16 Feb 2018 - {{hitsCtrl.values.hits}}

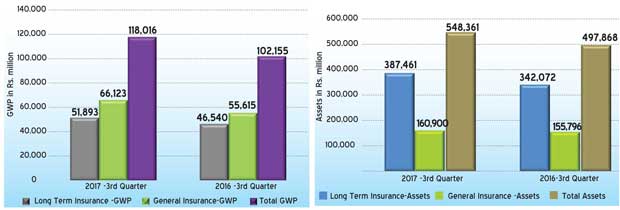

The insurance industry was able to achieve a growth of 15.53 percent (3Q 2016: 16.97 percent) in terms of overall gross written premium (GWP), at the end of the third quarter of 2017, recording an increase of Rs.15, 862 million when compared to the same period in the year 2016.

Gross written premium

The GWP for long-term insurance and general insurance businesses for the nine months ended on September 30, 2017 was Rs.118,016 million compared with the same period in 2016, amounting to Rs.102,155 million. The GWP of long-term insurance business amounted to Rs.51,893 million (3Q, 2016: Rs.46,540 million) while the GWP of general insurance business amounted to Rs.66,123 million (3Q, 2016: Rs.55,615 million).

Thus, the long-term insurance business and general insurance business witnessed a GWP growth of 11.50 percent and 18.89 percent, respectively, when compared to the corresponding period of year 2016.

Total assets

The value of total assets of insurance companies has increased to Rs.548,361 million as at September 30, 2017, when compared to Rs.497,868 million recorded as at September 30, 2016, reflecting a growth of 10.14 percent (3Q 2016: 13.41 percent).

The assets of long-term insurance business amounted to Rs.387,461 million (3Q 2016: Rs.342,072 million) indicating a growth rate of 13.27 percent year-on-year (YoY). The assets of general insurance business amounted to Rs.160,900 million (3Q 2016: Rs.155,796 million) depicting a growth rate of 3.28 percent.

Investment in government securities

The investment in government securities for the period of nine months amounted to Rs.181,791 million representing 46.92 percent (3Q 2016: Rs.162,084; 47.38 percent) of the total assets of long-term insurance business, while such investment of the total assets of general insurance business amounted to Rs.29,598 million representing 18.40 percent (3Q, 2016: Rs.33,503; 21.50 percent).

Accordingly, the total investment of both long-term insurance business and general insurance business in government securities amounted to Rs.211,389 million (3Q 2016: Rs.195,587 million). Thus, the investment in government securities of long-term insurance business has increased by 12.16 percent and the investment in government securities of general insurance business has declined by 11.66 percent.

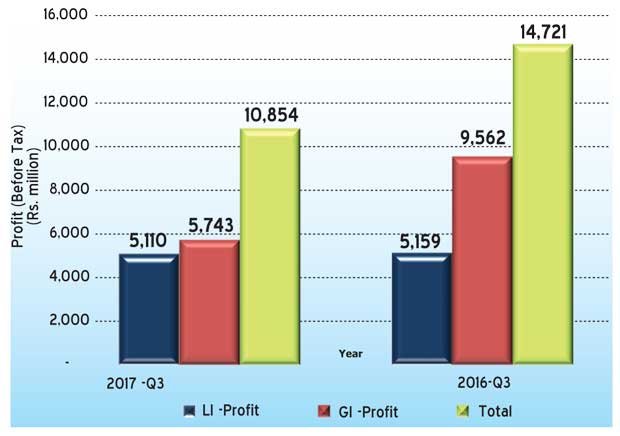

PBT of insurance companies

The profit before tax (PBT) of insurance companies in both long-term insurance business and general insurance business for the nine months ended September 30, 2017 amounted to Rs.10,854 million (3Q, 2016: Rs.14,721 million) showing a decline in profit by 26.27 percent. The PBT of long-term insurance business amounted to Rs.5,110 million (3Q 2016: Rs.5,159 million) while the PBT of general insurance business amounted to Rs.5,743 million (3Q, 2016: Rs.9,562 million).

Thus, PBT of general insurance business showed a significant decrease of Rs.3,819 million (39.94 percent) when compared to the period ended September 30, 2016. This is mainly due to receipt of significant dividend income of an insurer during the year 2016.

However, there was no significant declaration of dividend income for the period ended September 30, 2017. Apart from the general insurance business, no material deviation noted in respect of the PBT of long-term insurance business for the period ended September 30, 2017.

Insurers

Out of 27 insurance companies (insurers) in operation as at September 30, 2017, 12 are engaged in long-term (life) insurance business, 13 companies are carrying out only general insurance business and two are composite companies (dealing in both long-term and general insurance businesses).

Insurance brokers

Sixty insurance brokering companies, registered with the board as at September 30, 2017, mainly concentrate in general insurance business. Total assets of insurance brokering companies as at September 30, 2017 have increased to Rs.4,148 million when compared to Rs.3,961 million recorded as at September 30, 2016, reflecting a growth of 4.70 percent year-on-year.

10 Jan 2025 2 hours ago

10 Jan 2025 2 hours ago

10 Jan 2025 3 hours ago

10 Jan 2025 3 hours ago

10 Jan 2025 4 hours ago