01 Feb 2022 - {{hitsCtrl.values.hits}}

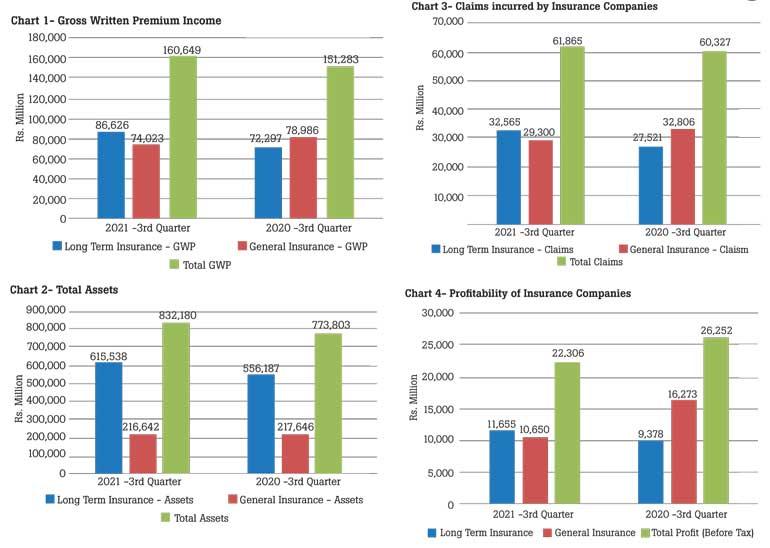

The insurance industry was able to achieve a growth of 6.19 percent in terms of overall Gross Written Premium (GWP), during the 3rd quarter of 2021, recording an increase of Rs. 9,366 million when compared to the same period in the year 2020.

The GWP for Long Term Insurance and General Insurance Businesses was Rs. 160,649 million compared to the 3rd quarter of 2020, amounting to Rs. 151,283 million.

The GWP of Long-Term Insurance Business amounted to Rs. 86,626 million (3Q, 2020: Rs. 72,297 million) recording a growth of 19.82 percent. The GWP of General Insurance Business amounted to Rs. 74,023 million (3Q, 2020: Rs. 78,986 million) recording a decline of 6.28 percent.

Total Assets

The value of total assets of insurance companies has increased to Rs. 832,180 million at the end of 3rd Quarter 2021, when compared to Rs. 773,803 million recorded as at the end of Q3 2021, reflecting a growth of 7.54 percent.

The assets of Long-Term Insurance Business amounted to Rs. 615,538 million (3Q, 2020: Rs. 556,157 million) depicting a growth rate of 10.68 percent, mainly due to increase in business volume which is represented by investments in government debt securities and corporate debts. The assets of General Insurance Business amounted to Rs. 216,642 million (3Q, 2020: Rs. 217,646 million) indicating a slight decline of 0.46 percent.

Investment in Government Securities

Investments in Government Debt Securities amounted to Rs. 239,478 million representing 43.37 percent (3Q, 2020: Rs. 227,584 million) of the total investments of Long Term Insurance Business and increased by 5.23 percent, while such investment of the total investment of General Insurance Business amounted to Rs. 51,008 million representing 36.29 percent (3Q, 2020: Rs. 61,557 million) and decreased by 17.14 percent.

Accordingly, the total investment in Government Securities in the two businesses amounted to Rs. 290,486 million (3Q, 2020: Rs. 289,141 million), showing an overall increase of 0.47 percent respectively.

Claims incurred by insurance companies

The claims incurred by insurance companies in both Long Term Insurance Business and General Insurance Business were Rs. 61,865 million (3Q, 2020: Rs. 60,327 million) showing an increase in total claims amount by 2.55 percent year-on-year.

The Long-Term Insurance claims, including maturity and death benefits, amounted to Rs. 32,565 million (3Q, 2020: Rs. 27,521 million).

The claims incurred in General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 29,300 million (3Q, 2020: Rs. 32,806 million). Hence, during the 3rd quarter of 2021, claims incurred by Long Term Insurance Business have increased by 18.33 percent and claims incurred by General Insurance Business have decreased by 10.69 percent when compared to the same period in2020.

Profit (Before Tax) of insurance companies

The profit (before tax) of insurance companies as at the end of 3rd Quarter 2021 in both Long Term Insurance Business and General Insurance Business amounted to Rs. 22,306 million (3Q, 2020: Rs. 26,252 million) showing a significant decrease in total profit amount by 15.03 percent.

The profit (before tax) of Long-Term Insurance Business amounted to Rs. 11,655 million (3Q, 2020: Rs. 9,978 million), while the profit (before tax) of General Insurance Business amounted to Rs. 10,650 million (3Q, 2020: Rs. 16,273 million). Thus, profit (before tax) of Long-Term Insurance Business has increased by 16.81 percent and General Insurance Business has decreased by 34.55 percent.

Insurers

Out of twenty-seven (27) Insurance Companies (Insurers) in operation as at 30th September 2021, thirteen

(13) are engaged in Long Term (Life) Insurance Business, twelve (12) companies engaged in General Insurance Business and two (02) are composite companies (dealing in both Long Term and General Insurance Businesses).

Insurance Brokers

Sixty-eight (68) insurance brokering companies, registered with the Commission as at 30thSeptember 2021. Total Assets of insurance brokering companies have increased to Rs. 7,618 million as at the end of 3rd quarter 2021, when compared to 5,951 million recorded at the same period of 2020, indicating a growth of 28.03 percent.

04 Jan 2025 9 hours ago

04 Jan 2025 9 hours ago

04 Jan 2025 9 hours ago

04 Jan 2025 04 Jan 2025

04 Jan 2025 04 Jan 2025