01 Nov 2021 - {{hitsCtrl.values.hits}}

LB Finance PLC, country’s leading non-banking financial institution, recently introduced a revolutionary digital solution to boost its key gold loans business.

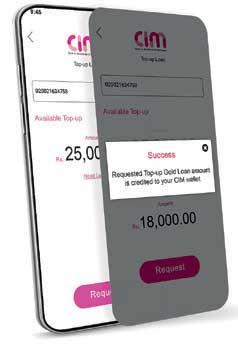

With the latest solution, the company’s gold loans customers have the opportunity to avail an instant digital top up gold loan through LB CIM (Cash-In-Mobile) smartphone app. This is a landmark development considering the lightning speed and efficiency of delivering a top up loan in mere 30 seconds, directly crediting the loan proceeds to the customer’s LB CIM wallet. The move further epitomises the company’s efforts to deliver cutting-edge financial solutions in a highly competitive, rapidly evolving industry, fast adopting to digital financial services.

With the latest solution, the company’s gold loans customers have the opportunity to avail an instant digital top up gold loan through LB CIM (Cash-In-Mobile) smartphone app. This is a landmark development considering the lightning speed and efficiency of delivering a top up loan in mere 30 seconds, directly crediting the loan proceeds to the customer’s LB CIM wallet. The move further epitomises the company’s efforts to deliver cutting-edge financial solutions in a highly competitive, rapidly evolving industry, fast adopting to digital financial services.

LB Finance PLC is the undisputed market leader for gold loans among NBFIs. Gold loans currently account for nearly a third of the company’s loans and advances and serves a large and diverse group of customers spread throughout the island, representing every strata of the Sri Lankan society. LB CIM, the mobile app-based digital wallet by LB Finance, performs the central role in LB customers’ digital journey in availing an array of financial services provided by the company.

LB Finance PLC is the undisputed market leader for gold loans among NBFIs. Gold loans currently account for nearly a third of the company’s loans and advances and serves a large and diverse group of customers spread throughout the island, representing every strata of the Sri Lankan society. LB CIM, the mobile app-based digital wallet by LB Finance, performs the central role in LB customers’ digital journey in availing an array of financial services provided by the company.

Speaking on this pioneering solution, LB Finance PLC Chief Manager Gold Loans Suraj Karunanayaka said, “We are delighted to enhance our unparalleled customer experience using the company’s popular digital platform LB CIM. Keeping up with our customer needs and redefining our business to cater to changing consumer behaviours and industry dynamics have been the secret behind our success over the years. We take pride in our speedy and efficient service delivery that differentiates our business from the competition. The nature and the demand patterns for gold loans necessitate an organisation to have delivery channels available in every nook and corner of the country geared to operate for extended business hours to serve the quick financing needs of our customers.

Integrating our core business with LB CIM app gives us this much-needed flexibility and dynamism to operate 24x7, not deterred by limitations of conventional branch banking during government-imposed travel restrictions. This is of greater significance during a time where physical branch operation has been somewhat challenged due to the pandemic-related health and safety concerns.”

“Commenting on this breakthrough innovation, LB Finance Head of Strategy and Digital Finance Bimal Perera stated, “CIM is more than just another mobile payment platform as it has a very high level of integration with our core banking system. This uniqueness enables our valued customers to enjoy an unhindered access to their portfolio of lease, loans and deposit accounts through one single digital platform. In Sri Lanka, gold loans are commonly perceived as a conventional, quick financing solution. This innovation has brought a new dimension to the product by allowing customers to obtain a top up loan from the safety and comfort of their homes, regardless of the time or day. There are many use cases of customers needing quick and convenient additional financing for planned or unplanned expenses. Instant digital top up gold loans from CIM addresses this very need. Customer are empowered to leverage their valuable gold articles whilst enjoying the benefit of appreciated value of their collateral held with LB. Our company has made considerable investments in key digital assets and technology infrastructure that is capable of churring out such robust solutions,” he further added.

08 Jan 2025 3 hours ago

08 Jan 2025 3 hours ago

08 Jan 2025 3 hours ago

08 Jan 2025 4 hours ago

08 Jan 2025 4 hours ago