04 Dec 2014 - {{hitsCtrl.values.hits}}

NR market is on a slow track mainly on account of a lull in demand across the globe, after the historic boom in the beginning of this decade.

The crucial question now is: Will NR prices bounce back or go down further? Projections of the supply-demand scenario are not all that encouraging to spell an immediate boom in the market.

Former Secretary General of IRSG, predicted that natural rubber prices will decline to the levels of around US$ 2.50 for the next few years and then further down to around US$2.00 afterwards. According to him, prices will improve only towards the end of the current decade.

.jpg)

The bull run of natural rubber prices, witnessed in the latter half of the last decade, peaking as much as around US$5 in 2011, is apparently on hold if the current price trends are any indication. Though the situation is not alarming as such, especially as the price is still somewhat fair at around US$2.25 – 2.50, what really worries both the growers and consumers alike is the future behaviour of the price spiral.

Most of the recent industry forecasts indicate a slow recovery of the European and US economies and a somewhat slackening of the economic growth in emerging economies like China and India. Vehicle sales are also down in most of the economies, both in the developed and the developing ones, which means that the demand for NR from tyre and auto components industry that consume the lion’s share of NR supply will come down with its tell-tale impact on NR consumption.

So the question of an imminent bounce back of NR prices is ruled out at least during 2014/2015. But the forecasts are vague as to what extent the prices will bounce back in 2016, if all it happens.According to market analysts, unless and until the EU and US economies recover fully, NR consumption cannot be expected to be back on a fast track due to the sheer fact that they still continue to be the biggest markets.

DEMAND - SUPPLY

Now, let us just have a glance at some of the facts and figures. In 2012, world NR production was 11.607 million tonnes registering an increase of 3.6 percent from 2011. In 2013, production was 12.079 million tonnes registering an increase of 4.0% and up to September 2014, it touched 8.725 million tones.

Meanwhile, NR consumption which was around 11.08 million tonnes in 2012, touched 11.344 million tonnes in 2013, an increase of 2.7 percent. In 2014, up to September it has gone up to 8.903 million tones.

.jpg) Taking the year 2013 as a whole, NR production outstripped consumption by 735,000 tonnes. As a result, the implied stocks increased in December 2013, the surplus of 2013 has been the largest in absolute tonnage terms since 2000, when the NR market was in deficit of 625,000 tonnes.The apparent responsiveness of the supply side of the NR industry to signals from the demand side in 2013, could be a reflection of an effect of increased tappable extent, despite the climate change threat on production.Increased capacity of an additional 220,000 hectares of tappable area that was available during 2012, the low NR prices in 2013 that continues to be deemed as unremunerative to smallholders, has not, however affected supply at the early stages of NR price fall.. The additional capacity is the result of the surge in new planting and replanting of rubber trees that began in 2005. Taking the year 2013 as a whole, NR production outstripped consumption by 735,000 tonnes.

Taking the year 2013 as a whole, NR production outstripped consumption by 735,000 tonnes. As a result, the implied stocks increased in December 2013, the surplus of 2013 has been the largest in absolute tonnage terms since 2000, when the NR market was in deficit of 625,000 tonnes.The apparent responsiveness of the supply side of the NR industry to signals from the demand side in 2013, could be a reflection of an effect of increased tappable extent, despite the climate change threat on production.Increased capacity of an additional 220,000 hectares of tappable area that was available during 2012, the low NR prices in 2013 that continues to be deemed as unremunerative to smallholders, has not, however affected supply at the early stages of NR price fall.. The additional capacity is the result of the surge in new planting and replanting of rubber trees that began in 2005. Taking the year 2013 as a whole, NR production outstripped consumption by 735,000 tonnes.

RUBBER GLUT

A sixth year of global surplus may depress rubber prices through 2016 as maturing trees boost production and slowing growth reduces demand in China, the biggest consumer, according to an industry expert.

Supply will outpace demand by 316,000 metric tons in 2016, compared with 483,000 tons in 2015, according to the London-based The Rubber Economist. The adviser increased its forecast for this year’s glut by 78 percent in March as output in Thailand, the largest grower and exporter, surpassed predictions. The International Rubber Study Group also raised its estimate saying production will increase as trees planted between 2006 and 2008 mature.

Futures in Tokyo, the global benchmark contract, have tumbled 26 percent this year, touching a four-year low in April. Lower prices may boost earnings at tire makers including Pirelli & C. SpA and Bridgestone Corp. (5108), while squeezing profits for small farmers who account for about 80 percent of world supply. China’s economy is forecast to grow 7.3 percent this year, the weakest pace since 1990, based on the median estimate in a Bloomberg survey.

“The natural rubber market may remain in surplus until 2016,” The Rubber Economist, has said “Prices may remain bearish until then, unless demand picks up faster than anticipated in China and other major consuming countries.”

Futures on the Tokyo Commodity Exchange settled at 203.4 yen a kilogram ($2,015 a ton) very recently, down about 62 percent from a record in 2011, and fell into a bear market in January as stockpiles in China climbed.As can be seen, there is flexibility within the NR supply in 2014 and this is expected to remain throughout 2014/2015. The rubber tree is a perennial crop that is harvested throughout the year and its tapping intensity, to some extent, can be altered in both directions.

