11 Jul 2016 - {{hitsCtrl.values.hits}}

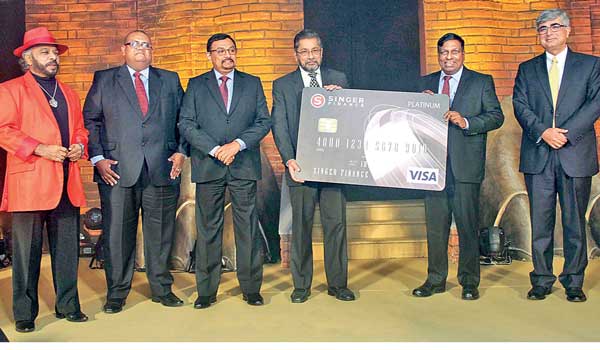

Singer Group Chief Executive Officer Asoka Pieris and Singer Sri Lanka PLC Chairman Saman Kelegama display the newly launched card along with Singer Finance CEO Shantha Wijeweera and other dignitaries

Singer Group Chief Executive Officer Asoka Pieris and Singer Sri Lanka PLC Chairman Saman Kelegama display the newly launched card along with Singer Finance CEO Shantha Wijeweera and other dignitaries

By Zahara Zuhair

Singer Sri Lanka embarked on a historic venture recently by introducing a credit card through Singer Finance with Visa International. It can be used at merchants who accept credit cards across the country and withdraw cash from ATMs connected to the Visa network.

Singer Finance CEO Shantha Wijeweera said that Singer Finance is the first finance company to issue a credit card approved by the Central Bank.

“We launched the credit card at the correct time and it will be issued free of charge and the target market will be not only the city-based customers but also traditional customers,” he said.

Singer Group Chief Executive Officer Asoka Pieris said that it was very logical for Singer to enter the credit card business as apart from major banks, Singer has the highest number of customers being provided with financing at any time.

“In terms of the number of customers we are huge, more than many finance companies, only behind few banks in Sri Lanka. In the years to come, consumer finance business will be move into credit cards, so that is the reason why Singer is into this business,” he imparted.

Though some question why they needed to enter into the credit card market, as it is a cluttered business, where many credit card companies compete among the limited number of credit card consumers, he explained that when looking at the number of credit cards available, which is 500,000, and out of the working people 8.5 million do not have credit cards and their vision is to fill that market providing the consumers with credit cards.

He said that Singer has one of the lowest non-performing loan ratios in the island, which is an invaluable asset in the credit card industry.

Taking through the history, he said that when they started operations way back in 1877 in Sri Lanka they started the concept of higher purchasing, having introduced it to the world in 1851.

“In 2004, Singer set up Singer Finance and with that entered business with leasing and higher purchase of vehicles. Then moved on to other consumer products such as loans and then business-to-business (B2B) transactions, invoice discounting,” he said.

Singer Head of Credit Cards Thilan Rupasinghe said that they are the first non-banking institution to issue a credit card in Sri Lanka.

He said in Sri Lanka credit card penetration is only 10 percent and the mass market is yet to be capitalised.

When it comes to security of the credit cards he said that it is equipped with

chip-based technology, which would avoid card skimming.

Singer Finance (Lanka) being their first partner in Sri Lanka, Worldline South Asia and Middle East CEO Deepak Chandnani said that they would be responsible for card issuance and management.

“The Sri Lankan market has a strong base of over 16.3 million debit and credit cards. With transactions growing at around 27 percent we see a great potential in this country,” he said.

27 Nov 2024 58 minute ago

27 Nov 2024 3 hours ago

27 Nov 2024 4 hours ago

27 Nov 2024 4 hours ago

27 Nov 2024 4 hours ago