03 Jul 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

Secondary market activities continued to see lackluster movement during yesterday as investors resorted to sidelinesawaiting the weekly auction outcome.

Moreover, market participants also exercised caution, seeking clarity on the progress of external debt restructuring.Consequently, sentiment was mixed during yesterday’s session with two-way quotes narrowing downwithin a limited range on mid tenors amidst the sideways movement in yields.

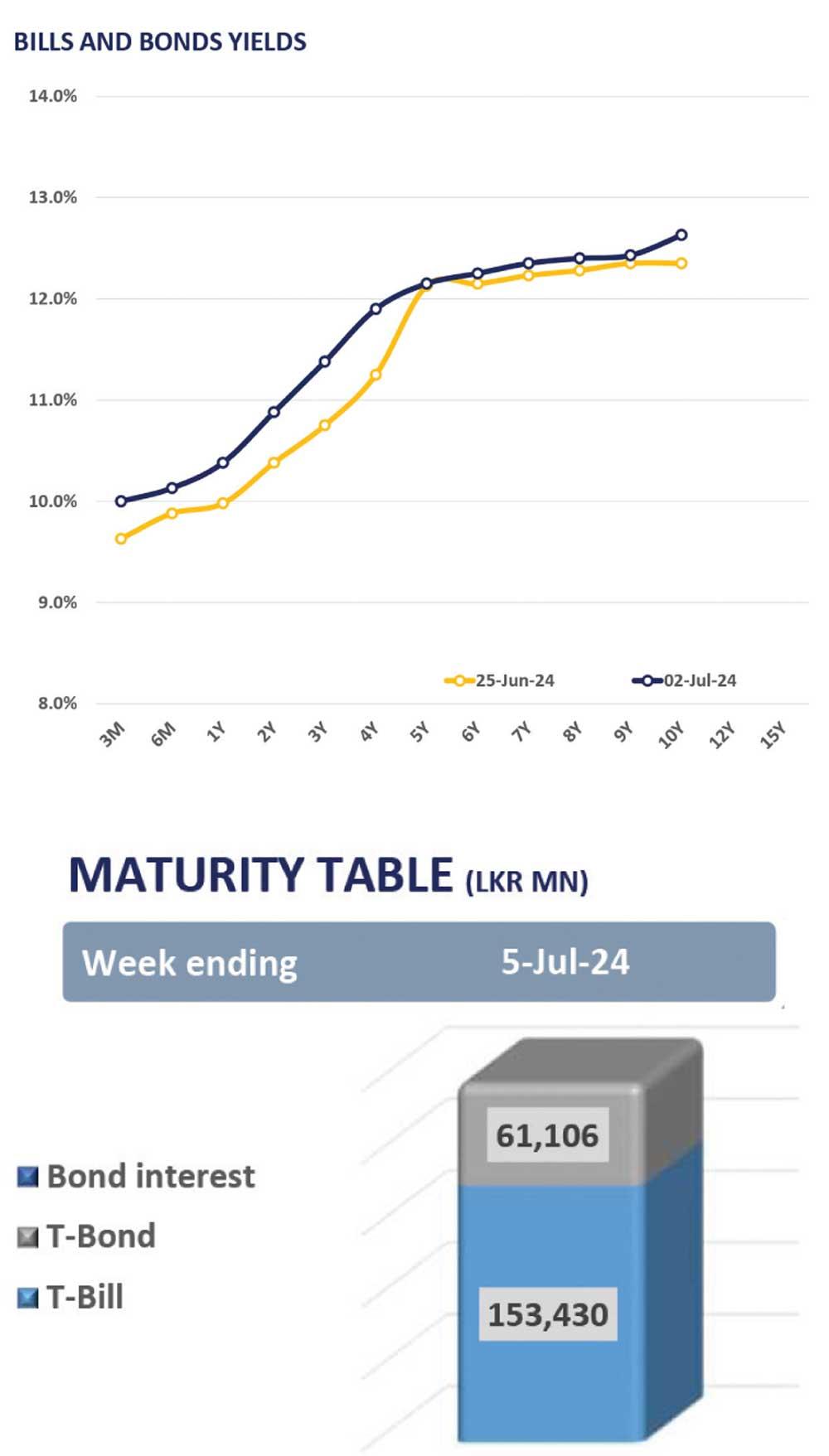

On the short end, 01.06.2026 closed trades at 10.70% whilst 15.09.2027 closed at 11.25%.

Meanwhile, on mid tenor maturities, both 01.05.2028 and 01.07.2028 enticed trades at 12.00% level while 15.09.2029 and 15.05.2030 registered trades at 12.15% and 12.20%, respectively.

CBSL expects to raise Rs. 190.0bn from the weekly T-Bill auction scheduled for today. Accordingly, Rs. 50.0bn, Rs. 90.0bn and Rs. 50.0bn is expected to be raised from 91-days, 182-days, 364-days maturities, respectively.

On the external side, LKR saw a considerable appreciation against the USD, recording at Rs. 305.8 compared to the previous days indicative rate of Rs. 306.1, following two consecutive days of decline.

Meanwhile, total outstanding stock of government securities inclined marginally by 0.27%WoW contributed by a 1.2% WoW uptick in T-Bills for the week ending 28th June 2024. However, foreign holding in government securities saw a 9.4% decline over the week.

24 Dec 2024 1 hours ago

24 Dec 2024 3 hours ago

24 Dec 2024 4 hours ago

24 Dec 2024 5 hours ago

24 Dec 2024 5 hours ago