’ promised during the election campaign. 7.2 The outflows had to be matched with adequate revenue proposals to ensure that we do not increase the debt burden. The excessive expenditure based dynastic image building, coupled with wanton waste that was prevalent, as provided in the original budget, made life easier for the team that formulated this most valuable statement.

7.3 Speaker, Members of the Parliament, the people of Sri Lanka who went through a period of untold hardships during the last decade, due to the spiralling cost of living, will be in for a pleasant surprise. We are positively focused on easing the burden on the poorer strata of the society. They are also stakeholders of our nation. The time has come for the rich and the super-rich to make a telling contribution towards nation building. As we are well aware, certain individuals and organisations did receive concessions beyond reasonable yardsticks from the previous regime to garner profits excessive and extraordinary.

7.4 As I indicated earlier, the number of ministers has reduced to 31 from 71 in the previous regime. This measure alone will help us to save about Rs.2,500 million annually, which can be utilized for much more productive purposes.

7.5 It also signifies the level of resources that the previous regime has wasted for mere political intentions. This is the difference between them and us, who are focused about the wellbeing of the people of this country.

Public sector salary revision

7.6 Now I would like to formerly announce one of our major proposals within the Hundred Day Revolution. We promised the public servants in the country that we will increase their salaries by Rs.10,000 per month and initially Rs.5,000 will be provided in February 2015.

7.7 I am happy to say that all permanent public servants of over 1.3 million got Rs.3,000 in January and will get their February salary by Rs.5,000 and will get the balance in June 2015 thus honouring the promise given by us.

7.8 Speaker, this revision may be recorded as the highest ever salary increase granted to public servants of Sri Lanka. It is a special privilege for me to propose this increase to public servants the vanguard of administration of our nation.

7.9 I call upon the unions, public servants and all stakeholders of the public sector to improve the productivity to be on par with the standards in the Asian region.

Private sector wages and salaries

7.10 I wish to make an earnest request and a humble appeal to all private sector employers to assist the government in national reconciliation by ensuring compliance. Such a positive endeavour I am sure will create a vital impact on narrowing and hopefully eradicating the gap between the haves and the have-nots. Human capital is the most important tool and the best asset in your company. Therefore, let us have a contended workforce which will help increase the productivity and have a pleasant working environment.

7.11 We understand the great difficulties that the private sector undergoing. However, considering the input cost reduction especially on energy, we urge the private sector to consider an increase of Rs.2,500 per employee per month, linking to productivity. Furthermore, the employer may utilize any value arising out of non-cash benefits such as provision of food cost as a part of proposed increase. The contribution made by private sector employees also needs to be mentioned in glowing terms and hopefully the employers will ensure a positive outcome. It is the most opportune period for the engine of growth, the private sector of the country, to prime up their human resource, the life blood of their institutions.

7.12 The new government is working to get the GSP+ facility back. I am happy to say that the Prime Minister and the External Affairs Minister are working seriously on this matter. The country has enjoyed this concession for several years and it has undoubtedly assisted country’s industrial exports. Unfortunately, the previous government did not look at this positively and we, as a country, had to suffer a lot.

7.13 The loss of this facility has resulted in a loss of about US $ 5,000 million in the past seven years. Not only that, the number of job opportunities lost is countless and even today, many people are suffering from the loss of their jobs due to the removal of this facility, which has resulted in lost incomes and employment thereby driving them in to poverty.

7.14 It was also a serious setback i n the export side, which had serious implications on the trade balance, Balance of Payments and external reserves.

7.15 Our plan is to set up new factories and restart the factories which were shut down during last many years with the renewal of the GSP+ facility. The private sector will get a huge boost due to this.

7.16 Speaker, at this very moment, the European Union (EU) has suspended the import of fish and fishery products from Sri Lanka, which became effective from January 15, 2015.

7.17 Although the EU allowed Sri Lanka to address the concerns by implementing international maritime law obligations and putting in place an efficient vessel monitoring system and a sanction scheme for deep sea fleets three months before this import ban came into effect, the previous government did not take it seriously and hence did not take any effective measures regarding this.

7.18 However, as this is an important issue which is particularly linked with our fishing community and fish exporters, we as a responsible government are taking every possible measure to get this ban removed and resume fish exports to the EU. Once resumed, it will provide many new opportunities to the private

sector to enhance their activities in the lagging regions.Revision of pensions

7.19 The retired public servants of Mother Lanka had contributed i mmensely towards the betterment of the country and it is time that they are provided with just means during retirement.

7.20 As such, we propose to increase the amount of pensions for retirees of the public service since we are very concerned about their wellbeing. I would like to propose that they will receive an additional Rs.1,000 in their monthly pension from April 2015. About 550,000 pensioners will benefit from this revision of pensions and we will have to incur an additional Rs.4,900 million on this proposal.

