14 Sep 2021 - {{hitsCtrl.values.hits}}

The insurance industry was able to achieve a growth of 14.36 percent in terms of overall Gross Written Premium (GWP), during the first quarter of 2021, recording an increase of Rs. 7,211 million when compared to the same period in the year 2020.

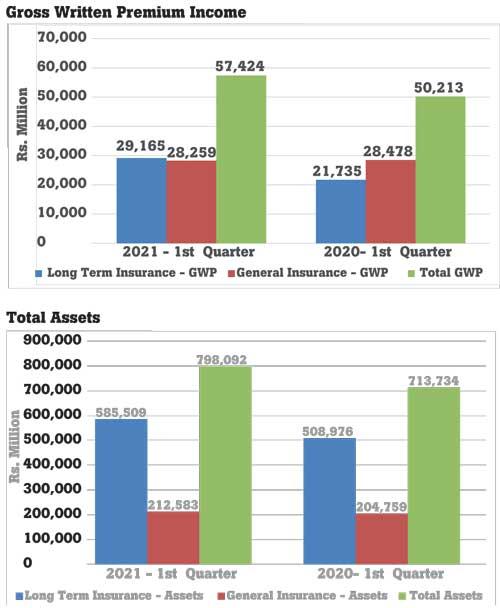

The GWP for Long Term Insurance and General Insurance Businesses for the period ending 31st March 2021 was Rs. 57,424 million compared with the same period in 2020 amounting to Rs. 50,213 million.

The GWP for Long Term Insurance and General Insurance Businesses for the period ending 31st March 2021 was Rs. 57,424 million compared with the same period in 2020 amounting to Rs. 50,213 million.

The GWP of Long Term Insurance Business amounted to Rs. 29,165 million (Q1, 2020: Rs. 21,735 million) while the GWP of General Insurance Business amounted to Rs. 28,259 million (Q1, 2020: Rs. 28,478 million). Thus, Long Term Insurance Business witnessed a growth of 34.18 percent and General Insurance Business shows a decline of 0.77 percent, when compared to the corresponding period of year 2020.

Total assets

The value of total assets of insurance companies has increased to Rs. 798,092 million as at 31st March 2021, when compared to Rs. 713,734 million recorded as at 31st March 2020, reflecting a growth of 11.82 percent mainly due to increase in corporate debts, government securities and equity.

The assets of Long Term Insurance Business amounted to Rs. 585,509 million (Q1, 2020: Rs. 508,976 million) indicating a growth rate of 15.04 percent year-on-year. The assets of General Insurance Business amounted to Rs. 212,583 million (Q1, 2020: Rs. 204,759 million) depicting a growth rate of 3.82 percent.

Investment in government securities

At the end of first quarter of 2021, investment in Government Debt Securities amounted to Rs. 232,081 million representing 44.77 percent (Q1, 2020: Rs. 204,620 million; 45.78 percent) of the total assets of Long Term Insurance Business, while such investment of the total assets of General Insurance Business amounted to Rs. 49,717 million representing 36.95 percent (Q1, 2020: Rs. 53,801 million; 42.33 percent).

Accordingly, the total investment of both Long Term Insurance Business and General Insurance Business in Government Debt Securities amounted to Rs. 281,798 million (Q1, 2020: Rs. 258,421 million) as at 31st March 2021.

Thus, the investment in government debt securities of long term insurance business has increased by 13.42 percent and such investment of general insurance business has decreased by 7.59 percent.

Claims incurred by insurance companies

Claims incurred by insurance companies in both Long Term Insurance Business and General Insurance Business was Rs. 20,352 million (Q1, 2020 Rs. 20,562 million) showing a slight decrease in total claims amount by 1.02 percent.

The Long Term Insurance claims, including maturity and death benefits, amounted to Rs. 9,828 million (Q1 2020: Rs. 8,723 million). The claims incurred in General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 10,524 million (Q1, 2020: Rs. 11,839 million). Hence, during the first quarter of 2021, there had been an increase in 12.67 percent in Long Term Insurance and decrease in 11.11 percent in General Insurance, when compared to the same period in 2020.

Profit (Before Tax) of insurance companies

The profit (before tax) of Long Term Insurance Business amounted to Rs. 4,038 million (Q1, 2020: Rs. 3,580 million) while the profit (before tax) of General Insurance Business amounted to Rs. 3,210 million (Q1, 2020: Rs. 3,952 million) at the end of first quarter of 2021. Thus, profit (before tax) of Long Term Insurance Business has increased by 12.79 percent and profit (before tax) of General Insurance Business has decreased by 18.78 percent.

Insurers

Out of twenty-five (27) Insurance Companies (Insurers) in operation as at 31st March 2021, thirteen (13) are engaged in Long Term (Life) Insurance Business, twelve (12) companies engaged in General Insurance Business and two (02) are composite companies (dealing in both Long Term and General Insurance Businesses).

Insurance Brokers

Sixty-eight (68) insurance brokering companies, registered with the Commission as at 31st March 2021, mainly concentrate in general insurance business. Total Assets of insurance brokering companies have increased to Rs. 6,641 million as at the end of first quarter of 2021 when compared to Rs. 5,965 million recorded as at 31st March 2020, indicating a growth of 11.32 percent.

09 Jan 2025 5 hours ago

09 Jan 2025 6 hours ago

09 Jan 2025 9 hours ago

09 Jan 2025 9 hours ago

09 Jan 2025 09 Jan 2025