It has also been said that while a looming El Nino may not be enough to reduce the glut, the weather event that brings drought to the Asia-Pacific region might curb the decline in prices. The El Nino during 1997-1998 slowed production growth to 0.4 percent in 1997 from 6 percent in 1996. There’s no evidence of any impact during occurrences in 19821983 and 1987-1988, according to recent reports. But it may help to slow down the declining price trend

IRSG

“We’re in a period of, I would say, instability in the industry,” Stephen Evans, secretary-general of IRSG, the Singapore-based inter-governmental group, told a conference recently in Singapore. “It’ll probably last for another year or two until we see a shift in global economic performance.” Futures rose as much as 1.3 percent today on speculation that Thailand’s plan to “reduce state stockpiles of 200,000 tons could be delayed after the military imposed martial law.

Global demand in 2014 may grow close to the IRSG’s lowest estimate of 4 percent, says the IRSG. “What might support rubber prices is, obviously, increased demand,” Evans said. “What is stopping everybody getting excited about the possibility of the U.S. and European recovery is that China is apparently slowing down.”

INDIAN SCENARIO

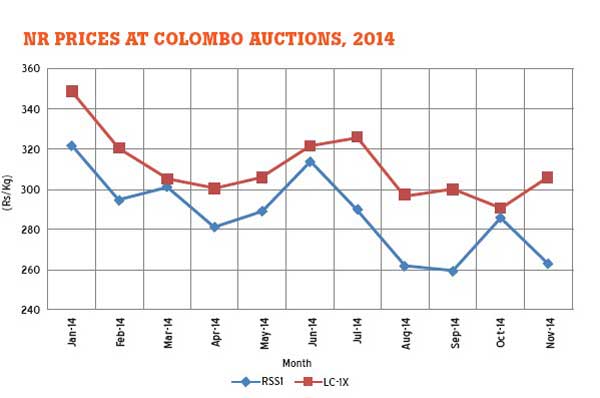

In fact NR price fall in the recent past, which is comparable to Colombo auction prices, has been mainly owing to a demand recession for rubber in India itself and abroad arising out of the world economic downturn and a fall in demand for rubber products. Fall in sale of vehicles is one major factor causing decline in demand for tyres and tubes which account for 57 percent of the NR consumption globally and 65 percent of the NR consumption in India. Demand fall for vehicles and the consequent fall in demand for tyres and other auto rubber components have led to low consumption of rubber leading to the price fall around the world.

Moreover, Rubber prices are expected to fall further for the same reasons, as the prices are coming under pressure both in the Indian and international markets. On the National Commodity and Derivatives Exchanges (NCDEX ) rubber declined 17.5 percent to Rs 12,380 per quintal on September 9 against Rs 15,010 per quintal on May 26.

According to market experts, poor demand from the tyre sector , which consumes over 50 percent of the natural rubber production in India and bear trend in the overseas market put pressure on prices despite disruptions in tapping owing to heavy South-West monsoon rains in the major rubber growing areas in Kerala.

Looking ahead, for the further movement of rubber in India, the outlook is likely to stay weak. Amidst burgeoning imports and subdued demand, aggravated by the Southwest and the North East monsoons that disturbed tapping, is unlikely to pick up in the major rubber growing areas in Kerala and with Onam, Kerala’s national festival, also that delayed tapping.With prices still languishing near multiyear lows it is to be seen whether growers will raise the production. “By the end of December 2014, we can see further fall in rubber prices by Rs 2,500 per quintal,” says Globe Commodities

SRI LANKAN PLIGHT

Can Sri Lankan rubber industry wait indefinitely for NR prices to pick up? There are no short term remedies available other than subsidizing NR prices further by GOSL for the benefit of small holders. The only long term strategy that comes to my mind is CROP DIVERSIFICATION, as recurrence of such calamities are bound to occur at various intervals. Diversification programme may have to be done in stages. Plantings ear marked for replanting may be considered, initially.

INCIDENTAL NEWS : CLIMATE CHANGE AND TYRES

The tyre company Pirelli has been recognized as a corporate leader in its actions to thwart climate change.The company scored 99 out of 100 points on the Climate Disclosure Leadership Index Italy 2014, an index that evaluates the completeness of a company’s strategy against climate change and the transparency of its communication to stakeholders.

Pirelli’s commitment to investors and stakeholders in the challenging area of climate change can be seen in its integration of environmental sustainability targets—both for products and processes—into the Pirelli Group’s Industrial Plan, according to the report. It said Pirelli “has set itself the goal of reducing rolling resistance by 40 percent for its car tires, by 20 percent in the truck segment and by 10 percent in motorcycles by 2020 compared with 2007.

Pirelli said it plans to reduce specific CO2 emissions by 15 percent and the specific consumption of energy in its factories by 18 percent compared to 2009.”

Pirelli’s main global commitments in the area of climate change includes CDP Supply Chain, which it said is a program which in 2014 involved more than 120 strategic suppliers in the quantification of benefits in financial, reputational and risk management terms stemming from the correct management of its CO2 emissions.

Pirelli also said it subscribes to Road to Paris 2015, an international initiative that aims to promote the cooperation between the public and private sectors in order to find shared solutions and policies to deal with climate change.

The initiative resulted in Pirelli’s signing of the international agreement on climate change (Paris Declaration), which will be underwritten during the next worldwide meeting of the United Nations Framework Convention on Climate Change that will take place in Paris in 2015.

25 Nov 2024 24 minute ago

25 Nov 2024 36 minute ago

25 Nov 2024 38 minute ago

25 Nov 2024 39 minute ago

25 Nov 2024 47 minute ago