Samurdhi welfare scheme - Enhancement of Samurdhi allowance

7.21 From the i nception, t here was no proper scheme to identify the desired beneficiaries of the Samurdhi system. A comprehensive survey would be undertaken to i dentify t he needy segments of the society. The future payments of the Samurdhi allowance would be carried out through a more efficient method to facilitate t he minimization of an expenditure outlay of over Rs.10 billion per annum, an enormous administrative expense entailed with the programme.

7.22 Samurdhi beneficiaries will be granted enhanced monthly payments with an increase of 200 percent with effect from April 2015, as per the commitment enumerated within the Hundred Day Revolution.

7.23 Samurdhi/Divi Neguma banks will be integrated with Regional Development Bank in order to enhance access to finance in the rural areas.

Concessionary fixed deposit interest rates for senior citizens

7.24 We know the low interest rates in the market have created serious repercussions to the senior citizens in the country. There is a significant number of senior citizens who sustain themselves with the monthly interest income t hat t hey receive on t heir deposits. As we were much concerned about them, we made a commitment to increase the interest rates on their deposits under t he Hundred Day Revolution.

7.25 I am happy to announce that the senior citizens will be receiving a higher interest rate of 15 percent per annum for their savings up to a maximum level of Rs.1 million for funds deposited in commercial banks.

A healthy motherhood - Assistance to maintain health standards

7.26 A nutritious and healthy society is an asset to a country especially when the issue relates to motherhood. However, the level of nutrition among the lowincome earning pregnant mothers is much lower than the affluent and the middle-class strata of the population in the country.

7.27 Assistance will be given through an electronic teller card banking system and the grant will be disbursed over a period of two years. The extended time period will ensure that disbursed funds will be rationally utilized for the purpose intended. We will seek the assistance of the Children’s Affairs Minister to guide and assist the officials in guaranteeing that the beneficiaries will receive all benefits expected relating to the grant. This grant will be focused on the welfare of the new born children and mothers.

7.28 In order to ensure the children who will be born to such mothers are healthy, we promised to provide an allowance of Rs.20,000 for pregnant mothers to supplement their nourishment under the Hundred Day Revolution.

7.29 In order to ensure that Rs.20,000 is not utilized in an irrational manner, a method of utilizing the funds would be communicated through a circular.

Waiver of advances granted to farmers

7.30 As an agriculture-based nation, we will never forget the valuable contribution made by farmers to foster the economy. We have reliable information that they borrow from many sources, particularly from banks by pawning their valuables, to undertake their agricultural activities. We know that in the recent past, they had to undergo many difficulties as their crops were damaged as a result of natural disasters and hence, many of them were unable to repay their loans to the banks.

7.31 We are concerned about these farmers who were not able t o repay t heir borrowings to the banks. That is why we propose to provide relief to them under our Hundred Day Revolution. I am pleased to announce that as a relief measure, a 50 percent waiver will be provided for a maximum loan capital of Rs.100,000 on the loans advanced to farmers by commercial banks and presently overdue. This will cost Rs.2,500 million to the government budget.

Guaranteed prices to boost agricultural economy

7.32 The provision of a guaranteed price for selected items is also considered an important measure to further energize the farmers. This would reduce the uncertainty of those who are involved in respective fields. Accordingly, the following guaranteed price structure will be implemented.

a. The guaranteed purchase price of paddy will be increased to Rs.50 per kilogram. commencing from the 2015 Maha season. Depending on the variety, moisture contain and the quality, paddy will be graded. Stringent purchasing procedures will be implemented to avoid corruption and misuse which is the foremost intention of the government.

b. The guaranteed purchase price of potatoes will be increased to Rs.80 per kilogram. commencing from the next harvest.

c. The guaranteed purchase price of tea leaves will be increased to Rs.80 per kilogram.

d. The guaranteed purchase price of rubber to be Rs.350 per kilogram. The guaranteed price scheme for tea leaves and Rubber will be implemented subject to a comprehensive evaluation of the industry within a short span of time. This process will facilitate the origination of a suitable mechanism to introduce the proposed guaranteed purchase prices listed above.

Hand tractors at concessionary prices

7.33 A concerted effort will be made by our government to reduce the price of hand tractors for the use of farming community i n a focused effort t o upgrade t he agriculture sector. A comprehensive evaluation of t he present tax and other cost factors will be taken into account in arriving at a feasible price. Hand tractors offered to the farmers at a lower price would not only make them efficient but also promote the concept of mechanization of agriculture.

7.34 We are also happy to state that the fertilizer subsidy will continue. However, the quality of fertilizer will be upgraded to meet international standards. We will be socially responsible unlike the previous regime, which contributed to the CKD.

7.35 We will be consulting t he farmer community and relevant cooperative societies for t he best technology and financing terms to the farmer community.

7.36 Our President Maithripala Sirisena hails from a farming commun